Whether you’re buying a house, a car, or applying for some other type of loan, your credit score will most certainly affect your interest rate options. This is important to understand because the cost of servicing loan debt is directly influenced by the interest rate or APR (Annual Percentage Rate) on your account.

As with all forms of credit, a lower interest rate could potentially save you thousands of dollars annually and over the life of your loans.

Why Lenders Care About Your Score: Poor Credit Costs More

Lenders are in the business of making a profit. The first way to make a profit is to not take a loss. To make money instead of losing money, lenders need to extend credit to borrowers who will pay back the funds they borrow, plus any interest and fees. You can call that Lending 101.

Sometimes people borrow money and can’t or won’t pay it back as agreed. When these borrowers go into default, the bank takes a loss on that deal.

If too many borrowers go into default, a lender can experience severe financial distress. You only have to think back to 2008 and 2009 to recall what happens when banks experience severe financial distress.

The reason credit scores come into play is so lenders can evaluate your financial history and get an idea about whether you’ll pay your obligations as promised. Lenders need to review your track record with debt to see how you’ve managed it in the past. When your credit reports show problems, such as late payments, collection accounts, or poor credit scores, lenders may be hesitant to work with you.

Both FICO and VantageScore’s credit scores are designed to predict the likelihood you’ll become 90 days past due, or more, on any obligation within the next 24 months.

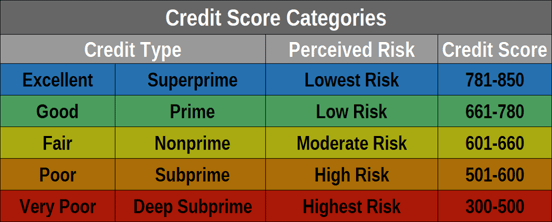

This graph shows the credit score ranges for the two main scoring models used by credit bureaus.

If your scores are low, a lender knows the odds of you paying late are elevated. As a result, your application could be denied, or a lender may charge you a higher interest rate.

Lenders Use Risk-Based Pricing

Lenders use pricing tiers to set the cost of credit for new applicants. And while credit risk isn’t the only factor considered, higher credit scores generally result in better pricing and more attractive terms on loans.

For example, you may see an auto lender offer an APR as low as 0% for qualified applicants. That same lender may offer a 7% APR to finance the same vehicle if your credit isn’t up to par. And, in the worst-case scenario, the same lender may deny your application outright.

While each lender closely guards what they believe to be the definition of good and bad credit scores, here are some reasonable examples of credit score ranges and how they’re generally perceived in the lending community.

Keep in mind, each lender chooses independently how it will price a loan based on your credit risk. Lenders typically don’t share this information with the public.

But one fact holds true, and that is that better credit scores typically lead to better offers. Their pricing is based on your risk, hence the term “risk-based pricing.”

Your Credit Score Significantly Impacts the Cost of a Loan

You may wonder how much your credit score matters when it comes to the pricing of your loan. Here’s a realistic example so you can compare the figures.

Suppose you want to take out a mortgage in the amount of $350,000. Your credit score falls in the lowest range that your lender will approve, which is generally around 620 for a conventional mortgage loan. In that case, the lender offers you an APR of about 5% on a 30-year fixed mortgage.

Now, let’s assume you worked hard to improve your credit scores before you applied for the mortgage loan. Thanks to your hard work and smart credit management habits, your scores climbed to the best pricing tier of 760+.

Because you earned such high credit scores, the lender offers you an APR of about 3.5% on the same 30-year fixed mortgage.

You may be wondering how much that difference really affects your wallet. The short answer is, a lot!

The lower rate will save you tens of thousands of dollars over the life of the mortgage loan. In this particular example, the lower interest rate would save you:

- $325 per month

- Almost $117,000 over the life of the loan

Think about what you could do with $325 extra dollars every month.

That is money that can be used to pay off expensive credit card debt. The money can be used to create an emergency fund in case you lose your job or have an unexpected major expense, like needing a new air conditioner unit. The money can also be contributed to your IRA or some other type of wealth-building account.

Point being, anything you choose to do with that extra $325 is better than giving it to the lender.

Your Credit Deserves Your Attention

Your credit reports and scores deserve your attention. There are tangible benefits that come with a good credit rating — starting with the ability to save a ton of money.

If you plan on applying for a new loan anytime soon, it’s wise to take steps in advance to increase your approval odds. You can start by reviewing all three of your reports from Equifax, TransUnion, and Experian.

You have the right to a free credit report from all three credit bureaus once every 12 months. You can visit AnnualCreditReport.com to claim your Federally guaranteed free reports.

Once you download your reports, you should review them carefully for mistakes. If you find any errors, Federal law gives you the right to dispute them and have them corrected at no cost.

You can’t change the fact that lenders base their interest rates and terms on the condition of your credit reports and scores. However, now that you understand why this occurs and the financial benefit of earning and maintaining solid credit reports, you can use the knowledge to your advantage throughout your credit life cycle.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.