A secured credit card is a type of credit card that the cardowner backs with a cash deposit that typically serves as collateral for the credit line. This makes secured credit cards easier to obtain, even if you have no credit, limited credit, or bad credit. Besides the collateral, secured credit cards look and act just like the unsecured variety.

What to Expect From a Secured Credit Card

If you’re thinking about getting a secured credit card, it’s important to know how it works. This kind of credit card is a good tool for building or fixing your credit score.

A Security Deposit is Required

You’ll need to put down a security deposit for a secured credit card. This deposit is a safety net for the issuer and usually determines your credit limit.

Issuers of secured cards need collateral to cushion the heightened risk that you may default on your card debt. Normally, your deposit sits in an escrow account without paying you interest. Issuers only tap into your security deposit if you fail to pay at least the minimum monthly payment. This will reduce your credit limit unless you replenish your deposit.

However, the issuer will likely close your account if you miss more than one payment. The issuer may siphon your unpaid balance and any fees from the deposit and then send you the remainder.

Typically, deposits range from $200 to $5,000, depending on the card and your credit profile. You usually have the option to add more money to your initial deposit to increase your credit limit.

Secured card deposits are refundable, and you can get your money back in a couple of ways. The bank will return your deposit if you close your account with a fully paid balance. Alternatively, the issuer may upgrade you to an unsecured card if you consistently pay on time.

This upgrade means the issuer no longer needs your deposit as collateral and will return it to you. The refund may be deposited into your bank account or mailed to you as a check.

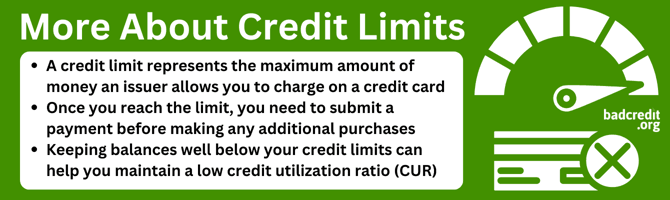

How Issuers Determine Credit Limits

The issuer may consider several factors to decide whether to accept your card application and the maximum initial deposit it will allow. These considerations can include your income, how much you spend on housing, whether you have a stable job, and any other debts you may have.

However, some secured credit cards do not check credit and rely solely on your security deposit to approve your application.

Your deposit determines your credit limit. For example, if you deposit $500, your credit limit will be $500. However, a secured card issuer may require a deposit smaller than the initial credit line.

Some secured cards set a low initial deposit amount and require you to wait before it will accept additional funds. Others may allow larger initial deposits and/or quick additions to the collateral amount. Secured cards may unilaterally increase your credit limit after six to 12 months of timely payments. Alternatively, they may simply upgrade you to an unsecured card.

Monthly Payments and Interest Rates

When you use a secured credit card, you make monthly payments, just as with any other credit card. Since your credit limit is equal to your deposit, your spending and, thus, your monthly payments may be lower than for unsecured cards, which often have higher credit limits.

Interest rates on unsecured cards for bad credit are generally higher than those on secured cards for no or bad credit. Despite the security deposit, issuers still view secured card customers as high-risk. However, secured card APRs may undercut those of unsecured cards for consumers with bad credit.

In fact, secured card APRs seldom exceed 30%, whereas unsecured cards for those with the worst credit may charge up to 36%.

You can avoid interest by paying your entire purchase balance each month. Paying late can cause some major headaches as you’ll likely pay extra fees and risk damage to your credit score.

In fact, the secured card issuer may increase your interest rate or even cancel your card if you miss payments. It’s really important to pay on time every month. Doing this helps you avoid these problems and can help boost your credit score.

How Secured Credit Cards Differ From Unsecured Credit Cards

Secured credit cards are a practical choice if your credit score is low and you can’t qualify for an unsecured credit card. These cards require an initial cash deposit, which sets your credit limit.

The following chart summarizes the differences between secured and unsecured credit cards:

Secured cards are a budget-friendly option for consumers with credit issues. They’re cheaper because they usually have lower fees and interest rates compared to high-fee unsecured cards that cater to consumers with bad credit. Plus, some secured cards offer perks that may include cash back rewards and insurance for rental cars and cellphones, all without extra fees.

Getting a secured card is fairly easy because the issuer doesn’t focus too much on your credit score. Instead, it uses your deposit as security. Plus, secured cards can help boost your credit by reporting payments to all three credit bureaus. However, your payments must be on time to benefit you.

Applying for a Secured Credit Card

Applying for a secured credit card is usually more straightforward than applying for an unsecured card. Secured cards cater to individuals who want to establish or repair their credit, so they accept people with a wider range of credit histories.

Typical Eligibility Requirements

First, you must be a U.S. resident, 18 or older. The good news is that secured card issuers are more flexible about your credit score. You can get approved even if your credit score is terrible or if you haven’t established credit.

But you do need to make sure you have enough money coming in to pay at least the minimum amount due on the card each month.

The issuer will also look at how much you owe already and what you spend your money on to make sure you can manage a new credit card.

As part of the paperwork, you typically need to show a government-issued ID (such as a driver’s license), something that proves where you live, and proof of how much you earn.

You also must disclose your Social Security number. All this data helps the credit card company confirm your identity and decide if you are a good fit.

Choosing the Right Card

When selecting a secured credit card, you should compare terms, fees, perks, and interest rates. Aim for cards with lower costs and better benefits.

Check out what extra benefits each card offers, including rewards or free credit score tracking. The card agreement contains all this information, so be sure to read it before you apply.

To find a card that suits you, read reviews from trusted sites (including BadCredit.org) and perhaps get some additional financial advice. You want a card that helps you build credit and works well with how you manage money.

Application Steps and Approval

Once you identify the right card, applying is fast. You can typically apply online, over the phone, or by filling out a paper form. Here are the typical steps to follow:

- Complete the application form: Provide some basic data about yourself. This includes your name, age, where you live, your phone number, email address, Social Security number, how much money you make, your monthly housing costs, and where you work.

- Wait for the issuer’s review: After submitting your application, the issuer will review your financial information and possibly check your credit. It may send a verification link to your phone or email that requires your response. Many issuers can provide a decision almost instantly. However, some may need more time if any information is missing or invalid.

- Receive a decision: Your chances of approval are good because most secured cards have lax requirements beyond the security deposit. If the issuer approves your application, you must sign an agreement form.

- Submit your deposit: If approved, the issuer will require you to submit a deposit. This amount will generally set your credit limit. You must send the deposit before the issuer grants final approval. The credit card company will cancel your application if it doesn’t receive your deposit within a set period.

Once your deposit clears, the card issuer will send you the card within a few business days. It may take up to two weeks for you to receive your card in the mail.

After receiving your card, you must activate it online or over the phone according to the issuer’s instructions. Only then can you start using it to build or rebuild your credit.

Any annual fee will appear on the initial credit card statement. It temporarily reduces your credit limit until you pay it. You can now use the card for purchases and bill payments up to your credit limit.

You need to manage your new credit account responsibly. To gradually improve your credit score, try to maintain low balances and make payments on time.

Considerations Before Applying

Before deciding on a secured credit card, you should weigh several factors. You need to assess your financial situation, understand the card’s terms and conditions, and consider the long-term implications of owning a credit card.

Assess Your Financial Situation

Understand why you want a credit card. A secured credit card is a solid option for establishing or rebuilding your credit because approval is easy. It makes shopping more convenient and helps you prove that you can manage credit responsibly.

A credit card also allows you to stretch your payments over multiple billing cycles if you can’t afford to pay for a purchase all at once. Unless the card offers an introductory 0% APR promotion, you pay interest when you carry a balance across billing cycles.

You need to lay out money for a deposit, but the issuer will refund it when you close the account or upgrade to an unsecured card.

There are other ways to improve your credit score besides using a secured credit card. For example, you could become an authorized user on someone else’s credit card. The issuer will report both your and the card owner’s activity to one or more credit bureaus. We explore this option in detail below.

Alternatively, you may want to secure a credit-builder loan (typically from a credit union), in which the lender holds the loan proceeds in escrow until you pay off the loan. The lender reports your payments to the three credit bureaus, enabling you to build credit through responsible use. We will also dive deeper into credit-builder loans below.

Take some time to think about what you need for your finances and what you can manage within your budget. A secured credit card can be an effective step toward improving your credit. But if it’s not a good fit for your situation, consider alternatives that may better suit your financial situation.

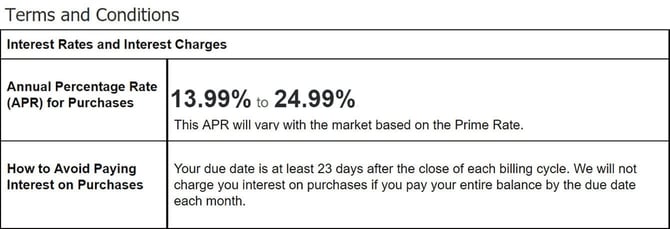

Understand the Terms and Conditions

Credit newbies may find their card agreement full of mumbo-jumbo. Here’s a short glossary of the key terms to look out for in your card agreement:

| TERM | DEFINITION |

|---|---|

| Annual Fee | A yearly fee from some credit card issuers for the privilege of using their card |

| APR (Annual Percentage Rate) | The annualized interest rate you will pay on any outstanding balance on your credit card |

| Balance Transfer Fee | A fee for transferring a balance from one credit card to another |

| Billing Cycle | The interval between your credit card statements |

| Cardholder Agreement | The contract between you and the credit card issuer that outlines the card’s terms and conditions of use |

| Cash Advance Fee | A fee for withdrawing cash from your credit card at an ATM or bank |

| Credit Limit | The most you can charge on your credit card |

| Credit Score | A number for your creditworthiness that lenders use to predict default risk |

| Foreign Transaction Fee | A fee for transactions in a foreign currency or through a foreign merchant |

| Grace Period | The period during which you can pay your balance in full without incurring interest charges |

| Introductory APR | A temporary, lower APR for a limited time after opening a new credit card account |

| Late Payment Fee | A fee for not making the minimum payment by the due date |

| Minimum Payment | The smallest amount you must pay toward your credit card balance each billing cycle |

| Overlimit Fee | A fee when you exceed your credit limit |

| Penalty APR | A higher APR that may apply to your account if you make a late payment or violate other terms. |

It would be best if you considered several factors to ensure a secured card meets your needs. Here are potential deal-breakers to watch out for:

- High annual fees or hidden charges

- The card lacks a grace period

- It has low credit limits

- High-interest rates

- Limited cash advances

- No introductory promotions

- No balance transfer offers

- No path to an unsecured card or higher credit limit

- Lousy customer service

- Clunky account management

On the plus side, secured cards seldom saddle you with nuisance fees for signup or monthly maintenance.

Think About the Long-Term Implications

Using a secured credit card can help your credit score, but only if you use it wisely. You should always pay your bill on time and try to only use some of your available credit. Your credit score will improve over time if you pay your bills responsibly because it shows card issuers that they can trust you with credit. Conversely, it may hurt your credit score if you miss payments or frequently max out your card.

Having a secured credit card should be part of a broader money management plan. Think about what you want to achieve financially. For example, using a secured card carefully can help you improve your credit score enough to eventually buy a house or a car. Just ensure that the card fits with your other financial goals (including saving money or paying off other debts).

Using a Secured Credit Card to Build Your Credit Score

Secured credit cards are a great first step if you’re looking to establish or build your credit. They help prove you can manage credit responsibly. Let’s see how.

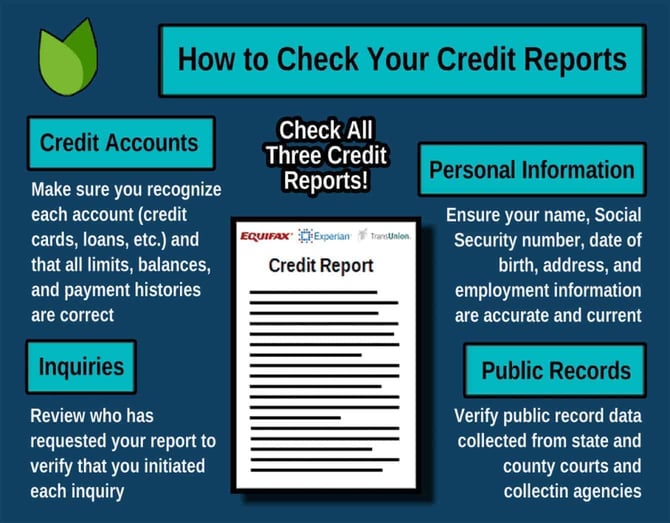

Credit Bureau Reporting

When you buy something or pay a bill with your secured credit card, the card issuer reports the transactions to one or more major credit bureaus, usually monthly. These bureaus — Experian, Equifax, and TransUnion — track your credit activity and create a report that shows how well you manage your credit.

FICO is the leading company that creates credit scoring models. The credit bureaus use FICO and other models to calculate your credit score based on your credit report. Your FICO score is important because financial institutions often use it to decide whether to lend you money or give you a credit card.

Your credit score will go up if reports show that you pay your bills on time and don’t use up all of your available credit. This can make it easier for you to qualify for future loans and credit cards.

Strategies for Secured Credit Card Use

Using your secured credit card wisely can help improve your credit score. Here are a few areas to focus on:

- Pay on time: Always pay your credit card bill by the due date every month. Late payments can hurt your credit score.

- Keep your balance low: Try to use only some of your credit limit. It’s best to use only a small portion (i.e., 30% or less) of your total credit available.

- Pay more than the minimum: If possible, pay off your whole balance each month. Otherwise, try to pay more than the minimum payment so you can reduce your balance faster.

Here are a few traps you should avoid:

- Spending too much: Just because you have a credit limit doesn’t mean you should spend it all. Spending too much can look risky and potentially lower your credit score.

- Paying only the minimum: If you only pay the minimum amount each month, you will incur interest charges. This may lead to your inability to make payments in the future.

- Ignoring the bill: Forgetting to pay your bill can seriously damage your credit score. Always keep track of your payment due dates.

By following these strategies and avoiding common mistakes, you can use your secured credit card to improve your credit score.

Monitor Your Credit Score

Your credit report is a detailed record of your credit history, including your past and current debts, payments, and how much credit you have available. It’s important to understand the information on your credit report because it determines your credit score.

Many tools and services allow you to regularly check your credit score. Most credit card issuers offer free access to your credit score. Additionally, websites and apps such as Credit Karma or Experian provide free services to monitor your credit score and send you alerts when it changes. Some online tools offer tips on how to improve your score based on your credit history.

You can get a free copy of your credit report from each of the three major credit reporting agencies and through AnnualCreditReport.com. Check your reports carefully to ensure everything is accurate. If you find any errors, you should dispute them because mistakes can hurt your credit score.

You can dispute inaccuracies yourself or hire a credit repair company to do the heavy lifting.

By regularly monitoring your credit score and understanding your credit report, you can stay informed about your financial health and identify areas for improvement.

Benefits Beyond Credit Building

Secured credit cards offer more than just credit-building opportunities. They can also provide immediate financial benefits.

Credit Access

One of the main advantages of a secured credit card is the immediate access to a credit line. This means you have a set amount of money available to use when you need it. You can tap into your credit line to purchase items when cash is tight (and perhaps earn rewards as well).

Credit is especially helpful in emergencies. For example, if you suddenly need to pay for unexpected expenses such as car repairs or medical bills. Your secured card lets you manage these costs even if you don’t have enough cash on hand at the moment. In the case of a secured card, this is thanks to the security deposit you have already set aside that established your credit limit.

Rewards and Bonuses

Even though secured credit cards require a deposit, many of them provide reward programs. With these options, you can earn points, cash back, or miles just as you can with a traditional credit card.

For example, you may get cash back on groceries or points when you pay for gas. Rewards can add value to every dollar you spend on purchases.

When choosing a secured credit card, it’s important to weigh its benefits and costs. Look at the annual fee, interest rates, and any other charges. High fees can offset a card’s benefits even if it offers great rewards.

Ensure the rewards you can earn are worth more than the fees you’ll pay. Also, consider how you plan to use the card — it should offer rewards for the categories in which you spend the most.

A secured credit card that offers valuable rewards and matches your spending habits can allow you to earn rewards as you build a stronger credit history.

Learning Financial Discipline

Secured credit cards encourage you to spend wisely because your credit limit is usually equal to your security deposit. You can only spend what you actually have available, which can help keep you from falling into debt.

Secured cards play a crucial role in teaching budgeting skills. Because you have a fixed spending limit backed by money you have already deposited, you must plan your monthly expenses and prioritize essential purchases over your desires. This restriction can help you learn to manage your money better and make rational financial decisions.

Over time, this practice can teach you budget management, which makes it easier to manage larger credit lines responsibly. That’s an essential skill for when you graduate to an unsecured credit card.

Effectively using a secured card requires you to review your expenses regularly, stay within a budget, and plan for a stable financial future. These disciplines are the cornerstone of lasting financial health.

Additional Fees and Potential Charges

It’s important to understand the extra costs you may have to pay with a secured credit card. These can include annual fees, other common charges, and interest payments.

Annual Fees

Some secured credit cards impose an annual fee. This is a charge you pay every year just for using the card. The amount typically ranges from $20 to $50.

Secured cards may have lower annual fees than comparable unsecured cards for consumers with bad credit scores. Some unsecured cards charge high yearly and signup fees.

Other Common Charges

You may run into other fees besides the annual fee. For example:

- Late fees: Pay your bill on time to avoid a late payment, which can cost around $25 to $41.

- Foreign transaction fees: You may pay an extra fee if you use your card to buy something in another country or in a foreign currency. Typically, the charge is 1% to 3% of your spending.

- Cash advance fees: If you use your secured credit card to withdraw cash, you’ll pay a cash advance fee. This fee is a percentage of the amount withdrawn, typically around 3% to 5%, with a possible minimum fee of $5 or $10. Cash advances also start accruing interest immediately, potentially making them quite expensive. You should avoid using your secured credit card for cash advances unless absolutely necessary.

To avoid these extra fees, always pay your credit card bill on time and try to use other methods of payment when traveling abroad or buying something in another currency. If possible, fund a savings account so you can access money suddenly without cash advance fees.

Interest Payments

You will pay interest if you don’t repay your entire balance each month. Credit card companies calculate interest based on your card’s annual percentage rate (APR) and the amount of your balance remaining.

For example, if your card has an annual interest rate of 24%, you’ll pay about 2% interest per month on any balance you don’t repay by the due date.

The best way to avoid paying a lot of interest is to pay off your whole balance each month. The card issuer typically grants a grace period of 21 to 28 days from the previous statement date to the next payment due date. You won’t face interest charges on purchases if you pay the entire balance by the due date.

If you can’t do that, try to pay as much as you can, not just the minimum, to lower your balance faster and pay less interest. Also, make payments early in the billing cycle since that will reduce the number of days that accrue interest at the higher amount.

Cash advances accrue daily interest charges as soon as you receive them. You’ll save money if you can fund a savings account and use it when you need quick cash instead.

Transitioning to an Unsecured Credit Card

Many secured credit cardholders want to move on to an unsecured credit card as their credit improves. An unsecured card doesn’t require a cash deposit, and the good ones come with better benefits and lower fees.

Timing and Qualification

You can start thinking about switching to an unsecured card after using your secured card carefully for at least six months. The time may be right to ask your credit card company to move you to an unsecured card if you’ve paid all of your bills on time and haven’t used too much of your credit limit, which could have improved your credit score.

Many secured credit cards automatically upgrade you to an unsecured card if you make timely payments for a set period (typically five to eight months) after opening the account.

When you move to an unsecured card, the issuer will refund your deposit (minus any outstanding balance and charges). Typically, your unsecured card will have the same or better features.

How to Make the Switch

Here are a few things you typically need to switch to an unsecured card:

- Good payment history: This shows you have used credit responsibly.

- Higher credit score: You’ve improved your score since getting a secured card.

- Stable or rising income: Proving you have steady money coming in helps.

If you meet these criteria, you can contact your credit card issuer and request an upgrade to an unsecured card. It helps if you have waited at least six months between requests. As previously mentioned, the issuer may offer an unsolicited upgrade if it sees you’ve used your secured card responsibly

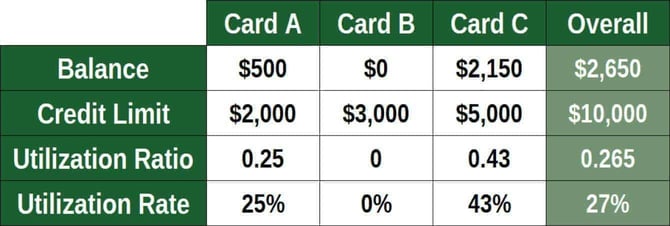

Managing Multiple Credit Cards

When you have multiple credit cards, wise management is the key to keeping your finances healthy and avoiding debt. You can start by assigning different roles to each card. For example, use one for daily expenses and another for recurring bills. This can help you better track spending.

You should always know how much you owe on each card. To improve your credit score, try to keep the balances low compared to each card’s credit limit. Consider setting payment alerts on a mobile device or calendar app to ensure you never miss a payment date. Remember, late payments can hurt your credit score and lead to costly fees.

The best way to avoid falling into debt is to stick to a budget. Know how much you can afford to spend monthly and stay within that amount. You can use budgeting apps or tools to keep track.

Try to repay your entire balance to avoid interest charges. If you can’t pay the full amount, at least pay more than the minimum to reduce your balance faster. It helps if you can keep your overall card balances low compared to your credit limits. A good rule is to use less than 30% of your available credit on each card.

Also, check your credit card statements every month for errors — and to understand your spending patterns. This can help you adjust your budget and avoid overspending.

If you follow these strategies, you can effectively manage multiple credit cards (secured or unsecured) and possibly avoid falling into debt.

Alternatives to Secured Credit Cards

While secured credit cards are a popular choice for building or improving credit, other options may suit you better. These include credit builder loans, prepaid debit cards, and authorized user status. Let’s look into all three.

Credit Builder Loans

A credit builder loan is designed to help you build credit. Unlike a typical loan, you don’t receive the money upfront. Instead, the lender puts the loan proceeds into an escrow account, and you make monthly payments.

The lender reports your payment history to the credit bureaus, which helps you build credit as you pay. You receive the money once you’ve paid off the loan.

These loans are often available through credit unions and other local financial institutions and are ideal for people who need to establish a credit history or want to save money while building credit.

Since the loan encourages saving, it’s also a way to instill financial discipline.

Prepaid Debit Cards

Prepaid debit cards are another financial tool that may seem similar to secured credit cards. However, they have distinct differences, especially when it comes to building credit.

A prepaid card does not link to a line of credit. Instead, you fund it by loading money into the card account in advance. With a secured credit card, you make a deposit that acts as collateral and defines your credit limit. In essence, you borrow money when you use a secured card and the issuer reports those payments to credit bureaus.

A prepaid card is akin to spending cash you already have rather than borrowing money. This fundamental difference between prepaid and secured cards means that your spending on a prepaid card doesn’t influence your credit history.

If you are new to credit, choosing the right path may be confusing. The following chart clarifies the differences between secured credit cards, credit-builder accounts, and prepaid debit cards:

| FEATURE | SECURED CREDIT CARDS | CREDIT BUILDER ACCOUNTS | PREPAID DEBIT CARDS |

|---|---|---|---|

| Access to Funds | Immediate credit line equal to your security deposit | Access funds after you repay the loan | Immediate access to loaded funds |

| Credit Requirement | Low due to security deposit | None | None |

| Impact on Credit | Builds credit with payments | Builds credit with payments | Does not build credit |

| Initial Deposit | Deposit required ($200 to $5000) | No upfront money, pay into account | Load money as needed |

| Costs | Annual fees, possible interest | Interest may be low or refunded | May have monthly fees or per-transaction fees |

| Financial Management | Requires budgeting and spending discipline | Encourages saving and disciplined payments | Helps manage spending, no credit impact |

The major limitation of prepaid cards is that they do not report to the credit bureaus. Because no borrowing is involved, and you are simply using your own money, prepaid cards have nothing to report about your credit behavior. They function best as a reasonable alternative to a bank account.

In contrast, secured credit cards report your borrowing and payment behavior, which can directly impact your credit score.

Become an Authorized User on Someone Else’s Account

Becoming an authorized user on someone else’s credit card account is another strategy to help build your credit. It is best to become an authorized user alongside a trusted family member or friend who has good credit habits. Their account should have a history of on-time payments and low credit utilization.

The primary account holder needs to contact their credit card issuer to add you as an authorized user. They can usually do this online, over the phone, or by completing a form provided by the credit card company.

You may need to provide personal information such as your name, address, date of birth, and Social Security number. This information helps the credit card issuer add you to the account properly and ensure that the account reports all activity on your credit reports.

Once added, you’ll receive a credit card in your name linked to the primary holder’s account. You can use this card to make purchases, although the primary account holder remains responsible for making the payments.

Ensure both you and the primary account holder understand and agree on how you may use the card, including whether you can access the credit available, how you’ll manage payments, and what your spending limit will be.

Becoming an authorized user can impact your credit in several ways, including the following:

- Credit history sharing: When a primary cardholder makes you an authorized user, the card issuer reports the account’s credit history for your credit reports as well. This can positively affect your credit score if the account is in good standing — meaning both you and the main account holder pay bills on time and keep balances low.

- Immediate impact: This method is effective immediately, as you should benefit from the older credit line and the good payment history of the account holder.

- Dependence on the primary cardholder’s behavior: Your credit score is partially at the mercy of the cardowner’s actions. If they miss payments or max out their credit card, it will also negatively impact your credit score.

- Relationship risks: Financial dealings can strain relationships, especially if problems arise with the credit card account. Ensure you have a mutual understanding and trust with the primary account holder.

- Limited Control: As an authorized user, you won’t have the power to make changes to the account, such as increasing the credit limit or changing account settings. Your role is to use the credit under the terms set by the primary holder.

Before becoming an authorized user, it’s important to agree on the limits and conditions of the arrangement so it will benefit rather than harm your credit.

A Secured Credit Card Can Help You Build Credit Wisely

A secured credit card is an accessible tool to build or repair your credit history because it relies on a refundable security deposit, which sets your credit limit. By using the card responsibly, making purchases within your limit, and paying your balance on time, you can demonstrate financial reliability and improve your credit score.

Over time, responsible credit card use can create more opportunities for better credit options. That’s why a secured credit card is a wise choice for anyone looking to establish a strong credit foundation.