According to a study by the Federal Trade Commission, about 1 in 5 American adults have an error on at least one of their credit reports. Errors on your reports can impact your credit scores, potentially leading to increased fees and interest rates on your next credit card or loan.

A reputable credit repair service can help remove erroneous accounts and false information from your credit reports, which can quickly boost your FICO score.

While there is no official definition for credit repair, in general, it is the process of addressing errors and negative items, such as charge-offs, late payments, and collections, on your credit reports.

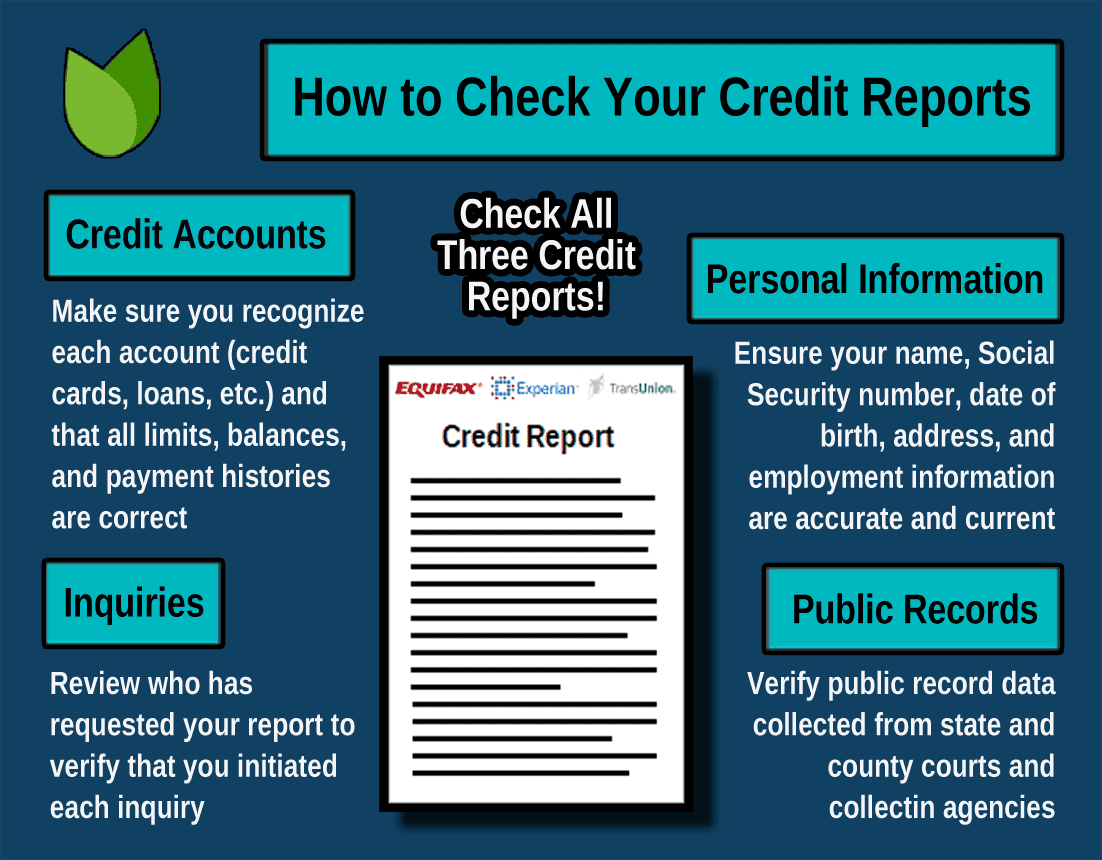

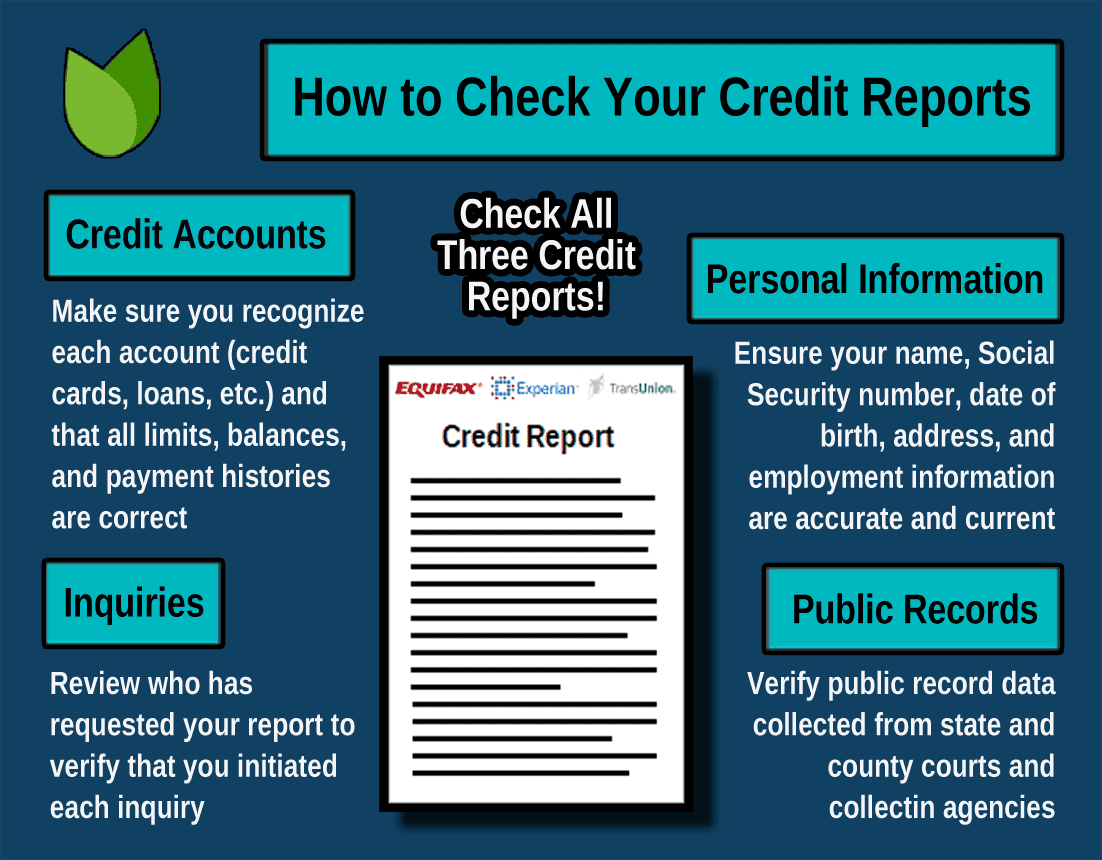

The simplest form of credit repair involves disputing wrong or expired information on your credit report with each of the three credit reporting bureaus — Experian, Equifax, and TransUnion.

More complicated cases, such as those involving identity theft, may require more significant credit repair procedures. Some repair organizations also offer resources on credit counseling, debt consolidation, unlimited dispute letters, debt collectors, fraud alerts, credit repair scams, and other ways to successfully obtain a good credit standing.

Just as with any service, the cost of your credit repair will vary based on how much work it will take to solve your problem and the solution you choose.

A full-service option, such as a credit repair agency, may cost more because it takes care of everything for you, while doing it yourself costs less because you’re not paying for professional assistance.

Credit Repair Agencies ($49 – $139/Month)

Enlisting the services of a credit repair agency is often the easiest way to complete the credit repair process.

Most companies charge a monthly fee, ranging from about $50 to over $100. Fees will vary not only from company to company, but will also depend on the types of services you need.

If you have a complicated case or a large number of errors to dispute, you may be charged more than if you only have a few items that need to be addressed. The more complex your repair, the longer it will take — and monthly fees can add up after a while.

Credit Repair Software (Up to $399+)

As with a repair company, credit repair software will vary in cost depending on the features it offers — the less you pay for your software, the less you’re likely to get.

At the low end of the spectrum, expect a bare-bones collection of templates and tips for you to go about the process on your own, and maybe some simple calendars. For an attractive user interface, automated reminders, and comprehensive letter generators, you should be prepared to spend at least a few hundred dollars.

However, once you pay for the software you own it and are free to use it anytime a future credit repair need arises.

Free Credit Repair (DIY)

The only truly free credit repair solution is to do it yourself. All three of the major credit bureaus now offer online portals where you can file your dispute or check the progress of an existing dispute.

Keep in mind that as with most things, you get what you pay for — especially when it’s free.

If you have a large number of disputes, are battling fraud, or have other complications, it could be worth the money to spring for the help of a credit repair professional who knows exactly how to repair your credit.

While the best credit repair company is the one you feel comfortable using, there are several factors to consider when comparing services.

While things like fees and features may be more obvious, don’t forget to check the company’s status with the BBB and industry associations; if the company has a bad reputation among other companies, you should heed the warning.

Credit Repair Reviews — 3 Top Credit Repair Companies

If you don’t know where to start or want an expert opinion on a good place to begin your search for a credit repair company, check out our top-rated suggestions.

Lexington Law Credit Repair

A group of consumer advocacy law firms, Lexington Law offers its clients over 25 years of credit repair experience. Lexington offers a free consultation and reasonable monthly fees, all backed by a solid reputation and round-the-clock client support.

A group of consumer advocacy law firms, Lexington Law offers its clients over 25 years of credit repair experience. Lexington offers a free consultation and reasonable monthly fees, all backed by a solid reputation and round-the-clock client support.

CreditRepair.com

With customized tools and a focus on technology, CreditRepair.com offers both an online dashboard and a mobile application. Clients can track the status of their disputes, as well as changes in their credit score, from wherever they need to be.

Sky Blue Credit Repair

Offering a flat-rate payment structure and lower-than-average monthly fees, Sky Blue is an affordable option for a credit repair company with a BBB score of A+. Sky Blue has a dedication to speed, advertising an average of 15 disputes (five items per bureau) every 35 days.

The time your credit repair process takes will depend on your personal situation. The more disputes you have, the longer it will take to resolve them all.

Once a bureau receives a dispute, it is required by law to investigate the matter within 30 days, unless the dispute is deemed frivolous. If the dispute is valid, the bureau will remove or update the item(s) so your report is accurate. This same process must be repeated with each bureau whose credit report shows the same mistake(s).

Expect credit repair to last at least six weeks, but it could take much longer.

For a quick credit score improvement, try a free service like Experian Boost. This service helps consumers improve their FICO Score 8 by an average of 13 points by adding recurring bills like Netflix or utilities to their payment history. The user manually chooses which accounts with positive payment histories they want added to their Experian credit report.

The effectiveness of credit repair is a bit of an eye-of-the-beholder deal. Insofar as credit repair is a process designed to remove errors and certain negative accounts from your credit report, then it does work — the credit repair process can effectively help remove disputable items.

On the other hand, many people undergo the credit repair process in the hopes of improving a poor credit score. In this respect, credit repair may only sometimes work.

Successfully removing an item from your credit report can only improve your credit score if the removed item is hurting your credit score in the first place. There is no guarantee that credit repair will impact your credit score at all, as many variables are taken into account when calculating your score.

Either way, you should always remove any errors or outdated information from your credit report as soon as you discover them — regardless of the actual effect this has on your score. A clean credit report can give you peace of mind the next time you apply for a loan; you’ll know that an inaccurate credit score isn’t holding you back from qualifying for a better interest rate, saving you time and money in the long run.

Credit repair companies can file disputes to remove inaccuracies or outdated information from your credit reports on your behalf.

You should be skeptical of any credit repair service that claims it can wipe your credit profile clean or remove all negative items from your history. This is not only impossible to promise, but, in some cases, it may be illegal.

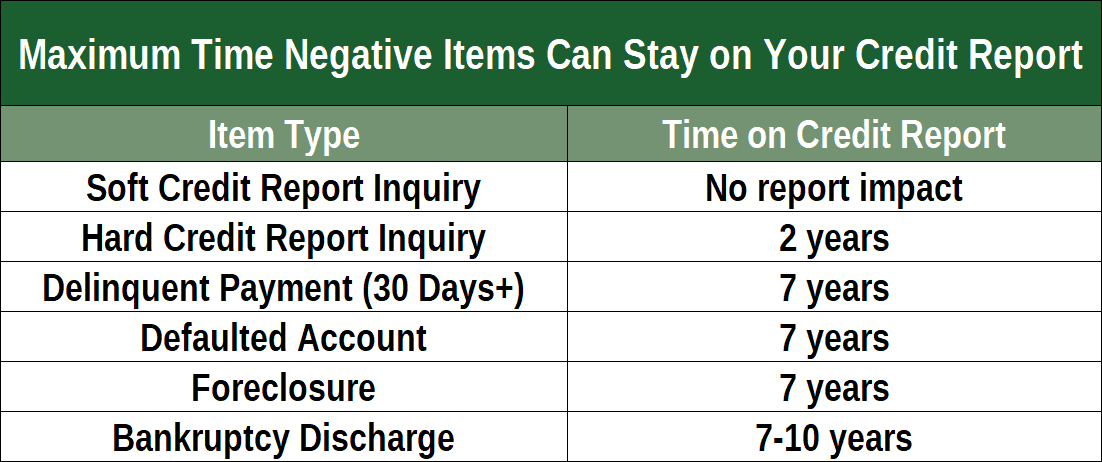

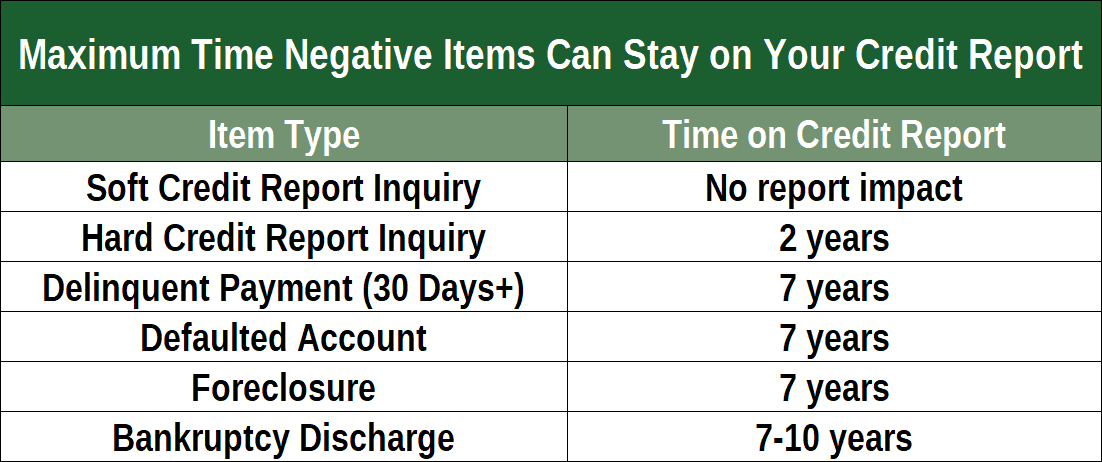

Legitimate items are supposed to remain on your credit history until they’re old enough for removal. In most cases, that is between seven and 10 years after they’re posted.

While you or a credit repair company can implement several methods to petition items for approval, nothing is guaranteed to work. Instead, any removals of legitimate negative items are at the discretion of the reporting lender.

Items that a credit repair service can help remove or modify may include:

- Old items that should no longer appear on your credit report

- Inaccuracies regarding the spelling of your name, your address, or other contact information that could trigger a credit application rejection

- Inaccurately reported late payments, collection accounts, or balances

- Mistakes in your payment history

- Duplicate accounts

- Unauthorized inquiries

- Accounts that don’t belong to you

A good credit repair agency, like those listed above, can also send debt validation letters to creditors, send cease-and-desist letters to debt collectors on your behalf, and follow up on any disputes that each credit bureau receives.

Just remember that the credit repair process is more about your credit profile than your credit score. A credit repair service can look for inaccuracies or potential flaws in your credit report that it can dispute or petition for removal.

In many cases, this work will result in an improved credit score. No legitimate credit repair company can guarantee any specific credit score improvements, though.

To avoid a potential credit repair scam, steer clear of any so-called credit counselor who:

- requires payment upfront before the company does any work.

- insists that you not contact a credit bureau or credit reporting company on your own.

- advises you to dispute accurate items on your credit report or lie about your dispute.

- does not explain your legal rights before you sign up for its services.

The services listed above are all vetted and respected in the credit repair industry. Each credit repair service has a long track record of success and a history of helping clients achieve their credit goals.

You can absolutely attempt to repair your own credit. Each major credit reporting bureau has an online tool that allows you to file your own disputes.

While the process isn’t difficult, your disputes have a greater chance of success if you are prepared. But a dependable repair service can take care of the credit repair process without you needing to take a crash course in credit repair.

If you want to attempt to repair your own credit, start by accessing your annual free credit report. This report will not tell you your credit score, but it will give you the basic information you need to determine if you have anything worth disputing.

When reviewing your credit report, look for accounts older than seven years. Make sure your name is spelled correctly and that your address and other personal details are also accurately spelled and up to date.

Be certain that your payment history, balances, and other pertinent data are also properly reported and that no account is listed more than once.

If you find something that needs removal or modification, you will need to file an online dispute with each credit bureau that lists the item. There’s no way to file an all-encompassing dispute. Instead, you’ll need to prepare separate disputes for TransUnion, Equifax, and Experian.

Not long ago, each credit reporting company required you to file disputes by traditional mail. Thankfully, each now maintains an online portal where you can file disputes and check the status of previously filed disputes.

Once you file your dispute, the credit bureau has up to 30 days to make a ruling. During this time, the bureau will investigate your claim by following up with the creditor to validate your debt or whatever other information you disputed.

A bureau may require more information from you during this process. Be sure to follow up quickly with any requested supporting documentation. A failure to do so may slow down your resolution process.

When the investigation concludes, the credit reporting agency will update your online portal with the results. If the bureau rules in your favor, the disputed item (or items) will be removed or modified immediately.

However, some removed items could reappear on your credit history. Occasionally, a creditor has an automated reporting software glitch that sends the same data each month. This means a recently removed item could end up re-reported and added back to your credit file.

Unfortunately, the only way to resolve this is to refile a dispute. This is where a good credit monitoring program — like those often offered by a credit repair business — comes in handy.

You’re limited in the number of free credit report pulls you can access each year. Once you’ve reached that limit, you have to pay to make sure items aren’t added to your credit file again. Credit monitoring can help detect this and protect against any potential identity theft or illegal use of your Social Security number.

Credit repair companies can attempt to remove collection accounts, but this process isn’t guaranteed. If a credit repair organization promises to remove legitimate collection accounts in your name, you’re likely buying into a credit repair scam.

Photo source: Lexington Law

To understand how a credit repair service can remove a collection account, you first have to understand the difference between a legitimate and an inaccurate collection account.

An inaccurate collection account is one that is improperly reported to a credit reporting bureau. This could be an account that is not in your name, is not actually in collections, or has a misreported balance or date.

If you’re seeing this type of account on your credit reports, you or a credit repair service can petition for removal or modification of the account. Just be prepared with any supporting documentation to prove your claim.

A legitimate collection account is one that should be on your credit profile. This is an account you stopped making payments on for 180 days or more, which prompted the original lender to sell your account to debt collectors.

A collection account can cause substantial harm to your credit score for up to seven years. But that doesn’t mean it can’t technically be removed early.

You can sometimes negotiate with debt collectors to have the negative item removed from your credit report. This will typically require repayment of all — or at least part — of the debt.

In some cases, you can strike a pay-for-delete deal that prompts the debt collectors to remove the item once you make an agreed-upon payment.

Just remember that this type of deal falls within a gray area of the law and not every collection agency or lender will agree to it. Removal of any legitimate negative items on your credit report is completely up to the lender’s discretion. This is why a credit repair company can never truly guarantee to remove any collection accounts from your credit profile.

A legitimate credit repair company, though, may have relationships with some lenders that can give you an edge in your attempt to remove a collection account from your credit profile.

Your interactions or dealing with a credit repair firm such as Lexington Law does not show up on your credit profile. Therefore, working with Lexington Law or any credit counseling service cannot hurt your credit score.

Instead, a credit polish service from Lexington Law will work to remove items from your credit history that may bring your credit score down. Removal of these items frequently produces an improved credit score.

There are times when a credit repair service cannot have items removed. This will not lower your credit score, but it could mean that your score will not change at all.

A legitimate credit repair company such as Lexington Law will provide you with a free consultation before you pay for an account. This consultation will include a review of your credit report where you and a credit expert will look for disputable items and devise a plan to improve your credit score.

If you do not have any items that you can dispute, whoever you’re working with should let you know you’re not a good candidate for its services. This will keep you from spending money on a service that can’t help you.

Paying off a charged-off debt can help you look better in the eyes of future lenders. But in most cases, it will not improve your credit score or have the charge-off removed from your credit profile.

A lender charges off your debt once you stop making payments on your account for several months. Initially, listing a debt as charged-off is a clerical act that moves your debt from an active account to an inactive account and allows the lender to write the debt off as a business loss.

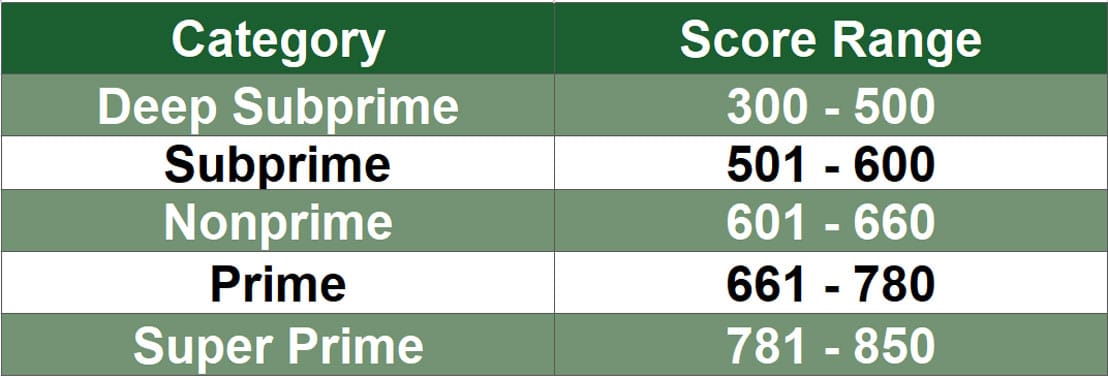

Soon after, the lender will either sell or transfer the debt to a collection agency. That’s when you often start receiving harassing phone calls. And the account will be reported to the credit bureaus as a charged-off debt, which can easily shave 100 or more points off your credit score.

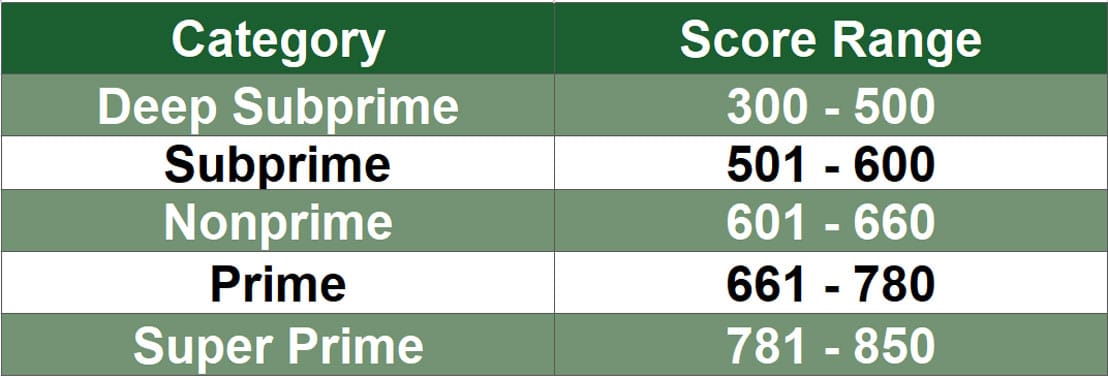

A charge-off can shave 100 or more points from your credit score and put you in a lower credit tier.

You can have a collection account for any type of unsecured debt, including a personal loan, a student loan, or credit card debt. Secured loans, such as a mortgage loan or an auto loan, result in foreclosure and repossession.

When you repay a charged-off debt, the negative items remain on your credit file but update to show that the debt is paid off. This shows future lenders that you’re attempting to make good on your financial obligations despite the setback. It will not add points to your credit score, but it will help you appear more responsible.

Occasionally, you can negotiate with the lender to have the charged-off account removed if you repay the debt in full. A credit repair firm can also help negotiate such a deal. If your creditor agrees, the charge-off will be removed from your credit report after you pay the debt.

You may remain saddled with the 90-days-or-more late payment notation on your credit file. While this is still a negative item on your credit report, it isn’t as bad as the charge-off status.

There’s no way to pay a fee to completely clear your credit history. But a credit repair business can attempt to clean up some inaccuracies or other negative information on your credit report that may result in an improved credit score.

The credit repair process typically requires an account and a monthly payment. Each service charges varying fees based on the services you need.

The amount of time you’ll need to repair your credit depends on the current state of your credit report. While some consumers can finish the process within 30 days, others may need six months or longer to completely repair their credit profile.

A general rule of thumb is that really bad credit takes longer. The more negative items you have to dispute, the longer you should expect to maintain your credit repair account. The credit repair organization you choose to work with should provide a free consultation during which you can talk with a credit expert who can give you a general idea of how long your process may take.

Just keep in mind that disputes require investigations by each credit bureau. That means you’re reliant on other people working quickly to get your case wrapped up.

Not long ago, consumers had to file new credit disputes through the mail, which sometimes took two months or more to complete. Today, you can file new credit disputes online through each credit bureau’s website. This cuts out the mailing and processing time and immediately puts your dispute in the queue for investigation.

By law, a credit reporting agency must investigate your dispute within 30 days. This means you can reduce the time it takes to resolve your dispute if you file your complaint online. Keep in mind that you must file a separate dispute with each credit bureau that lists the item you’re disputing.

Lenders typically report your updated payment, balance, and account information to each credit bureau once per month. Depending on when you made your payment, it could take up to 30 days for it to reflect on your credit history. That information typically moves to your credit profile within 45 days.

Once your credit utilization and overall debt load decrease and are updated on your credit reports, your credit score should improve the next time it is calculated, which is generally monthly.

A group of consumer advocacy law firms,

A group of consumer advocacy law firms,