Just about everything can be done online these days, from grocery shopping to filing your taxes to taking college courses. Even the process of applying and getting approved for a loan can now be done entirely online. Some of the easiest loans to get online are from lending networks that submit your loan request to a variety of lenders so you have more options to choose from.

The advantage of online lending networks is that you complete one simple application that is viewed by multiple lenders. You can compare rates, see if you prequalify for a loan, and get a quick decision on whether you’re approved.

Online loans are ideal for consumers with bad credit and those who need quick access to cash in an emergency.

Installment Loans | Short-Term Loans | FAQs

Easiest Installment Loans to Get Online

An installment loan is one that’s paid back over time, usually in equal payments, i.e., installments. Among the advantages of an installment loan is having a fixed monthly payment that you can better fit into your budget. Installment loans also allow for larger loan amounts and more manageable terms.

Qualifying for an installment loan can be challenging, but many lenders are willing to consider even borrowers with bad credit. Here are our recommendations for the easiest online installment loans to get:

1. Avant

- Personal loans of $2,000 to $35,000

- Compare rates in 2 minutes without affecting your credit

- Best for low origination fees for bad credit

- 550 minimum credit score required

- Powered by Credible

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $2,000 to $35,000 | 9.95% - 35.99% | 12 to 60 Months | See representative example |

Avant is a direct lender that can help you secure an installment loan of up to $35,000, which you could repay in equal monthly payments over as long as 60 months.

You can compare competitive rates in just two minutes, and there’s no obligation to accept any loan offer you receive.

2. Upstart

- Personal loans starting at $1,000

- Find loans you prequalify for, complete your application, and close your loan

- Loans for 300+ FICO Scores

- Checking rates doesn't impact your credit score

- Powered by Credible

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $1,000 to $50,000 | 6.40% - 35.99% | 3 or 5 Years | See representative example |

Upstart is a lender network consisting of more than 100 banks and credit unions that can help you get a quick installment loan as soon as tomorrow. Checking to see if you qualify for a loan won’t affect your credit score, and you never have to worry about hidden fees.

Upstart says it has helped more than 2.8 million customers to date. There are no prepayment penalties if you pay off your loan early.

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% - 35.99% | 60 Days to 72 Months | See representative example |

24/7 Lending Group can get you a personal installment loan of up to $35,000, but only those with good credit should expect a loan offer that large. You may have up to six years to repay your loan, depending on the amount you borrow and the direct lender you work with.

This network has a 4.6 Trustpilot rating from more than 2,000 reviewers and adheres to responsible lending laws. You can easily check the status of your loan request by submitting your email address.

4. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

Offering personal loans of up to $10,000 from its large network of lenders, CashUSA.com works to match each loan request with the right direct lender. Upon approval, funds are often made available within 24 hours and deposited directly into your checking account.

To be considered, you must be at least 18 years old, a U.S. citizen or permanent resident, and have an income of at least $1,000 a month. You also need to have a checking account in your name where the funds can be deposited, and provide a valid email address and phone number.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 60 Months | See representative example |

The name says it all — Bad Credit Loans offers online personal installment loans to people of all credit types, including those with bad credit. A loan from Bad Credit Loans can be used for any purpose, from paying past-due bills to making car repairs to covering an urgent medical need.

Unsecured loans are available in amounts of up to $10,000 with repayment periods of three to 60 months in duration, depending on the lender. The requirements to qualify for a loan are simple in most cases, with lenders looking beyond just a credit score to make their loan approval determination.

Easiest Short-Term Loans to Get Online

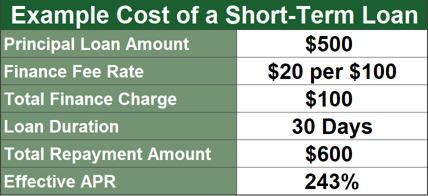

Unlike most installment loans, short-term loans are generally paid back within a few weeks. These loans are intended to get you through a short period of financial hardship or to cover a bill that comes due before your next paycheck. Also called a cash advance or a payday loan, this type of quick loan should be used very cautiously since most come with high interest rates.

You should be absolutely sure you can pay back any short-term loan to avoid financial hardship. Avoid rolling over these loans whatever you do, as this can lead to a debt spiral that can be difficult to break free of.

If you absolutely need a loan like this to see you through, here are the trusted lenders we recommend as the easiest online short-term loans to access.

6. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

Borrowers of all credit types looking for a short-term cash advance loan need look no further than MoneyMutual. More than 2 million customers have trusted this online marketplace of lenders for loans to cover things like car repairs, medical bills, and all types of emergency expenses.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

CreditLoan is a trusted online lending network that offers personal loan options ranging from $250 to $5,000 for folks with less-than-perfect credit scores. Applying for an online personal loan with CreditLoan is free, quick, and easy. Potential lenders will review your loan request and, if you meet their lending criteria, will make an offer.

If you choose to accept a loan offer, you’ll be directed to the lender’s website to complete the process. Upon approval, funds can be made available and deposited into your checking account in as little as 24 hours.

The simple and secure online form takes just minutes, and your request is reviewed by lenders interested in making a loan offer. If accepted, funds can be available in as little as 24 hours after approval.

- Quick loans up to $5,000 as soon as tomorrow

- Submit one form, get multiple options

- All credit ratings welcome — good or bad

- Requires a checking account and $800 minimum monthly income to apply

- No collateral or cosigner required

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

InstallmentLoans.com is a fast-growing lending network that offers applicants of all credit ranges installment loans of up to $5,000.

The site requires applicants to have an active checking account and Social Security number to apply but otherwise offers a quick and simple process for getting a bad credit loan.

- Short-term loan of $100 to $1,000

- Large network of lenders

- Loan decision as fast as a few minutes

- Funding as soon as the next business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $1,000 | 200% - 2,290% | Varies | See representative example |

CashAdvance.com‘s large network of lenders offers short-term loans of $100 to $1,000 to borrowers of all credit types, including those with bad credit. You must meet certain minimum requirements to qualify, including having an income of at least $1,000 a month and be employed for at least 90 days.

If you meet these and some other basic criteria, you could be offered a short-term cash advance loan from one or more of the lenders in the CashAdvance network. If you do receive a loan offer, the repayment term, including the APR and total payback amount, will be clearly stated.

What Makes These Loans Easy to Get?

If you’ve ever tried getting a loan through a bank or other traditional lender, you know how time-consuming and challenging it can be. From gathering stacks of financial documents to filling out multipage loan applications and waiting weeks for approval — who has time for all that?

Online lending has changed the landscape for many borrowers, letting in more competition and creating a faster, easier way to access cash. The creation of online loan platforms has allowed for more specialization, with some lenders choosing to focus on credit-challenged and subprime borrowers.

Technology has also made it possible for lenders to make quick loan approval decisions based on factors other than just credit history and income. Lending algorithms take into account a wide range of non-financial indicators that can help a lender more accurately assign risk to a potential borrower.

Perhaps the biggest game-changer in making online loans easier to access has been the growth in lending networks. Borrowers can now go to a single online loan marketplace for a loan and have their request seen by potentially dozens of lenders.

This growth in lending networks has led to more specialized lenders, more available loan types, more flexible lending requirements, faster approval, and easier access to funds with bank direct deposit.

What are the Easiest Online Payday Loans to Get?

Another impact of technology on the lending industry has been the dramatic surge in payday lenders promoting their businesses online. Most of these short-term and payday loans are quite easy to get, but are they really the best choice for you?

Unsurprisingly, payday lending has become a very lucrative business, accounting for more than $90 billion in borrowing every year according to the Office of the Comptroller of the Currency (OCC).

It’s no wonder so many of these businesses have popped up recently. But who can you trust when you’re in desperate need of a payday loan?

We recommend the two trusted and well-established short-term lenders we’ve listed in this guide — MoneyMutual and CashAdvance.com. They are among the most reputable and best-reviewed lending networks and stand by all of the lenders they work with.

It’s a fact that Americans earning $40,000 a year or less are more likely to take out a payday loan. It’s also true that these are among the most vulnerable members of our society, often just a paycheck or two away from disaster. An online payday loan can sometimes be the difference between staying afloat or losing it all.

What’s the Easiest Loan to Get With Bad Credit?

Let’s face it: Getting a loan of any kind when you have bad credit is just tough. And, all too often, the easiest loan to get comes with high interest and a short repayment term. So, are there any loans out there that are both easy to get and worth applying for?

Among the easiest loans to get is a secured loan. That’s where you put up something of value in exchange for cash. Other loans that can be easy to get with bad credit include:

- Personal installment loans. Installment loans meant for individuals with bad credit, like the ones we’ve recommended in this guide, tend to be the best balance of affordability and practicality. One drawback with installment loans for bad credit borrowers is that they are usually small-dollar loans with relatively short repayment periods.

- A payday loan: Whether online or in person, payday lenders offer one of the easiest loan options available. That’s because these are no credit check loans that rely on your income and ability to repay the debt rather than your credit score. You could walk into a local payday loan center and receive an instant loan minutes after applying.

- A loan with a cosigner. If you have someone with good credit who is willing to cosign with you, you’re likely to get better terms than any loan you can get on your own. That means lower and more manageable payments, as well as a potentially larger available loan amount. Just be sure you make the payments diligently and on time.

- A car title loan. Just as the name implies, a car title loan uses the value of your vehicle as collateral to secure a loan. The problem is that most car title lenders charge exorbitant interest rates and lend only a fraction of your vehicle’s worth. We don’t recommend car title loans.

Unfortunately, in addition to being easy to get, these loans also come with high rates and short payment terms.

Which Online Loan Site is Best?

The best online loan site for anyone seeking an affordable loan is one you can trust. It’s also one that offers the type of loan that best fits your financial needs. While that may seem obvious, too many people turn to the first online lender they come across and take their chances.

It’s important to keep in mind that most online loan websites are not direct lenders, but are loan marketplaces that partner with a network of lenders. As such, the rates and terms are seldom advertised on the website, since they are determined by the individual lenders that ultimately make the loan offer.

The things you can learn from a website have more to do with reputation, length of time they’ve been operating, actual customer reviews, etc. It’s this information that will give you a start in deciding which online loan site is best for you.

Other things to consider when making a decision include:

- Do they offer different loan types?

- Do they operate in all 50 states?

- Do they list a range of APRs and loan terms available?

- Do they offer a secure online application with 256-bit encryption?

- Do they have an A+ BBB rating?

- Do they charge a fee to apply?

- Do they list their minimum qualifications or requirements for applying?

- Do they have a direct customer service number?

Finding answers to these questions will give you a good indication of which online lenders to trust, and which to avoid. Using any of the lenders we’ve recommended in this guide is a great place to start.

When you do receive a loan offer, be sure to review the terms carefully before agreeing to any loan.

Consumers Have More Borrowing Options than Ever Before

Online loan websites have brought a level of convenience and ease to the lending environment that gives borrowers more choice than they’ve ever had before. Through their lender networks, these sites offer the easiest loans to get online, even if you have bad credit.

By doing a small amount of follow-up research and due diligence, you can find just the right loan option at an affordable rate. Or simply check out the lenders we’ve recommended in this guide and know that they’re among the best and most trusted available.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.