The world of consumer finance is loaded with data, statistics, trends, acronyms, and averages. It’s truly a numbers-driven industry.

As it pertains, specifically, to credit reports and credit scores, there is also no shortage of statistics. Accordingly, what follows is a handful of some of the more interesting data, in no particular order.

Numerical Data About the Credit Industry

1. You have four garden-variety credit reports from four companies. These companies are Equifax, Experian, TransUnion, and Innovis. My guess is many of you have never heard of Innovis, a smaller agency that produces reports often used by cell phone service providers and for pre-screened marketing offers.

2. There are two credit score brands that enjoy pretty much 100% of the credit score market in the United States. They are FICO and VantageScore. Under those two brands, you have dozens of credit scores.

3. According to the credit industry’s trade association, there are roughly 14,000 companies that report information to the credit bureaus on a monthly basis. This process is formally referred to as data furnishing.

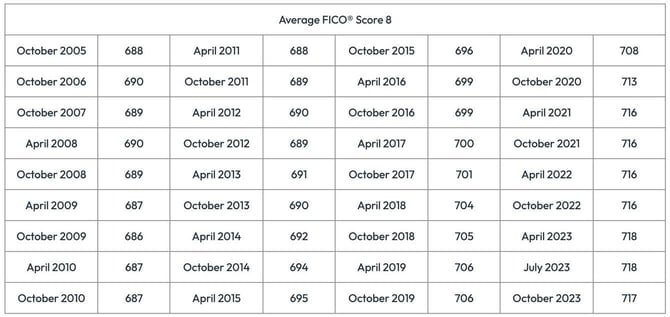

4. The average FICO score is 717 as of FICO’s most recent analysis in October 2023. October 2023 marks the first time in over 10 years that the average FICO score has gone down.

5. The top end of the scale or range of both the FICO and VantageScore is 850. FICO has several credit scoring models that top out at 900.

6. According to the Federal Reserve, as of Q4 2023 cardholders who paid interest on credit card balances paid an average interest rate of 22.75%. This figure was as low as around 15%-16% just a few years ago, meaning the cost to service credit card debt has gone up considerably.

7. The average VantageScore credit score is 701 as of December 2023, VantageScore’s most recent analysis.

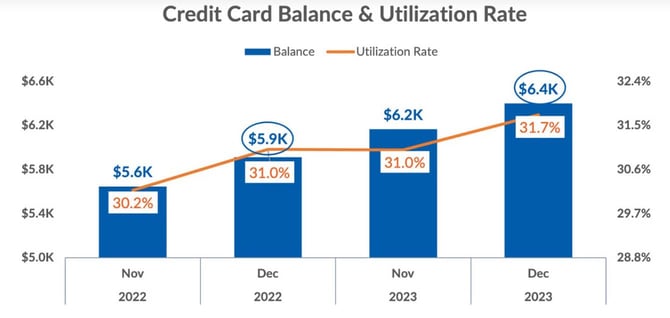

8. The increase in credit card balances from December 2022 to December 2023 was 8.2%, according to VantageScore Solutions.

9. There were 5,587 Fair Credit Reporting Act (“FCRA”) lawsuits filed in calendar year 2023, according to WebRecon. FCRA lawsuits are generally filed against credit bureaus and the companies that report information to credit bureaus, although there are exceptions to that rule.

10. According to WebRecon, 4,165 Fair Debt Collection Practices Act (FDCPA) lawsuits were filed in the calendar year 2023. FDCPA lawsuits are generally filed against third-party debt collectors or, informally, collection agencies.

11. The United States’ Big Three credit bureaus, Experian, Equifax, and TransUnion, have credit file data on 220 million consumers.

12. It costs $0 to obtain copies of your credit reports from the Big Three credit reporting agencies. You can pull copies of your credit reports as often as once per week at www.annualcreditreport.com.

13. It also costs $0 to place security freezes on all of your credit reports is zero dollars. At one time you did have to pay to place credit freezes on your credit reports. Recent amendments to the FCRA have made placing and removing credit freezes free.

14. The first credit bureau-based FICO risk score became commercially available in 1989. It was called BEACON and was introduced through FICO’s partnership with Equifax.

15. Experian became a credit bureau in the United States in 1996. The data that became Experian’s credit file database was previously owned by TRW, which is still in business today, just not in the credit report business.

16. FICO, formerly Fair Isaac and Company, was founded in 1956 by Bill Fair and Earl Isaac with an $800 initial investment from the pair.

17. The FACTA, or the Fair and Accurate Credit Transactions Act, became law in 2003. FACTA, among other things, provides consumers with the right to one free credit report from each credit bureau once every 12 months through AnnualCreditReport.com.

18. The FCRA, or the Fair Credit Reporting Act, became law in 1970. The FCRA is a consumer protection statute that governs most things related to credit reports including when a credit report can be pulled, consumer rights to dispute errors, and the free credit freezes. The FCRA has been amended 34 times since 1970.

19. The CROA, or the Credit Repair Organizations Act, became law in 1996. Among other things, the CROA defines what is a credit repair organization and provides restrictions on advanced billing before credit repair services have been fully rendered.

20. The FDCPA, or the Fair Debt Collection Practices Act, became law in 1978. Among other things, the FDCPA prevents collection agencies from contacting debtors before 8 AM or after 9 PM in their time zone or contacting debtors if they know the debtor is represented by a lawyer.

21. The percentage of the population that had a FICO score at or above 750 was 47.7% as of April 2023, the most recent date of such data.

22. The percentage of the population that had a FICO score below 650 was 23.9% as of April 2023, the most recent data of such data.

23. The threshold dollar amount for the credit reporting of medical collections is $500. Medical collections with a balance less than $500 cannot be reported to the credit bureaus and haven’t been allowed to be reported since April 2023.

24. NCTUE is the acronym for the National Consumer Telecom and Utilities Exchange. NCTUE is a credit reporting agency that maintains data about how you’ve paid your utility, telecommunications, and pay TV accounts. Equifax manages the NCTUE database, so when you pull a copy of your NCTUE credit report it looks very similar to the format of your Equifax credit report.

25. The average FICO score of Minnesota residents was 742 in 2023. Minnesota had the highest average FICO scores in the country. Mississippi — with an average of 680 — had the lowest average FICO scores in 2023.