Budgeting is one of the first and most crucial steps toward getting your financial life in order. Yet, only 41% of Americans use a budget.

Without a budget, there’s no way to know how much money you’re spending every month or what you’re spending on. And, if you aren’t aware of where your money is going, it’s easy to waste it on things that don’t bring you joy and keep you from affording the things or experiences you truly value.

Not to mention it will make it difficult to prioritize savings goals, cause you to spend beyond your means and take on debt, and miss out on achieving important milestones, such as buying a home or even starting a business.

Even if you set a budget, though, sticking to it is a whole other beast. After all, setting parameters on how much you can afford to spend on certain expenses is the easy part — actually following your limits is the more challenging element.

However, with more financial awareness, motivation, and proper preparation, you can build a monthly budget that truly works for you and one that you can follow. Here are five steps to help you set a budget you can actually stick to.

Step 1 — Figure Out What Brings You Joy

When it comes to budgeting, there’s no one-size-fits-all approach. A budget must be customized to your specific circumstances, income, goals, and personal preferences.

Setting one that doesn’t meet these criteria will backfire since it won’t support your dreams or bring you happiness. Although it’s important to focus on the necessities, your budget must also include room for expenses or experiences that bring you joy so you feel motivated to adhere to it.

To establish a sound financial plan that you actually want to stick to and enjoy, review all your expenses over the last three months, from the major ones to the small ones, to come up with your average spend per category and determine which of those you want to keep and which need to go.

If travel brings you joy, include it in your budget.

Remember, even the $5 streaming video service and $10 takeout orders add up, so make sure you’re reviewing each and every expense to determine where and how you should spend to create the best budget for yourself. This practice ensures you are satisfied with how you’re using your hard-earned dollars and gives you the chance to free up cash that can be used in more meaningful ways.

Until you spend time analyzing how you want to spend your money and what brings you joy, you won’t be able to create a budget that satisfies your financial and personal needs. Ultimately, this will be the biggest motivating factor in helping you stick to your budget.

Step 2 — Use an App to Stay on Track

Once you determine which categories to add to your budget and a dollar limit per line item, you have to manage your spending every month.

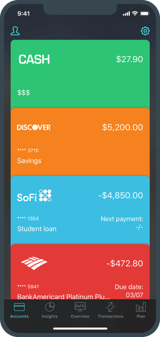

Tracking your money is rather complicated when you have multiple bank accounts, several credit cards, and a few different savings or retirement plans. However, several apps can make it easier to track your spending habits and help you stick to your budget.

The PocketGuard app, for instance, allows you to assign bills and other expenses into specific “pockets” so it’s easy to keep tabs on your spending.

By setting limits for each expense category, the app will send notifications when you’re close to going over so you can rein in on spending before blowing your budget. It will also alert you to ongoing spending habits that you need to fix or help you identify areas where you need to cut spending back.

Other apps such as Mint and YNAB are other great budgeting tools that help you keep track of your spending.

Step 3 — Automate Savings

Savings goals are often the first item to be ignored in a budget since it’s not a fixed monthly expense. Because there’s no repercussion for missing a payment, it’s easy to miss your savings goals and blow your financial plan.

Luckily, one simple solution can help you stick to this budgeting goal — automating your savings.

Creating an auto-transfer from your checking account or from your paycheck directly into your savings account (or towards the various accounts you’ve created for different goals like a vacation fund or holiday shopping account), ensures you meet your savings targets every month while taking the work out of thinking about putting money away.

Plus, once it’s transferred, you won’t have the opportunity to spend it in any other way, which kind of forces you to stick to your plan. Otherwise, it’s more likely you will find reasons to slip up or accidentally spend on a tempting impulse purchase.

Step 4 — Add a Cushion for Contingencies

Even the most carefully crafted budget can explode if you don’t make room for contingencies. Unexpected expenses and emergencies can take place at any time, wreaking havoc on your finances.

A trip to the emergency room, a broken water heater, a car accident — such events are impossible to predict, but, if they do occur, they’re sure to be expensive and will make it difficult to stick to your budget. For this reason, it’s important to plan for potential emergency expenses by setting up a separate savings fund allocated to these unexpected life moments.

Not only will this alleviate a lot of the stress you may experience emotionally, but it will limit the financial pressure these instances create while allowing you to stick to your budget. Otherwise, you’ll have to deter from your spending plan, potentially dip into savings, or take on high-interest debt just to get through it.

Aim to save three to six months’ worth of living expenses for emergencies.

Ideally, you should aim to set aside three to six months of living expenses in a separate account that can be quickly accessed in the event of an emergency.

If this number seems like more than you could realistically save, start with something. Anything is better than nothing, and the sooner you begin to build an emergency fund, the sooner you will be able to avoid budgeting hold-ups.

Step 5 — Make Periodic Updates

One of the biggest money management faux pas is setting a budget and assuming you don’t have to adjust it. However, you can’t expect your budget to stay the same throughout the years or that it will magically adapt to new expenses.

This is especially true if you experience a significant change in your personal or professional situation that affects how much money you are earning or spending.

When you encounter a major life moment, such as tying the knot, getting a new job, having a baby, buying a house, or sending your kids to college, your budget will need some TLC. These types of situations will cause significant changes to your cash flow and how much you can afford to spend on different expenses or stash away in savings.

If you’re not spending the time to make appropriate modifications in these moments, you will bust your budget and lose motivation to stick to your spending and savings plan. So, spend time reviewing your budget periodically to make sure it still meets your needs, goals, and current financial picture to make it one you can actually stick to.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.