There’s a persistent rumor that you can’t get a car loan when you have bad credit. We put that rumor to bed in this review of three approval tips for buying a used car with bad credit.

Used cars provide needed transportation and cost way less than new cars. And cars are so well-built nowadays that you can often enjoy 200,000 or 300,000 miles of service before retiring the vehicle. Arranging a bad-credit car loan can be easy and convenient if you choose the right lenders.

1. Find a Lender that Works with Bad Credit Applicants

The following three auto loan matching services all work with networks of car dealers that specialize in loans to folks with bad credit. They refer you to a local dealer who will be happy to arrange a used-car loan if possible.

These dealers are motivated to move their used car fleets off their lots and will work hard to get you the loan you need.

- Network of dealer partners has closed $1 billion in bad credit auto loans

- Specializes in bad credit, no credit, bankruptcy and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have $1500/month income to qualify

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 3.99% - 29.99% | 1999 | 3 minutes | 9.5/10 |

Auto Credit Express is a loan matching service established in 1999 with a network of dealer and lender partners that’s closed $1 billion in auto loans for bad credit. It takes less than a minute to prequalify for a loan with an estimated approval amount.

You’re then linked to a local dealer who specializes in bad credit loans and who will complete the application process. Applicants must have a monthly income of at least $1,500.

- Free, no-obligation application

- Specializes in auto loans for bankruptcy, bad credit, first-time buyer, and subprime

- Affordable payments and no application fees

- Connects thousands of car buyers with auto financing daily

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1994 | 3 minutes | 9.0/10 |

Car.Loan.com is a loan matching service specializing in bad-credit and no-credit auto loans, including loans to consumers during or after bankruptcy. It takes just a few minutes to complete your no-obligation loan request form.

Car.Loan.com then matches you to the most appropriate dealers on its partner network. In fact, it matches thousands of consumers to dealers every day. Car.Loan.com charges you no fees for its matching service, and you can receive final approval as quickly as the same day.

- Loans for new, used, and refinancing

- Queries a national network of lenders

- Bad credit OK

- Get up to 4 offers in minutes

- Receive online loan certificate or check within 24 hours

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2003 | 2 minutes | 8.5/10 |

The myAutoloan.com can match you to multiple lenders on its dealer network when you fill out the short loan request form. The process leads to preapproval within a few minutes.

The website stands apart from others by displaying today’s lowest available car loan rate, in addition to providing online tools to estimate your interest rate and to calculate your payments. If approved, you can receive an online loan certificate as soon as the next day.

2. Make a Down Payment or Trade In a Vehicle

Naturally, a bad credit score is a challenge to overcome when you need to purchase a used car. The challenge includes showing the lender that you are seriously committed to repaying your loan on time and in full.

One strategy is to establish that you are willing to put some of your own money on the line. You can demonstrate this by committing upfront money to the loan. Two typical tactics are:

- Make a down payment: A down payment is an upfront amount you contribute to reduce the car loan balance. The larger the down payment, the more it helps you win approval for the loan. For example, if the used car you want sells for $5,000, a 10% down payment will cost you only $500 but could be decisive in closing the deal. It’s true that many dealers will offer loans with no down payment, but you can bet that these will be the smallest offers with the highest interest rates. If at all possible, save for your down payment before applying for a loan.

- Trade in your current vehicle: This is another way to reduce the size of the auto loan. The process requires you to bring your current vehicle to the dealership where it will be appraised for value. If you agree to the trade-in price, it will be subtracted from the price of the car you wish to buy, shrinking the size of the required car loan. If you can afford it, repair any problems or damage to your current car before offering it for trade-in, as the price of repairs may be less than the amount the dealer will ding you for the damage. Note that you also can simply sell your car for cash at one dealer that you can use as a down payment at another dealer. However, you may find a dealer to be more generous with trade-ins versus straight sales.

When your credit score is low, upfront money can go a long way toward putting you into your next car.

3. Have Someone Cosign for You

Another way to overcome your poor credit score is to find a cosigner for the loan. Clearly, the best cosigner will be someone with a good or excellent credit score, but even an average score may be enough to swing the deal.

When someone else cosigns your loan, you both become responsible for payments. That’s why the lender can consider the cosigner’s income and creditworthiness when underwriting the loan.

Frequently, the cosigner will be a friend or family member. This has nonfinancial consequences for the car buyer.

For example, how will your relationship with the cosigner change as a result of the agreement? You may severely jeopardize that relationship by failing to make your payments on time, forcing your cosigner to do so instead.

Unless you have a good reason for missing payments, you risk alienating your cosigner, who naturally wants to protect his or her credit rating. If the estrangement is severe enough, a lawsuit can ensue that further complicates the relationship.

To be fair to your cosigner, you should agree to certain stipulations that include:

- You — not the cosigner — will make the monthly loan payment.

- You will make the payments in full and on time.

- You will not ask the cosigner to step in unless there is a genuine reason why you cannot make a payment.

- You will reimburse the cosigner for any payments he or she makes on your behalf.

- If possible, you will try to repay the loan early so you can release the cosigner from the financial obligation as soon as possible.

When dealing with a cosigner, you should be honestly committed to taking full responsibility for repaying the loan.

FAQs about Buying a Used Car with Bad Credit

You’ve got questions, and we have answers. Here are a few questions we frequently receive.

Can I Get a Used Car with Bad Credit?

The three loan matching services we review here all cater to consumers who have bad credit. They all share the same revenue model — to collect fees when a referred consumer accepts a loan from a recommended dealer.

To that end, they prequalify you for a dealer loan and hook you up with the most appropriate car dealer. In turn, the dealer belongs to the matching service’s network and knows that referred consumers will likely have bad credit. Despite that, the dealers are eager to earn your business and will work hard to find a way to make the deal work.

Getting a used car through this process is often much easier than buying a new vehicle. That’s because dealers like to move used cars off their lots quickly to make room for shipments of new cars that have a much larger profit margin.

You can help close the deal by selecting a car on the dealer’s lot, offering a down payment and/or trade-in, and securing the help of a cosigner. Saving for a significant down payment is a good strategy, as is making any minor repairs on your current car that would increase its trade-in value.

The more willingness you display to responsibly repay the loan, the better your chances will be of receiving it.

Do I Need a Down Payment with Bad Credit?

The question comes down to how bad your credit really is. Dealers often follow credit score guidelines on how to lend to bad-credit customers, including the circumstances under which a no-down-payment loan is feasible.

Dealers are more likely to consider foregoing the down payment if your credit score is closer to 600 than to 500. Naturally, you can expect to pay a higher interest rate when you skip the down payment, and the loan will be more costly because of the higher rate and bigger loan principal.

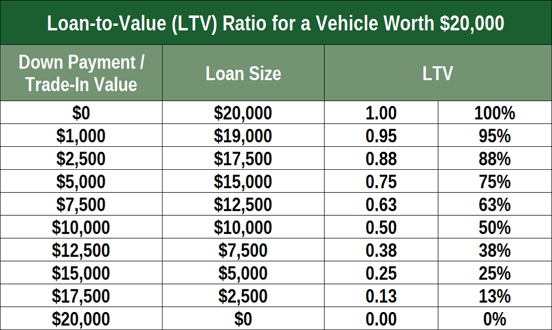

The amount you put down or the value of your trade-in will directly impact the amount you finance. A lower LTV can greatly improve your chances of approval.

To qualify for a no-down-payment auto loan, you should be able to demonstrate that you have sufficient resources to repay it throughout the loan term. Remember that the loan is secured by the vehicle, and the last thing you want to do is for the dealer to repossess the car after you’ve made substantial payments.

Another way to obtain a no-down-payment auto loan is through the use of a cosigner who will be responsible for payments if you miss making them. Some dealers may allow for no down payment by limiting your loan amount and/or requiring payments twice a month instead of once a month.

Clearly, both you and the dealer must be willing to work together to waive a down payment if you wish to obtain your next car.

What Credit Score Do Car Dealers Use?

The auto credit score used by the three major credit bureaus — Experian, TransUnion, and Equifax — is the FICO Auto Score 8 (FAS8). It is expressly designed for consumers seeking car loans.

FAS8 uses a score range of 250 to 900 points, compared to the 300-850 range for FICO’s standard score system. The FAS8 scores enable lenders to more accurately forecast the probability that you’ll repay your loan each month on time and in full.

According to FICO, FAS8 provides significant improvements for nonprime loans in terms of predicting creditworthiness. FAS8 scoring works like this:

- The credit bureau calculates the consumer’s traditional FICO credit score within the range of 300 to 850.

- It then adjusts the score based on risk behavior to create the FAS8 score in the 250 to 900 range.

- The adjustment process includes assigning more weight to risk behavior specific to auto loans.

For context, note that each lender has its own score requirements that are subject to change over time. That makes it hard to guess what FAS8 score that dealers demand as the minimum necessary to get a car loan.

If you want to obtain your FAS8 score before applying for an auto loan (which is a good idea), you may have to pay a fee to a provider such as FICO.

Find the Transportation You Need Using These Tips

We’ve recommended three car loan services that can help consumers who are buying a used car with bad credit. All three work with dealership networks that offer loans to folks with low credit scores.

You can increase your loan approval chances in several ways, including making a down payment, providing a trade-in vehicle, or recruiting a cosigner. If possible, save for a down payment before applying for a car loan and repair any minor damage to your trade-in.

If you can show you have sufficient income to repay, you may have a decent chance of getting a car loan approved despite a bad credit score.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.