In a Nutshell: Founded shortly after the first commercial credit card hit the market, the National Foundation for Credit Counseling (NFCC) is the nation’s first and largest nonprofit dedicated to improving people’s financial well-being. The NFCC oversees a network of accredited member agencies that have provided financial literacy programs for consumers of all ages for more than 65 years. The NFCC’s members help consumers with everything from credit card debt, to home buying, credit report review, and student loan debt management. Accredited member agencies can be found in all 50 states and Puerto Rico through its website locator tool and dedicated phone number.

For as long as there’s been steady access to credit, consumers have found themselves navigating debt problems. Today, the average American household has $8,377 in credit card debt. Some have far more.

The first modern consumer credit card, the Diner’s Club card, appeared in 1950. Less than a year later, the National Foundation for Credit Counseling (NFCC) was formed to promote financial literacy and conduct public awareness campaigns about credit. It didn’t take long to notice the trend in credit abuse that still exists today.

The NFCC is the nation’s first and largest nonprofit dedicated to improving people’s financial well-being. The foundation has certified counselors who deliver NFCC-branded services — from credit card debt counseling and home buying to retirement saving and student loan debt management — in all 50 states, as well as Puerto Rico.

“Our mission is to promote the national agenda for financially responsible behavior as well as build capacity to our membership,” said Barry Coleman, VP of Counseling and Education Programs.

“Our mission is to promote the national agenda for financially responsible behavior as well as build capacity to our membership,” said Barry Coleman, VP of Counseling and Education Programs.

“We have a membership of locally based organizations that are in every state in the country, and they provide financial education and counseling services,” he added.

Member counselors are trained to review your credit score and offer help in managing debt loads of all kind. Many of the services are free, but small fees are sometimes charged by member agencies to cover their cost of operation. All of the members of the NFCC are certified 501(c)(3) nonprofit.

“They’ll deliver services even if someone isn’t able to pay the nominal fee that some of our agencies charge,” Barry said. “We don’t really turn anyone away. Our agencies’ mission is to help consumers.”

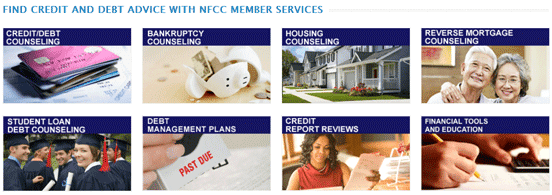

From College to Retirement, NFCC Members Provide a Range of Counseling & Educational Services

Most Americans don’t learn about managing money until they’re actually making it and can spend it on their own. That’s where the NFCC member counselors offer valuable tools for learning about financial literacy and how to correct any mistakes that have been made.

“We have a variety of services that are available — everything from credit and debt management services,” Barry said. “We also do housing and mortgage counseling. We do reverse-mortgage counseling that’s mandated before a senior can take out a reverse mortgage. We also do first-time home buyer and student loan debt counseling, which is our newest offering.”

More than 50% of college graduates leave school with debt. In most states, the average debt is well above $20,000. While student loan debt isn’t seen by most lenders as bad debt, as the numbers climb, it can have a severe effect on your ability to purchase a home or create a nest egg that will carry you to retirement. As a mortgage, credit card, or other debts associated with adulthood creep in, the weight on consumers’ shoulders can become too heavy to bear.

While the NFCC doesn’t provide services as a foundation, instead offering all of its counseling through member agencies, it does have an impact on the services that are delivered. The NFCC negotiates with creditors that take part in its Debt Management Plans.

Creditors typically make standardized concessions on fees or interest rates that are then passed down to consumers who take part in these plans. Without these negotiations, credit counseling agencies would have to have discussions with individual creditors on behalf of every single consumer in the program. The time that would take makes such a feat nearly impossible. This streamlining of processes has allowed 73% of the NFCC clients to pay back debt more consistently.

“Some (consumers) will enter a debt management program where the NFCC members have agreements with these credit card companies to either lower the interest rate or reduce the fees and make the monthly payment more manageable,” Barry said. “So the consumers can then make the payments to our members, and the members disburse those funds to the various creditors. Through that, we’re able to gauge those who are able to stay on track and pay off their debt. It’s designed to have it paid off within 60 months or less, depending on the debt load.”

NFCC-Certified Counseling Services are Available Nationwide

Member agencies certified by the NFCC can be found all over the country. While some states have heavier concentrations near large cities, other states might not have as many members. However, that doesn’t mean services aren’t possible in those areas.

“We have some members who are considered national counselors and can deliver services to anyone in the country over the phone or online,” Barry said. “We also have local members that deliver services to one state or even one community. Some offer one specific service, and some offer a whole host of services.”

NFCC members handle a variety of services, from credit counseling to debt management plans.

Consumers looking for financial advice or services are urged to search the NFCC’s Locator tool to find the counselor closest to them. Nearby counselors can also be found through a dedicated phone line at 1-800-388-2227. Through either connection, you can specify the service you’re searching for and get access to all of the local and national members who provide counseling to meet your needs.

Member Agencies Must Obtain & Maintain Accreditation Through COA

Becoming a certified member of the NFCC means following a strict set of guidelines that maintain the high standards consumers have come to expect from the nonprofit. To maintain the reputation that has been built over 65 years, Barry said the NFCC looks at every potential member closely before allowing consumers to seek help from them.

“They have to be a 501(c)(3) nonprofit organization that provides financial counseling,” he said. “They also have to agree to adhere to our eight member quality standards that cover everything from the governance of their organization to ethics and how the services should be delivered to the consumer. One of the biggest standards that we have are that members are required to deliver services regardless of someone’s economic status or without regard to their race or religion.”

Part of how the NFCC keeps its reputation is by ensuring that all of its member agencies are accredited by the Council on Accreditation (COA), an independent nonprofit that monitors more than 1,500 social service programs. Each NFCC member must go through the reaccreditation process every four years.

“Before member counselors can deliver NFCC branded services, they have to go through a very rigorous certification process,” Barry said. “We currently have certifications for basic credit counseling, housing counselors, a certification for our student loan counseling services, and anyone that wants to run financial education workshops.”

More Than 65 Years of Prioritizing Financial Responsibility

The NFCC first recognized the need for financial literacy shortly after Americans were introduced to the first commercial credit card. Since then, the nonprofit has grown and expanded to a nationwide network of members that stay ahead of the needs of consumers with traditional debt, like mortgage and credit cards, to the newer forms of debt, like student loans, which are overwhelming the younger demographic.

Through its high member standards and long-standing relationships with credit and government agencies, the NFCC has been able to help thousands of consumers successfully navigate the financial pitfalls of life to achieve their dreams and reach their goals.

As time passes and new forms of debt evolve, the foundation is set to not only help others overcome their problems, but to educate consumers so that mistakes aren’t repeated, or in some cases, never made at all.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.