As a prospective borrower, one of the most important things you can do is conduct research before submitting your application for a loan. You will want to compare a wide variety of products and be as sure as possible that your application will be accepted.

This is especially important when your credit rating is poor because your options are more limited than if your credit rating were excellent.

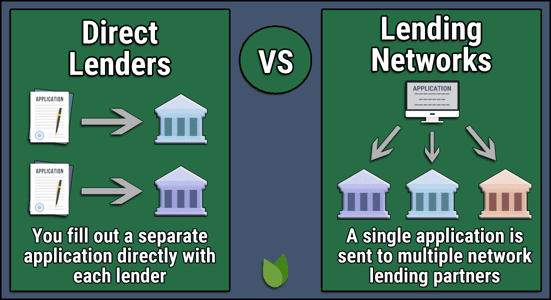

To increase the odds of getting a loan with the best terms that you can qualify for, consider using an online lending network. These companies are different from direct lenders, as they can put you in touch with multiple lenders willing to offer you a loan. Here is what you need to know about working with an online lending network.

Direct Lenders Versus Lending Networks

When you pursue a loan from a specific bank or credit union, you are working with that financial institution only. These direct lenders usually have a suite of products from which to choose.

For example, it may offer credit cards, private student loans, personal loans, business loans, car loans, and mortgages. The direct lender sets the qualification criteria and terms for each product. You will find that information on the company’s website and other marketing literature and in the fine print of the terms and conditions.

If you choose to apply with that specific financial institution, that direct lender will lend you the money – if you qualify.

On the other hand, lending networks do not provide loans and other credit products. Instead, they are vetted marketplaces of many financial institutions. The networks generate leads for lenders — their partners — seeking borrowers.

Lending networks are essentially matchmakers whose sole purpose is to connect you with the span of lenders and the products they offer.

Benefits of Using a Lending Network

Using a lending network has several advantages over going through a direct lender:

- Easy comparison. An online lending network saves you time since you won’t have to research individual lenders and review the offers separately. Instead, the offers would come to you all at once, and you can review them all at the same time.

- Instant access to many lenders. Depending on the lending network, it may have partnerships with well over a hundred lenders.

- Find a lender that specializes in the loan you want. Some lending networks focus on specific loan types, such as personal loans or car loans, while others offer a variety of loans.

- Avoid disappointing denials. When you work with a direct lender, you run the risk of being rejected for the loan after doing all the research and getting your hopes up. An unexpected denial can hold up a loan you need for something important, such as covering an emergency expense. But when using an online lending network, you will be connected to the loans that fit your credit profile, greatly minimizing the risk of being turned down.

- Protection against credit damage. Every time you complete a loan application, the lender sends the credit reporting agencies — TransUnion, Experian, and Equifax – a notification that you applied. A hard inquiry will be placed on your credit file when you do. Having several hard inquiries on your reports can negatively affect your credit scores just as you’re trying to become appealing to lenders. When you use a lending network, you can narrow your applications to one viable loan, which can protect your credit.

- No cost to you. Another advantage of online lending networks is that they’re free for the borrower. If you accept the offer, the lending network will receive compensation from the lender. If you don’t accept the offer, they will not receive the fee. That’s why it is in the lending network’s best interest to make sure that the loans presented to you make sense and are beneficial to both parties.

You can review our top-rated lending networks for bad credit in the following loan categories: auto, personal, home.

How Lending Networks Help People With Bad Credit

If you have great credit, your borrowing options are wide open. Lenders from across the financial universe may be more than willing to work with you and may even come to you with offers in the mail.

But it can be frustrating to have bad credit while you are looking for a loan. You may not be able to get what you need from traditional banks and credit unions. That will leave you wondering if anyone is willing to lend you money. And even if you do find a lender on your own, you may worry that the company is not well regarded.

That’s where a lending network comes in. They do that work for you, so you don’t have to spend your time searching and worrying. They’ve already formed partnerships with sound financial institutions that cater to consumers with less-than-perfect credit and even bad credit.

How to Use Online Lending Networks

Each online lending network is its own separate company, though the process for finding the loan for you is similar among them:

- Pinpoint the network for the type of loan you want. There are networks for all types of financing, including auto loans, personal loans, home loans, and loans designed for people with bad credit.

- Complete the online form. Every online lending network will have a form on its website. You will be asked to provide data that includes your name, address, and basic financial information.

- Submit the application. When you submit the application, you are authorizing a credit check. Once done, the lending network will find the lenders and loans that match your financial and credit status. This process usually takes just a few minutes.

- Review your loan options. When you are presented with the different loan options, read them over to learn the amount you can borrow, the interest rate, and the term (number of months you have to repay the loan).

- Select the loan that best suits your needs and costs the least. Depending on your circumstances and the lender, you may be offered a loan that ranges from a few hundred dollars to many thousands of dollars. Pay close attention to the APRs and terms. The more you borrow, the higher the interest rate, and the longer the term, the more a loan will cost you in the end. Determine the loan that matches your goals and select it.

After that, all you must do is wait for the money to be sent to your bank account. In most cases, funding takes about one business day, but it can be longer if you start the process on a weekend or bank holiday.

Use the Loan to Build a Better Credit Score

Almost all lenders furnish account information to the credit reporting agencies. They will include the date the loan was granted, the original loan balance, your payment amount, and whether you paid on time.

If you manage the loan responsibly by making all the payments by the due date, your credit will improve over time.

Credit scores, including those developed by FICO and VantageScore, rank payment history as the most important factor, so each on-time payment is a step in the right direction.

The Bottom Line About Online Lending Networks

When you use an online lending network, you will learn about financial institutions that you may never have known existed. This is your opportunity to work with the right lender and take out the best loan for you.

Just be sure to only borrow the amount you truly need, that you can handle the payments without stress, and that you can afford to pay the loan off in the shortest term. By doing so, you will keep costs down as you build your credit up.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.