It’s not unusual to read articles about credit scoring and the various categories of metrics that influence your credit scores. What is unusual, however, is reading articles that barely mention one of the lesser understood categories of metrics in FICO’s credit scoring systems — credit mix.

So what is credit mix, and how does it affect your credit? And, maybe most importantly, how can you improve it?

Credit Mix Represents the Types of Accounts In Your Credit Reports

Your credit mix is exactly what it sounds like. It is the consideration of the different types of accounts that appear on your credit reports during the scoring process. But credit mix is one of the least important metrics in FICO’s credit scoring systems.

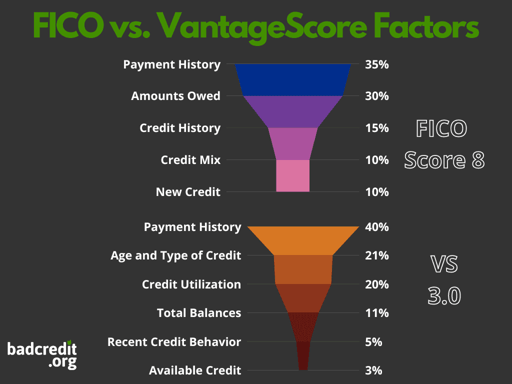

The mix of your credit experiences accounts for only 10% of the points in your FICO credit scores. You’d be incorrect in assuming that 10% of your credit score is not terribly important.

Ten percent of the points in your credit scores can be the difference between approval and denial, and the difference between a great APR and a terrible APR. And, for the sake of relativity, 10% is the same value of the New Credit category, which includes the potential consideration of hard credit inquiries.

If you’re trying to max out your FICO scores, then you’re going to have to perform well across all five metrics categories, including credit mix. The credit mix category, however, isn’t terribly actionable, and it may take time to earn those 10% of points.

Differences Between Open, Revolving, and Installment Credit

While we tend to throw around the word “credit” without thinking much about the different types of available credit, several types exist, and they all tell a story about your credit risk.

The more common types of credit all fall neatly into three categories; revolving, installment, and open. These are referred to in the credit reporting language, Metro 2, as the Portfolio Types for credit reporting purposes.

Open Credit

Open credit, in this context, does not mean the opposite of closed. Open credit means your payment is due in full each month. Utilities, collection accounts, and any charge card that requires you to pay in full each month are examples of open credit types.

Revolving Credit

Revolving credit, like credit cards and home equity lines of credit, do not have to be paid in full each month and you’re allowed to carry or “revolve” some of the balance from month to month. In exchange for this convenience, the customer pays interest on the unpaid amount.

Revolving credit also allows you to draw from a predetermined credit line or limit, pay that amount back, and then withdraw it again. You’re permitted to do this repeatedly until the account is closed.

Installment Credit

Installment credit is best described as a form of credit that is repaid with a fixed payment for a fixed period. Auto loans, mortgages, personal loans, and student loans are common forms of installment credit.

For example, your auto loan may have a fixed payment of $350 for a fixed number of months, such as 48, 60, or 72. Once you finish making your payments or you sell the asset, the loan is paid off, and the account is closed.

Installment credit is also commonly secured by a physical asset that is pledged by the debtor when he or she takes out the loan. For example, when you borrow money to buy a car or house, you pledge the car or house as collateral security for the loan.

If you do not make your payments to the point where you go into default, the lenders are going to take back the asset, sell it, and use the proceeds to cut their losses. In auto lending, this is referred to as repossession. For mortgages, this is referred to as foreclosure.

Obviously, you don’t want either of those to happen because then you’re going to harm another much more important factor in your FICO scores — your payment history.

To do well in the credit mix category, you’re going to need to have both revolving and installment accounts on your credit reports. Open accounts are less frequently reported to the credit bureaus and, hopefully, you don’t have any collections. So if you have open accounts on your credit reports and you’re paying them on time, then it’s a bonus that many consumers aren’t going to experience.

But all forms of credit (revolving, installment, open) are counted in your scores if they’re on your credit reports.

How to Improve Your Credit Mix

Wondering how to improve your credit mix is a simple and fair question without a great answer. The best way to improve your credit mix is to have loans and credit cards. But it’s not really a good idea to open a credit card or take out a loan simply for the purpose of improving this tertiary credit scoring metric.

You’re going to improve this category over time as your credit experiences evolve. You’ll earn more points in the credit mix category as you acquire credit cards and take out loans as part of your organic credit usage practices.

Some consumers may have had student loans while in college and have opened credit cards already, which means they’ve already checked all the boxes in the credit mix category.

Credit Mix Naturally Progresses Over Time

Credit mix is an important enough category of metrics that it made its way onto FICO’s radar when it first started building credit scores in the late 1980s. But it’s probably not the best idea to take on new credit just to build the credit mix category.

As you work your way through your consumer credit life cycle, you’re going to earn and bank the points from this category simply by having revolving and installment accounts on your credit reports, whether they are open or closed.

If you’re not sure whether you have installment accounts or revolving accounts on your credit reports, it’s simple enough to do the research. Simply pull your credit reports from AnnualCreditReport.com and check to see if you have any, either, or both account types. If you do, you can check the box and move on to the more important credit scoring categories.