You can get approved for a credit product, in most cases, even if you have bad credit. However, a positive credit history will help you keep the ultimate cost of a loan or credit line down.

In addition to income and other factors, lenders check your credit reports and credit scores to determine your qualification and set terms, including the interest rate. There is often a stark difference between the rate a lender will offer to applicants with credit scores ranging from the bottom to the top of the scale.

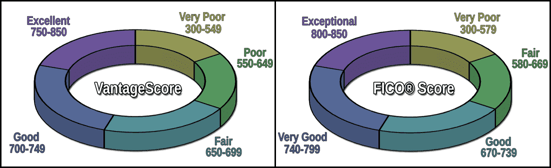

You should know how much a credit product can cost you if your credit is considered bad before you borrow. FICO Scores and VantageScores range from 300 to 850, with higher numbers indicating less lending risk.

You can use an online loan calculator to tally the payments and financing fees for multiple credit situations. Here are some examples to get you started. The results may surprise you.

Credit Cards

You can avoid all interest on the charges you make with a credit card no matter what the card’s APR is. You just have to satisfy the entire balance in full within the account’s grace period. But if you choose to pay your balance incrementally, a high interest rate will translate into steeper financing fees.

Your credit scores need to be in good shape to obtain a credit card with a preferable APR. You will also have to keep the card in good standing to avoid an especially high penalty rate, which the card issuer may impose if you skip payments.

Imagine you owe $5,000 on a credit card. Instead of making the minimum requested payment, treat the balance as you would a loan with fixed monthly payments because credit card debt should be considered a short-term obligation.

Here is what it would cost to pay the balance off over 12 months for someone with excellent credit, good credit, fair credit, and at the penalty APR rate. All the figures we used were obtained from Wallethub’s 2021 Credit Card Landscape Report:

Average APR For Excellent Credit — 13.13%

Monthly payment $446

Total of 12 payments $5,362.70

Total interest $362.70

Average APR For Good Credit — 19.41%

Monthly payment $461.76

Total of 12 payments $5,541.14

Total interest $541.14

Average APR For Fair Credit — 22.58%

Monthly payment $469.37

Total of 12 payments $5,632.42

Total interest $632.42

Penalty APR (Default Rate) — 28.88%

Monthly payment $484.69

Total of 12 payments $5,816.22

Total interest $816.22

As you can see, the difference between the lowest interest rate and the highest is $453.52 over the course of a year. That may not seem like much at the end of the day, but when you think about what you would do with nearly $500, the figure becomes more meaningful.

Also be aware that some credit cards come with 0% APRs for a limited time, such as 12 months, after opening the account. That means you won’t pay a penny in interest if you repay the debt before the regular purchase APR goes into effect. These deals are not available to applicants with bad credit scores, however.

Personal Loans

You’ll find a more dramatic interest rate differential on personal loans. These are typically unsecured loans, so there is no collateral the lender can claim if you do not make your payments as agreed.

That’s why credit scores are a significant factor to lenders, especially when setting the terms. Lower rates will be made available to people with higher scores and higher rates to people with lower scores.

Here are the average personal loan interest rates for different credit scores, along with the payments and final interest based on a $10,000 loan with a 5-year term. All figures used were obtained from Bankrate.

Credit Scores 720 to 850 — 10.3% to 12.5%

10.3% interest

Monthly payment $213.95

Total of 60 payments $12,836.97

Total interest $2,836.97

12.5% interest

Monthly payment $224.98

Total of 60 payments $13,498.76

Total interest $3,498.76

Credit Scores 690 to 719 —13.5% to 15.5%

13.5% interest

Monthly payment $230.10

Total of 60 payments $13,805.91

Total interest $3,805.91

15.5% interest

Monthly payment $240.53

Total of 60 payments $14,431.91

Total interest $4,431.91

Credit Scores 630 to 689 — 17.8% to 19.9%

17.8% interest

Monthly payment $252.85

Total of 60 payments $15,170.85

Total interest $5,170.85

19.9% interest

Monthly payment $264.38

Total of 60 payments $15,862.96

Total interest $5,862.96

Credit Scores 300 to 629 — 28.5% to 32.0%

28.5% interest

Monthly payment $314.38

Total of 60 payments $18,862.89

Total interest $8,862.89

32% interest

Monthly payment $335.93

Total of 60 payments $20,155.53

Total interest $10,155.53

The difference between the loan with the lowest interest rate versus the loan with the highest rate is extreme. If your credit scores are at the bottom of the scale, you could be paying $7,318.56 more than if they were at the top.

Private Student Loans

Direct student loans available from the federal government are not based on your credit. The interest rate will be the same no matter what your scores are. Lenders for private student loans, on the other hand, do base the interest rate on your credit rating, so be prepared.

Variable rates can adjust higher or lower (depending on fluctuations of the associated index), and fixed rates remain constant until the debt is repaid. According to Bankrate, private student loan rates range from:

- .99% to 11.98% variable

- 1.49% to 12.99% fixed

Let’s say you took out a $20,000 private student loan and it has a 10-year repayment term.

If the rate is variable:

.99% interest

Monthly payment $175.12

Total of 120 payments $21,014.57

Total interest $1,014.57

11.98% interest

Monthly payment $286.71

Total of 120 payments $34,405.29

Total interest $14,405.29

If the rate is fixed:

1.48% interest

Monthly payment $298.50

Total of 120 payments $21,528.80

Total interest $1,528.80

12.99% interest

Monthly payment $179.41

Total of 120 payments $35,820.42

Total interest $15,820.42

There is a considerable difference between these scenarios. If your credit is bad and you chose the variable rate, you could pay $13,390.72 more for the same loan amount than if you got the best rate.

If your credit is bad and you chose the fixed rate, you could pay an additional $14,291.62 for the loan than if your credit were good enough to secure the lowest fixed rate.

Auto Loans

Financing a vehicle can be an inexpensive or an expensive experience, depending mainly on your credit rating. In addition to your down payment, the average interest rate for a new car loan relies heavily on credit scores.

If you were to take out a $30,000 car loan that has a 5-year term, here is what it could cost you in interest, depending on your credit scores. The figures used were obtained from Experian:

Credit Scores 781 to 850 — 2.34%

Monthly payment $530.31

Total of 120 payments $31,818.42

Total interest $1,818.42

Credit Scores 661 to 780 — 3.48%

Monthly payment $545.48

Total of 120 payments $32,729.02

Total interest $2,729.02

Credit Scores 601 to 660 — 6.61%

Monthly payment $574.56

Total of 120 payments $34,473.56

Total interest $4,473.56

Credit Scores 501to 600 — 11.03%

Monthly payment $652.72

Total of 120 payments $39,163.30

Total interest $9163.30

Credit Scores 300 to 500 — 14.59%

Monthly payment

Total of 120 payments

Total interest $9,163.30

In the end, the interest you would be charged on the car loan if your credit score is in the very lowest range compared with the highest range would be $7,344.88. You could take a couple of vacations or do something practical that you’ve put off with that money.

Mortgages

Ready for the biggest difference of all in interest based on credit scores? These can be found in mortgages because the amount you would borrow is frequently hundreds of thousands of dollars, with very long repayment terms. That’s why even a fraction of a percentage will have a strong impact on the final loan total.

Imagine you want to take out a $200,000 mortgage with a 30-year fixed interest rate. Here is what the home loan would cost, based on the rate you may get for your current credit score. The rates used below were obtained from Business Insider.

Credit Scores 760 to 850 — 2.813%

Monthly payment $823.17

Total interest $96,341.83

Credit Scores 760 to 850 — 2.813%

Monthly payment $846.99

Total interest $104,915.69

Credit Scores 680 to 699 — 3.212%

Monthly payment $866.25

Total interest $111,848.90

Credit Scores 660 to 679 — 3.426%

Monthly payment $889.85

Total interest $120,345.38

Credit Scores 640 to 659 — 3.856%

Monthly payment $938.30

Total interest $137,788.68

Credit Scores 620 to 639 — 4.402%

Monthly payment $1,001.76

Total interest $160,632.92

The spread between the mortgage with the lowest interest rate and the mortgage with the highest interest rate is an astonishing $64,290.49. What would you do with such a dollar figure?

A Little Improvement Can Save You Big

These preceding scenarios paint an important picture. As a consumer, you can usually borrow money even if your credit scores are very low. But when they are, the financial institution takes a bigger risk when lending you the money. That risk translates into higher interest rates.

But, thankfully, this doesn’t mean the rate you get needs to stay that way. Your credit scores should rise as you pay down your debt, make your payments by the due dates, and keep your credit card balances low. When they do, you may be able to refinance the loan or credit line at a much lower interest rate — saving you a lot in financing fees.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.