Maybe you’ve had some missed credit card payments here and there but you’re ready to put those tardy payments behind you. Below, we’ll take a look at some valuable information about how long late payments stay on a credit report.

Remembering can be hard. Whether it’s the location of your keys, an upcoming anniversary, or whether you’ve already paid the credit card bill this month, it’s often all too simple for things to slip our minds. For most things, the consequences of a little mental slip are fairly minor. You may be a few minutes late to work, have to buy a special apology gift, or pay a late fee as penance for your forgetfulness.

That is, of course, unless you really forget. Apologies that come too late are not only scorned by bosses and partners — but by creditors, too. In fact, when you’re more than 30 days past due on a debt, your creditor considers the payment delinquent. If it’s then reported to the credit bureaus, it will likely be your credit score paying the price. In this article, we’ll explore in more detail exactly what happens to those late payments on your credit report, what you can do about it, and how to avoid them to begin with.

Delinquent Payments | Early Removal | Avoiding Late Payments

Payments Reported As Delinquent Remain for 7 Years

To be clear, not every late payment is reported to the credit bureaus as a delinquent payment. Missing your due date by a few days may get you a late fee, but it shouldn’t impact your credit. In general, you’ll need to be at least 30 days past your due date before the credit bureaus will consider your payment delinquent, and some creditors may not report the payment as delinquent until it’s even later.

That being said, once your payment is legitimately delinquent and reported to the bureaus as such, your credit report will be updated with a note telling anyone who pulls your credit report that you had a delinquent payment. And that note can stay on your credit report for up to seven years from the date of delinquency.

Worse, the impact isn’t limited to your credit reports; your credit score is based on the information in your credit reports, and it will also reflect that delinquent payment. Moreover, since your payment history factors into 35% of your FICO credit score, a single delinquent payment can mean a drop of dozens of credit score points, depending on your initial score.

On the bright side, while the negative mark will still be on your credit report years after The Incident, the damage it does will start to fade over time. That’s because your credit score is based more on patterns of behavior than single mistakes, so ensuring you maintain a consistently positive payment history can eventually outweigh an anomalous delinquency.

In the case that a late payment is the result of an inability to pay, rather than a due-date oversight, it may not be as simple as paying a late fee and moving on. However, the absolute worst thing you can do if you find yourself falling behind on your debt payments is to do nothing. At the very least, contact your creditors to try and work out a plan to get back on track to prevent further credit damage.

It’s important to understand that all is not lost if you fall behind by a few days, or even a few weeks. Until your debt is charged off, you can still bring your account current and prevent it from turning into a defaulted debt (which will definitely sink your credit score).

Closed-end retail loans that become past due 120 cumulative days and open-end retail loans that become past due 180 cumulative days from the contractual due date should be classified Loss and charged off. — FDIC

The exact amount of time you have before your debt is charged off will depend on the type of debt. Installment loan debts, including most auto loans and mortgages, typically require that an account be at least 120 days past due before it can be charged off. Non-installment-loan debts, like credit cards, can generally be as much as 180 days delinquent before being charged off by the creditor.

Credit Repair Can Sometimes Remove Late Payments Early

Given the amount of damage even a single delinquent payment can do when reported to the credit bureaus, many consumers may seek ways to have them removed early. Unfortunately, this can be difficult to do if you were really late (and the creditor can prove it). You may have recourse, however, if that late payment was reported to the credit bureau erroneously or sticks around after its expiration date

Fraudulent, mistaken, outdated, or unsubstantiated credit report items can be disputed with the bureaus and, if evidenced correctly, can often be removed from your reports. Although credit report disputes can be filed by individual consumers, many have found hiring an experienced credit repair company, like those below, to be the most effective method for successful credit repair.

- Since 2004, Lexington Law Firm clients saw over 81 million items removed from their credit reports

- Get started today with a free online credit report consultation

- Cancel anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2004 | $99.95 | 8/10 |

- Best-in-class support

- In business since 1989

- Rapid 35-day dispute cycle, tailored to your situation

- 90-day 100% money-back guarantee

- Low $79 cost to get started, cancel or pause membership anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| A+ | 1989 | $79 | 9.5/10 |

- Free online consultation

- CreditRepair.com members saw over 8.6 million removals on their credit reports since 2012

- Free access to your credit report summary

- Three-step plan for checking, challenging and changing your credit report

- Online tools to help clients track results

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2012 | $69.95+ | 8/10 |

+See More Credit Repair Companies

Since the three major credit bureaus are all independent organizations, disputes will need to be filed with each separate credit bureau for every individual item you wish to dispute. For instance, if a late payment erroneously shows up on all three credit reports, you (or the credit repair company) will need to file three individual disputes.

Once a dispute is filed, the credit bureau has 30 days to investigate the validity of your claim. To do this, the bureau will look through any information and supporting documents you provide (which you should do if possible), as well as contacting the creditors responsible for the account in question. If the bureau finds the disputed item was reported unfairly, it will remove the item from your report.

Tips for Avoiding Late Payments Altogether

As the old saying goes, “the best defense is a good offense.” Being proactive about ensuring your debts get paid on time is the best way to avoid ever needing to worry about late payments — or their impacts on your credit. For example, if you’re prone to forgetting your due date because you tend to have too much on your plate, the best solution to avoid late payments is to set up automatic payments.

Available from most major banks, automatic payments can be set to pay your bills each month, with everything from the amount to the exact date customizable by you to fit your needs (and due dates). Of course, you’ll need to make sure you always have at least enough money in your account to cover any automated payments to prevent overdrafts, as overdrafts can come with a lot of fees.

For those who are at risk of making late payments due to financial difficulties, the very best way to avoid delinquencies is often to contact your creditors directly. It’s as much in your creditor’s best interest to get paid as it is in your best interest to pay them, so most creditors are perfectly willing to work with you — especially if you contact them before you fall behind.

And no matter what your situation, everyone can benefit from drafting (and maintaining) a proper budget. By knowing exactly where each dollar should go, you can better stay on top of those dollars, and making budgeting a habit each month can help you remember other important financial obligations, as well.

No Negative Credit Items Last Forever

Whether your credit card payment simply slipped your mind, or financial troubles have put you behind, a late payment can haunt you — and, more importantly, your credit reports — for years. But that doesn’t mean you’ll be stuck with poor credit for life. No matter how you got into credit trouble, those negative items won’t last forever.

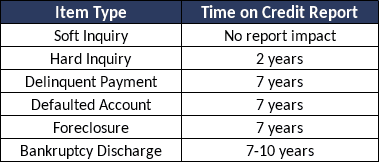

And that’s not limited to late payments. The majority of negative credit items, including late payments and foreclosures, fall off your report after seven years, and hard credit inquiries only last two years. And while bankruptcies can linger the longest, even those will typically come off your report entirely after 10 years.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.