When you or a dependent gets sick or injured, getting the medical care you or your loved one needs can be a necessary, yet stressful, experience. Yet after the physical recovery process is over, there’s often more work to be done. I’m not referring to physical therapy or return visits to a hospital. I’m referring to the financial aspect of medical care.

I don’t have to tell you that medical treatment from a doctor or hospital generally isn’t free, nor is it inexpensive. Imaging services, ER visits, prescription drugs, and other medical services also come at a steep price. Even if you have health insurance, there are often co-payments, deductibles, and co-insurance that can leave you financially responsible for a good portion of your medical bills. And if you’re uninsured, that financial responsibility can be much greater.

It’s also not uncommon for billing errors to occur, or you just can’t afford to make your payments. If a medical provider bills your insurance company and it refuses to pay for a service you received, the medical billing office will hold you responsible for the debt.

According to a 2022 survey by Morning Consult, 20% of American adults received a surprise medical bill last year, with 22% of those bills totaling over $1,000.

20% of US Households Have Unpaid Medical Debt

When medical debt goes unpaid, it can end up in collections status and assigned to a third-party debt collector or collection “agency.” This can be problematic for several reasons, not the least of which is the fact that it has the potential to damage your credit reports and credit scores.

According to the Consumer Financial Protection Bureau, some 20% of US households — around 43 million consumers — struggle with this problem. Many consumers faced with medical debt that ends up in collections will ask themselves: How do medical collections impact my credit reports and credit scores?

I’ve been answering questions like that for over 30 years. And there’s one thing that’s a constant in my world which is this: Almost every answer about credit reporting and credit scoring begins with the words “it depends.” The answer to this question is going to also depend on a variety of factors.

Recent changes in credit scoring and credit reporting policies have tilted the issue in the consumer’s favor and added some protections where medical collections are concerned.

Unpaid Medical Collections Remain on Credit Reports For 7 Years

The Fair Credit Reporting Act, also known as the FCRA, allows collection accounts — medical or otherwise — to remain on your credit report for up to seven years. The seven-year clock, however, doesn’t start ticking when a collection agency adds the account to your credit report.

Per the FCRA, a credit bureau must purge a collection account from your credit report seven years from the date the original account went delinquent and before it was considered in default. That date is called the Date of First Delinquency or DoFD.

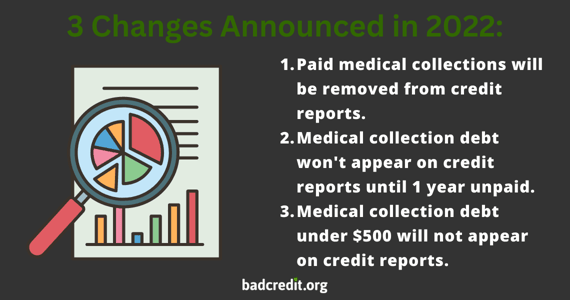

In March 2022, however, the three major credit bureaus (Experian, TransUnion, and Equifax) announced changes to the way medical debt was to be reported to consumer credit reports. The credit bureaus projected the collective changes would remove close to 70% of medical collections from consumer credit reports in the coming months.

The changes looked like this: As of July 2022, the credit bureaus stopped including paid medical collections on consumer credit reports. That means, if you had a medical collection on your credit reports that had a zero balance, it was purged.

This was a huge departure from past credit reporting policies held by Experian, TransUnion, and Equifax. Previously, paid medical collections would remain on consumer credit reports for up to seven years, as was allowed by Federal law.

Another meaningful change the credit bureaus introduced last summer had to do with the credit reporting time frame before unpaid medical collections showed up on consumer credit reports. Since the implementation of the National Consumer Assistance Plan in 2015, medical collections were delayed from being reported on credit reports for at least six months from the date of the default of the medical debt.

This waiting period was designed to allow more time for health care providers and health insurance companies to work together to address unpaid debts. That waiting period is now extended to 12 months.

The credit bureaus also announced that a third significant credit reporting change would occur in the first half of 2023. The credit bureaus will implement a policy to no longer include medical collection accounts under $500 on consumer credit reports. CFPB research estimates that two-thirds of medical collections on credit reports will no longer be reported when this change takes effect.

To use a common phrase from television advertisements, but wait, there’s more.

How Medical Debt Impacts Credit Scores

When a medical collection appears on your credit report, it still has the potential to hurt your credit score, with some exceptions. But the impact a medical collection has on your credit score, and indeed whether it has any impact at all, is a bit complicated.

VantageScore Solutions has announced that by the end of January 2023, VantageScore models 3.0 and 4.0 will not consider medical collection data in the calculation of credit scores, paid or unpaid. So if a lender uses one of these credit scoring models to calculate your credit score when you apply for a loan, a medical collection will not impact you in any way.

However, we still have to address how FICO considers medical collections given that, according to FICO, 90% of top lenders in the United States use their scores in lending decisions. Medical collections do have the potential to lower your FICO Score. But it’s important to understand that these negative items may not have the same impact as other derogatory credit items. For example,

- FICO 8 was designed to bypass third-party collections with balances under $100. FICO 8 has a critical mass of users of FICO’s scores.

- FICO 9 differentiates between medical and non-medical collections (with unpaid medical collections typically causing less score damage than non-medical collections).

- And FICO 9 ignores paid collections of any variety, medical or otherwise.

Ultimately, the impact a medical collection has on your credit score depends on the credit scoring model a lender uses to analyze your credit reports, and whether the collection has or has not been paid. There’s certainly potential for these derogatory accounts to impact your credit score and, as a result, it’s best to avoid them if possible.

Managing Your Medical Debt

Many medical bills arise out of unforeseen circumstances. Yet, you still have an obligation to take care of your debts once you incur expenses for medical care. If you receive medical bills in the mail or calls from medical providers regarding outstanding medical debts, take care of those bills as soon as possible.

Do not listen to anyone who gives you the advice to ignore debt collectors. That’s a great way to get sued.

You can call your insurance company if you believe your policy should cover the medical bill in question (or a larger portion of it). If you qualify for Medicaid, you may also qualify for retroactive medical bill coverage.

In the event you owe a medical provider but can’t afford to pay the bill, there may be options to consider as well. First, consider reaching out to the doctor or hospital to negotiate a settlement. Some medical providers may be willing to accept a lump-sum settlement of 50% or less.

You may also be able to set up an affordable payment plan that would protect your credit report and help you avoid other negative consequences like lawsuits. Point being, you have options to explore.

The Bottom Line

The changes mentioned above are good news for consumers. But it’s still important to stay on top of your medical bills. Otherwise, you risk credit report and credit score damage from unpaid medical debt. If you’re unsure whether you have medical collections, or any other type of collections, appearing on your credit reports you can check them all for free at www.annualcreditreport.com.