Unsecured credit cards for poor credit can help you rebuild your credit if used responsibly. And obtaining a better credit score is important for saving money on loans, landing a job, and even getting cheaper insurance, among other things.

Before applying for one of these cards, be sure you understand the fees you’ll be charged, which may be considerable.

Best Unsecured Cards For Poor Credit

Credit card options abound for consumers with fair credit scores both in secured credit card and unsecured credit card offerings. But people with lower credit scores may struggle to find attainable credit cards. That’s where credit cards for poor credit step in to fill the gap.

You can instantly prequalify for these cards without further damaging your credit score. These cards tend to have high interest rates and fees, so consider them as a way station on the road to better credit cards — a road you can travel over by paying your bills on time and keeping your debt under control.

- PREMIER Bankcard credit cards are for building credit.

- Start building credit by keeping your balance low and paying all your bills on time each month.

- When you need assistance our award-winning US-based Customer Service agents are there to help.

- Credit Limit Increase Eligible after 12 months of consistent responsible account management.

- We report monthly to the Consumer Reporting Agencies to help you build your credit.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 4 minutes | See Provider Website | Yes | 9.0/10 |

The PREMIER Bankcard® Mastercard® Credit Card is designed for consumers who have experienced credit problems. Its one-time setup fee and annual fee may decrease based on credit worthiness, see Provider Website for full Terms & Conditions. The card offers cash advances and waives the first-year maintenance fees on accounts with smaller credit lines (See Provider Website for full Terms & Conditions).

- You don’t need good credit to apply.

- We help people with bad credit, every day.

- Just complete the short application and receive a response in 60 seconds.

- You can build or rebuild your credit: apply for a PREMIER Bankcard credit card, keep your balance low, and pay all your monthly bills on time.

- Don’t let a low FICO score stop you from applying – we approve applications others may not.

- FICO scores are used to represent the creditworthiness of a person and may be one indicator to the credit type you are eligible for. However, credit score alone does not guarantee or imply approval for any PREMIER Bankcard® product.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 4 minutes | See Provider Website | Yes | 9.0/10 |

The PREMIER Bankcard® Grey Credit Card allows you to choose among three card designs at no additional fee. Another feature of this issuer’s cards is its grace period. PREMIER Bankcard reports to the major credit bureaus each month, so this is a fantastic card to build* credit if used responsibly. (See Provider Website for full Terms & Conditions).

*Build credit by keeping your balance low and paying all your bills on time every month.

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Up to $1,000 credit limit subject to credit approval

- Prequalify** without affecting your credit score

- No security deposit

- Free access to your VantageScore 4.0 score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

** Prequalify means that you authorize us to make a soft inquiry (that will not affect your credit) to create an offer. If you accept an offer a hard inquiry will be made. Final approval is not guaranteed if you do not meet all applicable criteria (including adequate proof of ability to repay). Income verification through access to your bank account information may be required.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 7 minutes | 29.99% or 36% Fixed | Yes | 8.0/10 |

The Aspire® Cash Back Reward Card is an unsecured card that pays rewards. As with most unsecured subprime cards, its APR is high, so be sure to pay your balance in full each month to avoid hefty interest charges. But you can earn credit limit increases and build credit over time with responsible use.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply!

- Monthly Credit Score – Sign up for electronic statements, and get your Vantage 3.0 Score Credit Score From Experian

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- See if you’re Pre-Qualified without impacting your credit score

- Fast and easy application process; results in seconds

- Online account access 24/7

- Checking Account Required

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 29.99% APR (Variable) | Yes | 8.5/10 |

The Surge® Platinum Mastercard® offers modest benefits, including zero fraud liability and cash advances. You can make payments, check due dates, and view statements online or through an app. You also get free access to your Experian VantageScore to help you keep track of your credit-building progress.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- See if you’re Pre-Qualified with no impact to your credit score

- All credit types welcome to apply

- Access to your Vantage 3.0 score from Experian (When you sign up for e-statements)

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- Fast and easy application process; results in seconds

- Use your card at locations everywhere Mastercard® is accepted

- Checking Account Required

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 8 minutes | 29.99% APR (Variable) | Yes | 8.0/10 |

The Reflex® Platinum Mastercard® is almost identical to the Surge® Platinum Mastercard®, both of which are issued by Continental Finance. Both offer the same fraud protection and opportunity to raise your credit limit by making six on-time payments in a row.

- Earn 1% cash back rewards on payments made to your Total Credit Card

- Checking Account Required

- $300 credit limit (subject to available credit)

- No security deposit, simply pay a one-time $95 program fee to open your account.*

- User friendly Mobile App.

- *See Rates, Fees, Costs & Limitations for complete offer details

- See Total Card Visa Rewards Programs Terms & Conditions for details

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 35.99%* | Yes | 8.5/10 |

The Total Visa® Card from the Bank of Missouri offers zero fraud liability and a credit limit review after one year. Its APR is high, and it charges annual, setup, additional card, and credit limit increase fees. It also charges cash advance and monthly servicing fees after the first year.

- Earn 1% cash back rewards on payments made to your First Access Credit Card

- Checking Account Required

- $300 credit limit (subject to available credit)

- No security deposit, simply pay a one-time $95 program fee to open your account.*

- User friendly Mobile App.

- *See Rates, Fees, Costs & Limitations for complete offer details

- See First Access Rewards Programs Terms & Conditions for details

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 10 minutes | 35.99%* | Yes | 8.0/10 |

The First Access Visa® Card is another Bank of Missouri card with all the charges and few of the features offered by its competitors. You can select from a collection of six card designs, and your credit limit may be reviewed after one year.

How Does an Unsecured Credit Card Work?

Unsecured credit cards give you a way to charge for purchases at retail and online stores.

You can apply for the card by providing information about your income and spending. If your application is approved, you should receive your new card within one to two weeks.

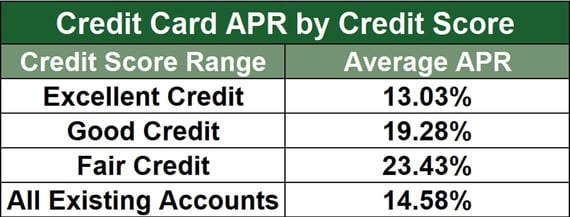

As part of the approval process, the issuer will specify your credit limit, a set of fees, and an interest rate (called the annual percentage rate or APR) for purchases, with possibly different rates for balance transfers and cash advances.

When you get the card, sign your name to the strip on the back. You’ll notice that the card reveals your name, account number, expiration date, and a three-digit security code.

The card’s chip contains important information, including your current balance and transaction history. Most cards still carry magnetic swipe strips for compatibility with older card readers.

Credit cards have billing cycles that are approximately one month long. Most credit cards offer a grace period of 21 to 25 days between the end of the billing cycle (known as the statement date) and the payment due date.

If you carry a balance beyond the grace period (i.e., an unpaid balance), you’ll be charged interest that accrues daily, based on your assigned APR. A few cards don’t offer a grace period and charge interest right away.

Once you establish an unpaid balance, you’ll continue to be charged interest until you repay all of it. Therefore, if you want to avoid interest charges, you’ll have to repay your entire balance, as reported on your latest billing statement, by the end of the grace period.

You can use your credit card to charge purchases up to the credit limit assigned to you. Your card may also offer loans with instant approval, known as cash advances, which have no grace period — you accrue daily interest until you repay the advance. The APR for cash advances is often higher than that for purchases.

Another type of credit card transaction is a balance transfer, which lets you consolidate the balances of multiple credit cards. Each transfer will trigger a one-time fee plus daily interest, although you can avoid this interest for six months or longer if your card offers an introductory 0% APR on balance transfers. The regular APR on balance transfers may be the same or higher than the purchase APR.

Many cards offer rewards denominated in cash back, points, or miles, although this is rare for a subprime card designed for consumers with a low credit score.

You accumulate rewards when you charge purchases on a rewards card. You can redeem your rewards in various ways. Cards may offer simple or complex reward schemes — so read the card’s disclosures for all the details.

Credit cards usually offer fraud protection and may offer other benefits, such as free security and purchase protection, travel insurance, discounts on purchases, and free access to airport lounges, among other perks. The higher your credit score, the more access you have to credit cards that offer generous benefits and higher credit limits, although sometimes they charge steep annual fees.

Most credit cards report your payment activity to one or more of the three major credit bureaus (Experian, Equifax, and TransUnion). The bureaus record your credit history, which credit scoring models such as FICO and VantageScore use to calculate your credit score.

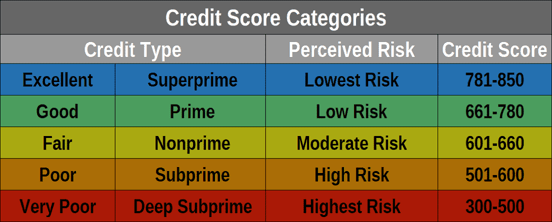

Your credit score helps determine your access to credit and the interest rates you are charged by lenders and credit card issuers.

Many consumers have multiple credit cards. That can be a useful strategy if one of your cards is stolen, lost, or at its credit limit. If your card is misplaced, you will want to immediately contact the card issuer, which will freeze the account and set you up with a new one.

How Do I Apply For an Unsecured Credit Card?

You can take two online routes to apply for an unsecured credit card. The first is to prequalify for the card. The second is to directly apply.

Prequalification is a good credit strategy when you have bad credit. It can tell you whether you have a chance to obtain the card, and you won’t risk damaging your credit score in the process. Prequalification is not a guarantee of final approval.

When you attempt to prequalify for a credit card, the issuer will gather some information about you but will not perform a hard pull of your credit history. Hard inquiries can lower your credit score, but prequalification has no impact on your credit score.

You’ll typically receive an instant approval decision when you submit your request to prequalify, and if you’re preapproved, you can then go on to the second step: the application process.

The data you enter to prequalify or apply for a credit card includes:

- Your name

- Your address

- Your Social Security number

- Your employer and income information

- Your home payments (mortgage or rent)

- Your email address

- Your phone number.

Regardless of whether you go through the prequalification step, most credit cards do a hard pull of your credit when you submit your application, which may cause your credit score to sink five to 10 points. Once again, you should receive an immediate decision unless the issuer has trouble retrieving your information.

Some unsecured cards for bad credit do not perform a standard credit check, relying instead on the data you submit when you apply and secondary sources of information. If your application is approved, you can e-sign the card agreement (after carefully reviewing the credit limit, APR, and card fees), at which point the issuer will mail you your card.

Expect to receive the card five to 14 days after your application is approved, depending on how the issuer dispatches the card. On the other hand, if the issuer rejects your application, you should receive a formal adverse action notice detailing the reasons you were turned down.

Some credit cards allow you to begin using them immediately. You may be given your card’s account information right away, or more likely, you’ll get a temporary, virtual account number you can use for purchases until the physical card arrives.

What Is the Minimum Credit Score Required For an Unsecured Card?

Generally speaking, a FICO score of 550 is about the minimum required by subprime card offerings geared toward consumers with bad credit. Consumers with scores in this range are considered highly risky.

A few credit cards don’t primarily rely on creditworthiness to make their approval decisions. Some cards may approve your application despite your subprime credit score if you meet certain criteria, including:

- You have sufficient income (including wages, benefits, alimony, structured settlements, annuities, etc.) to pay your monthly credit card bill.

- Your financial obligations, such as debts and housing costs, are commensurate with your income.

- You have a steady job.

- You have not had recent missed or late payments.

These cards are probably your best hope of getting approved for an unsecured account.

You can improve your chances of qualifying for a credit card by increasing your income or reducing your debt. This may be easier said than done, but it is an effective strategy if you are committed to getting an unsecured credit card. Your efforts at building credit can help convince some issuers to offer you a second crack at owning an unsecured card.

A student credit card represents a special case in which credit scores (or lack thereof) are not the sole factors in the approval process. To qualify, you must attend a post-secondary school on at least a half-time basis.

To be sure, it’s a good idea to improve your credit while attending college so you can enjoy a better lifestyle after graduation.

Discover it® Student Cash Back is a top choice among unsecured student credit card offerings. It offers cash back rewards and the famous first-year Cashback Match, plus several other benefits.

Secured credit cards are a good alternative when you have bad credit. We’ll have more to say about secured cards shortly.

You may come across ads for unsecured credit cards that guarantee acceptance no matter your credit score. We can’t confirm that these offers are legitimate, but they warrant a healthy dose of skepticism.

Of course, the credit card you may obtain despite a bad credit score is nothing like the fancy cards advertised on TV. For the most part, unsecured cards for bad credit provide no rewards and only the most basic benefits, like fraud protection. At the same time, these cards come with high fees and plenty of them, as well as a high APR range and low credit limits.

Can I Get a $5,000 Credit Limit With Bad Credit?

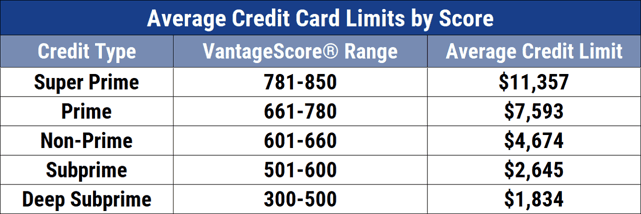

The chances of getting a $5,000 credit limit when you have bad credit are slim. In fact, any credit limit above $3,000 is an enviable achievement if your credit is poor.

The following chart shows the relationship between credit score and credit limit:

These are averages, meaning there is a chance you’ll receive a better-than-average credit limit.

The chart’s data gives perspective to the starting credit limits — $200 to $500 — offered by many of the reviewed credit cards. Even the lowest credit category shows an average credit limit above $1,800, which means there is plenty of room for building credit once you acquire your unsecured card.

If you care about increasing your credit limit, you may want to adopt a strategy to get you there:

- Be patient: It’s in the credit card company’s interest to give you more credit. The thinking is this: The more you charge on your card, the more likely you are to carry a balance, thereby supplying the issuer with interest payments.

You can do your part by paying your bills on time and keeping your unpaid balance low. Many credit cards automatically review credit limits every six months to one year, so your creditworthy behavior and patience may be rewarded before too long. - Ask for more credit: If you have been practicing financially responsible behavior during the first year of card ownership, you may want to speak to a customer rep about increasing your credit limit. It’s considered good credit etiquette to space your requests to no more than once per year.

Don’t be surprised if the issuer asks you to provide a lot of documentation to back up your request for a credit limit boost. Items like bank statements, pay stubs, and recent tax returns are all fair game when negotiating a higher limit.

Your tone and attitude can make a big difference when speaking with a customer rep. Don’t be too greedy — keep your requested increase in the 10% to 25% range. It helps to remain unfailingly polite and attempt to see the rep’s viewpoint.

You may hint at the desire to perform balance transfers with your higher credit limit. Issuers like balance transfers because they bring in nice fees — 3% to 5% for each transfer. There is nothing preventing you from applying to a different issuer if your negotiations stall out. If you’ve been exhibiting creditworthy behavior for the last year, you may get a higher limit from a new card than the limit attached to your current card. - Juggle your credit limits: If you own multiple cards from the same issuer, you may be allowed to reallocate your credit limits. In other words, you can move some of your credit line from one credit card to another, thereby growing one card’s limit at the expense of another card.

This won’t change your overall credit limit, but it will establish a precedent for a higher limit on a single card, a precedent that may yield dividends if you later apply to another issuer.

Each issuer sets its own rules regarding credit limit increases, so your results will inevitably depend on who issued your card.

Do Unsecured Cards Build Credit?

Your behavior builds credit, but unsecured credit cards can help. Just about all of them report your payments to one credit bureau or more, and that information is used to update your credit score at least once per month.

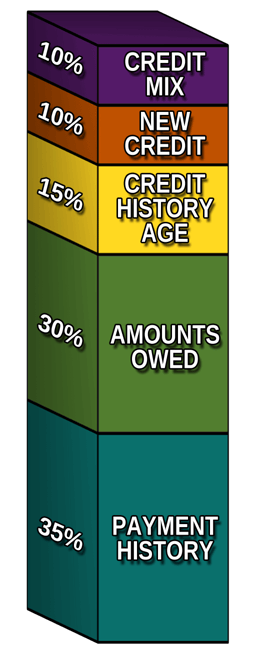

Your FICO score is based on five factors, four of which (i.e. payment history, amounts owed, length of credit history, and new credit) are heavily influenced by how you use your credit cards.

Payment History

The FICO model assigns 35% of its value to your payment history. If you pay your bills on time, your score will slowly rise. Delinquencies of 90 days are reported to the credit bureaus and will prompt them to immediately drop your score by dozens of points and remain on record for seven years.

Your score will suffer further should your payment history be littered with collections, defaults, repossessions, foreclosures or bankruptcies. If you want to protect your credit score, even a bad score, from further harm, you must try to pay your bills on time.

If you find it impossible to do so, contact your creditors and explain your situation. See if they are willing to restructure your debt instead of reporting you to the credit bureaus.

It may be possible to remove late payments from your credit reports by negotiating a goodwill removal with your creditor. That is, you agree to repay the money you owe if the creditor agrees to remove the late payments from your credit report.

Your chances of success depend, in part, on your previous relationships with your creditors. If you paid late only once or twice, you may have better luck reaching a satisfactory agreement. It also helps to be polite when speaking to a customer rep about a goodwill removal.

Eventually (i.e., in seven to 10 years), major derogatory items age off your credit reports, allowing your credit score to recover. But you can begin the recovery sooner by paying your bills on time, every time, without fail.

Amounts Owed

Another 30% of your FICO score depends on the amounts you owe. The metric called credit utilization ratio (CUR) is the amount of revolving credit you are using divided by the amount of revolving credit available. A CUR above 30% hurts your score, while a ratio below 30% helps.

FICO looks at the CUR of each credit card as well as your overall total CUR of all your cards. By repaying your balances, you can reduce your CUR and quickly increase your credit score.

Another metric, the debt-to-income (DTI) ratio, isn’t part of the FICO calculation. However, it is used extensively when you apply for a loan. You calculate it by dividing your monthly debt payments by your total monthly gross income. High values (above 36%) will make it harder to borrow money, and you may not be able to get a mortgage if your DTI exceeds 43%.

Length of Credit History

Another 15% of your FICO score stems from how long you have been using credit. FICO looks at the average of how long all your accounts have been open, rewarding you for having accounts that have endured over many years.

Accordingly, when trying to rebuild your credit, it’s a good idea to keep your old credit card account open, even if you no longer use it. For example, if your score moves into the fair or good range, you’ll probably be eligible for better credit cards. Don’t cancel old card accounts, but rather use them once a year so they don’t go dormant.

New Credit

The act of applying for new credit represents 10% of your score. While prequalifying for a credit card involves only a soft pull of your credit, applying for a card triggers a hard inquiry that can cause your score to drop by five to 10 points.

The reasoning behind this factor is that frequent applications for new credit may be a sign of financial desperation. The hit to your credit score lasts only a year, and hard inquiries drop off your credit report after two years. The solution is to limit your credit card and loan applications to one every six months.

There is one more FICO factor, credit mix, that’s worth 10% of your score. It’s only relevant to credit cards if you don’t have any. When you get your first credit card, your score should benefit due to the widening of your credit mix.

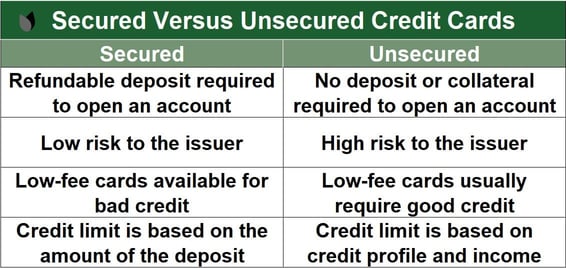

How Do Secured and Unsecured Credit Cards Differ?

Secured credit cards are designed for consumers with bad credit who want to enjoy the benefits of credit cards but don’t qualify for unsecured cards. They require you to make a minimum cash deposit into an account that acts as collateral against the credit card’s credit line.

If you are considering applying for an unsecured card and your credit is bad, a secured credit card may be a better deal. That’s because many secured credit cards have lower APRs and fees than do unsecured cards for bad credit.

In addition, secured credit cards are more likely to offer better rewards and benefits to consumers with low credit scores. For example, the top-rated Secured Sable ONE Credit Card offers cash back rewards, rental car insurance, and cellphone protection, all without annual or late payment fees.

Because secured cards rely on collateral rather than your credit score to approve your application, they are much easier to get than their unsecured counterparts. All secured cards report your payments to one or more credit bureaus, giving you the opportunity to rebuild your credit by paying your bills on time.

If you miss payments or exceed your spending limit, the issuer of your secured credit card will use the money from your refundable security deposit and reduce your credit limit accordingly. You’ll have to replenish your security account to restore your full credit line, but multiple incidents may cause the issuer to cancel your card.

Most issuers of secured cards are willing to upgrade you to an unsecured card after a period of timely payments. If you are upgraded, your minimum deposit will be refunded, and you may even be granted a higher credit limit.

What Is the Easiest Unsecured Card to Get?

Student credit cards are the easiest credit card to get, as you don’t need good credit to qualify for one. If you are enrolled at least half time in a post-secondary school, you should be able to acquire one or more student credit cards without much trouble, even with no or limited credit.

Store credit cards are also very easy to obtain when you have less than perfect credit. The Fingerhut Credit Account is probably the easiest store credit card to get. It is a closed-loop card, meaning you can use it only at Fingerhut and its affiliates.

All of the cards in this review are equal in terms of approval chances. You can prequalify for any of the reviewed cards without harming your credit score.

At the other end of the spectrum, it isn’t easy to get a business credit card when you have bad credit. Business owners usually have to personally guarantee the payments due for a business credit card.

Ranking Methodology

BadCredit.org reviews and compares credit cards to help you find the perfect one for your purposes. The overall ratings we awarded to each of the unsecured credit cards for poor credit reviewed in this article are based on factors that include APRs, fees, benefits, and third-party reviews.

The opinions we express in our reviews are not provided or approved by credit card issuers. We furnish links to reviewed cards to enable you to get more information and then apply for the cards that interest you. Always read the fine print before applying for a credit card so you have a firm understanding of its cost and benefits.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.