Putting together a thorough CashUSA review took substantial time sifting through online reviews, researching the company’s history, and developing an understanding of the role the network plays in helping consumers with bad credit find a potential lender.

Thousands of consumers who have poor credit submit personal loan requests of between $500 and $10,000 to CashUSA.com. The lending network then forwards those requests to a large group of partner lenders that make prequalification decisions in a matter of seconds.

If you’re prequalified, you can complete your loan application and have your funds deposited into a linked bank account within one business day. It doesn’t get much easier than that.

Apply For a Fast Personal Loan of Up to $10,000

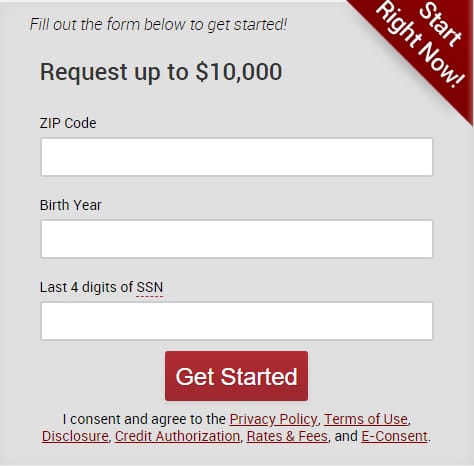

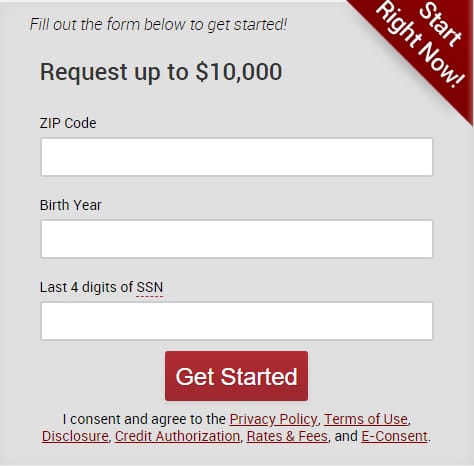

Submitting a personal loan request to CashUSA.com takes less than five minutes. Your request will trigger a soft credit pull under your name that will not affect your credit score.

You can start the process by submitting your initial online loan request to the network. This requires you to provide your zip code, birth year, and the last four digits of your Social Security number.

The following page will ask for more specific personal information, including your full name and address, whether you’re an active-duty military member, the loan amount you’re requesting, and your credit score range. This can be anywhere from poor (a score at or below 579) to excellent (at or above 740).

Since you’re applying for a personal loan, there are no rules as to how you can use the money you borrow. This is different from certain secured loan types — including an auto loan, a mortgage loan, or a student loan.

The network will still ask about your intentions with the loan, but this will not affect your ability to qualify. Among the options you can choose are:

- Debt consolidation

- Emergency situation

- Auto repair

- Auto purchase

- Moving

- Home improvement

- Medical

- Business

- Vacation

- Taxes

- Rent or Mortgage

- Wedding

- Major purchase

- Student-related/Education

This form will also require you to provide your email address, phone number, and physical address, as well as how long you’ve resided in your current location, the most convenient time to contact you, and whether you own or rent your home.

The next form breaks down your current income and asks for your:

- Income source

- Name of employer

- Employer’s phone number

- Length of employment

- Monthly gross income

- Frequency of salary

Remember that many legitimate lenders will accept income sources other than regular employment. This can include but isn’t limited to government benefits checks, Social Security, disability benefits, alimony, child support, annuities, investment income, rental property income, structured settlement checks, and other sources of nontraditional income.

The final page will ask for your driver’s license or state photo ID number, the issuing state, your full Social Security number, and your bank account type (checking account or savings account). The CashUSA platform forwards the bank account information to each loan company to help find you a match.

You finalize your request by providing your mobile phone number. You’ll soon receive a text message with a link to your mobile loan page. You’ll also receive loan-related text alerts. If the CashUSA platform connects you to an online lender, you will receive an official loan offer.

Note that every potential offer will have a unique interest rate, payment amount, and repayment term. Each loan offer may also contain a differing origination fee or another setup charge. Study each offer carefully before choosing the best one for you.

At this stage, all loan offers are tentative. You’ll still have to undergo a full credit check to give the lender access to your credit report. As long as there’s nothing substantial in your credit history that differs from the information gathered during your soft credit pull, you’ll get your bad credit loan.

If you accept an offer, the network will forward you to the lender’s website, where you will complete the online loan agreement. The loan provider will then initiate an electronic funds transfer to your bank account.

To qualify, you must be at least 18 years old and a US citizen or permanent resident with proof of at least $1,000 in monthly after-tax income. You must also have a bank account in your name and provide work and home phone numbers, as well as a valid email address.

Mixed Reviews Paint a Confusing Picture

Although CashUSA.com has its fair share of negative ratings and reviews across the internet, few reviewers were upset about the network’s service. Almost everyone who provided a review had received the loan they needed with an agreeable loan term.

The complaints came after the loan was completed — when other lenders and financial service providers contacted the borrower after acquiring their contact information from the network. This is part of the terms of service that each borrower agrees to and is highlighted in bold at the top of the network’s website:

You can opt-out or unsubscribe from third-party emails you receive as a result of your CashUSA.com loan request by following the “Unsubscribe” link at the bottom of each email you receive. For any calls you receive from a third-party lender, you can tell them you’ve completed your loan and would like to be put on their Do Not Call list.

As you search the internet, you’ll find many mixed CashUSA.com reviews. The network is currently not accredited by the Better Business Bureau. It has a 2.5 rating through Trustpilot from five reviewers whose complaints are about third-party calls and emails.

“Looks to be a data collector in order to sell the info. They’re not trying to hide that but beware if you’re entering personal information.”

Aside from the comments on BBB and Trustpilot, there are very few user testimonials for the lending network’s service — but the sheer number of loans generated by the network demonstrates that the service works. Many other third-party websites rate CashUSA.com among the best online lending networks for bad credit borrowers, and we tend to agree.

CashUSA is not a loan scam — it’s a loan network that helps connect borrowers who struggle to find a loan elsewhere. Its multiple lenders specialize in installment loans, emergency loans, or short-term loan options for bad credit borrowers.

Does CashUSA.com Lend Money?

CashUSA.com is not a direct lender. It’s a referral service that helps connect borrowers with multiple lenders that will consider applications for bad credit loans of between $500 and $10,000.

Fill out a short form to request a loan from one of CashUSA’s direct lending partners.

When you submit your initial loan request for a CashUSA loan, the network will forward your request to each direct lender it partners with. Each lender will use automated underwriting software to review your application within seconds.

If you qualify for a loan, you will receive an email with one or more loan offers for you to choose from. These offers come from partner lenders — not from CashUSA.com.

If you find an offer that you like, you can accept it, and CashUSA will transfer you to the lender’s website. That’s the last interaction you’ll have with the network during your loan request.

On the lender’s website, you’ll complete the loan paperwork after you undergo a credit check. You’ll receive your borrowed funds within one business day in your bank account.

You’ll never pay to use CashUSA.com. Instead, each lender pays a referral fee to the network for every closed loan. As stated in its website disclosure, CashUSA.com may also profit from sharing your contact and application information with third-party lenders and financial service providers.

Once you close your loan, you’ll submit your monthly payment to the lender you chose to work with. You will not send money to CashUSA.com, and the network will never ask for payment for your loan or other services rendered.

Is CashUSA.com Safe?

CashUSA.com provides a modern and security-rich platform for transmitting your loan request to the direct lender network it partners with. A robust privacy policy outlines the company’s efforts and states:

“We are committed to providing a high level of security and privacy regarding the collection and use of our customers’ personal information, as well as the personal information of all consumers who visit our website.”

CashUSA.com also uses industry-standard encryption and security measures to protect consumers’ personal information.

On top of the website security, CashUSA.com also vets all of its direct lender partners to make sure that every installment loan offer comes from a reputable lender.

Before you submit a loan request, you can contact the network’s customer support with any questions you may have. You can do so by submitting a form on the company website, sending an email to support@cashusa.com, or calling 1-866-973-6587.

What Credit Score Do You Need to Get a Loan From CashUSA?

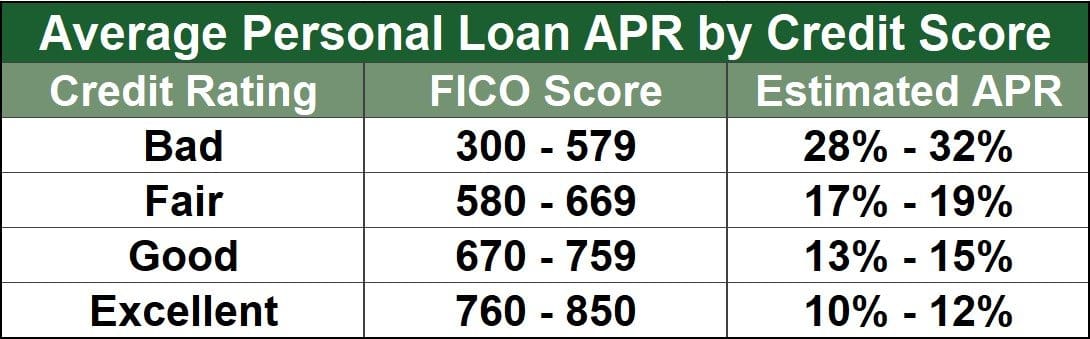

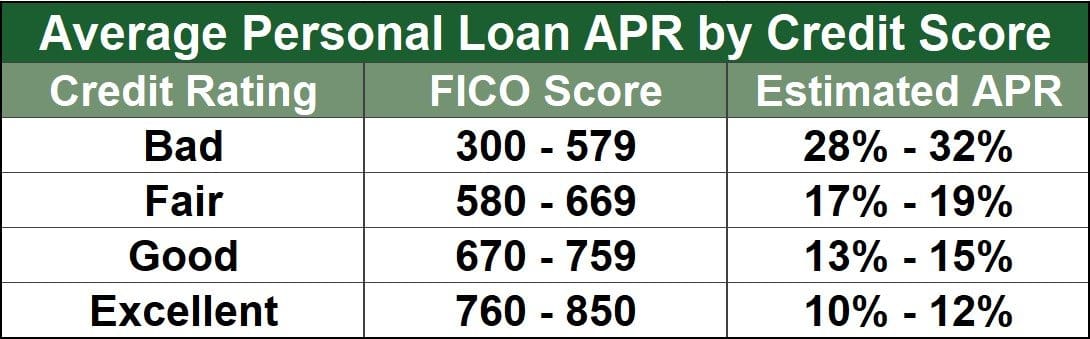

There is no set minimum credit score required to get a loan offer. That’s because each lender sets its own requirements — not the lending network. Some of its partnered lenders are payday loan providers that may not check your credit at all, meaning your credit score is not even considered for loan approval.

Other lenders that provide larger installment loans, such as loans for several thousand dollars, will require a credit check and likely a higher credit score, at least in the fair range (about 600+).

What Can I Use a CashUSA Loan For?

You can use a personal loan from CashUSA for any purpose. This is different from other loan types that limit how you use the funds you borrow. You can’t use the proceeds of an auto loan, for example, to fund home repairs.

But with a personal loan, sometimes referred to as a cash loan or a signature loan, you have complete control over how you spend your borrowed money.

There are two main types of personal loan products — a secured loan and an unsecured loan. CashUSA connects borrowers with unsecured loans, which means you don’t need to provide collateral to secure your loan.

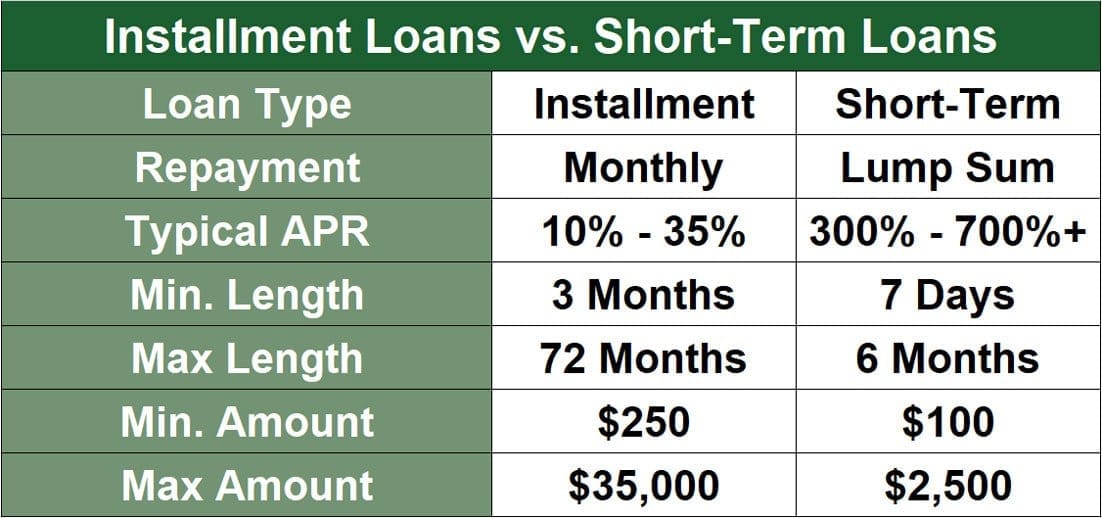

A personal loan is also commonly referred to as an installment loan because it gives you the option to repay your debt through a series of monthly payments — also known as installments. Each monthly payment will include a portion of your loan’s principal as well as incremental interest charges that provide the lender with the profit needed to make the loan worthwhile.

And even though CashUSA makes qualifying for an unsecured installment loan easy, you may still be charged a high interest rate, an origination fee, and other charges that may make the loan expensive. That’s, unfortunately, the cost of having bad credit.

The loan duration will typically range from six to 84 months, and your repayment term will vary by lender. While these loans may sometimes come with a high interest rate, the lack of collateral makes them a better deal for any consumer who has credit issues.

Does CashUSA.com Check Your Credit?

CashUSA.com only requires a soft credit pull for consumers who wish to submit a loan request. If you qualify for a loan offer from one of the network’s partner lenders, you may have to undergo a credit check.

Since CashUSA is not your actual lender, you don’t have to worry about the network running your credit to check your qualifications.

Each direct loan provider that partners with the network can set its own standards for qualification. While some may not require a credit check, others will. If you do connect with a lender that is willing to skip a credit check, you can expect your loan to cost much more than a loan that includes a credit check.

Lenders rely on three main things to make a credit decision: your credit history, your current debt load, and your income. Most will want an in-depth look at all three of those things before deciding whether you qualify for a loan. By removing the credit check, you can expect to pay added finance charges and higher interest rates to offset the risk to the lender.

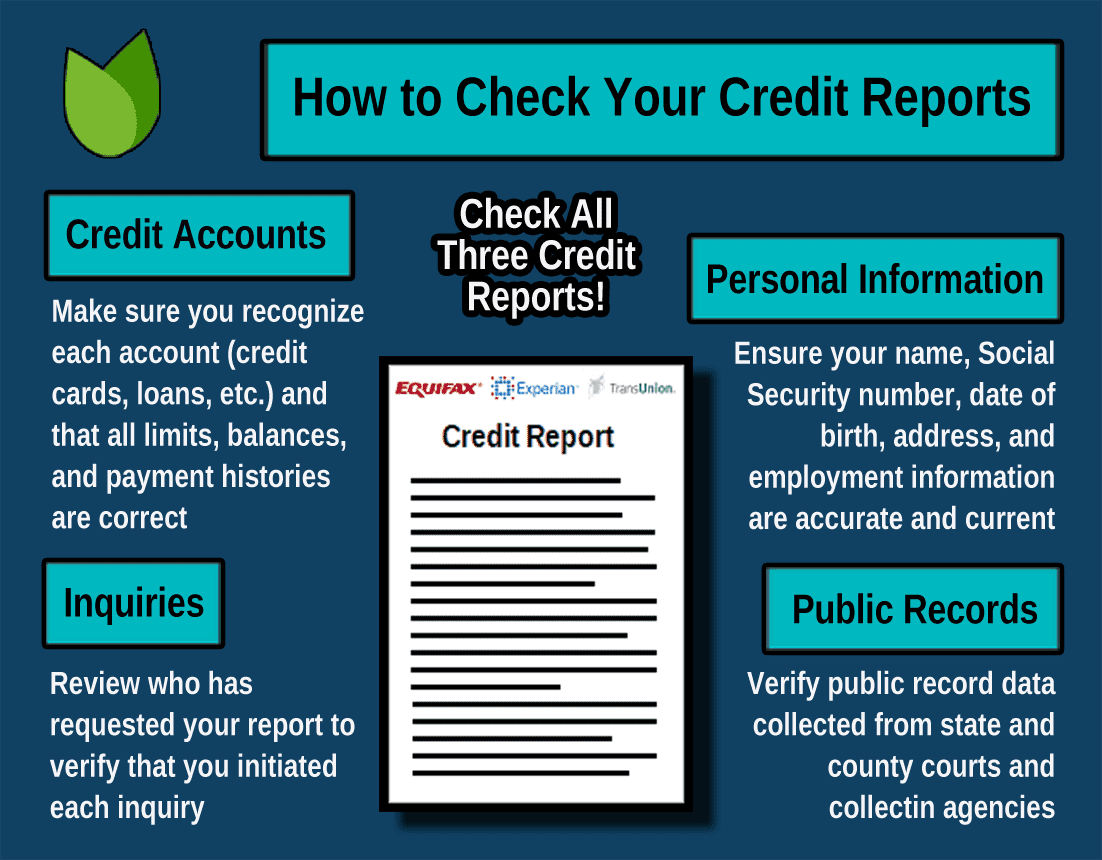

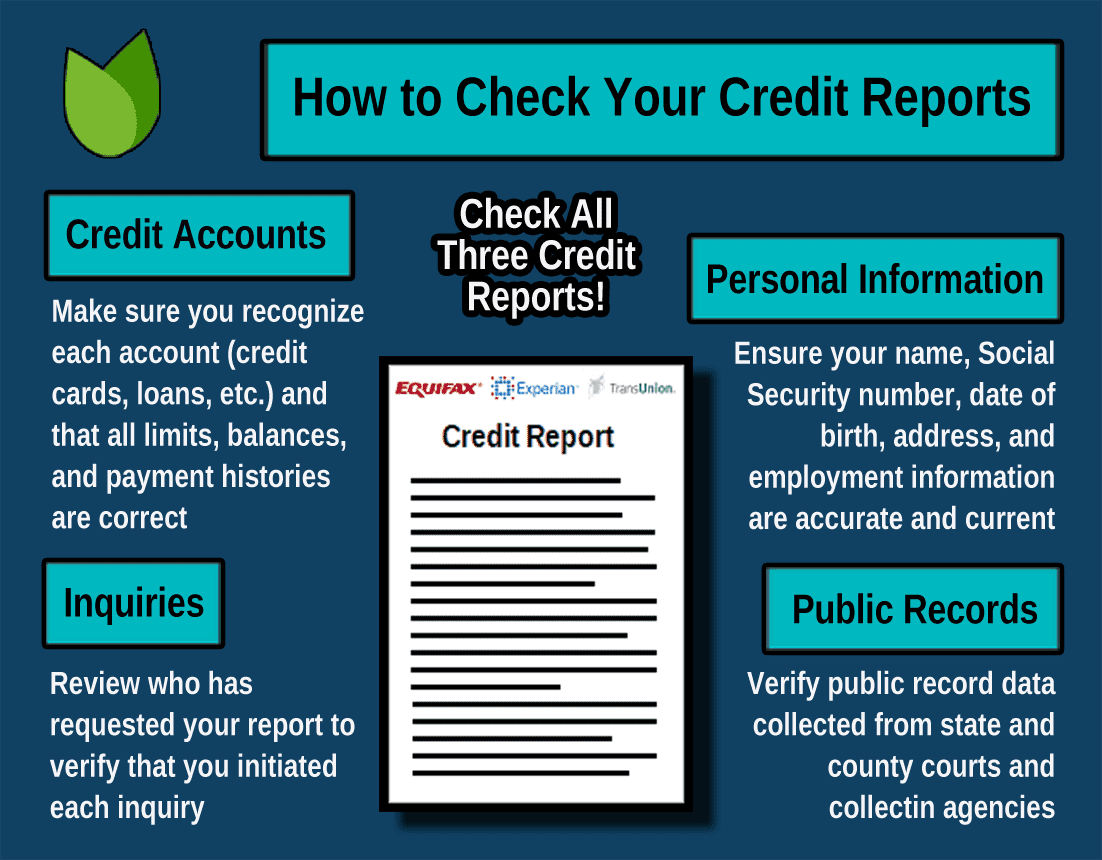

If you’re concerned that your credit score may keep you from qualifying for a loan, there are steps you can take before you officially apply. The first is to check your credit reports. You can do this for free on annualcreditreport.com.

This report will not show your credit score but you will see all of the information the credit bureau has that is used to calculate your credit score.

Examine your credit reports for any inconsistencies. This can include a misspelling of your name, a wrong address, or an old employer listed as your current employer.

Scan the report for any negative items that can drag your credit score down — things such as late payments, collection accounts, bankruptcies, defaults, or too many inquiries.

Negative items can remain on your credit reports anywhere from two to 10 years — but they lose their impact on your credit score as they get older. New items hurt your credit score the most. If you have recent late payments or collections, you may struggle to find a lender willing to work with you.

But if your negative items are older — and you’ve replaced them with recent positive items — you can likely qualify for a personal loan through CashUSA.com or another online lending network, such as Bad Credit Loans or PersonalLoans.com.

What Are the Pros and Cons of CashUSA.com?

As you can see from the mixed online reviews from around the internet, CashUSA.com has its good points and bad points. Thankfully, one thing is clear: very few people complain about their ability to qualify for a bad credit personal loan.

But before you hit the submit button on your loan request through this long-standing network, consider these pros and cons of working with the company:

CashUSA.com Pros

- A large network of lenders that work specifically with bad credit applicants

- Works in all 50 states

- Only a soft credit pull is required to get started

- Free to use

- Easy to understand loan terms

- Secure and dependable loan platform

- Easily accessible customer support

- A long history of dependability and success

CashUSA.com Cons

- The network will likely sell your contact data, which will result in loan and financial service offers until you opt-out of each email.

- You don’t know which lenders view your loan request

- There’s no way to know if you’ll need a credit check to qualify

- The max loan amount is $10,000

While the pros easily outweigh the cons, you should still consider the impact of CashUSA.com selling your contact and application data to third-party financial service providers. This will not include sensitive data, such as your Social Security number, but may include your cellphone number, home address, email address, credit rating, and name.

That can result in you receiving several offers for loans or credit repair for some time after you close your loan.

But if you need a quick cash loan and you’re having trouble qualifying through a traditional bank or credit union, CashUSA.com is substantially less risky — and less expensive — than a payday loan. More on that in the next question.

Is CashUSA.com a Payday Loan?

CashUSA.com is not a payday lender, which is important to remember if you’re looking for an affordable loan.

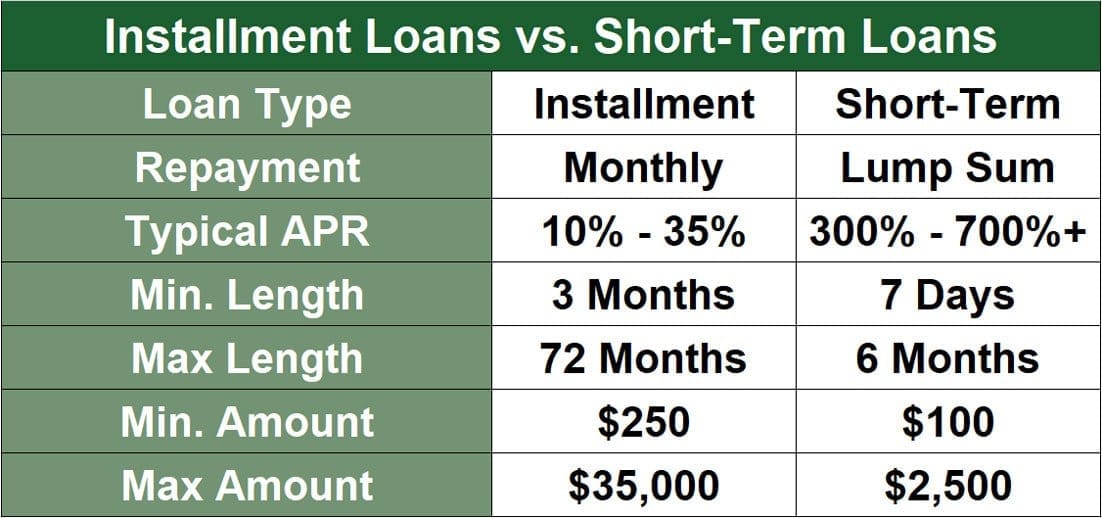

A payday loan — sometimes referred to as a cash advance — is an ultra-short-term loan that requires the full repayment of your debt, including interest, in one lump sum within seven to 30 days after the loan payout.

These loans are intended to act as a bridge between paydays — hence the name. They also rarely require a credit check because you usually leave a post-dated check with the payday lender to cash when you receive your next paycheck. If working with an online payday lender, you may have to sign an agreement that allows the lender to automatically debit the amount from your account.

Most cash advance loans start with an interest rate of approximately 400% — or nearly 100x the interest rate for the average personal loan.

You can expect to accrue roughly $15 in finance charges for every $100 you borrow. So, for example, a $500 payday loan may require a lump sum repayment of $575 within 15 or 30 days. That may not seem too bad, but the high default rates on these loans show why they’re a trap.

Studies show that around 6% of consumers default on their payday loans — which is a similar default rate to most credit card products. But a payday loan default is far more expensive.

If you cannot repay your debt on the due date, the lender will roll your debt over into a new loan. This time, you’ll have an even higher interest rate and more fees. If you cannot repay the debt within 15 days, you’ll roll over again — with another bump in fees and interest charges.

This snowballs very quickly. For example, one consumer racked up more than $50,000 in finance charges for a $2,500 payday loan.

Payday loans are very risky. That’s why the federal government has enacted many laws that limit how much they can charge consumers.

CashUSA.com, on the other hand, offers installment loans with an interest rate that varies by lender but never exceeds 35.99% — which is far more affordable than any cash advance you can find. It also offers short-term loans with higher interest rates.

How Much Can I Borrow From CashUSA.com?

CashUSA.com is not a direct lender. It partners with lenders that consider loan requests submitted to CashUSA.com. The lenders on the network fund loans of between $500 and $10,000.

Not everyone will qualify for a $10,000 loan. The loan amount you qualify for will depend on your creditworthiness, income, and the amount of debt you currently have.

CashUSA.com Provides Easy Access to Personal Loans

Consumer reviews are mixed on CashUSA.com as an online lending network, but most agree on one thing — the network provides poor credit borrowers with easy access to personal loans.

The application process is fast, easy to understand, and can yield multiple loan offers in a matter of minutes. You can review the terms to find the best personal loan for your needs, complete the paperwork, and have fast cash deposited into your checking account within one business day.

Just be aware that CashUSA.com may sell your personal contact information to third-party lenders or financial service providers. You can opt-out of this communication by clicking the “unsubscribe” link in the fine print of any solicitation email you receive. Doing so will keep lenders from pestering you and still give you the loan you need.

And, with on-time payments, your unsecured personal loan can help improve your credit score, which can help you qualify for larger and more affordable loans in the future.