If you’ve been doing research on how to build or rebuild your credit reports and credit scores, you may have stumbled across various sources that suggest becoming an authorized user on someone else’s credit card account can help you build credit history.

And while the internet is loaded with dubious information about credit reporting and credit scoring, the good news is that there is some truth to this concept.

But becoming an authorized user doesn’t give you an automatic pass to join the good or excellent credit club. In some cases, being an authorized user may lower your credit scores and backfire as a credit-building strategy.

The key is to have a solid understanding of how being an authorized user on a credit card account can affect your credit before you ask someone to add you to their existing account. Knowing how credit works (with authorized user accounts and beyond) puts you in a better position to build the type of healthy credit reports and credit scores that can make your financial life a lot easier to navigate.

Authorized Users Can Build Credit By Having a Positive Account Added to Their Credit Reports

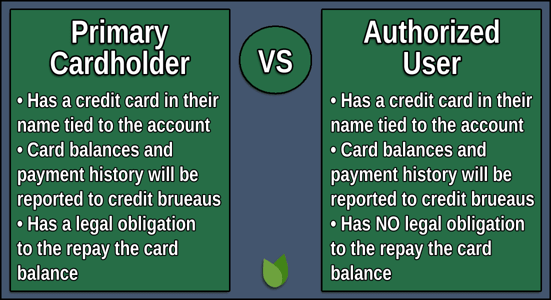

When you open a new credit card, the issuing bank will consider you to be the primary cardholder on the account. At that point, many credit card issuers may also give you the option to add a secondary cardholder (or more) and permit that person to use the account for purchases.

Those subsequent cardholders are known as authorized users.

After adding an authorized user, the issuing bank will mail the primary cardholder a credit card in their friend’s or family member’s name. Once the authorized user receives their card, any purchases they make with it will be posted to the primary account holder’s account.

Authorized Users Aren’t Liable For the Bill

It’s important to understand that the credit card company will hold the primary cardholder responsible for any charges the authorized user incurs. Primary cardholders are 100% liable for their authorized user’s charges.

That’s why primary cardholders should only add people they trust to their credit card accounts. Otherwise, they could be left footing the bill for someone else — regardless of any verbal agreement made.

But the primary cardholder could also choose to never give the authorized user a card so they can’t use it to make purchases. More on that later.

Rewards Belong to the Primary Cardholder & Account Access May Be Restricted

On a more positive note, any purchases the authorized user makes will help the primary account holder earn additional cash back or credit card rewards, depending on the type of account they have. But only primary cardholders can access and redeem rewards.

The authorized user has limited account permissions and may even have a reduced credit limit.

The credit building aspect of being an authorized user occurs when the card issuer reports the account to the credit bureaus. That effectively results in a positive account appearing on the authorized user’s credit reports, which is always good for credit building.

How Fast Can Authorized Users Build Credit?

When a credit card account in good standing shows up on your credit reports, it could begin helping you build credit right away. But if you’re wondering how soon after you become an authorized user on a specific account will your credit score be affected, first consider several important details:

- There’s no guarantee the account will show up on your credit reports. Most, but not all, credit card companies report authorized users to the credit bureaus. It’s not a requirement, and each issuing bank has its own policy regarding authorized user credit reporting. If you’re trying to help a loved one establish credit as an authorized user, you may want to chat with your card issuer first to gather more information.

- Being an authorized user can help or hurt your credit. When you’re added as an authorized user to a credit card account with a history of on-time payments and a low credit utilization rate, the account may help improve your credit. But being added to a credit card account with late payments or a high credit utilization ratio can instead hurt your credit scores.

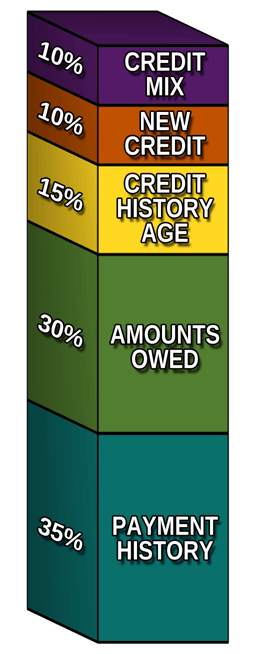

- The age of the account also matters. Credit scoring models, including FICO and VantageScore, consider many details when calculating your credit scores. A credit report that shows older accounts (and older average age of credit) could work in your favor from a credit scoring perspective. That means that being an authorized user on an account that has been open for some time will benefit you more than being added to a newer credit card account.

Data furnishers, including credit card issuers, generally report to the bureaus monthly. So being added to an account in good standing can theoretically improve your credit within 30 or fewer days.

How Much Will My Credit Scores Improve If I Become an Authorized User?

It’s impossible to know precisely how much an authorized user account can improve your credit scores. This may be frustrating, but it’s a result of how credit scores work.

Credit cards can impact your FICO scores in different ways.

First, there’s no guarantee that becoming an authorized user will boost your credit scores. Factors such as the history of the account and whether it shows up on your credit reports play a role here.

Even if you assume the account has a positive payment history and the card issuer does furnish the account to all three credit bureaus, results can still vary.

Hypothetically, you might see a 20-point increase with one credit bureau, a 30-point increase with another bureau, and no change with the third. Nothing is guaranteed.

Credit score changes do not happen in a vacuum. So, adding one positive account (or one new piece of negative credit information) is not worth X number of points.

Instead, a scoring model examines all the details on your credit report and predicts your credit risk level at that given point in time based on the totality of the information.

Being an authorized user on a well-managed credit card can help improve your credit scores. But you can’t predict the exact numerical impact in advance.

What Happens to My Credit Score If I’m Removed as an Authorized User?

Just as adding an authorized user account to your credit report may affect your credit score, being removed from an account could result in a score adjustment as well. But the exact credit score impact will vary.

Your credit scores may increase if you are taken off a credit card account with:

- A history of late payments

- A high credit utilization ratio

- A recent account opening date that lowers your average age of accounts

Note that just because you are no longer an authorized user doesn’t mean the account will be removed from your credit reports. It may remain on your reports and indicate that your association with the card has been terminated.

Your credit scores may decrease if you’re removed as an authorized user from a credit card account that has:

- An on-time payment history

- A low credit utilization ratio

- An older account opening date that increases the average age of accounts on your report

Consider one more factor if you’re removed as an authorized user and the account is the only credit card that appears on your credit reports: Credit scoring models reward consumers who have a more diverse mix of accounts on their credit reports.

Taking the only revolving credit card off your credit report may result in you earning a lower credit score the next time it’s calculated.

It’s Important to Have Your Own Accounts, Too

Having someone add you as an authorized user on a well-managed credit card can positively influence your credit scores. But being an authorized user should be just one part of a well-rounded credit-building strategy. It’s also important to open and establish credit accounts in your own name.

Just remember that, regardless of the type of account you decide to open, the way you manage your credit obligations is what’s most important. As long as you always pay on time and avoid a high credit utilization ratio, you’ll stand a better chance of building the good credit you desire.