Bad credit means your credit score is low — generally considered anything below 600 — because you’ve had problems paying bills or loans on time or you’ve previously filed for bankruptcy. This makes it difficult to get new loans or credit cards because lenders see you as a risky borrower.

Credit is the ability to borrow money or access goods or services with the understanding that you’ll repay later. Lenders, such as banks or credit card companies, extend credit because they trust that you’ll pay back your debt in the future. This arrangement provides you with financial flexibility, enabling purchases or investments that otherwise may be unaffordable.

How Credit Scoring Models Work

Lenders need a standardized, objective way to evaluate borrower creditworthiness. Before the development of scoring models, lenders often made subjective decisions based on personal judgments that led to inconsistency and bias.

As the consumer credit market grew, especially after World War II, lenders demanded a more efficient, dependable, and fair method of measuring credit risk. This led the Fair Isaac Corporation, or FICO, to develop the first consumer scoring model.

Scoring models strive for objectivity by using statistical methods to predict the likelihood of borrowers repaying a loan based on their credit history, income, and other factors. Typically, the prediction covers the next two years. This innovation made lending faster, more consistent, and more accessible to a broader range of borrowers.

Three major credit bureaus — Experian, Equifax, and TransUnion — publish consumer credit scores using information they collect from data providers, including lenders, credit card companies, and other sources.

Many data providers submit monthly reports to one or more of the credit bureaus. These reports include a borrower’s personal information, credit account details, history of credit applications, debt collections, and publicly available information.

Credit bureaus record, evaluate, and publish the information they collect. Their two main products are credit reports, which contain details about a borrower’s credit history, and one or more credit scores, which summarize a borrower’s creditworthiness.

The bureaus make money by selling these products to creditors and other interested parties, even potential employers and landlords. Of course, lenders and others often obtain additional information before reaching decisions, such as your income, job history, and legal problems.

FICO and VantageScore are the two main models that the credit bureaus use to calculate credit scores.

FICO

As mentioned earlier, FICO was the original credit score model, introduced in 1958. It is the market leader and 90 of the top 100 largest U.S. financial institutions use FICO Scores to determine a consumer’s creditworthiness.

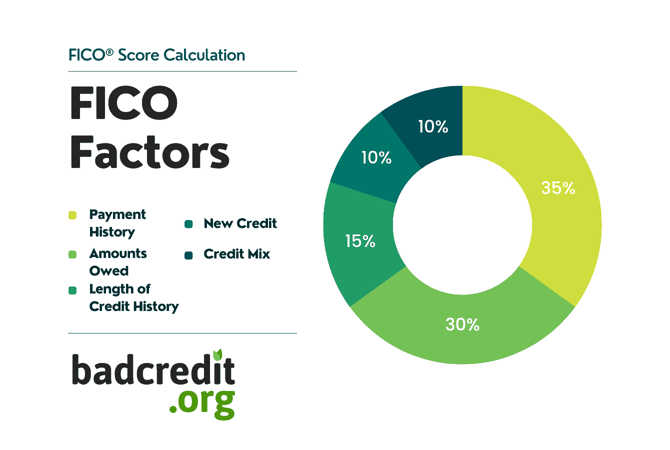

Several varieties of FICO Scores are available, but the most commonly used ones are Score 8 and the very similar Score 9. These models use a marking scale of 300 (worst credit) to 850 (best). Five major factors from a person’s credit report determine their score, as this chart depicts:

Let’s see how these factors operate:

- Payment History (35% of total score): This category includes your record of on-time and late payments. FICO research shows that your history of past payments indicates how likely you are to pay new debts on time. You don’t need a perfect record of on-time payments, but too many late payments will hurt your score.

- Amounts Owed (30%): This is the size of your debt compared to your income and your available credit. It indicates how easily you can afford to take on additional debt.

- Length of Credit History (15%): FICO tracks how long you’ve had each credit account and whether it’s still open or not. A long history of maintaining accounts in good standing helps your score by highlighting a responsible attitude. In addition to account age, this category considers how long it has been since you used an active credit card.

- Credit Mix (10%): This is your mix of loans and credit products, including mortgages, personal loans, car loans, credit cards, store cards, student loans, and others. A wider account mix indicates your ability to juggle debts of various kinds.

- New Credit (10%): Part of your FICO score depends on how often you applied for credit in the last year. Most creditors request your credit report when you apply for a new account. FICO folds these hard credit pulls into your score. Other inquiries (i.e., soft pulls from employers, landlords, or yourself) don’t count. Too many hard pulls within a short period can hurt your score.

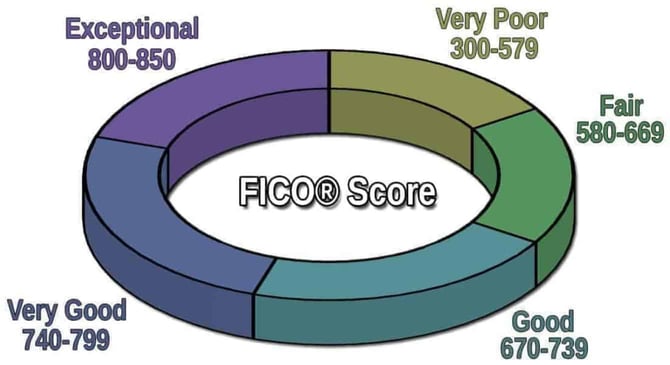

It takes a few months of data collection before you’ll receive your first credit score. FICO scores generally have the following meanings:

A FICO Score below 580 denotes bad credit.

Don’t expect your three credit scores (one from each credit bureau) to match. The FICO Score a bureau publishes depends on the information it collects and how it interprets the data. All three of your scores should be reasonably close to each other.

FICO Score 8 and FICO Score 9 are different versions of the FICO credit scoring model, with some key differences:

- Medical Debt Treatment: FICO Score 9 underweights unpaid medical debt compared to FICO Score 8. This means that medical collections will hurt your Score 9 less than Score 8.

- Paid Collections: FICO Score 9 ignores all paid collection accounts, whereas FICO Score 8 includes them.

- Rental History: FICO Score 9 includes rental history reported to the credit bureau. FICO Score 8 does not consider rental history.

- Overall Sensitivity: FICO Score 9 is more forgiving for one-time mistakes and occasional late payments.

These mean that, depending on your credit profile and history, you may have different results between FICO Score 8 and FICO Score 9.

VantageScore

In 2006, the three major credit bureaus collaborated to introduce VantageScore (VS). This single tri-bureau scoring model competes head-on with FICO. Creditors use VS widely, but it is less popular than FICO.

The VS model uses the same score range of 300 to 850. However, it applies different weights to its scoring factors:

- Payment History: 40%

- Credit Account Age and Mix: 21%

- Credit Utilization Ratio: 20%

- Total Balances: 11%

- New Accounts: 5%

- Available Credit: 3%

The latest VS model, 4.0, has a few unique nuances:

- VS considers the trend of your monthly bill payments, such as paying down your debt or making only minimum payments.

- It ignores unpaid medical collection accounts.

- VS lumps together any hard inquiries that occur within a 14-day window, thereby reducing their impact on the New Accounts factor. FICO 9 has a 30-day window, but it applies only to auto loans, mortgages, and student loans.

While your FICO and VS scores may be different, they should be in the same ballpark.

How Bad Credit Impacts Financial Opportunities

Lenders consider consumers with bad credit to be high-risk borrowers. This means lenders are more likely to reject their credit applications or offer higher-interest loans with less favorable terms. By following this approach, lenders reduce their risk of losing money through borrower defaults.

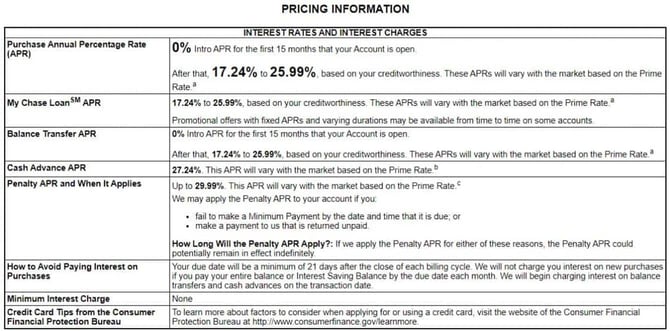

Typically, credit card APRs range from around 15% to 36%. Consumers with bad credit will generally face interest rates of 30% or more on unsecured credit cards and a few percentage points lower on secured cards.

Personal loan rates, even for subprime borrowers, tend to be lower than those on credit cards. The real problem occurs when your credit is very bad or limited, so you must resort to payday, pawnshop, or title loans. These can have APRs of 200% and up. Some payday loans may charge 700% or more.

A bad credit history can also count against you when you apply for a job, as employers often check your credit report to see if you exhibit responsible financial behavior. The same is true of a landlord when you apply for a rental.

Common Factors That Contribute to Bad Credit

Negative aspects of your financial profile, such as late payments, high debt levels, collections, repossessions, foreclosures, and bankruptcies, can significantly lower your credit score. These factors reflect past financial behavior and risk, making lenders less willing to extend credit or offer favorable terms.

Late Payments

Paying on time is vital because it proves to lenders that you can manage your debts well. Your payment history is a big chunk of your credit score — around 35% to 40%. If you skip payments, it tells lenders you’re not as good with money management, which can hurt your credit score. Just a couple of missed payments can drop your score.

A low score means getting loans or credit cards later on could be tougher. And if you do qualify for them, they could cost you more in interest or require collateral. Basically, if you want to keep or improve your credit score, make sure you pay your bills on time.

High Credit Utilization Ratio

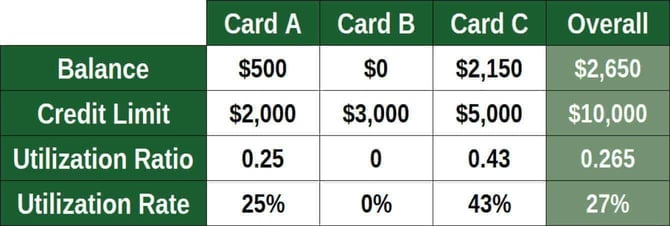

Credit utilization ratio (CUR) is the amount of credit you currently use compared to your credit limits. Higher ratios (above 30%) generally hurt your credit score. FICO has a stricter standard than VantageScore.

Let’s take an example using the three hypothetical credit cards:

Card 1 – $2,000 balance and a credit limit of $4,500

Card 2 – $1,000 balance and a credit limit of $3,000

Card 3 – $0 balance and a credit limit of $4,500

In this scenario, your total balance outstanding is $3,000, and your total available credit is $12,000, which is a credit utilization ratio of 25%.

In the FICO model, CUR is part of the Amount Owed factor, which contributes 30% to your overall score. VantageScore attributes 20% of your score to your CUR.

A high CUR tells potential lenders that you may have little wiggle room to take on additional debt. However, your overall income and expenses also play a role.

Defaulting on a Loan

Defaulting on a loan means you didn’t pay back the money you borrowed as you agreed. If you miss payments, the people to whom you owe money can say you defaulted. If your credit card payment is 30 days late, it starts to hurt your credit score. Usually, issuers give you about 90 days before they decide you’ve defaulted and write off your account. With a car loan, if you miss just one payment, they could take your car away.

Here are some typical consequences of default:

- Big credit score drop: Defaulting really harms your credit score.

- A negative mark on your credit history: This bad mark remains on your credit report for seven years, making you look risky to lenders.

- Harder to get new credit: After defaulting, it’s tougher to get new loans or credit cards, especially at a reasonable interest rate.

- Legal trouble: The lender may take you to court to get its money back.

- Additional stress: Defaulting means dealing with debt collectors and maybe even lawsuits.

Defaulting on a loan can make your financial life even more challenging for many years to come. If you think you may default, call your creditor to see if it will work with you rather than ignoring the issue altogether.

Strategies to Improve Bad Credit

Creating a strategic plan and a budget is an excellent idea because it provides a clear road map for achieving long-term goals. It allows you to allocate your resources and time efficiently. Your plan should help you to prepare for challenges, manage risks, and make steady progress over time. Hopefully, the plan will help you avoid bad decisions.

Effective Debt Management Plans

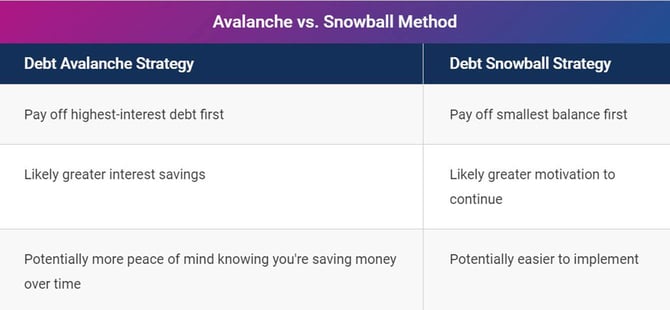

To manage and prioritize debts effectively, start by listing all your debts and noting the interest rates, balances, and due dates. Focus on paying off high-interest debts first, as they cost the most money over time. This approach, known as the avalanche method, reduces the total interest you’ll pay.

You may feel more comfortable with the snowball method, in which you repay the smallest debt first and then apply the savings toward repaying the next smallest debt. This won’t minimize your interest expenses but may give you faster (and psychologically reinforcing) victories.

Consider debt consolidation if you have multiple debts with high interest rates. This strategy involves taking out a new loan to pay off several other debts and credit card balances, ideally at a lower interest rate. In this way, you simplify your payments and potentially save on interest costs.

You can also consolidate credit card debt through balance transfers, although cards for bad credit may lack this feature. Many credit cards offer 0% APR introductory balance transfers, in which you move existing credit card balances to your new card (up to your credit limit) and pay no interest on the balance for a set period (typically six to 21 months).

Negotiating with creditors is another possible strategy. You can contact them to discuss your financial situation and seek more favorable repayment terms, such as lower interest rates, reduced monthly payments, or even settling the debt for less than what you owe.

Specialized Credit Building Products and Services

Solid credit scores benefit both creditors and borrowers. Good scores translate into reduced risk and collection expense for lenders, and cheaper, more accessible credit for borrowers. This mutual benefit explains the availability of specialized credit-building offerings, including secured credit cards and credit-builder loans.

Secured credit cards require a cash deposit that serves as collateral and typically becomes the card’s credit limit. The deposit reduces the risk for lenders, making it easier for individuals with bad credit to get approved. That’s why these cards are easy to get even if you have poor, limited, or no credit.

You can demonstrate responsible credit behavior by using a secured card for purchases and paying off the balance on time each month. Secured card issuers usually report your activity to all three credit bureaus. Responsible card use can help build your credit efficiently.

Many credit unions and specialized lenders offer credit-builder loans, in which the loan proceeds go into an escrow account. You repay the loan by making fixed payments into the account, and the lender releases the escrowed money to you after you repay the loan.

The lender reports your regular payments to the major credit bureaus, helping you build a solid credit history. As with secured credit cards, credit-builder loans show your ability to make regular, on-time payments, thereby gradually improving your credit score.

Avoid Credit Scams and Pitfalls

Be careful with companies that promise to fix your bad credit fast, as many of these are scams. They may ask for money upfront and claim they can quickly erase your bad credit, which is often not possible. Here are some tips to help you stay safe:

- No quick fixes: Real credit repair takes time. If someone says they can fix your credit overnight, it’s likely a scam.

- Avoid upfront payments: It’s a red flag if a company wants you to pay before it does any work. Legitimate companies charge only after providing services.

- Know your rights: You have the right to dispute incorrect information on your credit report yourself for free. Companies should inform you of this.

- Research the company: Look for reviews and complaints online. Check with reputable sites such as the Better Business Bureau or BadCredit.org to see if the company has a solid reputation.

- Beware of guarantees: No one can guarantee to raise your credit score. If they do, it’s probably a scam.

Stick with trusted, well-known credit counseling services and educate yourself on credit repair. This way, you can improve your credit score safely and avoid scams.

Building a Positive Payment History

Making payments on time is crucial for improving your credit score because payment history is the largest factor affecting your credit score. Consistent, timely payments show creditors that you are a dependable borrower.

Over time, creditworthy behavior can gradually improve your credit score as you build a history of reliability. A higher score means better loan terms, lower interest rates, and easier access to credit.

How to Check and Monitor Your Credit Scores

It’s important to keep an eye on your credit to catch any mistakes and identity theft early. You can start by getting free credit reports from the three credit bureaus — Equifax, Experian, and TransUnion. You can also go to AnnualCreditReport.com to get your free credit reports.

When you receive your reports, check them for typical mistakes — starting with your personal information. Verify your name, address, Social Security number, and employment details. Mistakes here could confuse your report with someone else’s.

Look for accounts that aren’t yours, incorrect account statuses (e.g., showing as open when they’re closed), wrong dates, or duplicate entries. Ensure your payments are correct. Late payments that you paid on time or completely paid off debts still showing as owed are red flags.

Verify that your credit card and loan balances are accurate. Overstated balances can make it seem that you owe more than you do.

One of the biggest sources of inaccurate data revolves around unauthorized hard inquiries. Remember, only you can approve a hard pull of your credit. If you see credit inquiries you didn’t authorize, someone could be trying to get credit in your name. Also, many creditors cannot (or choose not to) verify that you authorized a hard inquiry. If the bureaus can’t prove you initiated an inquiry, they must remove it from your reports.

You need to alert the credit bureau if you spot an error on your credit report. You can do so online using the following links:

Equifax: www.equifax.com/personal/credit-report-services/credit-dispute/

Experian: http://www.experian.com/disputes

TransUnion: http://www.transunion.com/credit-disputes

Alternatively, you can write a letter to a bureau identifying the mistake and requesting to fix the error. Include copies (not originals) of any documents that support your case.

If you write a letter, send it by certified mail so you have proof that the bureau received it. You can use a sample dispute letter from the Federal Trade Commission to get started.

The credit bureau must investigate your claim within 30 days. It will also inform the company that reported the error. If it finds a mistake, it must fix it and tell the other credit bureaus.

If fixing your credit reports seems like too much work, consider using a reputable credit repair company to do the heavy lifting for you. Service subscriptions run from about $50 to $150 per month. These companies cannot guarantee a higher credit score, but they are experts at finding and correcting mistakes.

Fixing errors can help improve your credit score and ensure your credit report accurately reflects your financial history.

Good Credit Scores Offer Financial Benefits

Good credit scores are 670 and higher on the FICO scale. You have many incentives to build a good score, including the following:

- Lower interest rates: Get loans and credit cards with lower interest rates, saving you money in the long run.

- Better loan approval odds: Improve your chances of getting approved for loans and credit cards.

- More negotiating power: Leverage good credit for better terms and rates on loans and credit lines.

- Lower insurance premiums: Pay less for auto and home insurance.

- Rental and housing approval: Receive easier approval when renting houses or apartments.

- Utility services: Get utilities like electricity, water, and phone with little or no deposit.

- Employment opportunities: Some jobs, especially in finance or government, check credit scores.

- Access to higher credit limits: Qualify for a higher borrowing limit on credit cards and loans.

Good credit can allow you save money and get better deals on loans, credit cards, and other financial offerings.

Credit Counseling Can Provide Personalized Guidance

Credit counseling helps you sort out your financial troubles; it focuses on debts and how to improve credit scores. A credit counseling agency will take a deep dive into your financial life by reviewing your income, spending, and debts. The agency aims to understand your situation so it can give you the best advice.

After a review, the agency will develop a personalized plan that should help you manage your money smarter, reduce your debts, and slowly boost your credit score. It’ll also guide you on how to budget your money wisely so you can cover your expenses and still save or pay off debts.

If you’re really struggling with debt, an agency may suggest a debt management plan and negotiate better terms for you, such as lower interest rates or combined monthly payments that are easier to manage.

Credit counseling agencies also assist with debt consolidation. They help you determine whether consolidation is right for you and can often oversee the process. If successful, debt consolidation can reduce your overall interest rates and simplify your monthly payments.

Many credit counseling agencies offer free services; others charge fees based on the work they do. By working with a credit counseling agency, you can learn how to make better financial choices, manage your debt, and improve your credit score.

Improving Bad Credit Can Lead to Financial Empowerment

Improving bad credit is a key part of gaining financial strength and independence. By understanding how credit works and taking steps to better your credit score, you’re setting yourself up for a healthier financial future.

It’s important to stay on top of your credit situation, make improvements where you can, and seek guidance from credit counseling professionals if you feel overwhelmed. Taking charge of your credit not only helps you secure better loan terms and interest rates but also boosts your overall financial confidence.

So, don’t hesitate to take proactive steps toward managing your credit and consider professional advice to navigate the path to a better, more secure financial lifestyle.