Whether it’s a new car or just new to you, buying a car can sometimes be a major hassle. That hassle level ratchets up a few more notches when you have a poor credit score, defined as one below 579.

Reduce the hassle with a little helpful advice about bad credit auto loans from our experts.

1. Can I Get an Auto Loan With Bad Credit?

Now more than ever, lenders are willing to extend auto loan offers to borrowers who have bad credit scores. Many factors play into this opportunity for consumers.

The first is that there is a glut of used cars hitting the market, and dealers need to find buyers. The second is that competition in the online lending market has many lenders considering applications that were once off-limits.

Plus, an auto loan is a form of a secured loan. This means that your purchased vehicle is used as collateral to secure your loan. If you stop making payments or default on the loan altogether, the lender can repossess the vehicle and sell it to recoup some of its losses.

Since the lender has some form of security as a backup in case of default, it will likely be more willing to consider your credit application.

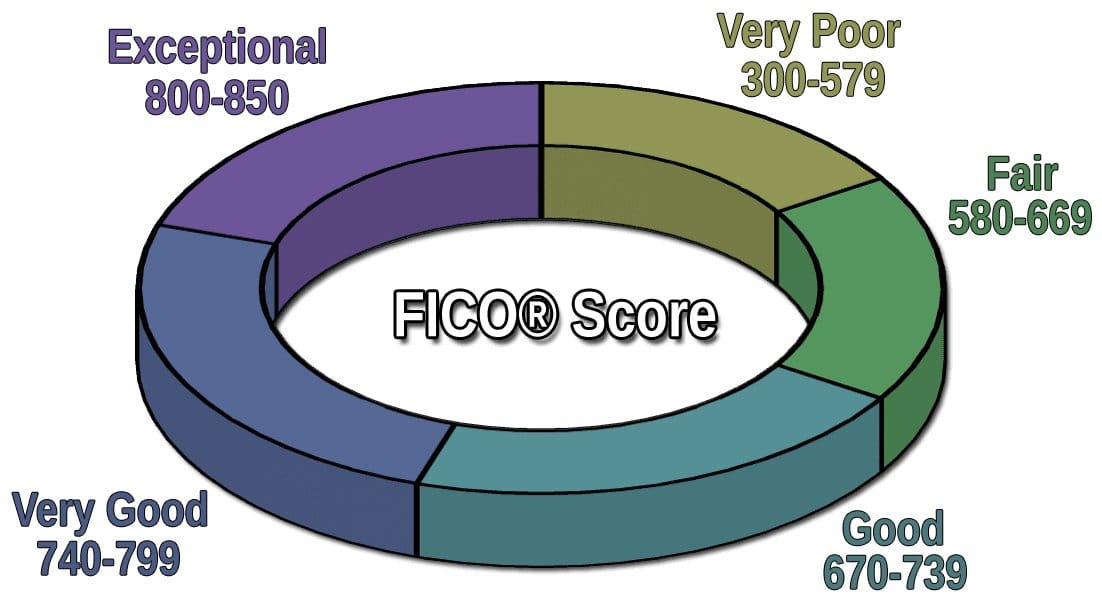

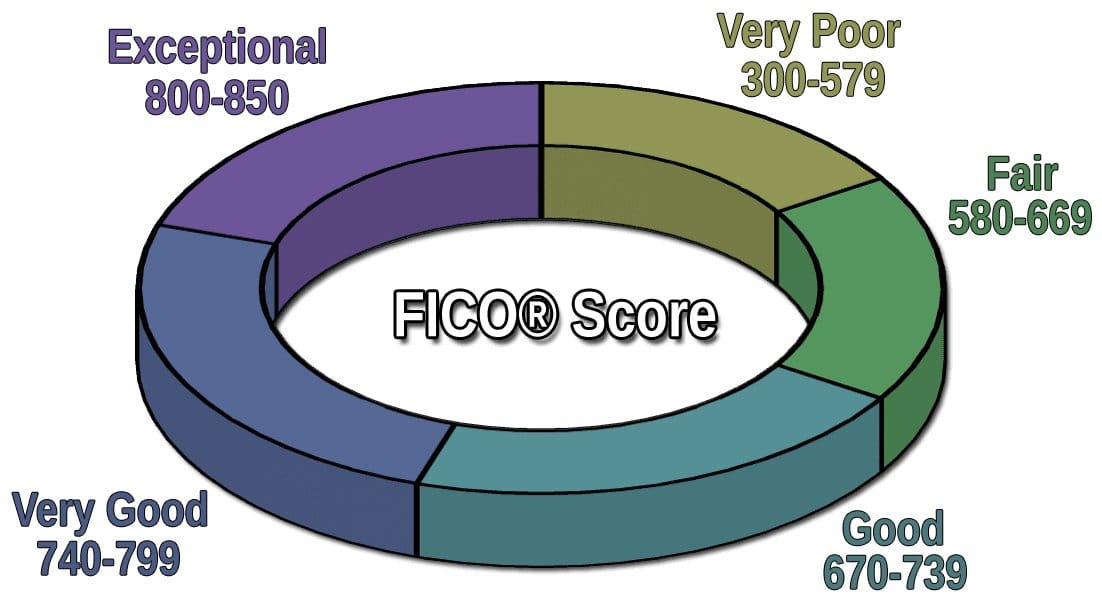

But keep in mind that there are different levels of bad credit. Your FICO credit score can range between 300 and 850. Any score at or below 579 is considered bad credit.

So, a subprime lender may consider your application for a bad credit auto loan if you have a credit score in the 500s. And you may still qualify for a bad credit car loan if you have a credit score in the high 400s.

But if your poor credit score falls at or below 400, you will likely struggle to find a lender willing to work with you. You can improve your application approval odds by:

- Adding a trade-in vehicle: The inclusion of a trade-in lowers your purchase price and increases your stake in the purchase. The lower your price, the less you need to borrow.

- Making a down payment: Lenders don’t like to be the only ones taking on risk in a bad credit auto financing deal. If you don’t include a trade-in vehicle or any money of your own, you’ll have less incentive to pay down your debt if times get tough. When you increase your down payment, you show that you have skin in the game and are serious about handling your debt.

- Enlisting the help of a cosigner: A cosigner is someone who has better credit than you and who is willing to sign for your loan to guarantee that you will repay the debt. Just be sure to stay on top of your loan payments because a late payment or default will hurt your and the cosigner’s credit scores, which can fracture friendships and family ties.

If you have a poor credit score and need a car loan, your best bet is to research the online lending networks listed above. These networks each allow you to submit a loan request that they forward to all of the lenders and dealers that partner with the website.

This means that you’re essentially applying to many lenders at once without causing any harm to your credit score. If you qualify, you could receive multiple loan offers to choose from or get a quick response from a local dealer that is willing to work with you to get you into a vehicle quickly.

Just remember that every offer will come with a unique interest rate, monthly payment, and loan term. Be sure to factor in the overall cost of your financing options when choosing the best bad credit financing offer.

2. Which Banks Offer Auto Loans For Bad Credit?

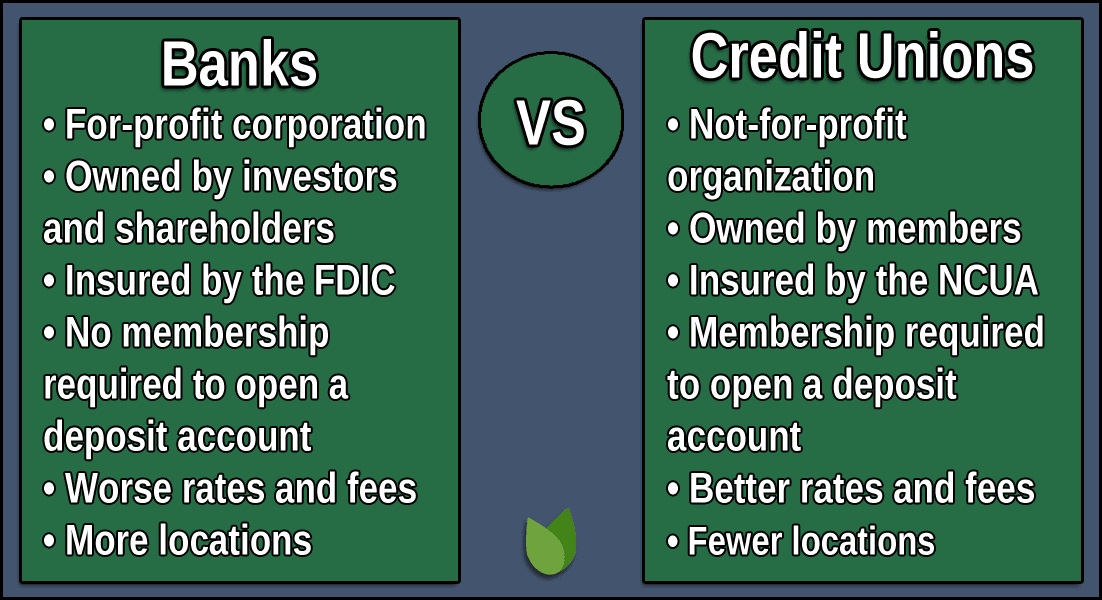

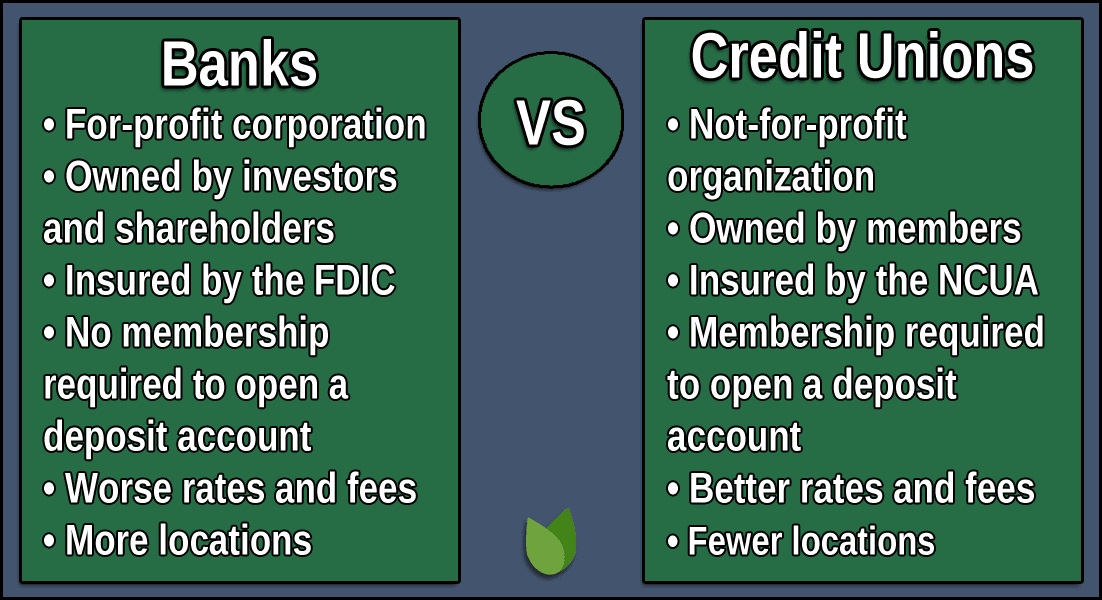

Most traditional banks will not consider car loan applications from consumers who have fair, limited, or poor credit.

The largest banks in America are all publicly traded companies that have boards of directors that expect to earn profits every quarter. To make sure that each bank remains profitable, the financial institution will limit its exposure to risk. That means denying loan applications from bad credit applicants.

A credit union, on the other hand, is a member-owned institution that returns all of its profits back to its members. While this means more affordable financial products and more lenient loan approvals, it doesn’t mean someone who has bad credit is guaranteed a loan.

Just about every credit union limits its loans to members who have fair credit or better. That means a FICO score of 580 or greater. But that doesn’t mean you’re out of luck — many independent lenders consider bad credit auto loan applications.

Many of these subprime lender establishments partner with online lending networks — including those listed above — and offer approval decisions within minutes. Depending on when you start the process, some lenders can approve your loan the same day and get you shopping for your next car right away.

This is similar to when you apply for auto financing through a dealer. The dealer will send your application to multiple lenders to see which may accept your loan request. An online lending network will take your single loan request — which takes only minutes to complete — and forward it to all of the lenders that partner with the network.

Shortly after you submit your loan request, you could receive an email from the network with multiple loan offers to choose from. Some networks partner directly with car dealership locations around the U.S. If you apply to one of these networks, you will receive a phone call or email from a dealership in your area to set up an appointment for you to tour the lot and go over your financing options. These may include traditional auto dealership locations or local buy here, pay here car lots.

3. How Do I Finance a Car With No Credit History?

A poor credit auto loan isn’t always about having poor credit. Unfortunately, consumers who have no credit are sometimes grouped together with those who have bad credit. But the two are very different.

Someone who has bad credit has likely made multiple financial mistakes in the past. These can include bankruptcy, late payments, defaults, or a heavy debt load.

Someone who has no credit is also known as credit invisible. This means they do not have enough information reported to the credit bureaus to generate a reliable credit rating. They don’t have past financial mistakes on their credit reports — they just don’t have a traceable past that lenders can view.

Most banks, credit unions, or independent lenders still see these loans as high-risk. After all, you can’t know what you can’t see. As a result, those who have no credit are often offered the same terms as poor credit auto loan applicants.

That doesn’t mean you can’t get the auto loan you need. Instead of working with a traditional bank, you can instead focus on lenders that specialize in bad credit financing. That may mean working with a local bad credit car dealership or sending a loan request to one of the online lending networks listed above.

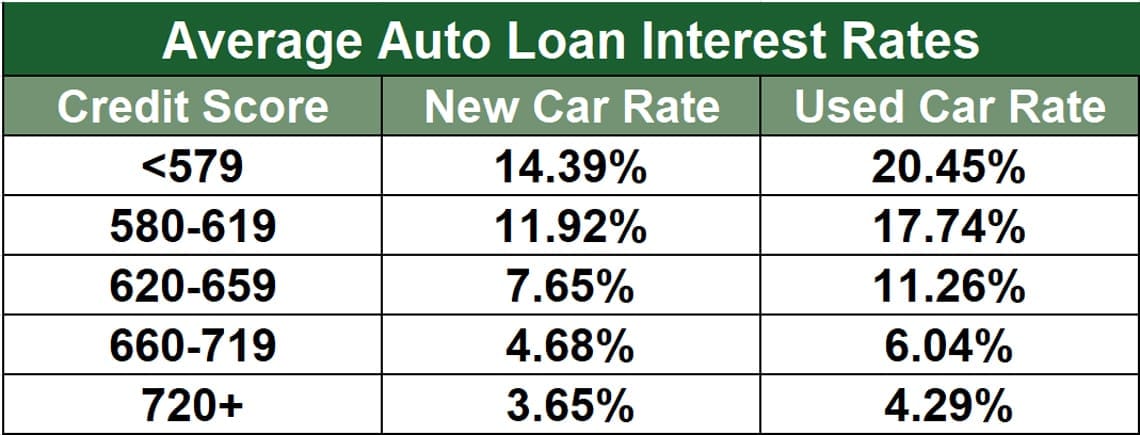

Just remember that a bad credit auto loan will likely include a higher interest rate than a loan offered to someone who has good credit. But since you do not have previous mistakes, you can use your new loan to establish a positive credit history and then refinance it with a new loan that has a better interest rate and loan term.

You may need as many as six months with a positive payment history to generate a credit score, but refinancing can save you much more money over the life of your loan.

4. How Can I Get a Car Loan With Bad Credit and No Cosigner?

A cosigner may improve your odds of getting a bad credit loan — as well as give you a better interest rate and loan term — but it may not be necessary.

A cosigner is someone who has better credit than you do and is willing to sign on to your loan to guarantee that you will repay the debt. This is a tricky situation because if you’re late on a payment or stop making payments altogether, the cosigner will also take the credit rating hit and the lender can go after that person for the money owed.

This is why many people refuse to be a cosigner and many borrowers try to avoid adding a cosigner to a loan.

But lenders like as much security as possible when extending a loan offer. A cosigner can make them feel better about a bad credit loan application. But since auto loans are a form of secured loan that uses the purchased vehicle as collateral, many lenders will consider your application without a cosigner.

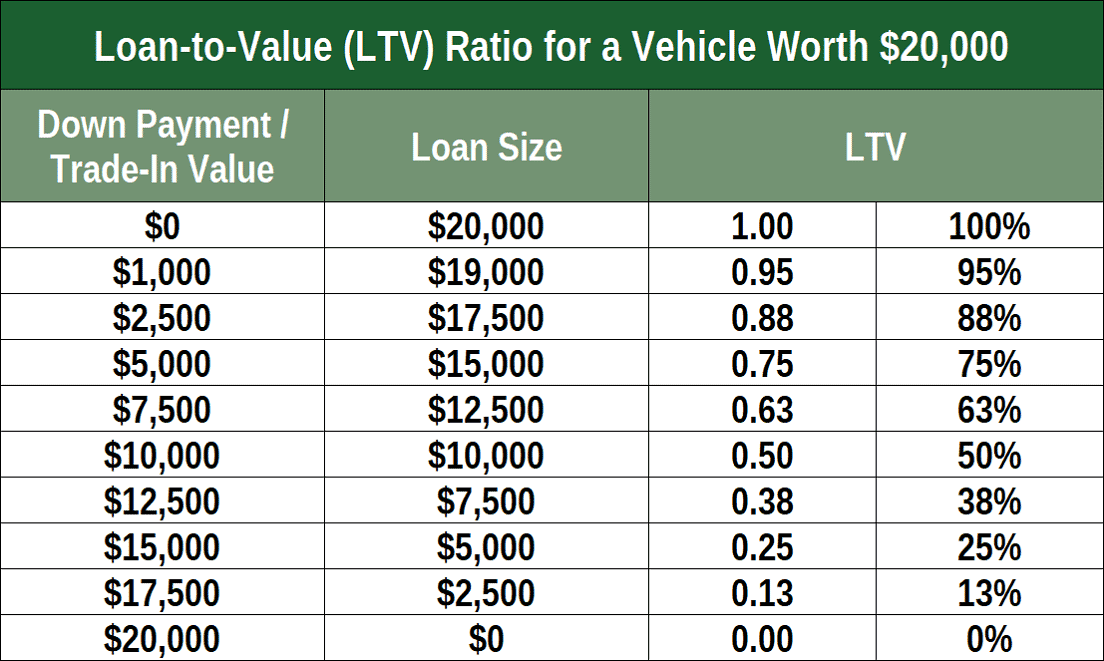

The best way to get bad credit auto loans without a cosigner is by increasing your down payment and/or including a trade-in vehicle. This decreases the amount you need to borrow, which means your loan-to-value ratio improves.

Plus, adding some of your own money increases your ownership stake in the loan and puts a lender at ease that you’re less likely to back out of the loan if times get tough.

Just remember that obtaining a loan — be it a personal loan or auto loan — is about much more than what’s on your application. You have to convince the lender that you’re responsible and motivated enough to cover the expense of the loan. This happens with your down payment, trade-in vehicle, and overall communication with the lender.

If you can do that, your approval odds increase substantially.

5. How Long Does It Take To Get a Car Financing Loan?

Bad credit auto loans are one of the fastest forms of loans to obtain. In many cases, you can go from applying for a loan to driving off the lot in your new vehicle within two hours.

Many bad credit car dealership locations have an in-house finance team that will allow you to apply at the dealership and get a credit decision within minutes. If approved, you can begin the purchase and loan paperwork and be on your way within an hour or two.

The online lending networks listed above are just as fast in their preparation and procedures. Through these networks, you can apply for a loan at any time of the day or night. You can also receive a loan decision within minutes and, if approved, begin filling out the loan paperwork right away.

Once completed, the lender will forward your money or provide a preapproved loan certificate that you can bring to the dealer of your choice to purchase a vehicle.

Other networks may not connect you with direct lenders but will put you in contact with local car dealers that provide in-house financing. These alternative lenders can still preapprove your application online and allow you to choose a car on the lot that matches your budget that same day.

Some popular online car dealers, such as CarMax and Carvana, will allow you to apply for bad credit financing online and immediately shop their online car inventory. In the case of Carvana, you can even have your new vehicle delivered directly to your home.

6. Does CarMax Approve Bad Credit?

Yes, CarMax can approve bad credit auto loan applicants. In fact, the dealer claims that approximately 8 in 10 car buyers finance their new vehicles through the dealership’s financing options.

The dealer claims that it aims “to give every customer an honest, straightforward, and haggle-free experience.” CarMax finance gives the borrower loan options that he or she can use to choose a shorter loan term, a lower monthly payment, or other choices.

Just realize that some of the finance options for truly low credit consumers can include very high interest rates. Some sources claim that these rates climb as high as 24% for some borrowers. That’s nearly eight times greater than the prime interest rates offered.

CarMax essentially works with online lending networks like those listed above and submits a loan proposal on your behalf — whether you’re online or in-store. Within minutes, you could receive multiple loan offers to choose from.

You can also attempt to prequalify for a loan before you head to the car lot.

CarMax’s finance sources include CarMax Auto Finance, Ally Financial, Inc., Capital One Auto Finance®, and a number of other industry-leading finance sources available through the online lending networks listed above.

7. What is the Lowest Credit Score Needed For an Auto Loan?

Lenders don’t publicize their credit score requirements for loans. That’s because your credit score is just one facet of what they consider when looking at your application.

Someone who has a very good credit score could still meet rejection if he or she has too much current debt and a bad debt-to-income ratio.

On the other hand, someone with a low credit score could get approved if they have a recent positive payment history, a solid down payment, and possibly a trade-in vehicle.

In short, approval isn’t all about your credit score.

That said, someone with a very poor credit score, such as a score below 500, will struggle to find financing without a very good down payment or a cosigner. But the FICO range for a low credit score is anything at or below 579. If your score falls between 500 and 579, you may be able to find financing through the online lending networks above.

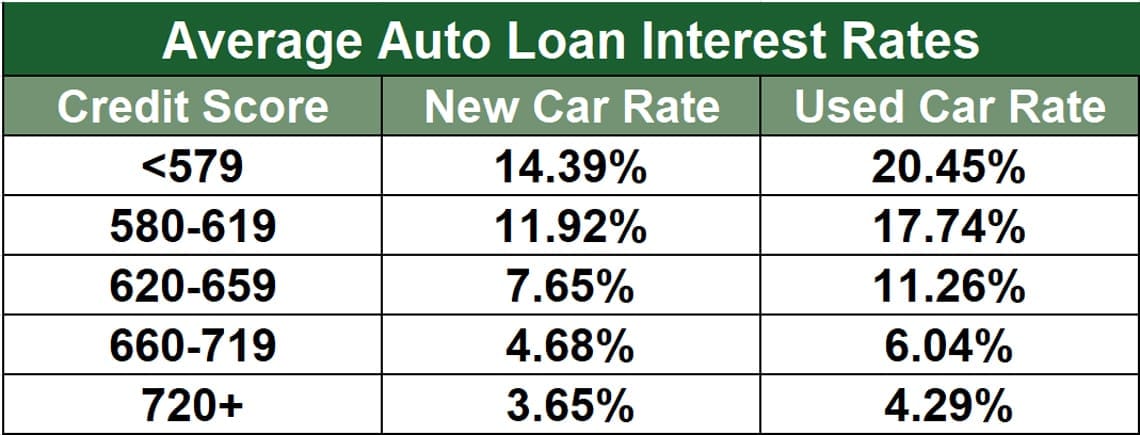

Just be aware that the lowest credit score often gets loans with the highest finance charges. Be prepared to pay more for your loan than someone who has a good credit score.

But if you repay your loan in full and have only a positive payment history, you could improve your credit score enough with the credit bureaus to qualify for a much better loan term when it comes time to shop for your next vehicle.

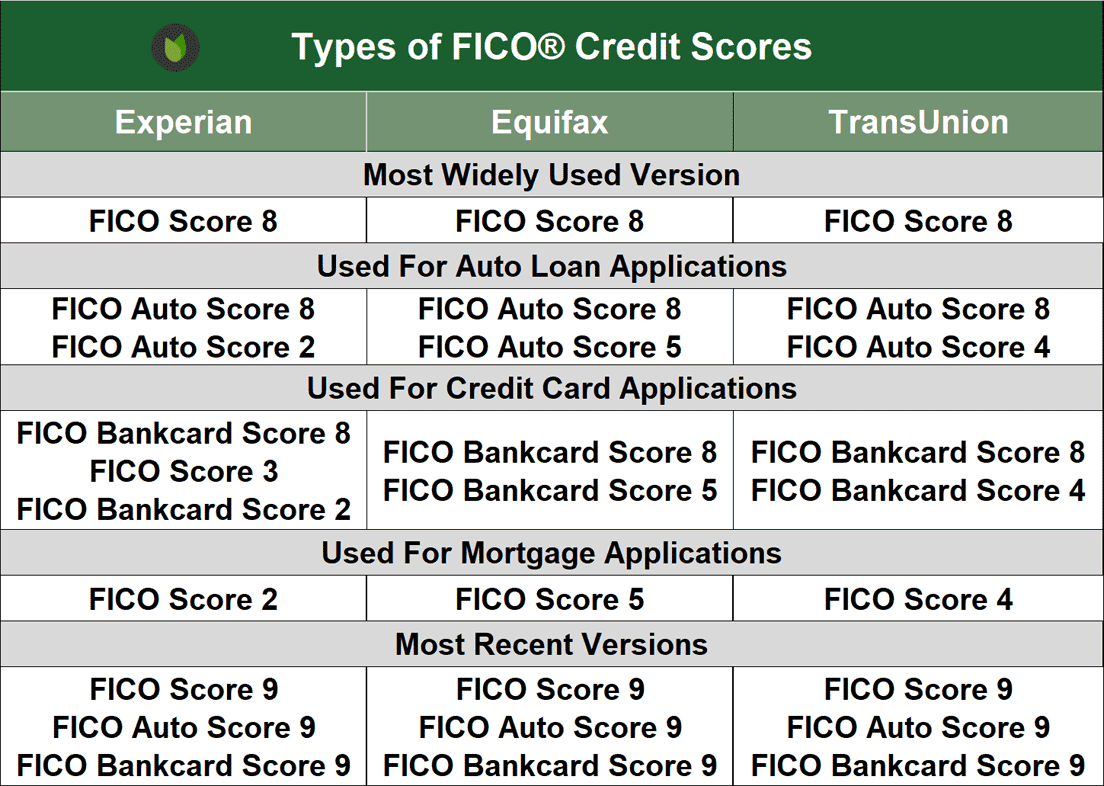

8. Which Credit Score is Checked When Buying a Car?

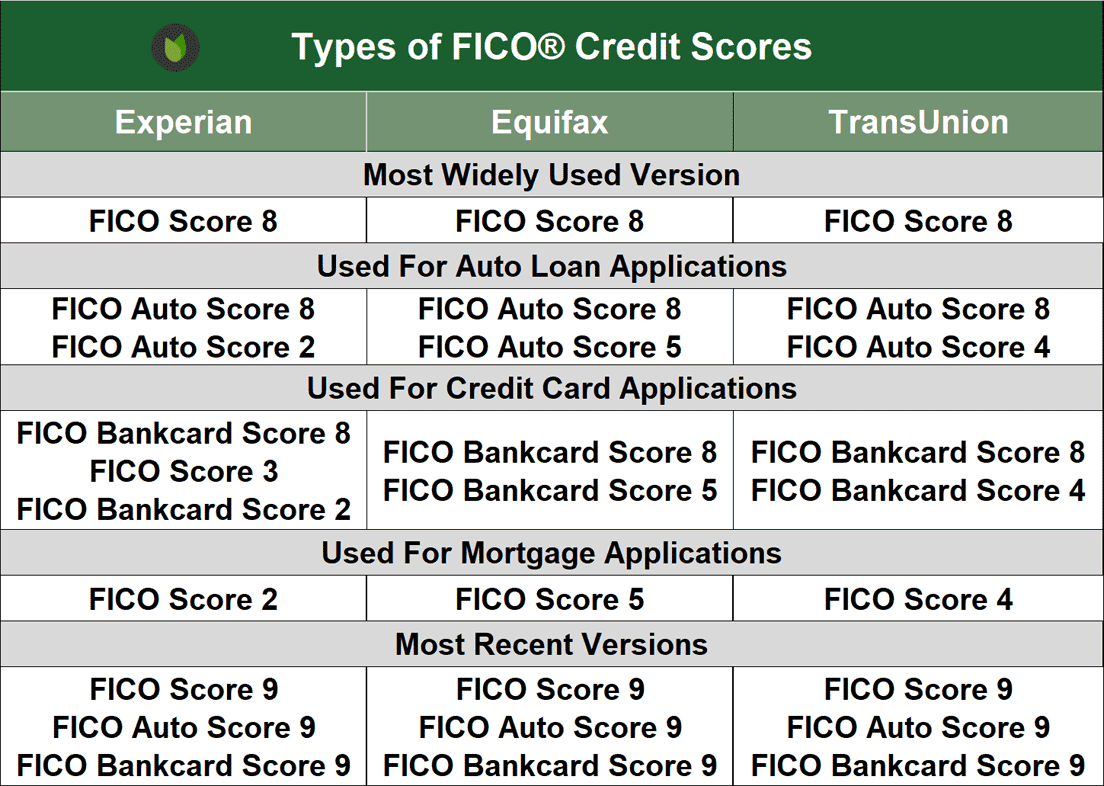

Most consumers don’t realize it, but most of us have dozens of credit scores attached to our name and Social Security number.

You can start with the credit score issued by each of the major credit bureaus — TransUnion, Equifax, and Experian. You can also factor scores calculated by Vantage and FICO.

FICO by itself has dozens of different scoring models. There are currently nine different scoring models just for auto loans. Lenders pay to access a certain version of a scoring model. Each year, when FICO releases a new version of the scoring model, the lender can either stay with the license they’ve purchased or pay to upgrade to the new score.

Since these scoring models are quite expensive, most lenders stay with the score they pay for until it becomes outdated, which can take several years. This also means you may not know which score the lender sees when it runs your credit. It could be the latest FICO® Auto Score 9 or an older model from previous years.

In many cases, your score will be in a similar range, regardless of which Auto Score version the lender uses. So, in other words, if you have bad credit with one model, you’re almost certain to have bad credit with others.

To make this even more complicated, some lenders may not use FICO’s Auto Scores at all. Lenders that offer different types of loans — including auto loans, personal loans, and student loans — may opt for a more basic and all-inclusive FICO scoring model that takes into account different factors.

If you want to make sure you’re fully prepared to apply for an auto loan, contact your preferred dealership or lender ahead of time to ask which scoring model it uses. This will give you clarity on where you stand and what you need to work on before you officially apply.

9. Is it Better to Finance a Car With a Lender or a Dealer?

If the choice is to apply with a single lender or bank or a dealership, you should choose the dealership. This is because a dealer has access to many different lenders and can run your loan request by all of them to improve your chances of success and increase the competition among the lenders — which can yield better terms for you.

But you don’t need a car dealer to do this for you. With the online lending networks listed above, you can conduct a similar search that sends your single loan request to many lenders that partner with each network.

This process can net you multiple loan offers to choose from and get you a better loan term while saving you money over the life of your loan.

These networks work similarly to dealership financing. The only difference is that you don’t need to purchase from a dealership or spend years cultivating relationships with lenders to get the best deal. All you need to do is submit a short loan request and wait a few minutes for an email with your application decision.

10. How Much of a Car Loan Can I Get With Bad Credit?

Every lender sets its own approval and lending standards. Unfortunately, lenders don’t always publicize those standards, so it’s hard to say exactly how much you may qualify for.

But you can control some factors that play into your loan amount to possibly increase the approved loan amount:

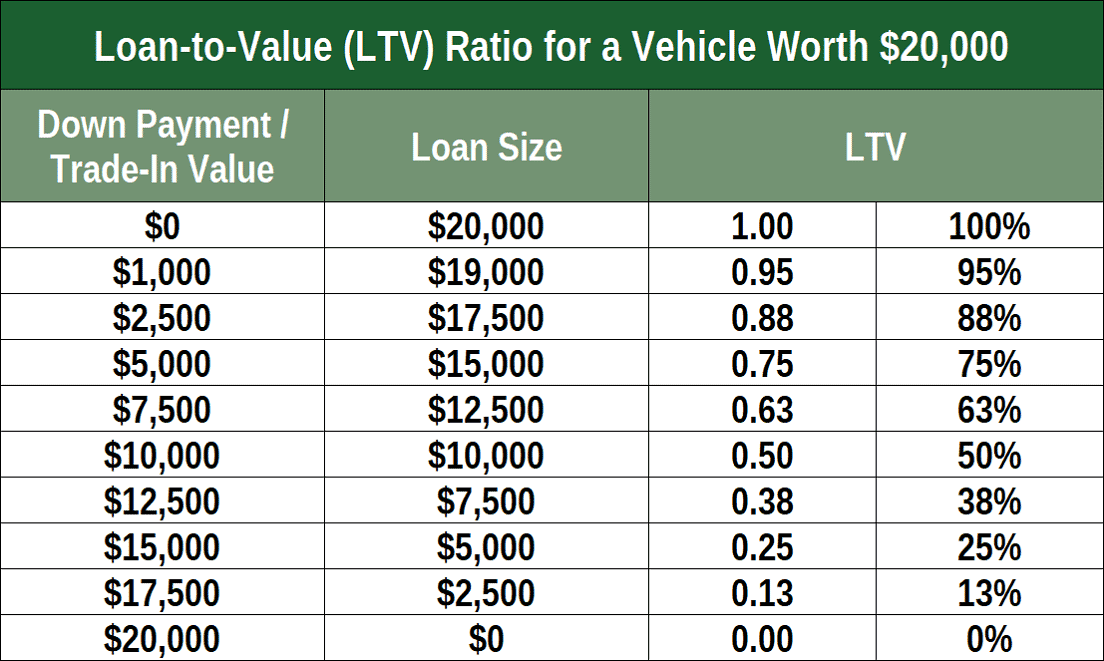

- Loan-to-Value Ratio: This is an important factor in any auto loan — regardless of your credit score. Your LTV ratio calculates how much money you’re borrowing compared with the current value of the vehicle you’re purchasing. For example, you may purchase a car that is worth $20,000 but only borrow $10,000 because of your down payment and/or trade-in. A lender will like that the collateral is more valuable than the $10,000 loan. On the other hand, if you need to borrow the entire $20,000, a lender may reject your application. This is because a vehicle depreciates as soon as you drive it off the lot. If you stop making payments early in the loan’s life, the lender can repossess the vehicle but is unlikely to recoup all of the money it lent you. If you can keep your LTV ratio low, you can likely get a larger loan despite your bad credit.

- Increase your down payment: The more money you contribute to an auto purchase, the more a lender is willing to contribute to the loan. If you’re not willing to add some money to the pot, your lender will also hesitate to do the same. When you increase your down payment, you also increase the likelihood that your lender will consider a larger loan amount.

- Add a cosigner: When you add someone else who has better credit than you to your loan, you also add a second income to the application. This means that the lender may consider a larger loan than if you applied on your own.

Remember that a larger loan means higher payments and more interest charges. Make sure you only borrow as much money as you can comfortably pay back through monthly installments. If you purchase more car than you can afford, you will end up in a situation where you will struggle to make your monthly payments — which can make your bad credit even worse.

11. Can I Refinance My Car Loan If I Have Bad Credit?

You can refinance an existing auto loan, even if you have a bad credit score. Most of the lenders associated with the online lending networks above consider applications for new and used car purchases, lease buyouts, and refinance loans.

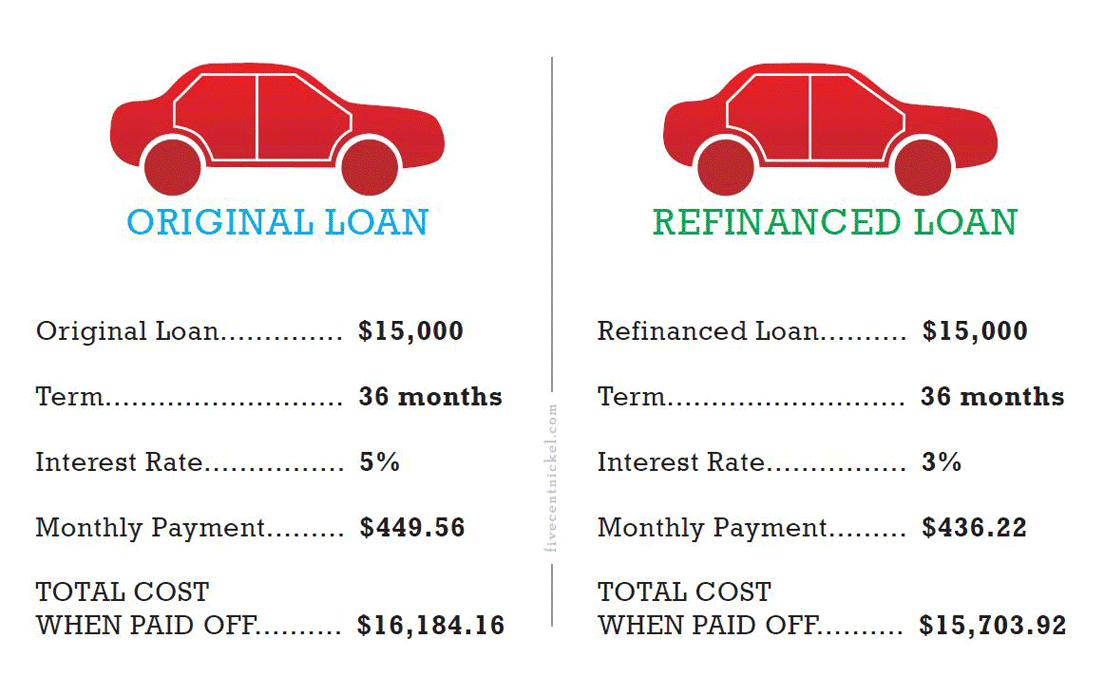

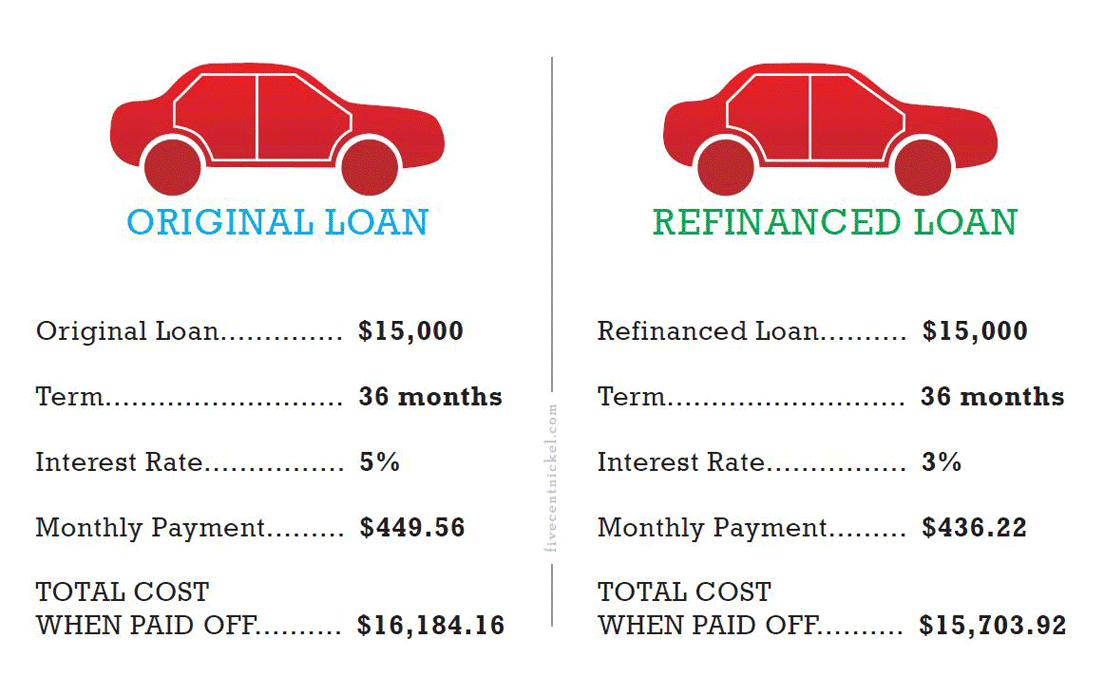

The key to a successful vehicle refinance is to move your old loan into a new loan with a lower interest rate and better loan term.

Photo source: FiveCentNickel.com

Many people choose a refinance offer that lowers their monthly payment in exchange for adding time to the loan. For example, a 36-month loan with a $250 monthly payment could become a $200 monthly payment if you extend the loan.

While this may help you out with your monthly budget, it will cost you more over the life of the loan. Adding extra payments to your loan means adding more interest charges to your loan. That means you actually lose money by refinancing your loan.

You can consider this tactic if you simply cannot afford your monthly payment right now. While you may end up paying more in the end, it’s better than missing payments or defaulting on the loan altogether.

You also want to obtain an interest rate that is lower than your current rate, though this may be difficult with a poor credit score. If the new rate is higher, you’ll pay more. If the rate stays the same, you’re essentially doing a lateral move and gain no benefit from the refinance.

12. Can I Buy a New Car With Bad Credit?

Several online loan options exist for purchasing a new car — even if you have bad credit. But remember that there are different levels of bad credit. If you have a very low credit score, such as a credit rating below 500, you may have trouble finding a loan without a large down payment or a cosigner.

If you’re in the upper tier of bad credit, say, above 550, you may have a better chance of qualifying for a new car loan.

In either scenario, you will likely need to include a substantial down payment or a trade-in vehicle to lower your overall loan amount. Few lenders, if any, will lend 100% of a new vehicle’s price to someone who has bad credit.

And since the average price of a new car ranges between $20,000 and $55,000, depending on the type and size of vehicle you buy, you will need to qualify for a fairly large loan if you cannot add a sizable down payment.

13. Does a Car Dealership Require a Hard Credit Check?

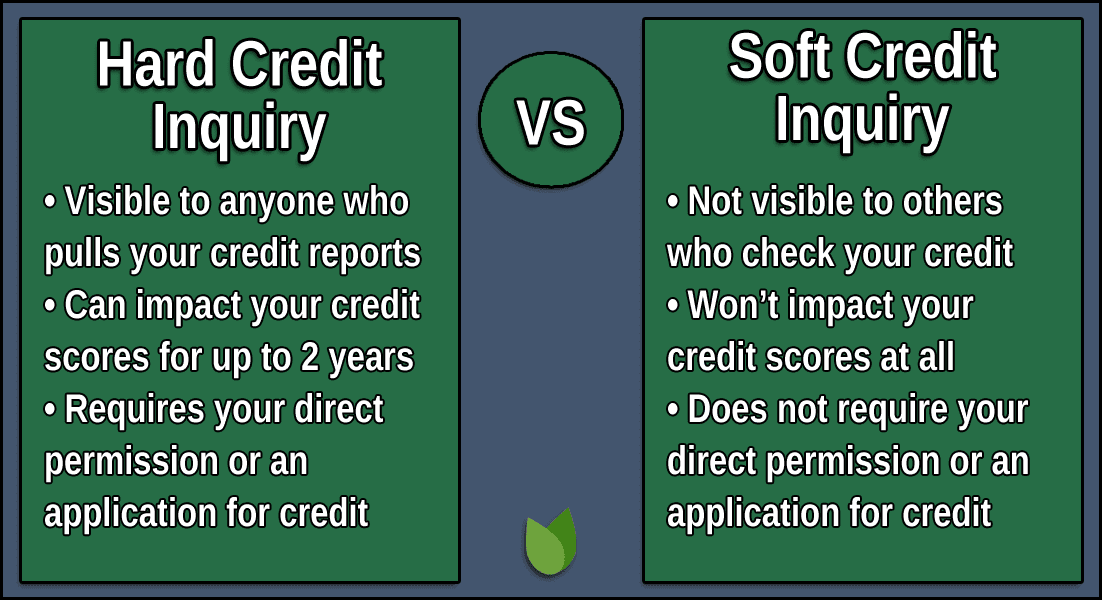

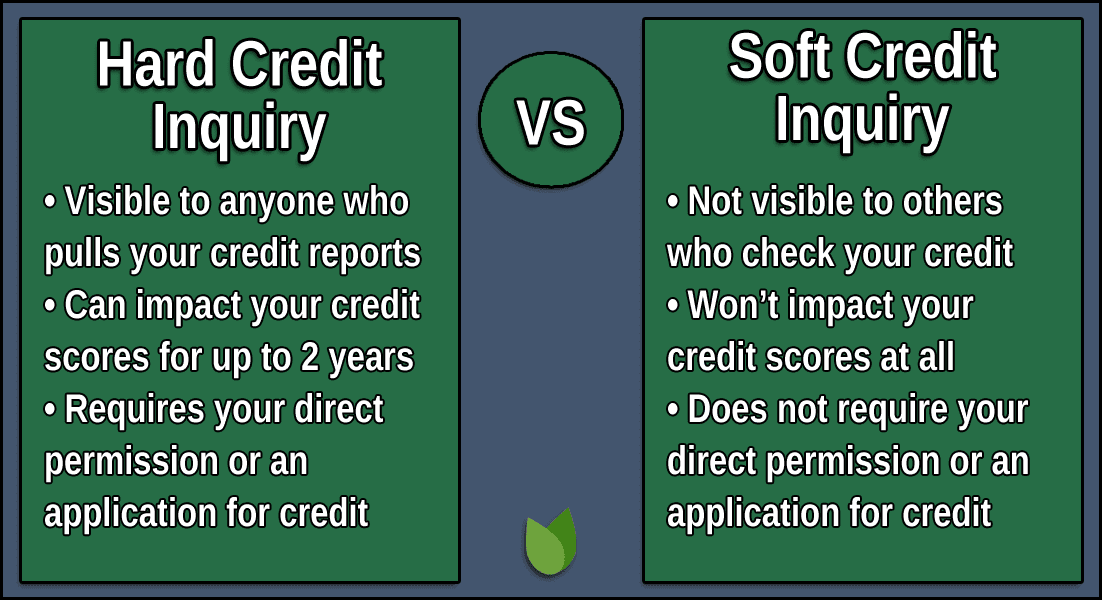

Most independent lenders and car dealers will require a hard credit check when you officially apply for an auto loan. Lenders will often allow you to prequalify for a loan by using a soft credit pull before the application process begins.

A soft credit pull gives the lender access to a short version of your credit history that shows the basics, including your payment history and current credit and loan balances. Lenders use this to see whether you can meet the general qualifications for an auto loan. This type of credit check will not harm your credit score.

If you decide to officially apply for a loan, the lender will require a full credit check that gives him or her access to your entire credit file and will leave a hard inquiry on your credit report. Lenders require this to minimize their exposure to risk and to get a better idea of your creditworthiness.

Occasionally, you may prequalify for a loan, but still not get final approval when you officially apply. This may happen if a negative item appears on your full credit report that was not present on the modified soft credit pull that took place during prequalifying.

A single inquiry by itself is not detrimental to your credit score. The damage comes if you have too many inquiries on your credit report from previous credit applications.

An inquiry lives on your credit report for two years. Once you accumulate three or more inquiries over that time frame, you could see a minor drop in your credit score for every new inquiry added. This rule is put in place to keep people from constantly applying for new credit.

But the drop isn’t permanent. You will regain those points once old inquiries age off your credit file.

14. Will Auto Lenders Verify My Income?

Most auto lenders will not directly contact your employer to verify your income. Instead, your auto dealer or independent lender will request two to four of your most recent paycheck stubs that show your year-to-date earnings.

This is how the lender verifies how much you make and how often you get paid.

Just remember that income is not only derived from paychecks. Most lenders will also consider income from government benefits, disability checks, Social Security payments, investment income, structured settlement payments, child support, student aid, or other regularly occurring payments.

When you add this information to your income, it could bolster your application and make it more appealing to a lender that wants to make sure you can afford your new monthly loan payment.