A credit check consists of reviewing your consumer credit reports and the credit scores derived from the information found on those files. When a company wants to know how much risk it will assume when doing business with you, it may conduct a credit check. Once complete, it will have a better understanding of your history with borrowing and repaying money, as well as how much you currently owe.

Types of Credit Checks

The first type of credit check is initiated by you when you submit an application. This is considered a hard credit check or inquiry. For example, you may want to take out a loan to buy a home or car, apply for a credit card, or rent an apartment. When you complete the forms and provide them to the business, you authorize it to conduct a thorough credit check.

The business will then have complete access to the data that appears on your credit reports produced by the three major credit reporting bureaus — TransUnion, Equifax, and Experian. They will see pertinent information such as:

- The date that you opened credit products and account details, including credit limits

- Your monthly payment pattern

- Your most recently reported debt

- Delinquencies and charge-offs

- Accounts that have been acquired by collection agencies

- Bankruptcy filings within the past 7 to 10 years

Some businesses will also review or defer to your credit scores because they provide a comprehensive risk analysis based on what is on your credit report. Instead of having to read the data listed on the credit report, the credit score will provide them an instant indication of your credit health.

The other type of credit check is a soft check. It happens when a business requests that the credit bureaus send them a list of consumers that fit a certain credit profile.

For example, a credit card issuer may want to identify people who have credit scores over a certain number and who have not made a late payment on any account listed on a credit report within the past five years. Such an inquiry is for marketing purposes. If you received a notice that you were preapproved for a loan or credit card, it’s because you matched the basic profile.

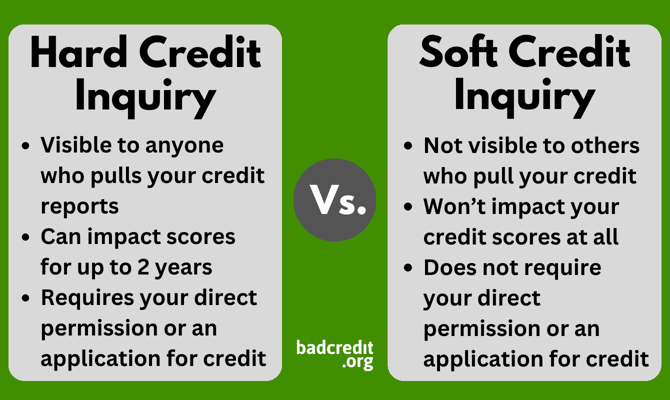

Hard inquiries are initiated by you when you grant permission for a business to conduct a thorough credit check. A hard inquiry will then show up on your credit file for two years and will be included in your credit score calculations.

Soft inquiries are often initiated by companies to identify people who fit certain credit profiles. They can also be initiated by you (to check your own credit report) or a landlord or employer to vet an application you submitted. A soft inquiry will be noted on your credit file for two years but will not be included in your credit scores.

Understanding How Inquiries Influence Your Credit Scores

In some cases, hard inquiries can negatively affect your credit score. An overabundance of hard inquiries in a short span of time can be perceived as an indication that you are desperate for money. If you have very little on your credit file, the influence of hard inquiries will be greater because you don’t have enough other data to indicate you are a responsible borrower.

The good news is that the impact of hard credit inquiries is usually limited and temporary. Each may shave approximately five points from your credit scores, but that could only last for a year. And if you do get the credit product and use it responsibly, your positive gains will soon overshadow any point loss by the company checking your credit.

Soft credit inquiries do not affect your credit at all, so you don’t have to worry about them. Although, it can be interesting to see who is checking your credit profile.

Credit Score Components

Credit scores don’t just look at hard credit inquiries. In fact, inquiries are far down on the list of what is considered important for either of the two most commonly used scoring models: FICO and VantageScore.

Here is how each scoring model breaks down, and where hard credit inquiries fit into the mix.

FICO Score 8

- 35% Payment History: It takes into consideration your payment patterns. If you have a long history of paying your bills on time, your scores will benefit. If you have paid late, especially recently, or if a pattern exists, your scores will decline.

- 30% Amounts Owed: This considers your current debt on credit cards and loans. It also takes into account your credit utilization ratio, which is the amount you owe on revolving debt products compared to your overall limit. The smaller your credit utilization ratio, the better for your score.

- 15% Credit History: How long you have had credit products is assessed. Longer histories are preferable.

- 10% Credit Mix: Various types of well-handled credit products listed on your reports will help your scores rise.

- 10% New Credit: Here is where hard credit inquiries come in, as well as the credit products you may have been approved for recently.

VantageScore 4.0

- 41% Payment History: A lengthy history of paying on time will give your VantageScore a boost, while paying late will make it fall.

- 20% Depth of Credit: This area assesses the average age of all your credit cards and loans, taking into consideration your oldest and newest accounts and the types of credit in use.

- 20% Credit Utilization: The gap between how much you owe and how much is available on your revolving credit accounts, with less being the best. It also factors in installment loan debt.

- 11% New Credit: Hard credit inquiries factored in and can reduce your score, but this scoring model considers all hard inquiries you make within a 14-day period as one inquiry instead of multiple.

- 6% Credit Balance: This is the total amount you owe on all credit accounts listed on your reports.

- 2% Available Credit: The least influential factor is the total available credit you have on revolving credit accounts, with more being preferable.

Both scores range from 300 to 850, with higher numbers being preferable because they indicate less lending risk.

How Credit Checks Affect Your Score

When you apply for credit, hard inquiries will be noted on your consumer credit reports for two years. Anyone who pulls your credit can see those inquiries during that time frame.

Hard inquiries also factor into your credit scores, but any damage they inflict is typically in the first few months, and it is diluted over time, and with other information that appears on your credit file.

If your credit report doesn’t include many accounts, or you have damaged credit already, hard credit checks may have a deeper and longer impact on your credit scores. For this reason, it will be especially important to only apply for the credit products you will likely qualify for and need, then begin to create a positive credit history that will offset any negative data.

How to Prepare for a Credit Check

It is your right and responsibility to review your consumer credit report on a regular basis. You can receive free reports from each of the credit bureaus weekly through AnnualCreditReport.com. Some issuers have relationships with the credit bureaus so you may receive reports from them for free. You will never be penalized for checking your own credit reports.

Check Your Own Credit

Review all of the sections of your credit report carefully:

- Your personal information should be correct.

- All the accounts listed in the trade lines must be accurate and timely.

- Negative information, such as late payments, charge-offs, and accounts in collections, will remain on your credit file for seven years.

- You will see an area for inquiries, both hard and soft, so give them a scan. If you see any hard inquiries that you did not initiate, it could be evidence that someone is trying to open a credit account in your name.

- If you have filed for bankruptcy, it will show up in the public records section. Chapter 7 will remain for 10 years, and Chapter 13 will remain for 7 years.

Improve Your Credit Score Beforehand

The great thing about credit scores is that they fluctuate with your behavior over time. Here are some areas to focus on for improvement:

- If you have a history of late payments, start paying on time from this point forward. Although the delinquencies will still be listed on your report for the full seven years, the impact they have will wane over time and as your positive payment history extends.

- If your credit cards are maxed out, concentrate on expanding your credit utilization ratio. You can do that by aggressively paying these accounts to well below the credit limit. You can also consider taking advantage of a card with a 0% APR balance transfer offer so you can pay off the debt without finance fees for a designated period. The original account may also be entirely paid off, so your total credit line will expand.

- Hold off on applying for credit until your scores improve, and then only pursue new products when your scores are within your ideal range.

To improve your credit score, identify the areas that are bringing those numbers down.

Best Practices Before Applying for Credit

First, you should read the fine print and understand the credit and financial requirements for the account. You should also review many different credit products before applying.

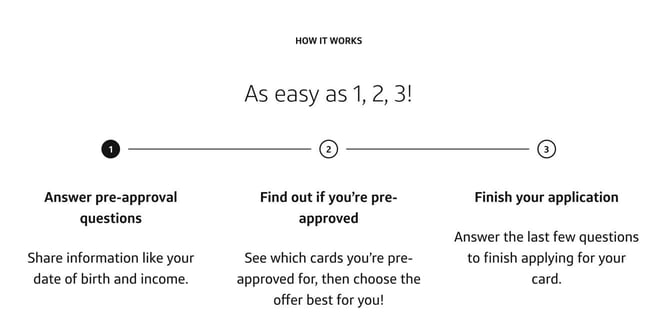

Take advantage of the prequalification tools that many lenders offer to see if you may qualify without getting too far into the process — or causing a hard credit inquiry. You can enter your basic financial information, and the issuer will perform a soft check to see if you may qualify. It’s not a guarantee, but I can definitely help narrow your choices.

Mitigating the Impact of Multiple Credit Checks

It is also your right as a consumer to shop around for the best rates on any account. Review multiple lenders and compare the cost of a loan, credit card, or line of credit. Here’s how to go about it without worrying about acquiring multiple hard inquiries on your credit reports.

How to Rate Shop

Rate shopping is important because it helps you find the best interest rate on a product that matches your credit profile and financial history. To do this, you can:

- Check sites that aggregate credit products based on credit score. For example, you may search for “best travel credit cards for fair credit.”

- Read the qualification expectations on the issuer’s website.

- Contact the company and speak with a representative to ask about eligibility standards. Just be sure you don’t trigger a hard inquiry.

- Use a pre-qualification tool if the company offers one.

- Compare offers for credit that may have been sent to you since they were generated by soft pulls.

Rate shopping will help you get the right credit product, and credit scoring companies recognize that people should not be penalized for being conscientious consumers. Therefore, both FICO and VantageScore offer allowances for the practice:

FICO: All hard inquiries for mortgages, auto loans, and student loans made in a 30-day time frame are not factored into your scores from the date of the inquiry. As such, they will have zero effect on your scores during that time. All inquiries that are older than 30 days will be counted as a single inquiry.

VantageScore: All inquiries made within a 14-day period are counted as a single inquiry when they are for a specific loan type.

Avoid Unnecessary Inquiries

Never apply for a credit product when you don’t need it, and certainly not when you probably don’t qualify. Many credit cards come with compelling perks, such as huge sign-up bonuses, cash back and rewards for charging purchases, and free travel benefits.

Once a year, take stock of the accounts you have. Ask yourself if they are working in your favor and if you need to add to your portfolio. When thinking about opening a new card, consider issuers that have a prequalification process so you can get a better idea of your approval odds without subjecting yourself to a hard inquiry.

Maybe you are driving more now, and a gas card would be beneficial. Or perhaps you have a retail card that you opened for a discount but never used again. You may consider closing it, even though that can reduce your overall credit history.

When you have the right accounts for your financial situation, and use them regularly and responsibly, your credit scores will benefit. After that, stop applying until your needs and circumstances change.

But know when to say “No”. If you apply for a card and get denied, you’ll have an unnecessary hard credit inquiry on your file. But even if you do qualify for the card, it can open you up to more credit than you can actually handle.

Understand Your Rights and Protections

Federal law protects consumers against abuse. The Fair Credit Reporting Act (FCRA) governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by credit reporting agencies.

Laws and Regulations

- Only those with a “permissible purpose” can check your credit file.

- You can opt out of prescreened offers for credit and insurance.

- If you are denied new credit, insurance, or employment, the credit reporting agency must notify you that the information on your file was used against you and will provide you with the contact information for the entity that reported the negative information.

- Positive information will typically stay on your reports as long as the account remains open.

- Most negative information will stay on your reports for seven years.

- You have a right to dispute inaccurate or false information.

How to Dispute Errors

Because so much is riding on the data in your credit report, it is important to dispute any errors that hurt your scores and hold you back from what you deserve.

In the event that you spot information on your credit report that is inaccurate or accurate but too old to be listed, dispute it with one of the agencies. It will notify the others. Each credit bureau’s system varies, but this is the typical process:

- Log into the credit reporting agency’s website. Find the section enabling disputes. Click “Start a new dispute” to access your credit report and begin the process.

- Indicate the reason. A drop-down menu will give you dispute options, but you may also type in your own reason. Depending on the case, you may need to provide documentation to verify the correction.

- Review and submit. You will see a confirmation page after you file the dispute, and can upload any supporting documents at that stage. For example, if you paid a collection account but your credit report is indicating that it is still an outstanding balance, copy any relevant correspondence that you have and information from your bank that proves that the debt has been satisfied.

- Wait for a response. The credit reporting agency will notify you that the dispute has been opened and will update you with the result. Disputes are usually resolved within 30 days.

Credit Checks Are a Necessary Part of Financing

You don’t need to fear credit checks. When you conduct your own, you will see how lenders and other businesses view your credit history.

Accessing your credit score is also a good idea because you will have an instant assessment of your creditworthiness. With that information, you can either take steps to build your credit as needed or, if your scores are already high, you can keep up the great work! Higher scores will usually translate into preferred interest rates, more attractive terms, and increased opportunities.

Additionally, credit checks protect you as a consumer. The data that appears on your credit report — and that translates into credit scores — is objective. Your age, occupation, income, net worth, location, race, religion, and marital status are never part of the process. Only the way you have borrowed and repaid in the past and the debt you may have today are factors. If you don’t like what appears on your credit file, you can change it with directed action.