If you’re dealing with a variety of financial obligations, you may want to bundle everything up into one neat package. Debt consolidation is a catch-all term that describes combining multiple debts and accounts. There are several ways to consolidate debt, but the overall idea is to simplify repayment of several accounts by making a single — sometimes lower — monthly payment ideally at a lower interest rate.

So, when does it make sense to consolidate debt? After all, debt consolidation isn’t always the best decision. Before entering into these agreements, understand the consolidation options that exist for different types of liabilities, the pros and cons of each, and make sure it’s the sound choice for you in the short and long run. We’ve got all that covered in the article below, so keep reading to learn more about debt consolidation and when it may the answer. And when it’s not.

It Depends on the Type of Debt You Have

The right consolidation plan is dependent upon many factors, such as the types of debt you have, i.e., student loans, credit card debt, medical debt, outstanding personal loans, etc., your credit score, and which types of repayment plans you’re comfortable with.

Below are a few common methods of consolidation associated with different types of debt.

Credit Card Balance Transfers

For credit card debt, you may be able to take advantage of a balance transfer, which entails transferring one or several credit card balances onto a new credit card that will absorb them all. For example, let’s say you have three credit card accounts:

- $1,500 balance, 22% APR

- $3,500 balance 19% APR

- $4,000 balance 18% APR

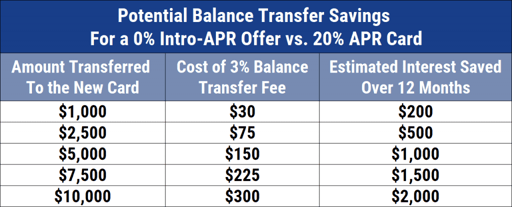

The total debt is $9,000. For this example, let’s say you get an offer to transfer up to $10,000 on a new credit card for a 3% balance transfer fee. In exchange, you’ll get 0% APR for the first 12 months, then 11.99% to 23.99% APR after that.

If you pay the entire debt within the promotional time frame, you wouldn’t pay any financing fees at all. You would save the $760 in combined interest fees that you would have paid with the original accounts (assuming you paid off the balance in a year). Even if you had a little debt left over, as long as you paid the remainder quickly after that, you’d still come out ahead.

Most balance transfer offers are accompanied by a balance transfer fee of 3 to 5% of the amount transferred.

Another advantage of balance transfers is that it opens up your credit utilization ratio, which is the amount you owe compared to the amount you can borrow. Lowering your credit utilization ratio can improve your credit score.

So what could be the problem? These offers require borrows to have a certain credit score, so if your scores are low, they won’t be available to you. And plenty of people get into worse debt because the original cards remain open and they use them again.

You must be dedicated to paying off your balances before the ultra-low rate expires and only charge what you will definitely pay in full each month. Also, the promotional rate is only applied to the amount you transferred, and not to new purchases or cash advances.

Debt Consolidation Loans

Another way to consolidate is by taking out a loan from a new lender. Then you would use the money you borrowed to repay any debt you may have, whether it’s credit card balances, collection accounts, medical bills, other loans, or legal fees.

Once done, you would only be dealing with that single lender. How long you have to pay depends on the term, which can be anywhere from one to five years in length. Some consolidation loans are secured with an asset, such as a certificate of deposit or an insurance policy, but the asset may also be a tangible item, like an insured vehicle or your home. Other consolidation loans are unsecured.

On the positive side, as with the balance transfer option, your credit utilization ratio would be lower with the repaid debts which helps boost your credit scores. Major commercial banks such as Goldman Sachs (with its Marcus loan that doesn’t charge an origination fee, as some banks do) offer these products, but so do smaller banks, credit unions, and online financial institutions like Prosper.

On the negative side, your scores have to be pretty high in the first place to be eligible for unsecured loans. If you are seeking a loan while currently behind on bills or you’re in over your head, you may not qualify or the interest rate you are offered will be prohibitive.

Here are a few recommended lender networks that may be able to match you with a loan product to consolidate your debt even if you have less-than-perfect credit:

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

2. Avant

- Personal loans of $2,000 to $35,000

- Compare rates in 2 minutes without affecting your credit

- Best for low origination fees for bad credit

- 550 minimum credit score required

- Powered by Credible

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $2,000 to $35,000 | 9.95% - 35.99% | 12 to 60 Months | See representative example |

3. Upstart

- Personal loans starting at $1,000

- Find loans you prequalify for, complete your application, and close your loan

- Loans for 300+ FICO Scores

- Checking rates doesn't impact your credit score

- Powered by Credible

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $1,000 to $50,000 | 6.40% - 35.99% | 3 or 5 Years | See representative example |

Before you take out a loan to consolidate debt, ask yourself if you can increase your payments by upping your income or decreasing your expenses (or both, simultaneously). Concentrate on paying off your higher interest rate accounts first and then move on to the next. As you work down each account, your scores will rise, putting you in a better position for a low rate consolidation loan — if you need one at all at that point.

And if you do get a consolidation loan, keep your spending in check. The idea is to get out of debt, not descend further into it. The underlying cause of your financial problems should always be addressed first.

Student Loan Consolidation

For student loans, you can only mix apples with apples; not oranges. Therefore, if you have four different federal education loans from your years in college plus a few private loans, the two loan types are separate. All federal loans can be combined, but you’ve got to leave the private loans out of the mix, and vice versa.

In addition to having one bill to pay instead of several, the benefits of consolidating federal education loans can include:

- a lower payment

- the ability to switch variable rate loans to a fixed rate

- access to flexible payment plans and loan forgiveness programs

- no credit requirement because they remain federal loans

Drawbacks can include a longer payoff time, which translates into more paid interest over the long run. You may also forfeit any benefits associated with your current loans, such as interest rate discounts and principal rebates.

If you’re interested in consolidating your federal education loans, visit StudentLoans.gov to get started.

As for the private student loans, they can be consolidated. The benefit of doing so may include a lower interest rate, which may be fixed or variable, and reduced payments. These consolidation loans are available from private lenders, such as Discover and SoFi, so you would need to have a credit rating that indicates you are a sound credit risk. If you’ve fallen behind on payments or are already over-indebted, your application could be denied.

Debt Management Plans

There is another type of debt consolidation that doesn’t involve borrowing more money at all. It’s a repayment arrangement called a debt management plan (DMP) offered by non-profit credit counseling agencies.

DMPs allow people to pay their credit card bills via the agency, which acts as a third-party. You have to attend a counseling session first, where the counselor will review your income, expenses, and assets in detail. If the DMP makes sense, the counselor will present it to you as an option and cover which of the credit card companies you owe will reduce their interest rates if you enroll in the plan. Some credit card issuers slash their rates substantially, though others won’t budge.

The DMP is arranged for you to get out of debt in three to five years. You would close the accounts and send one monthly payment to the credit counseling agency, which, in turn, pays each of your creditors. You get the benefit of the single payment and finance fee savings without having to qualify for a loan or a balance transfer card.

With a DMP, you make one monthly payment to a third-party agency that pays your creditors on your behalf, with the goal being to make you debt-free in three to five years.

An interesting aspect of DMPs is that you agree to not open any other credit cards or loans while you’re in repayment mode. The whole purpose of the plan is to help you achieve a positive net worth, so adhering to this promise is a smart idea. Also, if you ever have questions about personal finance and sticking to a budget, these agencies are there to provide support and education.

Some negative issues to consider: DMPs are almost exclusively for credit card bills and not for other forms of debt you may have. There is usually a monthly administration fee of about $25 to handle your accounts. Your credit rating won’t get the big bump that consolidation loans and credit cards can give (though over time, as your debts are reduced, you should improve). There are some scam credit counselors out there, so you have to be sure to work with a reputable agency.

To identify a highly rated credit counseling agency, check with the National Foundation for Credit Counseling or the Financial Counseling Association of America.

With the Right Plan, Consolidation May Be the Way to Go

If you’ve been struggling with the high costs and confusing management of various liabilities, consolidating can be the way to go. With the right product or plan, you can gain peace of mind and save quite a bit of money. Just be aware that each option has its disadvantages too, some of which you can avoid but others you can’t.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.