Credit cards aren’t just convenient payment methods. They’re also great tools you can use to establish or rebuild your credit reports. And, as long as you manage your credit card accounts wisely, they can certainly help you improve your credit scores. Add in limited fraud liability and all of a sudden you’re talking about, perhaps, the best of all credit products.

What you may not realize, however, is that you have the opportunity to enjoy most credit cards without being charged a penny of interest on your debt. Sound too good to be true? It’s not. The secret lies in something known as your credit card’s “grace period.”

What is a Credit Card Grace Period?

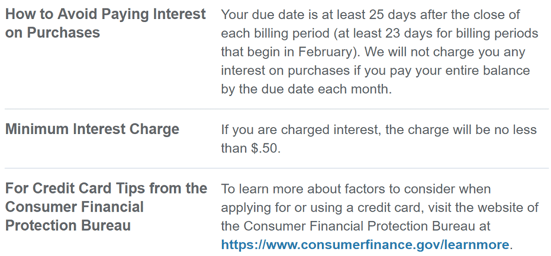

Most credit cards have a built-in, interest-free grace period each month, or a short period of time where no payment is yet due. If your card issuer offers a grace period, it must be for at least 21 days, thanks to the Credit Card Accountability Responsibility and Disclosure Act of 2009, more informally referred to as the CARD Act.

According to the CARD Act, if your credit card issuer offers a grace period it must deliver your statement to you at least 21 days before your account’s due date. So, your grace period is the period of time between when your billing cycle ends, also known as the statement closing date, and when your payment is due.

Next comes the part where you can save money and avoid paying interest on your credit card account balance. As long as you pay off your full statement balance before the end of your 21-day grace period, your card issuer won’t charge you any interest because there is no balance on which to apply an interest rate.

You can find information about your credit card’s grace period in the Rates & Fees documentation that came with your card; you can also check the issuer’s website or your online banking portal for a digital copy.

Keep in mind that if you want your credit reports to show a zero balance, you’ll need to pay a bit sooner than your due date. Your statement closing date is typically the day your card issuer reports your balance and account activity to the credit bureaus. If you want to hack the credit scoring system you should aim to pay your credit card in full a day or two before the statement closing date so your statement reflects a zero balance.

When the Grace Period Doesn’t Apply

Although most credit card issuers do offer interest-free grace periods to their customers, you shouldn’t automatically assume that your account has one. Instead, you should investigate for yourself or, as some people say, do your due diligence on the issue. Read over your credit card agreement to learn how your credit card company may charge you interest and fees, including whether a grace period is offered on your account.

Even if your card issuer does offer a 21-day grace period, there may be times when the interest-free grace period doesn’t apply. Here are a few common examples, though you should always check your own cardholder agreement to be sure:

- Balance transfers from another card

- Cash advances or cash-equivalent transactions

- Purchases made with convenience checks

Most credit card agreements disclose that your grace period won’t protect you from interest fees unless you pay your balance in full each month. If this language is included in your card agreement and you don’t pay your balance in full by the due date, your credit issuer will start charging you interest on the amount of the balance you did not pay off, and that you carry or “revolve” to the following month.

How Much Can Credit Card Interest Cost You?

Despite their best intentions, people don’t always follow best practices when it comes to managing their credit cards. If you are currently sitting on a pile of outstanding credit card debt, you are certainly not alone. The average credit card debt in the United States is just above $6,000.

You may be tempted to shrug off your credit card debt as just another bill. However, you should run the numbers in order to get an honest look at how much money the interest could be costing you.

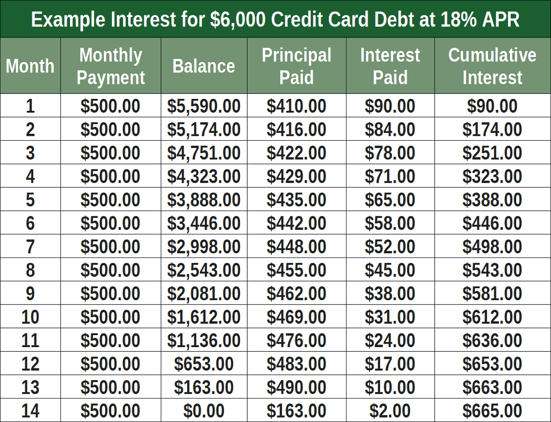

Here’s a look at how much interest you might pay on $6,000 in outstanding credit card debt with an 18% annual percentage rate or “APR.”

In the example above, $6,000 in credit card debt would cost you $665 in interest fees. That example, however, assumes you are not continuing to use the card and that you are aggressively paying $500 a month toward what you owe.

If you continued to use the card or made smaller monthly payments, the total interest paid could grow much higher than $665. And, we’re also assuming an 18% APR — which is actually below the average — and not a much higher APR. Subprime cards and retail store credit cards almost always have APRs that are well into the twenty-something range.

The Takeaway

Paying your credit card in full each month is the best way to manage your credit card accounts. Doing so will help you to avoid interest fees and may help you to maintain a low utilization ratio, which is fantastic for your FICO and VantageScore credit scores.

Are you worried about forgetting when your grace period ends? Signing up for account alerts, such as those that remind you when your statement becomes available or your payment is due, is a smart way to always remember your due dates. Even better, automatic credit card payments from your bank account is also a great way to stay on top of your credit card balances and avoid paying unnecessary interest fees.

And, if you get into the habit of paying your cards in full by the end of your grace period, you’ll never have to worry about APR or interest rates again because they won’t apply to you. You’ll also save money in late fees and — perhaps most importantly — start building positive payment history that can boost your credit scores.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.