While there may be no such thing as 100% guaranteed auto loans, many lenders will work hard to try to help every consumer get approved. When your financial well-being depends on your access to wheels, you need to connect with a lender that will give you a car loan despite bad or scant credit.

The auto loans we review here may not guarantee approval of every loan application they receive, but you can bet they all go the extra mile to get to “yes.” It’s nice to know that credit-challenged drivers have viable options that can get them into a vehicle and on the road.

Best Auto Loans For Bad Credit

Our experts have identified auto loan sources that connect you with lenders that look beyond your credit score. These networks of car dealers and lenders are adept at finding ways to virtually guarantee an auto loan for just about every applicant. Read on to see if one looks like a good fit for you.

- Network of dealer partners has closed $1 billion in bad credit auto loans

- Specializes in bad credit, no credit, bankruptcy and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have $1500/month income to qualify

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 3.99% - 29.99% | 1999 | 3 minutes | 9.5/10 |

Auto Credit Express is all about getting you a quick decision on your auto loan. It goes beyond bad or scant credit, even bankruptcies and repossessions, by evaluating your monthly income and recurring debt.

It takes 30 seconds to qualify for a loan and about three minutes to apply. The lender started in 1999 and is a member of the Internet Brands Automotive Group.

2. LendingTree

- Auto loans for purchase, refinance, and lease buyouts

- Nationwide lender network

- Get matched with up to 5 lenders that fit your financial profile

- It only takes a few minutes and is free with no obligation

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1998 | 4 minutes | 9.5/10 |

LendingTree is a large lender network that can match you with an offer for an auto loan even with terrible credit. You just have to meet the lender’s minimum income requirements and other basic qualifying criteria, such as being at least 18.

It takes minutes to be matched with a lender and there’s no obligation to accept any offer you receive.

- Loans for new, used, and refinancing

- Queries a national network of lenders

- Bad credit OK

- Get up to 4 offers in minutes

- Receive online loan certificate or check within 24 hours

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2003 | 2 minutes | 8.5/10 |

MyAutoloan.com is a matching service that attempts to get you up to four offers in a matter of minutes. The site posts the lowest new auto rate for the day, but you can also apply for used car loans, refinancing, financing for private party purchases, or lease buyouts.

MyAutoLoan shares your finance application with its network banks, finance companies, automobile dealers, credit unions, and affiliates. Loans are available with terms ranging from 24 to 72 months.

- Free, no-obligation application

- Specializes in auto loans for bankruptcy, bad credit, first-time buyer, and subprime

- Affordable payments and no application fees

- Connects thousands of car buyers with auto financing daily

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1994 | 3 minutes | 9.0/10 |

Car.Loan.Com has been hooking up credit-challenged borrowers with receptive lenders since 1994. Drivers with poor or no credit can fill out the short online auto finance request form.

The site works with the country’s largest network of car dealers that are skilled in special finance. You can expect a decision in as little as 24 hours, and sometimes it takes only a few minutes.

- Prequalify in minutes without impacting your credit score

- Refinancing loans save an average of $191 per month

- 125% financing available for cash-out refis

- PenFed Credit Union membership required but can be applied for at the same time as your loan

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 5.19% and up | 1935 | 5 minutes | 8.5/10 |

PenFed Credit Union helps its members obtain lower rates on financing than banks and other lenders. It doesn’t guarantee approval, but it will do its best to approve you for a new loan.

You can easily prequalify on its website to see whether you qualify for a loan offer before you officially apply.

6. RefiJet

- RefiJet helps people lower their monthly auto payment

- Pre-qualifying for a refinance auto loan does not impact your credit score

- Nationwide network of lenders

- Presents you with options from lenders that fit your situation

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2016 | 5 minutes | 8.0/10 |

RefiJet can help subprime borrowers secure an auto refinance loan to lower their monthly payment, though borrowers with bad credit may not qualify for a new loan with a lower APR.

You may even get to skip your first two payments when you refinance with RefiJet, which is a nice perk during tough inflationary times.

7. Buy-Here-Pay-Here Lots

Many dealerships throughout the country operate as buy-here-pay-here lots. These are dealerships that internally finance car loans instead of involving outside lenders.

Buy-here-pay-here lots specialize in serving consumers with bad or no credit. You can generally receive a guaranteed car loan from a BHPH lot if you have sufficient income to repay the loan, as credit approval is usually based on income rather than credit history.

One of their innovative practices is to accept multiple payments per month. This helps keep each payment affordable when it matches your pay schedule. Buy-here-pay-here dealerships can only profit when borrowers make timely payments, so they have a vested interest in offering affordable cars, flexible terms, and low-cost warranties or extended service agreements.

What is Guaranteed Auto Financing?

Guaranteed auto financing is what we call the efforts by certain lenders and lender-matching services to accommodate as many potential borrowers as possible. In effect, their practices and policies virtually guarantee that consumers with enough income can get auto financing despite bad or no credit.

These lenders guarantee applicants will receive every possible consideration because they specialize in making loans that other lenders won’t.

Different strategies come into play that help get consumers with blemished credit behind the wheel of a new or used car. Online loan-matching services have incredibly low operating costs and receive payments from the lender, not the borrower. Their networks of lenders compete for your business, which can give you options that would be otherwise unavailable.

Some lenders are self-funding. For example, RoadLoans.com makes direct loans to applicants who receive pre-approval. Buyers know exactly how much they can spend on their wheels and can shop at many dealerships. Buy-here-pay-here dealerships are also self-funding, which requires flexible thinking on their part to earn a profit. That means not pressuring buyers into vehicles they can’t afford or agreeing to costly service contracts.

Another guarantee you can expect from the lenders featured in this article is that no one is likely to embarrass you over your financial situation. These lenders have seen just about everything and know that many good people face daunting financial challenges. These companies know it’s good business to conduct themselves in a professional, helpful way that promotes sales while making customers comfortable.

Can I Get a Car Loan With Bad Credit and No Money Down?

Edmunds reports that the average down payment on a car was just under 12% as of 2019. It is possible to get a car loan with bad credit and no money down, but it may not be your best option.

Even a modest down payment reduces the amount you have to finance, lowering your monthly payment and total interest costs.

You could receive a higher APR if you insist on no down payment. Nonetheless, bad-credit lenders will try to accommodate you if it’s impossible for you to come up with a down payment.

The accessibility of zero-down-payment loans depends a lot on the car and the dealership. For example, the car dealer might be running vehicle specials that include cash rebates you can apply as a down payment toward new inventory. It’s also easier to arrange a no- or low-down-payment loan on affordable used cars, as they represent less risk to the dealer.

Naturally, you have an excellent chance of acquiring a no-money-down loan if you are trading in your current vehicle. Your equity in the vehicle serves as your down payment and reduces the total out-of-pocket costs for the new purchase.

Another way you may be able to avoid a down payment is to have a loan cosigner who has good credit. The cosigner is an additional resource the lender can tap if you have trouble making payments. Having a cosigner could also allow you to obtain a lower interest rate on the vehicle.

Sometimes, the best strategy is to postpone your purchase for a few weeks or months and use the extra time to save up for a down payment. Doing so will certainly improve your access to credit and reduce your overall costs.

Can You Get Guaranteed Financing With No Credit Check?

Maybe, but you’ll likely be limited to buy here, pay here dealers. As discussed, these facilities work with applicants of all credit types and rely on a borrower’s ability to repay the loan more than their credit report and score.

Vehicles are a necessity in many people’s lives — we rely on our cars to get us to and from work, school, the grocery store, and everywhere else we need to go. That’s why lenders do their absolute best to secure financing for every applicant.

The lender also has the security of knowing it can repossess the vehicle if you fail to repay, which isn’t ideal for anyone involved, but it means the lender won’t be burned by a defaulted loan. It can repo the car and sell it to recoup the money, so these loans aren’t as risky as other loans that aren’t secured by collateral.

Will a Down Payment Offset a Bad Credit Score?

For many, a down payment makes a virtue out of necessity. Auto Credit Express points out that most bad-credit lenders will not offer no-down-payment loans to subprime borrowers, those with credit scores below 580.

Instead, lenders would like to see a down payment of 10% or $1,000 from subprime borrowers. Therefore, a down payment can make all the difference in whether you get approved for the loan and the interest rate you’ll pay.

A down payment will not magically erase all the effects of a bad credit score, but it will certainly help you obtain a car loan. A down payment signals to the lender that you are serious about your payment obligations because you have some “skin in the game.” That is, you have something to lose if you skip payments and are less likely to fall behind on the loan.

One of the effects of having a bad credit score is that lenders may be hesitant to sell you new or expensive cars for fear that you won’t be able to make the payments. However, you could have a low score due to past financial problems, but you have a steady source of income today.

By making a significant down payment, you’re more likely to qualify for poor credit financing despite your low credit score.

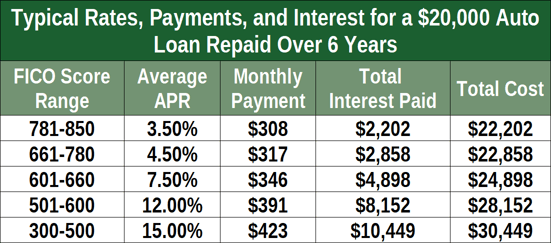

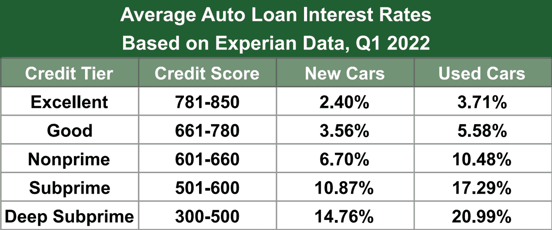

Another consequence of having poor credit is that you may face high interest rates on your car loan. A down payment may cut your interest rates, which can save you hundreds or thousands over the life of the loan, making the down payment well worth it.

Even a large down payment won’t stop the lender from evaluating your residence history, income, and ability to pay. But, because it significantly reduces your loan-to-value ratio, a large down payment can land you a car that otherwise would be unavailable due to your bad credit score.

Can I Get Dealership Financing With Bad Credit?

Yes, four out of the five lenders in this review can provide you with dealership financing despite a bad credit score. The first three, Auto Credit Express, Car.Loan.Com, and MyAutoloan.com, are matching services that work with networks of lenders, including car dealerships. They may be able to arrange dealership financing even if your credit is poor.

Buy-here-pay-here dealerships offer direct loans to customers. That is, these dealerships use their own internal funds to finance loans. When you visit one of these dealerships, the finance officer will sit with you and explore your loan options.

When the financing comes directly from dealerships, they want you to be able to make your payments. Therefore, you aren’t likely to find these dealerships pressuring you to purchase more car than you can afford. And, you have the satisfaction of knowing the loan fits within your budget.

That makes dealership financing a win-win for you and the dealer, whether you think you have the credit score to buy a car.

You should not overlook the advantages of third-party financing, however. These are loans that are pre-approved by banks, credit unions, and other financing companies, such as RoadLoans.com.

The matching service websites also offer these types of direct lenders. When you receive a pre-approved loan, you have the option of shopping wherever you please so that you can nail down the best deal.

Walking into a dealership with pre-approved financing puts you in the driver’s seat. The dealerships know you are likely to walk if you can’t get a good deal from them. That makes them more likely to accommodate your requirements even though your credit score is bad.

Hit the Road Regardless of Credit

Commuting to work, shopping, and chaperoning the kids are just three of the reasons why you might need a car. You can’t let your credit score get in the way.

Whether you ultimately can wrangle a loan depends largely on your credit score, income, down payment, trade-in allowances, and vehicle price. Our experts have evaluated the top sources of auto loans for folks with bad credit, and we think all these lenders can virtually guarantee you access to car financing.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.