When you apply for a new loan or credit card, a lender will check your credit score as part of the application process. Different brands of credit scores are available, but the most-used scores by lenders in the United States are the FICO branded scores.

As such, when FICO announces that it plans to release an updated version of its credit scoring models, it’s a good idea to pay attention.

These new scores, formally called the FICO 10 Suite, will introduce several changes to the way consumer credit reports are analyzed. Below are the top four things you need to know about the new FICO credit score changes headed your way before the end of 2020.

1. Late Payments Are a Bigger Problem

Paying your credit obligations late is never helpful from a credit scoring perspective. That’s been consistent across all generations and brands of credit scores, whether you’re talking about FICO credit scores, VantageScore credit scores, or other scoring platforms.

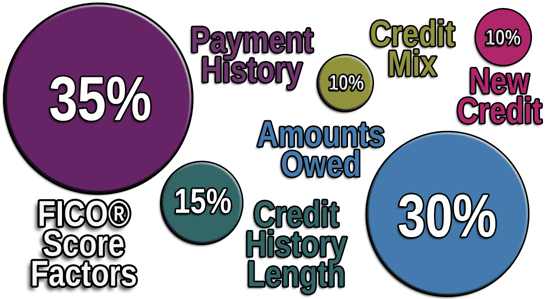

Payment history is worth 35% of the points in your FICO Scores. That makes it the most important category of metrics considered when your FICO Scores are calculated.

The new FICO scores will further penalize you for missing payments. What this means, in practical terms, is if a late payment appears on your credit reports, your scores may suffer more under FICO 10 than they would under previous FICO versions.

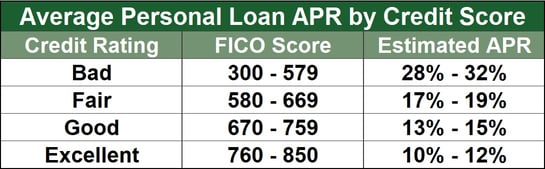

Lower credit scores can make it difficult to qualify for financing, or at least to qualify at decent interest rates. Plus, delinquencies on your credit report may be an obstacle when you apply for certain new loans or credit cards — especially if those delinquencies are recent.

2. Credit Utilization Matters More

The relationship between your credit card limits and balances, otherwise known as your credit utilization ratio, has always been an important factor where FICO Scores are concerned. In fact, 30% of the points in your FICO Scores are based on your debt.

You can calculate credit utilization by dividing your credit card balances, as they appear on your credit reports, by your credit card limits. If your credit report shows you have a $750 balance on a credit card with a $1,000 limit, your credit utilization is 75%. In general, lower utilization leads to higher credit scores.

Maintaining a low credit utilization ratio is part of using your credit cards responsibly and is even more important under FICO 10. Credit utilization will have a more significant impact on your score under the new model.

Examples of credit card utilization across three accounts.

The best way to lower your credit utilization is to maintain low balances on your credit cards and pay your credit card balances in full each month before the statement closing dates on your accounts. You can also consider asking your card issuer for a credit limit increase.

If the issuer approves your request, a higher credit limit would potentially reduce your utilization ratio, unless you increase your balances.

3. Trended Data is Now Relevant

When it comes to late payments and credit utilization, that information was already factored into your previous FICO scores. However, the T version of FICO 10 (called FICO 10T) will now consider information that hasn’t been factored into FICO’s credit scores before — trended data.

Trended data is a term that describes the historical payment information found on your credit reports. That information includes your credit card balances, minimum payments due, and how much you paid to your card issuers over the past 24 months.

When a scoring model, like FICO 10T, considers trended data, it considers historical information. For example, the scoring model will evaluate whether you’ve been a revolver or a transactor.

Here are two examples to illustrate the difference between credit card revolvers and transactors:

- Transactor: You charged $500 on your credit card last month. The minimum payment due was $20. You paid off the full $500 balance by the due date. You’re a transactor.

- Revolver: You charged $500 on your credit card last month. The minimum payment due was $20. You paid $20 by the due date and carried over a $480 balance. You’re a revolver.

In both examples, the payments were made on time. But if you revolved a balance instead of paying in full, it may hurt your FICO 10T score.

As a result, it’s even more important to follow good credit card management habits and pay off your full balance each month. Doing so will also save you money because no interest will accrue.

NOTE: VantageScore 4.0 also considers trended data.

4. Personal Loans May Be Treated Differently

Under previous FICO versions, personal loans didn’t have a negative impact on your scores as long as you paid them on time. But reports indicate the FICO 10 scores may consider personal loans in a different way.

Under the new scoring model, your score could be impacted negatively, albeit slightly, if you take out a personal loan.

It may still be wise to consolidate high-interest card debt with a personal loan if you can obtain a lower APR.

It is still a good idea to apply for a personal loan if you plan to use it to consolidate high-rate credit card debt. In general, consolidating credit card debt with a personal loan is a wise move. But you need to be extra careful not to charge your credit card balances back up again if you take this leap.

There’s Still Time

FICO Score 10 is slated to be available from all three credit reporting agencies by the end of 2020, according to Ethan Dornhelm, FICO’s Vice President of Scores and Predictive Analytics. But, even after the scoring models become commercially available, it will take years before a critical mass of lenders adopt the new scoring suite.

Changes in credit scoring don’t move at a fast pace. So, take advantage of this time if you can. One great step would be to work toward paying down your credit card balances to avoid further credit score problems in the future.

Now that you know the new credit scoring developments that could potentially impact you in the future, you can aim to make changes today to your personal credit reports.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.