You’ll want to identify the best deal possible, which includes getting the lowest interest rate you can qualify for, when searching for a new loan or credit card.

The problem is your credit scores can take a hit if you must apply to get the interest rate information. That means that the next time you apply, it may be with reduced credit scores, potentially making you less appealing to lenders.

Thankfully, you do get a break with the different credit scoring companies and certain types of loan applications. Here is what you need to know about shopping for the best rate and how it can and can’t affect your credit scores.

What Is Rate Shopping?

When you check with multiple lenders to compare the cost of a loan, credit card, or line of credit, you are engaging in rate shopping. It’s an important process because it lets you know which interest rates you can get based on your credit and financial history. Once you have that information, you can be confident that you’re making the right decision.

For example, imagine that you are shopping for a car loan. Instead of automatically going with the dealership financing, you decide to investigate several other lenders to see what terms they are willing to give you.

While you may be able to get an approximate rate without applying, many lenders need to see the details of your credit report and credit scores to provide you with the actual interest rate.

Rate shopping is a way to acquire the information you seek, but it can also result in multiple inquiries placed on your credit file if you’re applying to more than one lender or card issuer.

Soft vs. Hard Credit Inquiries

You should know the condition of your credit before applying for a new loan or credit card. Pull your TransUnion, Equifax, and Experian credit reports from AnnualCreditReport.com, the official website for obtaining free credit reports from each of the agencies once per year.

Verify that everything is correct, and dispute anything that is wrong or should not appear anymore because it’s too old.

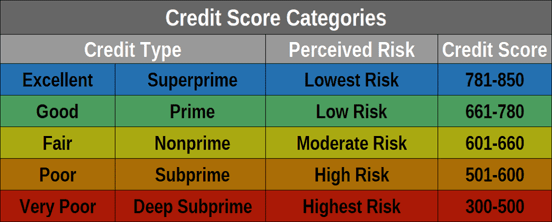

You’ll then need to access your credit scores. The two most common scoring companies are FICO and VantageScore, and both calculate consumer credit scores, which range from 300 to 850. Higher numbers indicate a lower lending risk.

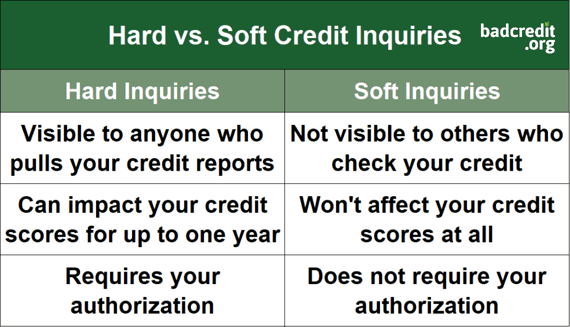

None of the scoring companies penalize you when you check your own credit report. This is called a soft credit check, and it is never included in credit scoring algorithms.

Other examples of soft credit checks include businesses that request your credit report for their marketing initiatives (which is why you would receive a preapproval letter from a creditor in the mail) and a new employer pulling your report for job screening purposes.

Hard credit inquiries, on the other hand, are factored into your credit scores. They show that you are actively trying to borrow money.

When you fill out the application and submit it, the lender will notify the credit reporting agencies that you have done so. A notification that you have applied for credit will remain on your credit report for two years, but will only affect your credit score for one year.

Of course, you must apply to get a credit product, but you don’t want to overdo the applications. Several hard inquiries in a short period can hurt your credit scores.

According to FICO, people with six or more inquiries on their credit reports can be up to eight times more likely to declare bankruptcy than those without any inquiries on their reports.

Does that mean rate shopping will always damage your credit scores? Not necessarily. It hinges on the type of credit product you want and the credit score the lender uses.

When You Aren’t Penalized For Rate Shopping

Every credit application was considered a separate credit scoring event in the past, so each submitted application would result in a hard inquiry being factored into your scores. But FICO and VantageScore recognized that consumers shouldn’t be penalized for shopping for the best rates, so they now factor them differently.

Each credit scoring company has its own approach to hard inquiries:

FICO: All hard inquiries for mortgages, auto loans, and student loans made in a 30-day time frame are not factored into your scores from the date of the inquiry. That means they will have zero effect on your scores during that time. When those inquiries are older than 30 days, they will be counted as a single inquiry rather than multiple inquiries — no matter how many credit applications you complete.

VantageScore: The latest version of VantageScore counts all inquiries made within a 14-day period as a single inquiry when they are for a specific loan type. For example, if you submit five applications for a mortgage and three for a car loan all within two weeks, only two hard inquiries will be imputed into your VantageScore — one for the mortgage, the other for the car loan.

Why You Shouldn’t Worry Too Much About Hard Inquiries

It can be easy to worry about how submitting applications for credit will impact your credit scores, but other data that appears on your credit reports is far more important.

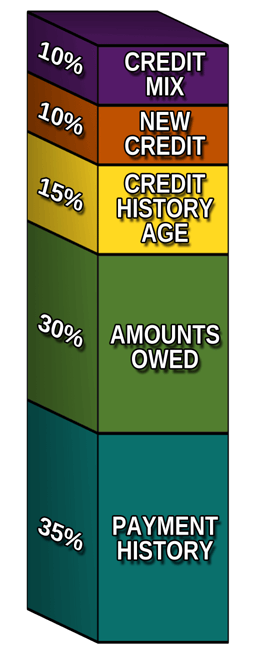

For your FICO Score, 35% of the score is based on the way you make your payments, and another 30% is based on the amount you owe as compared to your credit lines, both per credit card and in aggregate. So as long as you make all of your payments on time and keep your credit card debt extremely low, you should build a high credit score.

Another 15% of your FICO Score is based on your length of credit history, so the longer you maintain this pattern of timely payments and low revolving debt, the better. The types of credit you have is worth another 10%, which means a good mix of credit products will benefit you. This leaves hard inquiries as only 10% of your FICO Score.

VantageScores have a different system to factor in information. Payment history is considered the most important — or extremely influential — factor in determining your score, while age, type of credit, and percentage of credit limit used are considered highly influential.

Your total balances and debt are moderately influential. Less influential are your available credit, recent credit behavior — and hard inquiries.

As you can see, with so many other major credit-based factors taking precedence in how they influence a credit score, hard inquiries fall to the bottom of the list of both credit scoring companies.

This is not to say that hard inquiries, when they are included in the credit scoring company’s algorithm, don’t have any impact. They do, and just how much depends greatly on the data that is listed in your credit file.

According to FICO, a single inquiry can lower a FICO Score by less than five points.

If you have a lot of positive credit activity in your credit reports, your scores will probably not budge much after submitting a credit application. But if you have very little on your credit reports, credit applications may significantly affect your scores.

Apply Mindfully

Approach the credit application process with intention rather than randomly. There is no reason to apply for a loan or credit card that you aren’t interested in just to see what rate you can get.

Narrow down your options to products with the best rates, with terms and benefits that make the most sense for you, and that fit your financial and credit profile. You can find these products by doing your research.

Visit the lender’s website and review all of the terms. Call the customer service line and chat with a representative about what you’re looking for. Ask the representative to explain the details of the credit or loan product (just be careful not to give permission to apply, since this can be done over the phone).

Check out the various curated lists, too, especially if your credit isn’t perfect. Among the recommended reading are the easiest auto loans to get and home loans for bad credit. This can help you reduce the risk of being denied and an unnecessary hard inquiry on your reports.

After you’ve made a short list of the products that seem good for you, go ahead and apply. When you know the rate, you can make your final decision.

Treat the account responsibly and never miss a payment. If it’s a credit card, keep the balance down to zero, or at least keep it no more than 30% of the credit limit. With consistent and positive activity, your credit score should increase in a few months to whatever it was before you applied for the loan or credit card.

Don’t Fear Rate Shopping: It’s Your Right as a Consumer

In the end, finding the credit product — especially a mortgage or car loan — with the very best interest rate is too important to avoid. These loans are typically very large, so the rate attached to them will make a big difference in how much you eventually pay in financing fees. Just keep the time frames for rate shopping in mind.

You can’t predict which credit score the lender will use, so it’s best to go with the 14-day time frame. Then you are free to apply for a few loan products that you’re interested in, and your credit scores will be protected from harm.