How is your credit score calculated? In the article below, we’ll take a look at the factors that go into your score and what you can do to achieve and maintain a great score.

Over the last 30 years, the consumer credit score has gained a key role in many aspects of our finances, so it’s important to understand the ins and outs of credit scores. To start, your FICO credit score is the one used by most lenders to make decisions.

Your credit score is based on the information found in your consumer credit reports, and you may have a different FICO score for each of the three major credit bureaus. As such, your credit score can change every time the information on your reports changes, such as when your credit card issuer reports your monthly statement balance. Each specific request for your credit score can also generate a new/updated score.

That said, regardless of which credit report is used to calculate your credit score, the factors that go into the calculation will remain the same. And while FICO isn’t going to share its exact algorithms, of course, you can easily track the five different credit factors that FICO assesses when calculating your credit score.

1. Payment History — 35%

Quite likely the first question on the mind of anyone lending anyone else, well, anything, is, “Will I get it back?” This is true when your neighbor asks to borrow your lawnmower, and it’s certainly true when you ask the bank if you can borrow a hefty chunk of change.

That being the case, it makes perfect sense that your personal payment history is of chief concern to many lenders, and is the most important factor FICO considers when calculating your credit score, counting for a whopping 35%.

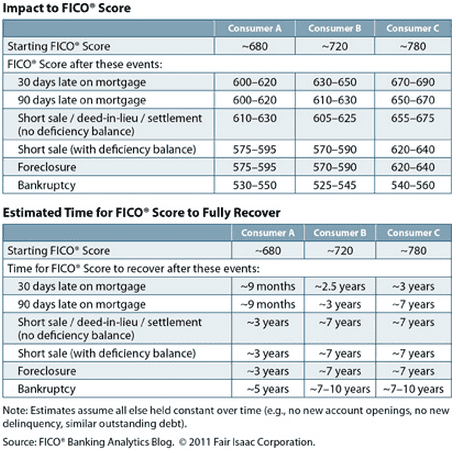

When looking at your payment history, FICO considers a variety of account types, including credit cards, retail accounts and store cards, installment loans (personal and auto loans), finance company accounts, and mortgage loans. FICO will also look at any public record and collections items — such as bankruptcies, foreclosures, certain lawsuits, and wage attachments — and factor those into its calculation.

Consumers who have good payment histories make sure to pay their debts on time and as agreed. Conversely, accounts that report late payments, missed payments, or defaults will have negative impacts on your payment history. The best way to get an idea of how your payment history will impact your credit score is to regularly check your credit reports for negative accounts or late or missed payments.

The mere presence of a negative mark, however, is not enough to derail your score. Details about each event, such as how long ago a missed payment occurred, are also taken into account. In general, negative items will have less impact on your credit score as they age, with older mistakes counting against you less.

This means you can recover from a late or missed payment simply by ensuring you demonstrate consistently good behavior after your mistake. Additionally, all negative items (excepting bankruptcies) have a seven-year shelf life and should come off your report (and, thus, stop impacting your score) after the seven years are up.

2. Total Amounts Owed — 30%

The second most important factor contributing to your FICO score calculation is the total amounts you owe (how much debt you already have), worth 30% of your score. Where your payment history may be said to determine your willingness to pay back a debt, the amounts you currently owe are an important gauge of your ability to meet your financial obligations.

When considering the amounts owed factor, FICO will investigate both the overall total amount of debt, as well as how much of each type of debt you have. For instance, FICO will differentiate between installment and revolving debts, looking at how much of each type you owe — and how much you’ve paid back.

For installment loans, such as auto and personal loans, the scoring model will take into account the original loan amount in addition to how many installments remain. The lower your loan-to-value ratio, the less it will negatively impact your score.

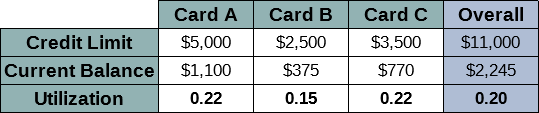

For revolving debts, like credit cards, FICO will determine your credit utilization rate for all of your revolving debts, as well as your rate for each individual line of credit. Your utilization rate is calculated using the ratio of how much credit you have available — your credit limits — to how much of that credit you are using, and most sources recommend it not exceed 30%.

For example, suppose someone carries balances on three credit cards, as shown in the chart above. With a total balance of $2,245 and a total available credit limit of $11,000, our fictional consumer would have a 20% credit utilization rate, well within the recommended bounds.

In some ways, improving your total amounts owed is the fastest way to increase your credit score, as it can be effective as soon as the lender or issuer performs a regular update to the credit bureaus. So, paying down high credit card balances could have a positive effect on your credit score in as little as 30 days.

3. Length of Credit History — 15%

While FICO’s scoring models don’t directly take into account your age when calculating your credit score, your age can have a big influence on your score through the third factor: the length of your credit history.

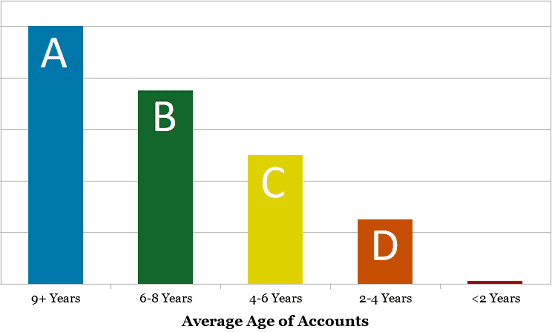

Where your payment history only looks at whether you pay your bills on time, not how long you’ve been paying them, the length of your credit history — which counts for 15% of your total score — has a definite bias toward more established consumers.

Essentially, potential lenders will want to see that you have successfully obtained and repaid credit before, as this implies you are likely to repay future debts, as well. Once again, FICO will be looking at multiple facets of your credit history’s age when calculating your score.

Initially, the model will get an overall impression of your history by looking at the age of your oldest account, but it will also determine the average age of all of your accounts. This is done by adding together the ages of each credit account, then dividing the total by the numbers of accounts.

For the most part, the easiest way to ensure you score well on your credit history length (eventually) is to start building credit early. Obtaining your first credit card while young, perhaps by taking advantage of a good student credit card, and using it — responsibly — over the next several years will put you well on your way toward great credit over time.

You’ll also want to remember that each new credit account you open will effectively lower your average account age and, thus, impact your credit score, so be selective when opening new credit accounts.

4. Number of New Credit Applications — 10%

The fourth factor of your FICO credit score is where any new accounts will bite you for the second time. In addition to impacting your average account age (the credit history length factor), the number of new accounts you open (or try to open), and how long it’s been since you opened them, will count for 10% of your score.

Since every new account you open represents more debt you are taking on — or, in the case of revolving debt, more debt that you could take on — lenders look at how recently you opened your last account. New credit accounts can potentially leave less capital for future credit obligations, decreasing your ability to handle more debt. A series of new accounts could also indicate financial trouble, another warning sign to lenders.

This is also the factor where the number of hard inquiries, or credit pulls, will impact your score. Every time you apply for new credit, including personal loans, auto loans, credit cards, and mortgages, the lender will run a hard credit inquiry, requesting your complete credit report from one or more of the credit bureaus.

Since these requests represent an attempt to establish new credit, they are taken into consideration when analyzing your new credit accounts. Soft credit inquiries, on the other hand, aren’t counted by FICO’s scoring model.

“Certain types of inquiries (requests for your credit report). Your scores do not count ‘consumer-initiated’ inquiries — requests you have made for your credit report, in order to check it. They also do not count ‘promotional inquiries’ — requests made by lenders in order to make you a ‘pre-approved’ credit offer — or ‘administrative inquiries’ — requests made by lenders to review your account with them. Requests that are marked as coming from employers are not counted either.” — myFICO.com

Although hard credit inquiries stay on your credit report for up to two years, FICO will only consider inquiries from the last 12 months, and the actual impact of hard credit pulls on your overall score tend to be small (a few points at most).

The scoring models also leave room for “rate shopping,” and multiple inquiries from auto or mortgage lenders within a short period of time — typically two weeks — are generally treated as one inquiry.

5. Mix of Credit Types — 10%

Your credit mix is the last factor that FICO uses to calculate your credit score, and it will count for 10% of your total score. Your credit mix is typically the least impactful of the five factors but will hold more weight for those without a lot of additional credit report information.

In general, lenders prefer borrowers who have experience managing different kinds of debt, including revolving credit and installment loans, as these consumers present less credit risk than inexperienced borrowers.

A healthy credit mix will include a combination of account types, such as one or two credit cards and a personal or auto loan. Consumers do not need to obtain every type of credit to score well on the credit mix factor, nor does FICO encourage anyone to do so.

“FICO® Scores will consider your mix of credit cards, retail accounts, installment loans, finance company accounts, and mortgage loans. It’s not necessary to have one of each, and it’s not a good idea to open credit accounts you don’t intend to use.” — myFICO.com

At the least, consumers should maintain at least one type of credit account, such as a basic credit card, to keep their credit reports current. If you are in the process of rebuilding your credit after a rough patch or bankruptcy, you may need to apply for credit cards for bad credit, but FICO doesn’t differentiate from prime or subprime credit cards — they all count as revolving credit and have the same impact on your credit mix.

Focus on All 5 Factors to Improve Your Score

Although the exact algorithms used by FICO to calculate our credit scores are the company’s own secret, consumers can get a good idea of where they stand by analyzing the five factors used by the FICO scoring models. For the most part, those who pay their bills on time, keep their balances low, establish credit early, are stingy with new accounts, and maintain a healthy credit mix will have great credit and high credit scores.

In addition, those who want to avoid credit score surprises should regularly check their credit reports. This can be done for free once a year through AnnualCreditReport.com without affecting your credit score. If you find items on your credit report that are expired, you can dispute them with the credit bureau to have them removed from your report.

- Since 2004, Lexington Law Firm clients saw over 81 million items removed from their credit reports

- Get started today with a free online credit report consultation

- Cancel anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2004 | $99.95 | 8/10 |

Getting the help of an experienced credit repair company, such as Lexington Law, may also be a good option for having old, mistaken, or other negative items removed from your report. Keeping your credit report clean will ensure you have the best score you can reach.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.