About 66 million Social Security beneficiaries qualify for cash advance loans. Another 5+ million are SSI recipients (SSI stands for Supplemental Security Income, a Social Security program for qualifying low-income individuals). Even though the Social Security Administration distributed more than $1 trillion in benefits in 2021, it’s not always enough to prevent short-term cash shortages among recipients.

Fortunately, lenders accept most forms of income, including Social Security benefits, when considering loan applications. Even at a high interest rate, an occasional short-term cash advance need not cause much financial damage. But beware of repeated costly borrowing, as it can lead to a debt spiral with devastating consequences.

Cash Advance Loans That Accept Social Security Benefits

These online loan networks arrange payday or personal loans to borrowers with bad credit but who receive a steady source of income, including Social Security benefits. Any one of them can quickly connect you to a direct lender that funds loans in as little as one business day.

While payday lenders usually don’t check credit, their loans are much more expensive than personal loans. If you have a choice between the two loan types, a personal installment loan is cheaper and less risky, especially for senior citizens on fixed incomes.

- Small personal loans starting at $100

- Receive an approval decision in as little as 2 minutes

- Funds can be deposited into your account in one business day and used for any purpose

- No hidden fees

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $20,000 | Varies | Varies | See representative example |

You can qualify for a loan from SmartAdvances.com as long as your benefits earnings exceed $1,000 per month. Its website says that some of its lenders accept requests from benefits earners, including Social Security recipients. You’ll also need a driver’s license or state-issued ID to verify your identity prior to loan approval.

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% – 35.99% | 60 Days to 72 Months | See representative example |

The 24/7 Lending Group can help you find a small loan with a fair interest rate. But you must be employed to receive a loan offer, so if Social Security benefits are your only form of income, we suggest using a different network.

3. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

You must collect at least $800 a month in earnings or benefits to prequalify for a payday or personal loan from MoneyMutual. This company remains our top-ranked network for short-term loans, thanks, in part, to its friendly customer service. It can quickly prequalify your emergency cash loan request and connect you to an appropriate payday lender or personal loan provider.

4. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

CashUSA.com can prequalify you for a personal installment loan if you receive at least $1,000 a month in after-tax earnings or benefits. You’ll also need to provide your email address, phone number, and checking account information. While CashUSA.com considers loan requests of up to $10,000, a low credit score will probably reduce the amount you can borrow.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 60 Months | See representative example |

For BadCreditLoans.com to prequalify your loan request, you must show a regular income from full-time employment, self-employment, or Social Security benefits. The amount you can borrow will depend on your income and credit profile, but each direct lender on the BadCreditLoan.com network sets its own loan approval criteria. You can apply for a personal loan or a revolving line of credit, whichever better suits your needs.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

While CreditLoan.com can arrange personal loans as small as $250, its website gives no hint about a minimum required income. However, it emphatically states its willingness to find a suitable direct loan provider for borrowers despite their low credit scores. More than 33 million folks have visited the highly educational CreditLoan.com website since its founding in 1998.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

PersonalLoans.com requires you to collect at least $2,000 a month in earnings or benefits to prequalify for a loan. Its website says, “In order to ensure that you will be able to repay a loan, you must either have full-time employment, be self-employed, or receive regular disability or Social Security benefits.” Beyond finding you a speedy cash loan, PersonalLoans.com can also connect you to providers of credit repair, credit monitoring, and debt settlement services.

- Quick loans up to $5,000 as soon as tomorrow

- Submit one form, get multiple options

- All credit ratings welcome — good or bad

- Requires a checking account and $800 minimum monthly income to apply

- No collateral or cosigner required

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

While the InstallmentLoans.com website emphasizes personal loans, it can also arrange payday loans if you prefer. It can instantly prequalify your cash loan request and refer you to one of its lending partners. The company’s website protects your security and privacy by employing AES 256-bit encryption.

What Is a Cash Advance Loan?

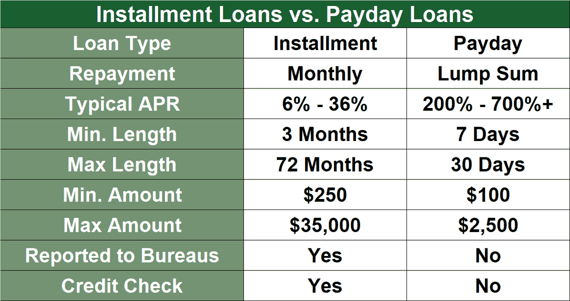

A cash advance loan is a short-term loan, usually tied to your income schedule, and the income may come from a job or another regular source. A payday loan is one type of cash advance, but you can borrow money via several alternatives, including short-term personal loans and credit card cash advances.

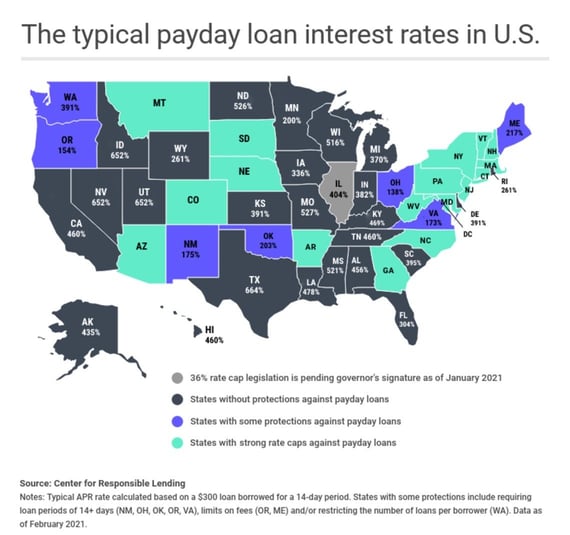

Payday loans are the most expensive form of a cash advance because they come with triple-digit APRs and very short repayment periods. You don’t need to pass a credit check to get a payday loan, which you repay in a lump sum. The Consumer Financial Protection Board cautions consumers about the safety of payday loans.

An online short-term personal loan requires a credit check and usually has an APR no higher than 36%. You repay the loan in a series of installments.

Most credit cards allow you to take cash advances up to a set limit with APRs no greater than 36%. While you may undergo a credit check to obtain a credit card, cash advances from the card require no further credit inquiries.

Can I Get a Cash Advance Loan When My Main Income Is Social Security?

Most lenders allow you to use your Social Security benefits as your primary income source. In fact, many lenders prefer Social Security recipient income to a paycheck because:

- You receive your money every month as a direct deposit.

- Your benefits continue for the remainder of your life.

- The amount you receive can grow each year due to cost-of-living adjustments.

- The federal government ensures payment.

On the other hand, employment income is less secure, and you could lose your job or the company could go out of business. Also, you don’t necessarily receive any cost of living increases.

How Do I Prove Income For a Cash Advance Loan?

Your lender may require documented evidence of your income before approving a loan. The evidence may include any of the following:

- Bank statements

- Paycheck stubs

- Benefits verification income letter from the Social Security Administration and other sources

- Tax returns

- IRS W-2 and 1099 forms

- A notarized document from your employer

Your lender may require online access to your bank account records to verify your income.

Can I Access Other Government Programs While Receiving Social Security?

Federal and state governments make available various other helpful programs to Social Security beneficiaries. A partial list includes:

- Medicaid for low-income persons under 65 years of age

- Medicare, including programs to pay for Medicare Parts A and/or B of low-income beneficiaries

- SSI benefits

- Social Security survivor benefits

- Supplemental Nutrition Assistance Program (i.e., food stamps)

- Social Security disability insurance

- Temporary Assistance for Needy Families (TANF)

- Unemployment benefits

- State or local assistance based on need

You can contact Customer Service at the Social Security Administration and your state or local governments for detailed information about resources available to you.

The Direct Express Card may be useful to folks receiving federal direct express emergency cash. The Direct Express Card is an SSI debit card designed for direct deposits of federal benefits. Unlike a prepaid debit card, the Direct Express Debit Card requires you to have a bank account to receive your direct deposits.

Are Cash Advance Loans Safe?

Any loan with a high interest rate is unsafe, especially if you are a Social Security recipient living on a fixed income. Cash advance payday loans are the least-safe payday advance due to their 391% and higher APRs. The fees are so high that you may not be able to repay them, leading to further financial problems.

Personal loans are less expensive than payday loans, but they are not cheap if you have bad credit. However, you can repay personal loans over an extended period, resulting in affordable monthly installments that don’t break your budget.

You can apply for a personal disability loan if you receive Social Security disability benefits. A disability loan relies on the benefits you receive for your disability.

Credit card cash advances are expensive, usually charging an APR of between 25% and 36% for subprime cardholders. You can repay the loan according to your schedule as long as you make the required minimum monthly payments on your credit card. The interest charges will mount up if you don’t repay these advances quickly.

An Income of $800 a Month Can Qualify For Cash Advance Loans

Short-term loans for Social Security and SSI recipients are available from several sources, including cash advance payday loans, personal loans, and credit card advances. The required income amount may be modest.

For example, our top-ranked lending network, MoneyMutual, requires an income of only $800 a month to prequalify for a cash advance loan. Keep in mind that most loans for folks with bad credit are expensive and can be pretty risky.

If you have trouble living on your Social Security income, consider seeking out a nonprofit credit counseling organization for free help budgeting your money. You can also contact a local social worker for additional information about your various options.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.