When you apply for a credit card, a loan, or any other form of credit, the lender will check your credit reports as part of your application and risk assessment process. Your credit reports and credit scores help lenders determine, at a glance, the risk of doing business with you.

Think of your credit reports and credit scores as report cards for adults. Lenders, however, don’t have just one credit report to choose from when you apply for financing.

Rather, lenders may request your credit reports from one of three major credit reporting agencies, also known as bureaus. Some lenders even check multiple credit reports at the same time to gather as much information about you as possible before making their decision.

Agencies | Similarities | Differences | Disputes

What Are the Credit Reporting Agencies?

In the United States, there are three major credit reporting agencies or, informally, CRAs. These three companies are Equifax, TransUnion, and Experian. While the process of credit reporting dates back well over 100 years, we’ve had these three major players for about 20 years now.

While the three major CRAs get the most attention, there are several smaller reporting agencies, as well. The primary purpose of most consumer reporting agencies is to gather information about you, specifically, your credit management history.

While the three major CRAs get the most attention, there are several smaller reporting agencies, as well. The primary purpose of most consumer reporting agencies is to gather information about you, specifically, your credit management history.

The reason these companies gather information about your credit management habits is simple. It’s valuable.

Lenders and other companies pay the credit bureaus for access to your information when you apply for credit, insurance, rent, utilities, and other services. By considering how you’ve managed credit in the past, lenders understand whether you’re likely to be a good customer and pay your bills on time in the future.

The tools generally used to make this assessment are credit scores, which are based entirely and exclusively on the information in your credit reports.

In the United States, the CRAs don’t need your permission to collect your financial information. However, once they have it, they must follow the rules. The Fair Credit Reporting Act, or FCRA, is the primary federal statute that regulates the CRAs and restricts what they can and cannot do with the information they collect.

Similarities Among the Credit Reporting Agencies

All three of the major CRAs serve a similar purpose. However, it’s important to understand that Equifax, TransUnion, and Experian don’t work together.

In fact, they are competitors. Think Pepsi and Coke, Ford and Chevrolet, Apple and Microsoft.

Still, many similarities exist among the credit bureaus, including:

- Each CRA maintains over 200 million credit files on U.S. consumers. The credit bureaus don’t share information, except when the law requires them to. Having said that, it’s very likely your three credit reports are going to be heavily redundant.

- All three CRAs must follow the rules outlined in the Fair Credit Reporting Act. This isn’t negotiable. If you are a credit reporting agency, then the FCRA applies to you. And, the FCRA applies to all credit bureaus equally, meaning the rules aren’t different across the major credit reporting agencies.

- The CRAs depend on data furnishers, just as credit card issuers and lenders do, to supply them with information about how you manage your accounts. Each month, more than 10,000 companies send information to the three major credit bureaus. The majority of these businesses are financial services companies and debt collectors, but there are certainly others.

Understanding these similarities will give you a better grasp of how credit reporting works and a better understanding of your rights as a consumer.

Differences Among the Credit Reporting Agencies

The three CRAs do business similarly but have a few key differences as well. Some of these differences may have a direct impact on your credit reports and scores, so they’re important to understand.

Differences include:

- Each CRA may work with different data furnishers. Credit reporting is entirely voluntary. While most major creditors report your information to all three of the CRAs, some smaller lenders and debt collectors may only report your data to one or two credit bureaus. This will result in you having different credit reports, and, possibly, different credit scores, and can also impact your ability to qualify for new financing and favorable rates.

- Credit report errors could occur with one credit bureau, but not the others. Because the credit bureaus don’t generally share information, it’s likely your information is going to be somewhat different from each. This includes accurate and inaccurate information.

- The CRAs may sell different products. While all three CRAs create and sell credit reports, they each sell other products too. For example, Equifax and Experian maintain and sell business credit reports, but TransUnion does not.

Now that you understand the similarities and differences among the CRAs, let’s look at what to do if there’s a discrepancy in one or more of your reports.

Disputing Errors with the Three Credit Bureaus

Thanks to the FCRA, if you discover an error on any of your credit reports, you have the right to contact the credit bureau that maintains the erroneous report and dispute the mistake. This is one of the core rights you have under the statute.

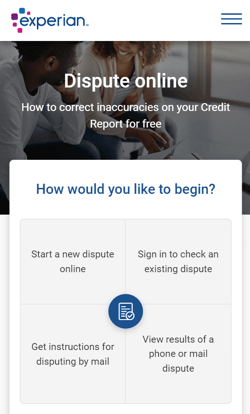

You can file online disputes with all three credit bureaus through their individual websites.

If an error appears on all three of your credit reports, the best practice is to file three separate disputes, one with each CRA. This is the best way to get all errors corrected. The cost of filing disputes is and always has been free.

When a CRA receives your dispute, it generally has 30 days to investigate your claim. As part of the investigation, the CRA contacts the data furnisher and asks it to verify whether the information in question is accurate.

If the data furnisher verifies the account accuracy, it will remain on your credit reports. But, if the data furnisher doesn’t verify the account, it must be deleted from your credit report.

A middle ground can also be that the furnisher of the information simply corrects the error but doesn’t delete the item.

Check Your Credit Reports Every Year

The credit bureaus each maintain their own independent credit file databases. Each CRA may receive slightly different information about you from data furnishers so your credit reports and scores aren’t going to be the same. That’s why it’s important to keep an eye on all three of your credit reports.

Checking one credit report isn’t enough. Just because your Equifax report is accurate certainly doesn’t mean your reports from TransUnion and Experian will be error-free.

Thankfully, pursuant to the FCRA, you’re entitled to a free copy of all three of your credit reports once every 12 months. You can visit AnnualCreditReport.com to download your free reports.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.