RefiJet partners with a national network of financial institutions to deliver quick auto refinancing quotes. It takes only a few minutes to prequalify without harming your credit score.

The service is personal — you’ll speak with a financial services representative who will explain all your options.

RefiJet may waive the first two months’ payments when you refinance with them. The company helps car owners get a lower monthly payment, saving an average of $150 per month.

Not every refinancing loan attempts to reduce monthly payments. For example, you may prefer the same payment amount but lower auto loan rates. Other reasons to refinance a vehicle loan include:

- Changing the loan amount or other loan terms

- Adding or removing a co-borrower

- Buying out your lease

- Adding a service contract

- Adding guaranteed asset protection

- Taking a two-month payment holiday

- Receiving cash back from the equity in your car

The lenders on the RefiJet network welcome consumers with all types of credit. Even if you have a low credit score, RefiJet may be able to help you find auto loan refinancing. Other factors that affect your loan approval odds include your debt-to-income (DTI) ratio, pre-tax income, and vehicle value.

By providing a single platform to represent multiple lenders, RefiJet helps customers avoid the tedious tasks of gathering information and comparing auto loan refinancing options on their own.

How the Process Works

Before applying for a RefiJet refinancing loan, you’ll want to assemble the required documentation, including:

- Proof of employment and income: You’ll need recent pay stubs or the W-2 from the previous year. You can use your 1099s or tax returns if you are self-employed.

- Proof of residence: You must provide a document that confirms your physical address, such as a bank statement, driver’s license, or utility bill.

- Proof of insurance: You will need an insurance ID card, policy document, or other information confirming your vehicle coverage.

- Vehicle information: RefiJet will need specific details about your vehicle, including its make, model, year, and VIN.

- Loan information: You must know your current loan’s payoff amount, which is usually available on your lender’s website.

Another pre-application step is to check your credit reports for errors that harm your credit score. You can dispute those errors yourself or with the help of a credit repair company. You may see your credit score rise significantly after removing inaccurate derogatory information.

Now that you’re ready to apply for refinancing, follow this simple three-step procedure:

- Speak to a RefiJet auto refinancing expert: They will help you decide on the loan option that works best for you. You can call a representative directly or submit a prequalification questionnaire to have a rep contact you. The preliminary information you will need to submit includes your name, date of birth, home address, email address, and phone number. You’ll also need to provide your gross annual income, citizen status, and monthly rent or mortgage payment. You can also indicate your goal for the loan, such as lowering your interest rate or reducing your monthly payment.

- Get prequalified: The RefiJet customer rep will review your information and the most favorable loan option. If you successfully prequalify, you’ll move to the final step.

- Select a lender: You can choose the direct lender with the best offer. RefiJet prepares your application and submits it to the lender. You should receive a final decision in minutes.

If the lender approves your application, you have only to read and e-sign the loan contract. The lender will pay off the old loan and establish a payment schedule for the new one.

You can make payments in several ways, including automatic payment from your bank or credit union account, mailed-in checks, over the phone, or online.

If you receive a cash-out loan, the lender will send you a check or deposit the money into your bank account.

Eligibility Requirements

You need to meet the following requirements to be eligible for loan prequalification:

- The minimum FICO credit score required is 500.

- The maximum debt-to-income ratio is 70%.

- You cannot have had open or discharged bankruptcies in the past 12 months.

- You must have a verifiable source of income, such as a job or government benefits.

- You need a clean record of making your recent car payments on time.

- You must have a valid driver’s license and vehicle registration.

- The vehicle cannot be more than 10 years old.

- The car must be insured.

Those are RefiJet’s prequalification requirements. Your direct lender may have additional or different requirements. A RefiJet customer rep may be able to preview lender requirements and guide you to the offer with the best chances for approval.

RefiJet Privacy Policy

The RefiJet Website Privacy Policy explains the company’s online practices and how it collects, uses, and protects your information. The company observes four categories of data for business purposes:

- Personal identifiers: Items include your real name, alias, postal address, unique personal identifier, online identifier, Internet Protocol address, email address, account name, Social Security number, driver’s license number, or other similar identifiers.

- Additional personal identifiers: Includes items in Category 1 plus insurance policy number, education, employment, employment history, credit card number, debit card number, or any other financial information.

- Network activity information: Items include search history and information regarding a consumer’s interaction with an internet website, application, or advertisement.

- Professional or employment-related information.

RefiJet may sell or share some of the data it collects to a wide range of recipients, depending on the information category and lending partner. The company claims not to sell personal information.

Category 1 and 2 recipients include lenders, ancillary financial product providers, marketing fulfillment/contact management vendors, referral partners, data backup and identity verification vendors, and document delivery/e-sign portal vendors.

Category 3 recipients include marketing fulfillment/contact management vendors.

Category 4 recipients include lenders, data backup vendors, and identity verification vendors.

RefiJet acknowledges certain privacy rights for its customers:

- You have a right to request the deletion of your personal information that RefiJet collects or maintains.

- You have the right to opt out of the sale of your personal information by RefiJet.

To verify your requests, RefiJet will match your full name, date of birth, and last four digits of your Social Security number to the information it collected about you. You may have additional privacy rights reserved if you live in California, Texas, or Vermont.

Why Refinance Through RefiJet?

You may want RefiJet to help you refinance your vehicle for several reasons:

- The company offers personalized help and support six days a week. You work through a single, dedicated customer service representative.

- RefiJet can prequalify you for an auto loan without a hard credit check.

- There’s no charge for its service.

- Borrowers with fair or bad credit may qualify.

- You can shop for multiple offers via a single car loan request.

- Vehicle refinance amounts vary from $5,000 to $100,000, with a loan term of 24 to 96 months.

- You don’t have to make a payment on your new car loan for two months.

- Some network lenders offer rate discounts when you elect to have your payment automatically deducted from your bank or credit union account each month.

- Refinancing may save you money or arrange a lower monthly payment amount.

- RefiJet has received accreditation from the Better Business Bureau. Its BBB rating is A+.

- RefiJet maintains a Spanish version of its website.

- Funding occurs in as little as one business day.

- Borrowers can refinance as soon as they obtain new registration documentation.

- Cosigners are welcome, especially if borrowers have a troubled credit history.

- There is no prepayment penalty.

- GAP insurance and extended service contracts are available, and you can roll the cost into your loan.

Of course, no company is perfect. RefiJet is unavailable in a few states (i.e., New York and Hawaii), and you’ll pay a $395 origination fee if you accept a loan. Also, RefiJet doesn’t work with cars more than 10 years old.

Does Refinancing My Loan Hurt My Credit?

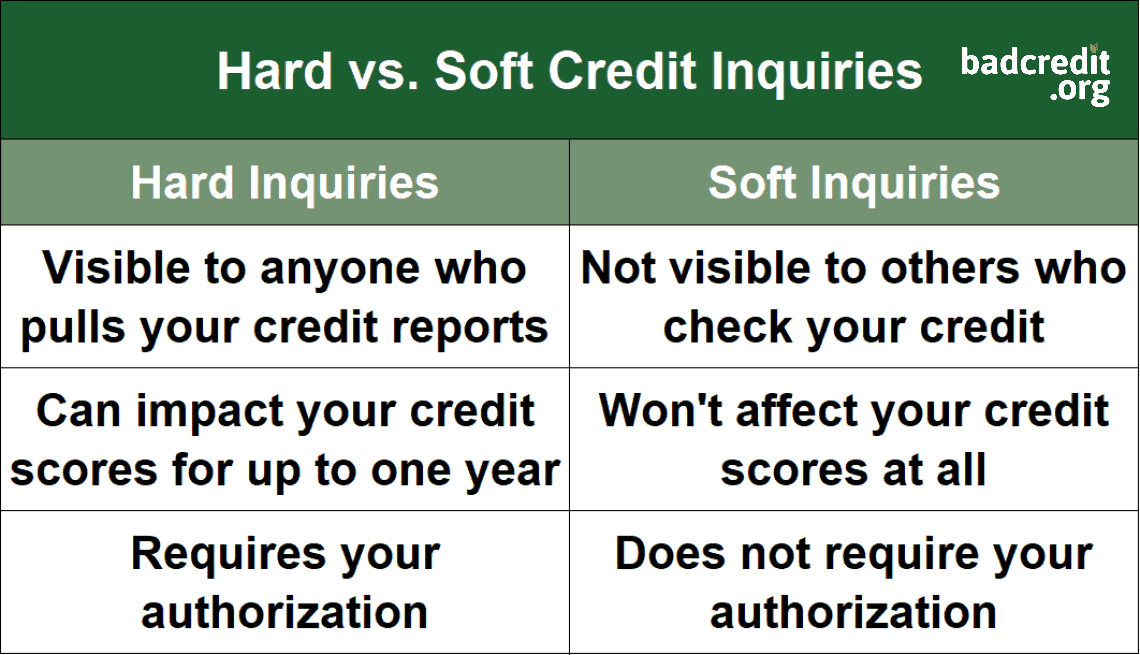

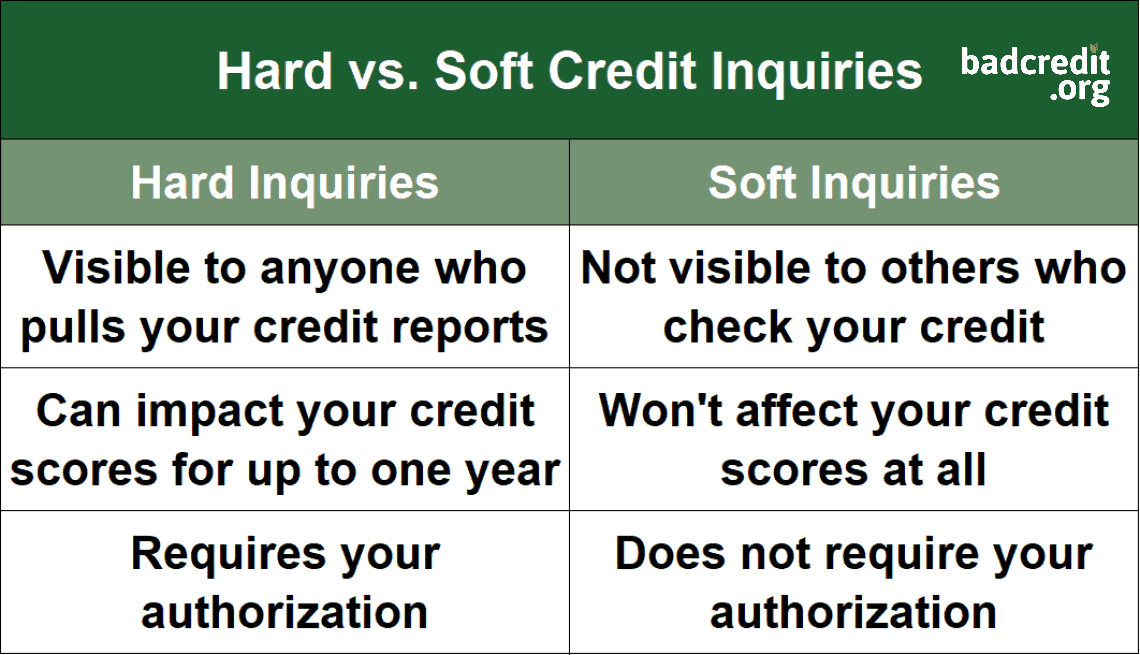

It may hurt it a little, but not by much. Every person’s credit profile is unique. But most lenders perform a hard credit check before approving a loan. This kind of credit inquiry may lower your credit score by a few points for up to a year.

RefiJet only subjects you to only a soft credit check since it is not a direct loan provider. A soft credit check does not hurt your credit score — only you can see the soft credit pull record on your credit reports.

The FICO scoring system aggregates hard inquiries that result from rate shopping. Multiple loan applications count as only one inquiry if they occur within a 15-day period.

The new loan may also lower your average age of credit, which counts for another 10% of your FICO Score. But you won’t be anymore in debt if you use one loan to pay off another, so it shouldn’t affect your debt amounts, which counts for a much more influential 30% of your credit score.

Can RefiJet Finance a Lease Buyout?

You may want to buy your leased vehicle if you prefer to keep it instead of purchasing or leasing another car. RefiJet works with lenders willing to offer lease buyout loans when you want to buy your vehicle.

Purchasing your leased vehicle makes sense if it still meets your needs and is in good shape. The buyout price is usually less than the cost of a new car. You also avoid lease-end fees, such as penalty mileage or wear and tear.

When buying out a lease, you must make a large balloon payment equal to the car’s residual value specified in the contract. The dealership will typically give you a credit against the loan amount if the vehicle’s current value exceeds the residual. Lease buyout loans allow consumers to finance net balloon payments and repay over an extended loan term.

Although most buyouts occur at the end of the lease, your contract may allow one at any time during the lease without a prepayment penalty. The earlier the buyout, the higher the payoff price and the bigger the refi loan.

Is RefiJet Legitimate?

RefiJet has Better Business Bureau accreditation and a top rating. The company has been operating since 2016 and facilitates thousands of auto refinance loans yearly.

Initially staffed by four employees, it now employs more than 100 people and maintains a high level of worker retention. This auto refinance company receives strong reviews from customers and independent sources.

We believe RefiJet to be a legitimate and trustworthy company. But the real concern consumers face is whether the same is true for the direct lenders on the RefiJet network, which the company refers to as “leading financial institutions.”

We assume RefiJet monitors its network members and doesn’t work with dishonest financial institutions. It knows that failure to do so would reflect poorly on RefiJet and counter the company’s interests.

RefiJet Review: Automobile Refinancing That May Waive Payments For Two Months

Our RefiJet review is positive, with few quibbles about its customer service. We think loan networks are the fastest and most convenient way to find the best loan terms. As a bonus, you get a two-month payment holiday on RefiJet-arranged auto refinance loans.

You’re under no obligation to take a loan from a RefiJet lending partner. This freedom encourages each to make a better offer. In the end, competition among lenders means lower