You may be on the lookout for credit card loans for bad credit for a specific reason. For instance, you may want to pay off all your credit card debt through a loan, which allows you to make one monthly, manageable payment on the loan. This strategy can save you a lot of money on interest and help you become debt-free faster.

Or, you may want to take out a credit card loan to fund a purchase you may not have the cash for upfront. This could be a home improvement project, car repair, or even a vacation. Click the link below that describes the type of credit card loan you’re seeking, and we’ll provide your best options from there.

Credit Cards for Bad Credit

You don’t need the best credit to get approved for a credit card. Fortunately, a variety of credit cards for bad credit can help you finance any purchase you’d like.

Each credit card comes with its own set of perks, so it’s important to familiarize yourself with all your options before selecting one.

- Earn 1% cash back rewards on payments made to your Total Credit Card

- Checking Account Required

- $300 credit limit (subject to available credit)

- No security deposit, simply pay a one-time $95 program fee to open your account.*

- User friendly Mobile App.

- *See Rates, Fees, Costs & Limitations for complete offer details

- See Total Card Visa Rewards Programs Terms & Conditions for details

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 35.99%* | Yes | 8.5/10 |

While you do have to pay a program fee to use the Total Visa® Unsecured Credit Card, it’s a good choice if you’d like to rebuild your credit. The card reports to the three major credit bureaus every month, so as long as you make timely payments, it can allow you to build a positive credit history.

You’ll find the application process to be fast and easy, and you’ll receive a response in seconds. Your chances of approval are high if you have a valid checking account.

- Earn 1% cash back rewards on payments made to your First Access Credit Card

- Checking Account Required

- $300 credit limit (subject to available credit)

- No security deposit, simply pay a one-time $95 program fee to open your account.*

- User friendly Mobile App.

- *See Rates, Fees, Costs & Limitations for complete offer details

- See First Access Rewards Programs Terms & Conditions for details

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 10 minutes | 35.99%* | Yes | 8.0/10 |

The First Access Visa® Credit Card may be the answer if you’ve been declined by other credit card companies. It doesn’t require perfect credit and can give you access to a $300 credit limit.

All you have to do to use it is pay a program fee. The First Access Visa® Card can help you improve your credit since it reports to all three credit bureaus.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply!

- Monthly Credit Score – Sign up for electronic statements, and get your Vantage 3.0 Score Credit Score From Experian

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- See if you’re Pre-Qualified without impacting your credit score

- Fast and easy application process; results in seconds

- Online account access 24/7

- Checking Account Required

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 29.99% APR (Variable) | Yes | 8.5/10 |

The Surge Mastercard® welcomes applicants of all credit types. Even if you don’t have the best credit, you can apply and receive an answer in seconds.

It’s a great resource if you’d like to boost your credit because it reports to the three major credit bureaus monthly. If you sign up for e-statements, the Surge Mastercard® will also give you free access to your Experian Vantage 3.0 score.

Credit Card Debt Consolidation Loans for Bad Credit

If you’re overwhelmed by debt, a credit card debt consolidation loan may make sense. Several lenders offer credit consolidation loans to applicants who have bad credit. They can help you simplify the debt payoff process and improve your financial situation.

4. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

CashUSA.com may be a solid pick if you have lots of debt, as it offers loans of up to $10,000 with APRs that range from 5.99% to 35.99%. Once you fill out the online form, it’ll connect you to loan offers from its partner lenders.

You may be eligible for one of its partner’s loans if you earn at least $1,000 a month after taxes. You can get the funds sent directly to your bank account and start paying off your debt right away.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

CreditLoan.com has matched more than 750,000 borrowers to personal lenders. You can use its marketplace to find a loan between $250 and $5,000 and receive a decision in minutes.

Once approved, you may get the money via direct deposit the next day. You’ll find its website useful for lender reviews and financial resources.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 60 Months | See representative example |

Bad Credit Loans focuses on helping people with bad credit get the financing they need to do things like pay off debt. The site can connect you to lenders that offer three- to 60-month loans ranging from $500 and $5,000.

You’ll need proof of regular income from employment or Social Security benefits to access the Bad Credit Loans network. If approved, you can get the cash you need as soon as the next business day.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

With PersonalLoans.com, you can secure a loan to pay off debt that ranges from $500 to $35,000. You don’t need a stellar credit score to qualify but you must show that you’re a responsible borrower.

That means you don’t have a history of late payments, overwhelming debts, or bankruptcies. PersonalLoans.com can get you your funds in one business day.

Can I Get a Loan on a Credit Card?

You may be able to get a loan on a credit card through a credit card cash advance. Essentially, a cash advance allows you to withdraw cash from your credit limit. It differs from a bank account withdrawal because you have to pay it back — with interest.

Cash advances are usually offered by banks, ATMs, and payday lenders. While they allow you to get the cash you need quickly, they are also very expensive.

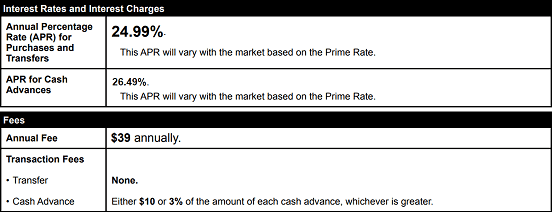

When you take out a cash advance, you’ll likely have to pay a fee that ranges anywhere from 3% and 5% of the cash amount. Not to mention the cash advance APR that is separate from your regular purchase APR, which also doesn’t allow an interest-free grace period.

The APR and fees you’ll be charged for a credit card cash advance are in your card’s terms and conditions.

In most cases, cash advances should only be used for emergency situations. So, if you can’t make your rent payment and are worried you’ll get evicted, a cash advance may make sense.

If you’d like to go on a vacation or splurge on a fancy dinner, it’s not a good idea to take out a cash advance.

Fortunately, cash advances are usually easy to qualify for and you don’t need the best credit. As long as you’ve used your credit enough over the past six months or so, you should be able to get a cash advance.

If you discover that a cash advance is not right for you but you need access to fast cash, consider your alternatives. You can take out a personal loan, borrow money from friends and family, or overdraw your checking account and pay a fee.

Is it Smart to Get a Loan to Pay Off Credit Cards?

It can be tough to keep track of all the different payments you owe if you have a lot of debt spread across multiple credit cards. After all, each payment is a different amount and due at a different time of the month.

Not only can these payments start to get very expensive, but they can also overwhelm you. Getting a loan is a smart move if you have more credit card debt than you can easily keep track of. With a debt consolidation loan, you can pay off all your debts and pay back your loan via one, manageable monthly payment.

You’ll no longer have to remember how much you owe to which card companies and when each payment is due. You’ll be less likely to lose track of your payment schedules since you’ll only have one payment to worry about. You’ll find it much easier to prevent missed payments, which can take a serious toll on your credit score.

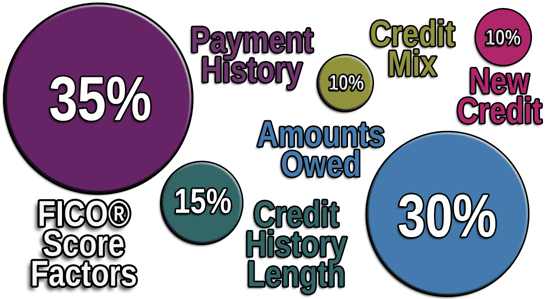

Debt consolidation can make it easier to manage payments. This is important because your payment history is the most heavily weighted factor used to calculate your credit score.

A loan can also help you save money because it can reduce the amount of interest you pay over the lifetime of your debts. This is a huge benefit, as credit card interest can add up to a great deal of cash.

If you have a spending problem, however, a loan to pay off your credit cards is not a solution. This strategy is a way to help you simplify the debt payoff process.

It won’t help you decrease your spending and live within your means. You may want to work with a credit counselor or join a support group instead.

Does Debt Consolidation Hurt Your Credit?

You may be hesitant to consolidate your debt because you’re worried it may hurt your credit. The reality is that while debt consolidation can hurt your credit, it can also help it. In fact, you may be able to prevent this strategy from lowering your credit score.

If you have bad credit, you may have to apply for several loans until you get approved for one. This can lead to multiple hard inquiries on your credit report in a short time frame, which will ding your credit.

Fortunately, you can avoid this issue by checking your credit before you apply for a loan.

Only apply to lenders that specialize in credit card loans for bad credit like the ones we’ve listed above. It doesn’t make sense to apply to a lender that only approves those with good or excellent credit if you have bad credit.

Now that you know how debt consolidation can hinder your credit, you may wonder how it can improve it. When you consolidate your debt, you can lower your credit utilization ratio, which is the total amount of credit you’re using divided by the total amount of credit available to you.

Example of credit utilization across three credit cards.

The lower your credit utilization ratio, the higher your credit score. Financial experts suggest that you keep your credit utilization under 30% if possible.

Debt consolidation can also make it easier for you to make timely payments. Having a positive payment history with no missed payments is another way to achieve a better credit score.

Meet Your Financial Goals

Whether you’d like to pay off debt or fund a large purchase, credit card loans for bad credit can help. They can make the debt payoff process less overwhelming or allow you to pay for goods or services without the upfront cash.

Be sure to do your research so you understand the fees and interest charges of all the credit card loans for bad credit at your disposal. This way, you can find the ideal card for your unique situation and meet your financial goals.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.