Same-day cash loans can be a tremendous resource when emergencies strike. They may tide you over when money is tight and you’ve maxed out your credit cards.

We review nine online networks that can arrange a quick loan in minutes and transfer the money on the same day or the next business day.

Bookmark this article for the next time your car needs repair, your basement floods, or your nephew needs bail. You’ll be only a few clicks away from an emergency loan source that will work with you even if your credit is subpar.

Best For: Low Income

You only need to earn $800 per month to qualify for a loan from MoneyMutual.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

MoneyMutual connects you to lenders for fast loans of up to $5,000. BadCredit.org repeatedly ranks MoneyMutual highest for its fast cash loan referral service.

Best For: Installment Loans Repaid Over Time

Avant can get you an installment loan starting at $2,000.

2. Avant

- Personal loans of $2,000 to $35,000

- Compare rates in 2 minutes without affecting your credit

- Best for low origination fees for bad credit

- 550 minimum credit score required

- Powered by Credible

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $2,000 to $35,000 | 9.95% – 35.99% | 12 to 60 Months | See representative example |

You could have between one and five years to repay your loan, and seeing whether you qualify takes just two minutes. Even applicants with poor credit scores in the mid-500s can be approved for loans through Avant’s issuing bank, WebBank.

Best For: Large Loans

Upstart offers the highest loan amounts among the lending companies we review, capping out at $50,000.

3. Upstart

- Personal loans starting at $1,000

- Find loans you prequalify for, complete your application, and close your loan

- Loans for 300+ FICO Scores

- Checking rates doesn’t impact your credit score

- Powered by Credible

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $1,000 to $50,000 | 6.40% – 35.99% | 3 or 5 Years | See representative example |

Of course, you’d need good to excellent credit for a loan that high, but all credit scores are welcome to apply, and you might be surprised by what you’re offered. There’s no cost or obligation to apply, and checking your loan offers and rates won’t affect your credit.

Best For: Small Loans

SmartAdvances.com can approve you for a loan as small as $100.

- Small personal loans starting at $100

- Receive an approval decision in as little as 2 minutes

- Funds can be deposited into your account in one business day and used for any purpose

- No hidden fees

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $20,000 | Varies | Varies | See representative example |

SmartAdvances.com has a fast prequalification process that can match you to multiple direct lenders on the same day. You must receive a regular income of at least $1,000 a month to be eligible. SmartAdvances.com is a member of the Online Lenders Alliance (OLA), committed to a responsible lending policy that complies with federal law.

Best For: Fair Credit

PersonalLoans.com offers loans of up to $35,000, but only borrowers with higher credit scores will qualify for large loan amounts.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

PersonalLoans.com advises that the amount you can borrow depends on your income and credit score, although it prequalifies all credit types. Some lenders on the network may require income verification, such as a pay stub or bank statement. You may not prequalify if you have a credit account more than 60 days delinquent, a recently charged-off loan, or a high debt to income ratio.

Best For: Payday Loans

CashAdvance.com is a lender network that solely matches borrowers with nationwide payday lenders. This service is not available in all states.

- Short-term loan of $100 to $1,000

- Large network of lenders

- Loan decision as fast as a few minutes

- Funding as soon as the next business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $1,000 | 200% – 2,290% | Varies | See representative example |

If you have a steady income, you can qualify for a payday loan through CashAdvance.com. You must be a US citizen, at least 18 years old, with an email address, bank account, and phone number to apply. You must observe the loan terms to avoid costly fees.

Best of the Rest

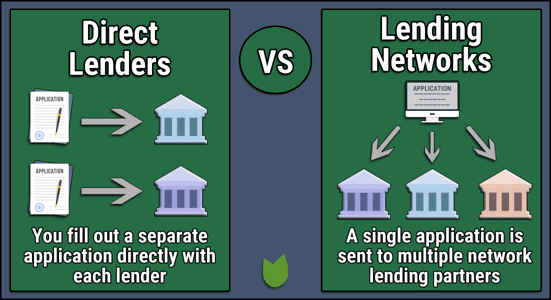

These loan websites don’t make loans; they find them. Each works with a direct lender network that can provide you with money on short notice. Moreover, they don’t charge a finder’s fee and can prequalify your loan request without damaging your credit.

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% – 35.99% | 60 Days to 72 Months | See representative example |

If you are employed, 24/7 Lending Group can get you one or more quotes in minutes. It doesn’t specify a minimum income requirement. This loan-finding service scores an Excellent rating from Trustpilot and works only with direct lenders that adhere to the Fair Debt Collection Practices Act.

8. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

To prequalify for the CashUSA.com lender-matching service, you must collect an after-tax income of at least $1,000 per month. Poor credit won’t disqualify you from getting a cash loan, and you may receive quick loan approval within minutes.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 60 Months | See representative example |

You can prequalify a loan through BadCreditLoans.com if you receive regular income from full-time employment, self-employment, Social Security benefits, or disability payments. You can contact the website to learn the minimum income needed for prequalification. The direct lenders on its network make the final loan approval decisions.

What Is a Same-Day Cash Loan?

A same-day cash loan is one in which the borrower receives same-day approval. Funding can occur on the same day but may require another day to complete.

Fast turnaround distinguishes same-day borrowing from a slowpoke bank loan that imposes high credit standards and reams of paperwork. Credit unions can provide better lending terms, especially if you apply for a Payday Alternative Loan, but several conditions limit these loans.

The fact that you can arrange a quick cash loan online is a critical factor when you need money in a hurry. If you are in the midst of an emergency, it’s much more convenient to arrange a loan on your computer than to go to an office or bank branch.

It’s also efficient to receive your loan proceeds through a direct deposit into your bank account rather than having to deposit a check that could take days to clear.

Best of all, the reviewed lending networks welcome borrowers with poor, limited, or no credit. Most accept alternative sources of income, and the minimum income amounts are modest (as low as $800 per month).

How Do I Apply For a Same-Day Loan?

The reviewed lending networks follow the same basic procedure. You start by filling out an online loan request form with information about your earnings, employment status, and monthly housing costs.

The loan-finding services verify your data but do not perform a hard credit inquiry, thereby preserving your credit score. If everything is acceptable, you’ll prequalify for a loan and connect to a lender’s website or receive multiple links to interested loan providers.

The next step is to supply any additional information the online lender may require, including documentary evidence of income — pay stubs, W-4s, 1099s, bank statements, tax returns, etc.

The lender may pull your credit report to decide whether to approve your loan. If approved, you’ll receive an offer within minutes that details the loan amount, interest rate, fees, and loan term. If you’re dealing with installment loans, you’ll also find out the amount of your monthly payments.

Please read all the disclosures carefully before accepting the loan offer. If satisfied, e-sign the online loan agreement and expect your funds to appear in your bank account on the same or next business day.

What Apps Give Same-Day Cash Advances?

Cash advance apps allow workers to take low-cost loans that are much cheaper than payday loans. These mobile apps can give you an advance (as much as $500) on your next paycheck for work you’ve already clocked. They charge low interest rates and fees, and some cost nothing to use.

Dave: The Dave app provides payday advances of up to $250 at no cost. These are no credit check loans that don’t charge interest. An optional feature reports rent and bill payments to the three major credit bureaus.

Earnin: The Earnin app can give you a small advance by linking your electronic timesheet and checking account to the app. Fees are optional. You can initially borrow up to $100, but the amount can increase to $500 over time.

Possible: The Possible mobile app advances you up to $500 until your next payday. Possible offers no credit check loans, instead using your pay schedule and work history to approve your loan.

Even: You can borrow up to half of your next paycheck by signing up for the Even app. You’ll join a million employees who use the app to get paid early, move money into savings, and budget their spending.

Brigit: More than three million employees use the Brigit app to instantly receive payday advances of up to $250. Brigit doesn’t check credit and takes only a few minutes to join. For $9.99/month, you also get account alerts, budgeting tools, and $1 million in identity theft insurance.

Can I Get a Same-Day Loan If I Receive Government Benefits?

The reviewed lending services require dependable income, but it doesn’t necessarily have to be earnings from work. You can also qualify for a loan if you collect benefits from federal or state agencies, including the Social Security Administration (SSA) and the Department of Veterans Affairs.

SSA benefits may take the form of old age payments or disability insurance. Lenders will verify that you are enrolled in a benefits program and receive enough income to qualify for a loan.

Can I Get a Same-Day Loan if I’m Unemployed?

Lenders need some sort of proof that you can repay your debt. That means a steady and reliable income of some kind.

The network lenders may accept alternative income sources, such as worker’s compensation, federal or state benefits, alimony, child support, pensions, and annuities.

If you don’t have an income and are unemployed, you may need to consider a cosigner for your loan. A cosigner is someone who has better credit than you and a steady income who is willing to sign on to your loan to guarantee your ability to repay the debt.

Keep in mind that if you miss a payment or stop making payments altogether, you and your cosigner take the hit to your credit scores. That’s a tremendous responsibility that doesn’t always end well.

Before you officially sign a loan with a cosigner, you should sit down with the person and come up with a mutual plan on how you’ll repay the loan. Be forward and honest when discussing your financial abilities, and don’t make any promises you can’t keep. This will help avoid potential problems that can arise from such an agreement.

Is There a Minimum Credit Score Required?

Payday loans do not check your credit history. Nor do loans from pawnshops, family and friends (usually!), and title lenders. Most personal loan providers perform credit checks, but there isn’t any agreed minimum required score — each online lender sets its own policies.

It will be harder to get a loan if your score falls below 600, but you may be able to overcome a troubled credit history by posting collateral on a personal loan or enlisting the help of a cosigner.

Where Can I Borrow Money ASAP?

Some emergencies won’t let you wait until the next business day to pay your debt. If you can’t wait for a loan with a 24-hour turnaround, consider one of the options below that could provide near-instant funding — with some extra costs or due diligence.

- Get a Credit Card Cash Advance: If you have a credit card that provides a cash advance option, you can use the card as you would a debit card at an ATM. Keep in mind that a cash advance starts accruing interest charges the moment you withdraw your money. Plus, some credit cards charge hefty fees for this service — which can make it a pricey option.

- Sell Something: Online marketplaces like Craigslist or used-item shops that specialize in video games, electronics, furniture, clothes, or other items can offer you quick cash for your valuables. A positive of this option is that you aren’t required to pay the money back. A negative is that you’ll lose the item you’ve sold.

- Pawn Shop Loans: Pawn shops offer short-term, secured loans that use your valuables as collateral for the deal. These loans often feature high interest charges and repayment windows that stretch no more than 30 to 90 days. And, if you don’t repay your loan, you lose the items used as collateral.

- Title Loans: If you own your car outright or have equity in your current auto loan, you can access a car title loan to get quick cash. You essentially start your car loan over with a title loan. The new loan will cover the full value of your automobile. You’ll use part of the loan to pay off your current auto debt and can keep the rest as cash to use however you choose.

- Local Payday Lender: Just about every city or small town features a payday lender. These businesses offer short-term bridge loans that you agree to pay back when you receive your next paycheck. The loans offer incredibly fast payouts — with a heavy cost for the convenience. Most payday lenders feature four-digit interest rates that can turn a $500 loan into a multi-thousand-dollar debt if you don’t pay your bill on time. That’s why these loans should only be considered as a last resort.

- Borrow Money from Friends or Family: This is an age-old way of getting fast money. It’s also an option that’s ruined friendships and splintered families. That’s why it’s important that you fulfill your promises and obligations, and only borrow money when you know for certain that you can pay it back in the agreed-upon time frame.

As you can see, there are several ways to borrow money quickly, but some are more expensive than others. Deciding which method to pursue depends on how much money you need to borrow, the cost of the loan, and the repayment arrangements.

The Best Same-Day Loans Are Available Online

The internet provides you with ample opportunities to apply for fast cash loans. It takes only minutes to apply online and receive a loan offer if you qualify. The reviewed networks specialize in lending to consumers with all types of credit, including poor, limited, or none at all.

While you can get a fast payday, pawnshop, or title loan, think twice about the astronomical interest rates and fees they charge. Furthermore, these fast cash loans don’t report payments to the credit bureaus, so they can’t help you rebuild credit.

An online personal loan has much lower costs, reports to the credit bureaus, and can arrange a direct deposit into your bank account on the same or next business day. That’s good to know when you suddenly need emergency cash.

As with any loan type, the options above should be exercised with caution. Be sure to fully read the terms and conditions of any loan agreement before signing.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.