If your credit reports show unfavorable data such as high debt, missed payments, collection agency accounts, bankruptcies, and money owed for lost lawsuits, lenders would be right to back away. You don’t appear to be a good credit risk.

Not all lenders pull credit reports; instead, they depend on the credit scores that are derived from what’s on them. The most commonly used scores are the FICO and VantageScore, both of which range from 300 to 850. When those numbers are on the low end of the spectrum, a loan rejection may be in your future.

Thankfully, you have recourse. Here are seven tips to borrow right, even when your credit is looking wrong.

1. Know How Poor Your Credit Rating Really is

Plenty of people think they have terrible credit ratings, but when they check, they’re pleasantly surprised. Find out your credit standing by obtaining your consumer credit reports from TransUnion, Experian, and Equifax, available for free once a year from AnnualCreditReport.com.

You can obtain a copy of each of your three credit reports at annualcreditreport.com

Read them over carefully and assess for damage. A single late payment, especially if it’s several years old, won’t put you out of the market for a loan, nor will a very old bankruptcy (as long as you’ve used credit products well since then).

Credit scores are not included with your free credit reports, but you have plenty of options for obtaining a free credit score so you can see how the data is translating numerically. If your scores are above 640, they’re in the average to fair credit range and you may have more sound borrowing options than you think.

2. Pay Off Collection Accounts

If your credit rating is being impacted by debts that have been routed to collections, you can make an immediate difference in your scores by simply paying them off. Satisfied collection accounts are not calculated into the most recent versions of the FICO and VantageScores.

Once they’re repaid, your scores may recover enough to make you very attractive to a lender. Use a credit score simulator, like the one developed by TransUnion, to understand how deleting collection accounts will affect your credit score.

3. Add Positive Information to Your Reports

Not having enough information listed on your credit reports — also known as a thin/limited credit file — can be construed as having bad credit. That’s because the past is an indicator of future performance. Without that history, a lender has little or nothing to go on about you as a potential borrower, and your application may be denied.

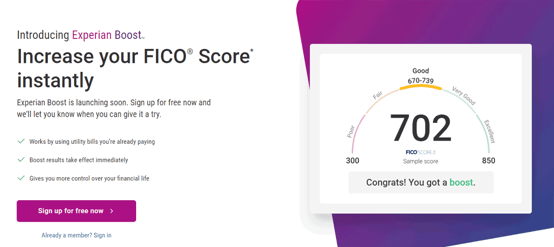

If you’ve been managing such household bills as your cellphone and utility accounts well, however, you can now add them to your report with Experian’s free Boost program. Once you do, those payments will be recorded and calculated into your credit scores in a positive way. This will help lenders see you as a financially responsible person, even if you’ve never had a credit card or loan before.

Experian Boost will allow you to add positive payment history to your credit reports.

You can also add your steady rent payments to your credit reports. There are a number of companies that do this, such as Rental Kharma and Rent Reporters, though they are fee-based.

4. Wait, If You Can

You may have negative information on your credit reports that is hurting your ability to qualify for a loan, but time is on your side. Negative information such as delinquencies, defaults, judgments, and collection accounts can only stay on a report for seven years. Chapter 7 and Chapter 11 bankruptcies can remain for 10 years.

So if any of these notations are sullying your reports and are at the end of their lifecycle, you may want to put loan applications on hold. When the dings drop off, your reports and scores will improve. At that stage, you may be eligible for the loan of your dreams — without having to do anything but exercise a little patience.

5. Avoid Destructive Loan Options

Even if your credit rating is terrible or nonexistent, there are ways to borrow money. The problem is, they come at a high price. Unless you repay them almost overnight, they’ll work against you.

According to the Consumer Finance Protection Bureau (CFPB), the APR for a two-week $100 payday loan with a $15 fee is nearly 400%. For car title loans, where you borrow against the value of your vehicle, the lender can charge 25% each month, which is equivalent to an APR of about 300%. And if you falter on payments, the lender can repossess the car, according to the Federal Trade Commission.

The APR for a two-week $100 payday loan is nearly 400%, according to the CFPB.

If these types of loans are your only option, it’s a sign that you shouldn’t be borrowing money anyway.

6. Consider a Credit Union

Big commercial banks can be tough for borrowers with less-than-stellar credit ratings because they tend to have high approval standards. Credit unions, on the other hand, are known for being more forgiving.

These financial institutions are owned by members — the very people who open up accounts with the credit union. Rather than having stockholders to please, credit unions are focused on helping their members achieve their financial goals. After joining, you can work with an employee to identify a loan with the best terms and favorable interest rates.

In the event you still don’t qualify, they will offer guidance on how you can increase your credit rating so that eventually you will qualify.

7. Bring on a Cosigner

Do you have a friend or relative who has excellent credit? That person may agree to guarantee the loan for you by cosigning. If so, that generous, trusting soul agrees to cover your debt if you default. This layer of security can sway even the toughest lenders in your favor since they take less risk in doing business with you.

If you pay late or default on the cosigned loan altogether, both of your credit ratings will be damaged, as will your relationship with your cosigner.

Of course, you would have to be absolutely sure that you can handle the loan responsibly, not only because the cosigner is obligated to pay your loan off if you default, but the late and missed payments will show up on both of your credit reports. Both of your credit ratings will suffer, and so will your relationship. Proceed with caution (and gratitude).

Once Approved, Pay on Time — All the Time

After getting the loan, use it to your advantage. Your consistent payments will be notated on your credit report each month and the balance will steadily decline. Since payment history and credit utilization (the debt you have as compared to the amount you can borrow) are the two most important credit scoring factors, you will soon become creditworthy. When you are, worrying about where and how to borrow funds will be a thing of the past — lenders will come to you.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.