Credit repair is a process that addresses errors and negative items on your credit reports. It can include identifying misinformation, disputing and removing inaccurate information, and learning how to manage debt more effectively. You can do it yourself or hire an agency to help.

How to Know if You Need Credit Repair

Start by looking at your credit reports from the big three bureaus: Equifax, Experian, and TransUnion. Go through these reports carefully to spot any potential mistakes or incorrect information that could be lowering your credit score.

If you find things that require correction, such as errors in your account details or actions you didn’t actually take, you may need to fix your reports. Next, think about whether you want to fix your credit alone or if you want help from a company that knows how to do it.

The Credit Repair Process

The credit repair process is about removing errors from your credit reports. The ultimate goal is to raise your credit score so you can get approved for loans, credit cards, or other financial products more easily. Here is some more information on the process:

Getting Started

First, you should obtain your credit reports from AnnualCreditReport.com. You are entitled to one free report from each of the three major credit bureaus — Equifax, Experian, and TransUnion — every week. Visit this website and complete the form with your details to access your reports.

Sometimes, you may get a free report if someone has denied you credit, you are unemployed and planning to look for a job soon, you are on welfare, or your report is inaccurate because of fraud.

Once you access your credit reports, do a preliminary review of them. At this stage, you’re just getting familiar with their contents and organization.

Identifying Errors

Once you are familiar with their layouts, review your credit reports carefully. You should especially be interested in inaccurate information that wrongly harms your credit score. Here are some of the items you should look out for:

- Check personal information: Look at all the loans, credit cards, and house payments on your credit report. See if they are open, closed, or in collections, how much you owe, your credit limit, and whether you’ve paid on time. Ensure everything matches what you know about your financial situation.

- Review credit accounts: Go through all the credit accounts listed on your reports, such as loans, credit cards, and mortgages. Check the status of each account (i.e., open, closed, in collections), the balances owed, the credit limits, and the payment history.

- Look for wrong numbers: Pay close attention to how much you owe and your credit limits. Numbers that seem too high or too low can mess up your credit score.

- Identify unknown accounts or transactions: Search for any loans or credit cards in your report that you don’t remember opening. If you find items that look wrong or that you do not recognize, beware that someone may have stolen your identity.

- Spot unauthorized inquiries: Identify any hard inquiries you did not authorize. A hard inquiry occurs when a lender checks your credit report as part of the lending decision process. Unauthorized Inquiries could be mistakes that drag down your credit score. Worse, they may indicate fraudulent activity.

- Check for outdated information: Ensure that no outdated debts or negative items (including bankruptcies, foreclosures, collections, and late payments) still appear. Negative information can appear on your credit report for two to ten years. If old negative items remain after this period, request their removal, as they can unjustly lower your credit score.

When you complete your review, you may have a list of items you want the credit bureaus to fix or remove. You’re now ready to dispute these erroneous items.

Disputing Inaccuracies

You can dispute credit report errors on your own or through a credit repair agency. If you decide on the DIY approach, begin by collecting any documents or records that support your claim that an item on your credit report is wrong. These may include bank statements, payment records, tax returns, and correspondence from creditors.

Write a dispute letter to each credit bureau (Equifax, Experian, and TransUnion) that lists the inaccurate item. You can get sample dispute letter templates from the Consumer Financial Protection Bureau and the Federal Trade Commission.

Experian

PO Box 4500

Allen, TX 75013

(888) 397-3742

Online disputes: https://www.experian.com/disputes/main.html

TransUnion

Attn: Consumer Dispute Center

PO Box 2000

Chester, PA 19016

(800) 916-8800

Online disputes: https://www.transunion.com/credit-disputes/dispute-your-credit

Equifax

PO Box 740256

Atlanta, GA 30348

(866) 349-5191

Online disputes: https://www.equifax.com/personal/credit-report-services/credit-dispute/

The credit bureau must reply to you in writing within 30 days. If you win the dispute, the bureau will fix or remove the wrong item and alert those who recently checked your report.

If you don’t agree with the bureau’s decision, you can challenge it, but you need to provide more information. If you dispute too many items without good reason, the bureau may disregard your claims as frivolous.

Even if you don’t win the dispute, you can add a statement of up to 100 words to your credit report to explain your side. This information can help lenders better understand your situation when they review your credit requests.

A credit repair agency can do all of this work on your behalf. These companies specialize in finding and disputing errors on your credit reports. They will review your credit reports, identify any inaccuracies or negative items that they can challenge, and then dispute those items with the credit bureaus and creditors.

Choosing a Credit Repair Service

DIY credit repair is free (except for postage) but requires plenty of time and attention. If you can’t or don’t want to tackle your own credit repair, consider hiring a credit repair service to do the heavy lifting for you.

What Credit Repair Companies Do

Credit repair companies aim to clean up your credit by finding and disputing errors on your reports.

These companies review your credit reports from the major bureaus to identify mistakes or negative items. They then dispute inaccurate information and demand that the bureaus remove or correct it.

A credit repair company manages disputes for you. Reliable companies typically have many years of experience with credit bureaus and understand complex credit report information. Their expertise can improve the chances of successful disputes.

While credit repair companies can dispute errors, they cannot legally remove accurate negative information from your reports. Be wary of companies that promise unrealistic outcomes. And always remember that you can perform these services yourself for free.

The time it takes to repair your credit can vary depending on the number and nature of the disputes. Generally, the credit bureaus have 30 days to investigate disputes, but resolving all issues and seeing a change in your credit score can take much longer.

Evaluating Credit Repair Companies

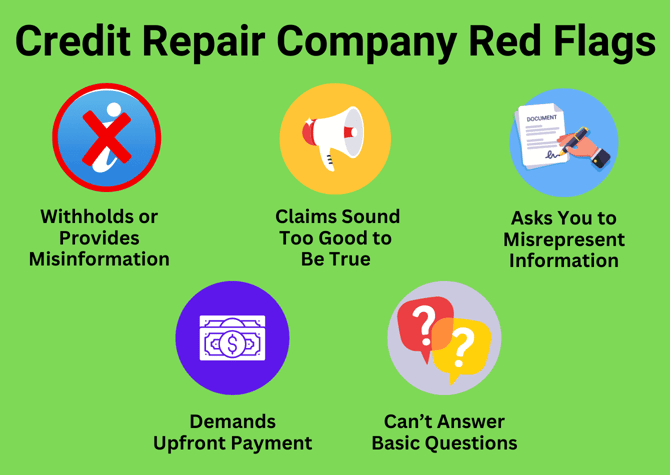

When picking a credit repair company, go for one that has a good reputation and delivers results. Be careful, though, because some bad companies exist in the industry.

Search for a company that has a history of success and plenty of happy customers. The company should be open about its process and what it can fix for you. Many offer free initial consultations.

Watch out for companies that say they can fix your credit score fast or want money before they start working. Trustworthy companies promise certain efforts rather than results and ask for payment only after they’ve completed the work they agreed to do.

Be sure to read the contract and understand all the costs before you agree to anything. A reliable company will explain everything clearly, including its services and how much they will cost.

Look for reviews and testimonials from previous clients regarding the company’s effectiveness and customer service. Positive feedback from other customers can indicate whether the service is dependable and effective.

Some credit repair companies offer a money-back guarantee if they can’t remove any negative items from your credit report. Understand these guarantees and how to qualify for a refund.

Professional Help or DIY?

You can fix your credit yourself or hire someone to do it for you. What you choose will depend on your situation and how comfortable you feel about the process. A DIY approach means you don’t have to pay someone else to do it, and you get to manage all of the details.

However, fixing credit on your own takes a lot of time and effort, including understanding how the process works, filing dispute letters, and keeping track of everything. The rules can be complicated, so don’t underestimate the job.

If all of this seems too much for you, or if your credit problems are big, you should consider getting a professional credit repair company to help. A good company knows how to deal with the credit system and may fix your credit problems faster than you could yourself.

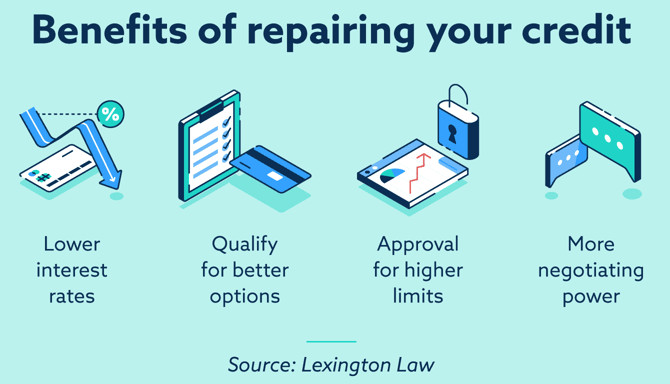

Think about how much it costs to hire a company to fix your credit compared to the value you’ll receive. Paying for a service might be valuable if it enables you to borrow money more easily and obtain lower interest rates.

The price of using a credit repair service depends on what they do for you. Some companies charge an “initial work” fee to obtain your credit reports and review them for problems.

Most of these companies charge you monthly for as long as you use their services, which is typically three to six months. This monthly cost can be anywhere from $50 to more than $150. For these fees, they typically argue against mistakes on your credit report, watch over your credit, and give you advice along the way.

Some companies offer multiple levels of service at various price points. The more you pay, the more help you receive. These additional services may include letters to stop debt collectors or protection against identity theft.

The length of time you need the service can vary. Some people may see their credit improve in just a few months. Others may need to stick with it for more than a year, especially if their credit problems are complex. You should have the option to cancel the service whenever you want.

Other Ways to Improve Your Credit Score

Credit repair isn’t for everyone; it’s only for those with erroneous data on their credit reports. However, several credit improvement strategies can help just about anyone with a low credit score.

Reduce Your Debt

Reduce and manage your debt to improve your credit score. Creating and sticking to a budget is crucial for managing your finances, especially if you want to pay off debt. You need to understand how much money you make and spend. Knowing this helps you plan a budget that can cover your costs and include paying down your biggest debts. Of course, creating a budget is usually easier than following it consistently.

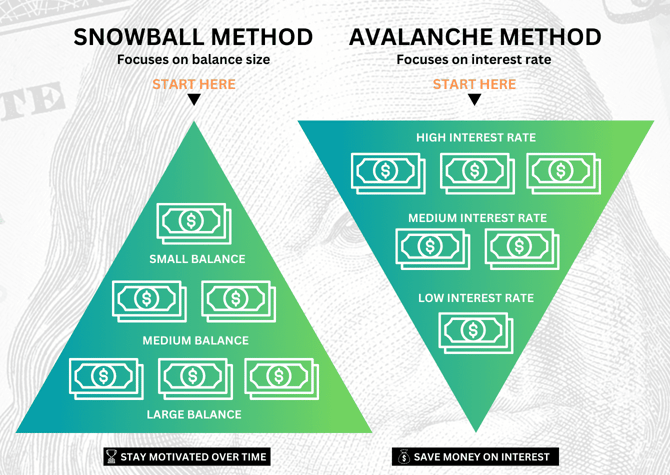

Once you understand your financial situation, it’s time to prioritize. Some of your debts are likely more expensive than others, so determine your most expensive debts and pay those off first. This is called the avalanche method. Bear in mind that the largest debt may not be the most expensive — compare APRs and choose the highest one first.

Alternatively, you can use the snowball method by paying off debts from smallest to largest. This method is less efficient but may boost your morale faster. In any event, you should pay more than the minimum balance on at least one of your credit cards. Otherwise, you will likely remain in debt for much longer.

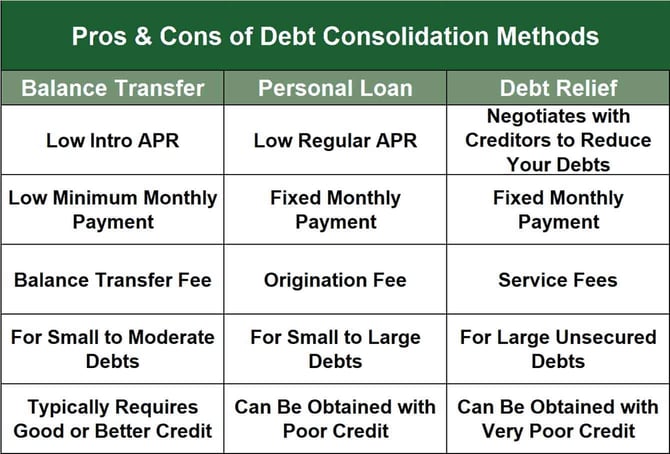

Consolidating your debt at a lower interest rate can save you money. Consider balance transfers or personal loans to pay off higher-priced debt. During (and after) debt consolidation, try to curb your impulse spending. Sticking to your budget is the best way to avoid new debt, but your budget needs to be realistic to succeed.

Suppose you cannot earn enough income to pay your bills, and you’ve eliminated unnecessary spending. In that case, you may want to negotiate with your creditors. Many state and local agencies offer free credit counseling. They can help you consolidate your debt and revamp your budget. They may even ask your creditors to reduce your interest rates or increase your loan term.

Your credit score drops when negative marks such as late payments or unpaid debts appear on your reports. You can try to remove these by offering to pay the debt in exchange for deletion through a “pay for delete” letter. This tactic may not always work, but it’s worth trying since you can remove the negative item and improve your credit score while also paying off your debt.

If a creditor reports a late or missed payment, you can ask them nicely, through a “goodwill letter,” to take it off your credit report. This approach works well if you’ve had a good, long history with the creditor and are up to date with your payments. Be polite in your letter, as the creditor doesn’t have to say yes to your request.

Build Positive Credit Habits

Using your money responsibly is the key to establishing and maintaining good credit. The single most important habit is to pay your bills on time.

Missing loan or credit payments can harm your credit score. This is something you must avoid if you are serious about getting a better credit rating. You should record and track the monthly deadlines for all your current loans and credit lines. You can set up an automatic payment system from your bank account so you don’t forget a payment. Consider using personal finance apps, such as Quicken, to ensure payments go out on time.

You can also improve your credit by reducing your debt relative to your credit lines (your credit utilization ratio, or CUR). Your CUR is the ratio of your credit card balances to your credit card limits. Keeping your CUR below 30% can help you improve your credit score.

Besides paying down your balances, you can decrease your CUR by requesting a credit limit increase on one or more of your credit cards.

The trick is to refrain from spending the additional credit, or else the maneuver may backfire. You can also increase your credit available (and reduce your CUR) by getting a new credit card and then sticking it in a drawer until you pay off your debts.

Monitor and Maintain Your Credit

Monitoring your credit is more straightforward in the modern world. You can receive credit reports for free from the three major bureaus, and many credit cards provide monthly updates and track your credit score.

Consider using a monitoring service to help you track your credit scores. The features you can access vary by cost and company. Some services work with a single credit bureau, but others monitor all three bureaus and look for suspicious activity. These services routinely message you when your credit score changes or they detect any unusual activity.

Many credit card issuers allow you to set up various automatic alerts (via direct messages or email) to keep you informed about your card’s transactions, balances, and due dates. Credit card mobile apps can provide similar information.

Legal Rights and Consumer Protection

In the United States, you have rights under the Fair Debt Collection Practices Act (FDCPA) and the Credit Repair Organizations Act (CROA). These two laws protect consumers against abusive debt collectors and credit repair services.

Dealing with Collection Agencies

The FDCPA is a U.S. law established in 1977 to protect consumers from abusive, deceptive, and unfair debt collection practices. Here’s what’s entails:

Limits on communication: It restricts how and when debt collectors can contact consumers, prohibiting calls at inconvenient times or places, such as before 8 a.m. or after 9 p.m., unless agreed upon.

Debt validation: The FDCPA requires debt collectors to send a validation notice to consumers within five days of first contact. The notice must detail the amount of debt, the creditor’s name, and a way for the consumer to dispute the debt.

Prohibits harassment: Debt collectors cannot use threats, obscene language, or harass consumers with repeated calls.

False statements prohibited: Collectors are not allowed to lie about the debt amount or their identity or use deceptive methods to collect the debt.

Unfair practices: The FDCPA prevents collectors from engaging in dishonest practices, such as charging excessive fees or attempting to collect debts you don’t owe.

The FDCPA ensures that debt collectors act fairly, and it allows consumers to dispute or validate debt claims without facing intimidation or harassment.

If a collection agency contacts you, keep calm. First, remember your rights under the FDCPA. Then, ask for a written notice or validation of the debt if you have yet to receive one. Collectors must provide this information, which includes the amount of debt and the creditor’s name.

Respond to calls or letters promptly. Pay attention to collectors — this can lead to further action, such as lawsuits. Document all communications with the debt collector, including dates, times, and conversation details. This will be important if you need to file a complaint or take legal action.

You can negotiate a payment plan for valid debt that fits your circumstances. If you believe the debt isn’t correct, you can dispute it. If you need help with what to do, consider collaborating with a consumer rights attorney or a credit counseling service.

Dealing With Credit Repair Organizations

The CROA, established in 1996, protects US consumers from fraudulent credit repair companies. Before the CROA, consumers had difficulty determining which credit repair companies were legitimate and which were scams.

Under the CROA, credit repair companies must tell you what they can and can’t do for your credit. They can’t charge you until they finish the services they promised. They must give you a contract that explains what services they’ll provide, how much they will cost, and how long it will take. In addition, you get three days to cancel the service without charge if you change your mind.

To avoid illegitimate credit repair companies, consider the following tips:

Research thoroughly: Look into the company’s history, reviews, and testimonials. Check for a record of success and satisfaction from past clients.

Check for registration and compliance: Ensure the company is registered with the relevant state authorities and complies with the CROA.

Beware of unrealistic promises: Steer clear of companies that guarantee quick fixes or promise to remove accurate negative data from your reports.

Avoid upfront fees before work performance: They’re illegal under the CROA.

Seek referrals and recommendations: Ask others you trust to recommend reputable credit repair companies. Check out reviews on reliable websites, such as this one and the Better Business Bureau.

Always protect yourself from bad actors and scams that disgrace the credit repair industry. Reputable companies abide by all laws and regulations, do the hard work for you, and can actually help you in the long run.

Identity Theft and Fraud

Identity theft occurs when someone steals your private identifying information for fraudulent purposes. It is a serious problem worldwide. You must vigorously respond when it happens to repair any damage to your credit.

You can become aware of identity theft in many ways, including:

- Unexplained withdrawals from your bank account

- Credit card charges you don’t recognize

- Bills for products or services you didn’t purchase

- New accounts under your name that you didn’t open

- A sudden drop in your credit score

- Unexpected denials when you apply for credit

You should act immediately if you become a victim of identity fraud. First, contact your bank and credit card issuers and have them freeze your accounts. Also, contact the three major credit bureaus to place fraud alerts and a credit freeze on your reports. This prevents the opening of new accounts without your permission.

You should file reports with your local police and with the Federal Trade Commission, which can help you establish a recovery plan.

If you purchased ID theft protection (e.g., LifeLock, Identity Guard, OmniWatch, etc.), file a claim and follow their instructions. They typically help you report the problem to the interested parties, provide a set amount of insurance to cover your claims, and pay for legal assistance. These companies usually offer several coverage tiers at different prices, so check with your provider for details.

Some steps you can take to prevent ID theft and fraud include:

- Use strong, unique passwords on all accounts and websites. A secure password vault makes this easy and convenient. Regularly update your passwords.

- Immediately report lost or stolen credit cards to the issuer.

- Respond cautiously to emails with links, even if they look official. Instead, contact the sender independently to verify the communication.

- Do not give out sensitive information in an email.

- Check your credit reports regularly and consider subscribing to a credit monitoring service.

- Set alerts on your financial accounts to stay informed of any transactions that occur.

- Shred sensitive documents you no longer need.

No one is 100% safe from identity theft, but these steps can go a long way to reducing your risk.

The Impact of Credit Repair

Credit repair can be useful if your credit reports contain derogatory misinformation. Correcting these inaccuracies can improve your credit score over time, but the exact amount depends on your circumstances. Do not expect credit repair to remove valid negative data.

You should see changes to your credit report within two months of winning a dispute. However, it can take considerably longer to see a higher credit score.

Credit repair services can cost a lot, with monthly subscriptions usually in the $100 to $150 range. You can avoid these fees by doing the work yourself, but prepare to devote a fair amount of time and energy to the enterprise.

Many credit repair companies offer a free initial consultation that can give you a good idea of the ultimate cost. Remember, you can cancel your service anytime.

Over the long run, an improved credit profile can save you money on interest and increase your access to credit. You should receive easier approvals for better credit cards, loans, and insurance policies. You’ll also qualify for higher credit limits that may enable you to finance big-ticket purchases.

In short, good credit can elevate your financial lifestyle.

Credit Repair Can Help Ensure Credit Report Accuracy

Credit repair can help ensure your reports are accurate. A clean credit report, free of inaccurate information, may also help improve your credit score. Although you can do it yourself, consider hiring a reputable credit repair service, as they typically have the expertise and years of experience to do the job efficiently.

The rewards for reviewing and fixing your credit reports can be substantial. You may see a higher credit score and, more importantly, identify any signs of fraud and identity theft. Credit repair also has the potential to improve your financial well-being over the long term.