Credit score charts are an easy way to make sense of what can be an overwhelmingly complicated topic. There’s a reason why teachers like to use visual aids when going over any kind of data.

Here are some of our favorite credit score charts, so you can have a better understanding of how your credit score stacks up — and how it may affect your ability to qualify for different loan products.

1. The FICO Credit Score Range

The Fair Isaac Corporation, better known as FICO, is the original credit scoring company. The FICO credit score is the most-used scoring model with about 90% of top lenders using a FICO score to make a lending decision. When you apply for a mortgage or a credit card, chances are the bank is looking at your FICO credit score.

FICO uses the following credit score range to categorize creditworthiness:

Prime and subprime are two other names given to differentiate credit scores and assess credit risk. Prime borrowers are more highly desired and have a credit rating of 620 or higher on the credit score scale. Subprime borrowers may have a harder time being approved for a loan and will have to pay higher interest rates on their loans and credit cards.

If you have poor credit, it will generally be difficult to qualify for mortgages, auto loans, and credit cards. You need a credit score of 580 or higher to qualify for an FHA mortgage and a score of 620 or higher to be eligible for a conventional mortgage loan.

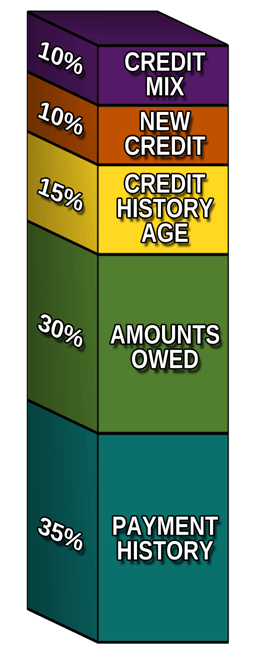

2. The 5 Factors that Make Up Your Credit Score

While the exact algorithm for determining credit scores is a secret, the most important credit scoring model components are public knowledge.

Here are the categories that factor into calculating your score.

Payment History: 35% of FICO Score

Payment history is the most important factor and makes up 35% of the total credit score. It refers to having a history of on-time payments.

Payment history only considers whether you paid the bill by the due date. You don’t get extra points for paying more than the minimum amount due.

How late you pay also affects your credit score. If you pay a bill 30 days late, that will impact your credit score less than if you were to pay 90 days late. If you realize that you accidentally forgot to pay a bill, make the payment as soon as possible.

This category is the easiest to control. As long as you pay your bills on time, your credit score will improve. Most credit card and loan providers offer automatic payments, which will automatically withdraw the amount needed from your bank account by the due date.

Setting up automatic payments is a straightforward process — and it’s free. It takes the guesswork out of paying bills and wondering whether you’ve paid them this month.

Some borrowers prefer to use their financial institution’s bill pay service, which sends a check to the lender or creditor. However, this is not as foolproof as using the provider’s own payment processing service.

When you set up automatic payments for a credit account, you can choose whether to pay the minimum balance, statement balance, current balance, or another amount. It doesn’t matter which one you choose for the sake of credit reporting unless you keep a high balance on the account.

In terms of your credit score, payment history only refers to payments made to loans, lines of credit, or credit cards. Your utility or cellphone bill is not included in this, so you don’t get extra credit for paying your internet bill on time.

However, if you are late enough on a bill, the provider may send it to collections. At that point, it will be reported to the credit reporting agency as a delinquent item and will appear on your credit file.

Credit Utilization: 30% of FICO Score

Your credit utilization ratio makes up 30% of your credit score and is the second most important factor that determines your credit score. Credit utilization refers to the amount of revolving credit you’re currently using divided by the total amount of revolving credit you have available.

Credit bureaus start to ding your score once your balance exceeds 10% of your total credit limit. A utilization ratio of 30% or higher will result in a lower credit score.

Calculating your credit utilization requires some basic division. Let’s say you have a $500 current balance on your credit card, which has $10,000 in total available credit. Your credit utilization percentage would be 5%, putting it in the safe zone.

Credit bureaus calculate both the utilization on each individual card and the total utilization from all your credit cards. If you have multiple credit cards, you should know the utilization ratio on each of them.

If you calculate your credit utilization and discover that it’s above 10%, you can remedy that by paying off some of the balance. Credit cards don’t notify you of your utilization ratio, so it’s important to check your accounts regularly.

Credit History Length: 15% of FICO Score

Credit history length refers to the average age of your credit accounts and makes up 15% of your credit score. The best way to improve this component is to keep old accounts open and avoid opening new ones. When you open a new account, it decreases your average age of accounts.

If you’re considering closing a credit card, try to avoid closing the oldest ones in your credit profile. It may be worth charging a small recurring bill on it every month to maintain a longer credit history.

Credit Mix: 10% of FICO Score

Credit mix makes up 10% of your credit score and refers to having both installment loans and revolving credit. An installment loan has a predetermined payoff date, like a mortgage loan or auto loan.

Revolving credit refers to credit with no set payoff date, like a credit card. You can borrow up to the maximum amount — known as your credit limit — and as you repay the outstanding balance (plus any interest), you can borrow against the account again.

Having a diverse credit mix shows lenders that you can handle a variety of credit types.

If you only have installment loans on your credit report, you can improve your credit mix by opening a credit card. However, you shouldn’t take out a loan just to diversify your credit mix — it’s bound to happen naturally over time.

New Credit: 10% of FICO Score

New credit refers to the number of hard inquiries on your credit report and accounts for 10% of your credit score. A hard inquiry is when a lender views your credit report to see whether you’re a good credit risk.

Each hard inquiry can cause your score to drop, usually by five to eight points. If you have several recent hard inquiries, it will look like you’re running out of cash and desperately need a loan. Too many hard inquiries can affect your chances of being approved for a loan or lead lenders to charge you a higher interest rate.

Hard inquiries stay on your credit report for two years, but they stop affecting your credit rating after one year. The simplest way to minimize hard inquiries is to be mindful of applying for new credit.

3. The Average Credit Score by Age

This credit score chart, based on data from Experian, shows that as borrowers get older, their credit score tends to increase.

The difference is minimal at first. There’s only a 12-point jump from 20-29-year-olds to 30-39-year-olds, and an 11-point increase from 30-39-year-olds to 40-49-year-olds.

However, the average credit score jumps by 20 points to 703 once borrowers reach age 50-59. The increase is even more dramatic once they reach age 60, with an average credit score of 733.

This data makes sense because people tend to earn more as they get older and pay off more debt. A 23-year-old who just graduated from college is likely to have student loans and credit card debt, while a 40-year-old is more likely to be financially stable and have less debt.

Plus, many young people find it hard to access credit because providers like to see a credit history. This creates a catch-22 in which the borrower needs a credit product to build a credit history, but they can’t get approved because they don’t have a credit history. It can take some time to build enough credit history to earn a good credit score.

Borrowers who are close to retirement have likely paid off all or most of their debts, including their mortgage, so it makes sense that their scores are the highest.

4. The Average Credit Score by State

The lowest credit score by state belongs to Mississippi, which has an average credit score of 667. This may be because Mississippi has a 19.5% poverty rate and the lowest median income in the country. It also ranks 46th in the country in education.

Minnesota has the highest average credit score at 733. In 2019, U.S. News & World Report named Minnesota as the third-best state to live in, factoring in categories including education, healthcare, economy, and crime.

When you look at average credit scores by region, the Midwest (688), Northeast (687), and West (687) have almost identical scores. However, the South has an average credit score of 667, about 20 points less than other regions.

Historically, people in the South have lower incomes, poor education systems, and fewer job opportunities than the rest of the country. It makes sense that their residents would have worse credit scores.

5. Top 10 Cities with the Highest Credit Scores

This chart shows which U.S. cities have the highest credit score. The first location on the list is The Villages in Florida, which is a senior adult community. Their average credit score is 785.

Because baby boomers tend to have higher total credit scores than other generations on average, it makes sense that a city full of seniors would have the highest aggregate credit score.

Los Altos in California is the city with the second-highest credit score, with an average score of 777. The city is in the heart of Silicon Valley, only 14 minutes away from Apple headquarters in Cupertino. This area is one of the most expensive places to live in the country, and people with greater incomes tend to also have higher credit scores.

The next city on the list is also near Silicon Valley. Saratoga, California, has an average credit score of 776. As with other top cities, Saratoga has a high average income, which also correlates positively with high credit scores.

Sun City West, Arizona, is No. 4 on the list, with an average credit score of 771. Similar to The Villages, this city is also a retirement community. This further proves that older Americans are most likely to have the highest credit scores.

Danville, California, ranks as the city with the fifth-highest credit score. This city is close to Oakland, which is another major tech hub in Northern California. Residents of Danville likely work in the Silicon Valley area, which is likely responsible for their high incomes and high credit scores.

Tying with Danville for the fifth slot is Lexington, a suburb of Boston in Massachusetts. As one of the most expensive cities in the country, it makes sense that a Boston suburb would crack this list. The average credit score in Lexington is 770.

Lexington isn’t the only Boston-adjacent city with a 770 credit score. Needham also ties for the fifth slot in this list. Silicon Valley suburb San Carlos, California, is the fourth city to have a credit score average of 770.

Potomac, Maryland, has the ninth-highest average credit score of 769. The city is close to Washington, D.C., and residents there have an average income of $178,085. A suburb of Chicago, Wilmette, Illinois is the next city on the list, with an average credit score of 768.

6. The Average Credit Score by Income

Not surprisingly, those who earn more have higher credit scores. Data shows that those who earn $30,000 or less have an average credit score of 590, while those who earn between $30,001 and $49,999 have an average credit score of 643. Consumers who earn between $50,000 and $74,999 have an average credit score of 737.

The more money you have, the less you need to rely on credit. If you have a low income, you may resort to using credit cards or payday loans when there’s an emergency. If you have a high income, there’s a good chance you also have a high savings rate.

7. The Average Credit Score by Race

Race has a huge impact on credit scores and other credit issues. A 2018 report found that 32% of African Americans and 28% of Latinos don’t have credit cards, compared with only 15% of White who don’t have access to a credit card.

A survey from the Urban Institute also found that in 50 out of 60 cities, the nonwhite areas had average credit scores of 660 or less. However, this only applied to white areas out of four of 60 cities.

8. The Average Credit Score by Gender

A survey from VantageScore found that women have slightly higher credit scores compared to men, 684 to 680. Women also had more credit cards than men, 3.13 compared to 2.98. The data also showed that men had more debt on average, $6,752 compared with $6,452.

It makes sense that women have higher credit scores and lower debt levels than men. A survey of more than 1,000 people found that about 55% of women maintained budgets while only 48% of men did. People who budget regularly may be better about paying off debt and managing their credit. They may also be better at remembering due dates for bills, which would also improve their credit score.

Women also seem to save more than men. Women said they have an average of 23.5% of financial assets in savings accounts and CDs, while men keep only about 15% of these assets in savings accounts and CDs.

This data also shows that despite the gender pay gap, women are just as capable or more capable of handling finances than men.

9. The Average Credit Score Over the Past 10 Years

The average credit score has increased by quite a bit in the past 10 years. In 2010, the average FICO Score 8 was 689, which falls into the good range, according to Experian data. That number has risen steadily, and in 2020, the average FICO credit score hit an all-time high of 711.

It’s hard to say exactly why the average credit score has grown. In 2010, the country was finally starting to recover from the Great Recession of 2008-2009, but the unemployment rate was still high. This may have accounted for greater credit use and more defaults and bankruptcies.

With the economy rebounding and a long bull market, this may have resulted in higher credit scores.

10. The Average Personal Loan APR by Credit Score

A borrower’s credit score can have the most significant impact on APR for personal loans. The average APR for someone with a credit score of 720 or higher is 7.63%, according to LendingTree. Those with scores between 620 and 639 pay an average of 38.64% APR, and borrowers with scores of 560 and below paid an average of 113.62% APR.

Credit scores also seem to affect how much borrowers can take out in personal loans. Borrowers with the best credit score received an average loan amount of $17,838.97, while those with the worst credit scores received an average loan amount of $2,787.45. Banks are likely to be selective in giving out unsecured loans to those with poor credit.

Personal loans already come with higher interest rates than the interest rates for auto loans and mortgages because they’re unsecured loans. That means there’s no collateral behind a personal loan for a bank to repossess in case the borrower defaults on payments.

11. The Average Credit Card APR by Credit Score

Credit scores have a strong influence on the APR you’ll be offered by a credit card company. Those with excellent credit scores will have lower APRs than those with fair credit.

As of 2020, the average interest rate for cardholders with excellent credit was 13.03%, according to WalletHub. The difference is substantial. Those with good credit have an average APR of 19.28%, and cardholders with fair credit pay an average APR of 23.43%.

Here’s how the difference works over time. Let’s say you have $5,000 in credit card debt with 13% APR. You pay off the balance in 24 months and pay $620 in total interest charges.

If you had fair credit and a 23% APR on a credit card with a $5,000 balance, you would pay $1,297 in interest after 24 months. That’s more than double the amount you paid because you have excellent credit.

Also, those with high credit scores are more likely to qualify for travel, cash back, and other rewards credit cards. These cards have more bonuses, higher cash back rates, and better perks. They can also qualify for cards with 0% APR offers, which also allow them to save on interest.

12. The Average Auto Loan Interest Rate by Credit Score

Borrowers can save a lot of money buying a car when they have a good credit score. Those with a score of 720 or higher will pay 3.65% for a new car loan and 4.29% for a used car loan.

Those with a score between 620 and 659 will pay 7.65% for a new car and 11.26% for a used car loan. Borrowers with the worst credit score, 579 or less, will pay 14.39% for a new car loan and 20.45% for a used car loan.

Here’s how those interest rates affect the monthly payment. If you buy a $15,000 car and pay 5% interest on a five-year loan, your payments will be $283. If you have a low credit score and pay 20% interest, your payments will be $397. That’s $6,840 extra in interest over the life of the loan.

13. The Average Mortgage APR by Credit Score

This credit score chart shows the strong correlation between high credit scores and low interest rates on mortgages. This can result in a huge monthly payment difference. These are the current interest rates on home mortgages, as of December 2020:

For example, a homeowner with a $300,000 mortgage and a credit score of between 760 and 850 has an average mortgage APR of 2.398%. They’ll pay $1,179 a month on their mortgage.

A borrower with a score between 660 and 679 has an average payment of $1,267. That’s $88 more a month, $1,056 more a year, or $31,680 more over the life of the loan.

The discrepancy grows even more for those with credit scores between 620 and 639. Their average mortgage APR for a 30-year loan is 4.047%, and their monthly payment is $1,440. They will pay $2,610 more a year than those with the best credit scores, and $78,300 more over the life of the loan.

14. Percentage of Americans with an Excellent Credit Score

The average credit score in the U.S. is 711. The average credit score has steadily increased over the past several years. In 2010, the average credit score was just 689.

According to research from the credit bureau Experian, about 59% of Americans have a credit score above 700. This score would fall into the “good,” “very good” or “excellent” range. In 2019, about 20% of Americans had a credit score above 800, which falls into the “excellent” or “exceptional” range.

This percentage has not changed much in recent years. In 2010, 18% of Americans had an excellent credit score.

About 25% of Americans have a credit score between 740 and 799, which is in the “very good” range. This number has also remained steady since 2010. Between 19% and 21% of Americans had a score between 670 and 739.

The fact that so many Americans have good credit scores is a positive indicator. It means that more people are able to access low interest rates on mortgages, auto loans, and credit cards. It also means they’re more likely to qualify for rentals, and it makes buying a home much easier.

The data also shows that consumers were able to rebound despite the recession in the 2000s. The overall percentage of Americans with poor credit scores declined, which is a positive trend.

The research also shows that in 2019, about 1.2% of Americans had a perfect credit score. Experian reports that this figure has also increased in recent years. While a perfect credit score isn’t necessary to receive low-interest rate offers, it is another good indication that Americans are practicing better financial habits.

To have a perfect credit score, you need to have low credit utilization, a near-perfect on-time payment history, a long credit history, and a good mix of installment and revolving credit. You also need to limit the number of hard inquiries on your credit report.

One of the biggest changes in credit score trends is how credit scores among millennials have improved. Their average credit score has risen by 25 points since 2012.

This makes sense on many levels because millennials are no longer fresh-faced college students. They’re now often married with kids, so their credit scores have matured as they have taken on more responsibility as well.

It also seems that Americans are obtaining good credit scores at younger ages. In 2012, the average age of a person with a 700 credit score was 62. In 2019, it was 54.

15. Percentage of Americans with a Bad Credit Score

A bad credit score is a credit score below 580. Having a bad credit score makes everything more difficult for consumers, including setting up utilities, buying a cellphone, or even getting a job. According to Experian, 16% of U.S. consumers have a bad credit score.

It also makes taking out a loan or qualifying for a credit card more difficult and expensive. Borrowers with bad credit may have to put down a larger down payment, which can affect their cash flow. For example, those with a credit score of 579 or lower need to put down 10% for an FHA mortgage. Those with a score above 580 only need to put down 3.5%.

As of 2019, the percentage of Americans with a bad credit score was 34%. This has slightly decreased from 2010 when it was 39%. About 16% of Americans have a credit score between 300 and 579, which falls into the “very poor” range.

About 18% of Americans have a credit score between 580 and 669, which falls into the “fair” category. This figure has remained steady for the past 10 years.

Other Ways Credit Scores Impact Consumers

Having a poor credit score can also mean paying more in car insurance premiums, having to put down a deposit for utilities, and even having trouble getting a job. Some employers run a credit check before hiring an applicant, and a poor credit score can get you disqualified.

If you try to buy a phone on a payment plan, the cellphone carrier may run a credit check and deny you. Prospective landlords almost always check an applicant’s credit and will either deny someone with a low score or require a cosigner.

In other words, a poor credit score can affect pretty much every part of your financial life – and a few areas that seem unrelated to your finances.

Where Do You Stand Among These Credit Score Charts?

These credit score charts can provide a good baseline to see how you stack up against other people in your age bracket, state, and income. But remember that this data can’t tell you exactly how a lender or service provider may evaluate your credit situation.

What’s most important is qualifying for the loan products and credit cards that you want. Even if your credit score is lower in every demographic, you may still qualify for mortgages, auto loans, and other loans.

Your income and, more importantly, your debt-to-income ratio can also greatly affect what kind of loan you qualify for. Finding a cosigner will also increase your chances of qualifying for a loan. Every lender is different. Some may have more forgiving requirements while others will be stricter.

Credit scores are malleable and can change over time. Even if you have a poor credit score now, you can improve it in the next few years. The key is consistency, patience, and a solid understanding of what goes into calculating a credit score. Make your payments on time, keep your card balances low, and be mindful of how many new accounts you open.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.