Consumers with very poor credit scores between 400 and 450 often have their credit applications rejected, according to FICO, a credit scoring agency. But it doesn’t have to be that way. Loans and credit cards for 400 to 450 credit scores are still available.

Being approved may require a little extra work, such as paying extra fees or putting down deposits on credit cards, since about 62% of consumers with a credit score under 579 are likely to become seriously delinquent in the future.

Having a FICO credit score in the 400 to 450 range is the result of several credit missteps: repeated missed or late payments, defaulted or foreclosed loans, and possibly bankruptcy. Building your credit takes time and is a worthwhile step toward better loan terms in the future.

Until then, look at our list of best loans and credit cards for 400 to 450 credit scores to see what’s available for your credit needs. We’ll cover personal loans, credit cards, auto loans, mortgages, and answer some of the most commonly asked questions about this issue.

Personal Loans | Credit Cards | Auto Loans | Home Loans | FAQs

Personal Loans: 400-450 Credit Score

Personal loans are one of the best ways to borrow a large sum of money. The repayment periods can last from a few months to six years, at rates ranging from 6% to 700% APR, depending on the type of loan. The money can be used for any reason, including to consolidate credit card debt, which often has higher interest rates than personal loans.

The loans are repaid through installments (fixed monthly payments) or with your next paycheck. Compare interest rates and repayment terms to find the least expensive offer.

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% - 35.99% | 60 Days to 72 Months | See representative example |

24/7 Lending Group helps consumers find unsecured personal installment loans from $500 up to $35,000. You may be required to repay the loan in a single lump sum or through monthly installments, depending on the loan offer you accept.

The site has a personal loan calculator to help you estimate the monthly payments and total cost, which can help you get an idea of what you can afford. There is never an obligation to accept a loan offer.

2. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

If you’ve had a recent bankruptcy discharge on your credit report, then a short-term loan through an online lending network such as MoneyMutual may be best for you.

It connects customers with several potential lenders so they can compare rates and see which is the best option for them. MoneyMutual offers short-term cash advance loans of up to $5,000 with loan terms of up to six months.

These loans may require full repayment in a single lump sum on the due date. That means paying back the full principal — the borrowed amount — along with all finance charges and any other fees, at one time. If you don’t think you can do that for a short-term loan, then you’re probably better off with an installment loan or a credit card to avoid high late fees and finance charges.

3. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

CashUSA.com is another online marketplace for finding personal loans. The lenders in its network charge APRs from 5.99% to 35.99%, with loan durations from 90 days to six years.

If approved, your loan amount can be electronically deposited into your account in one business day. Having a steady monthly income of at least $1,000 after taxes can be enough to be approved for a loan.

Credit Cards: 400-450 Credit Score

A very poor credit score below 450 may not qualify for an unsecured credit card, but you still have options. Some credit card companies offer secured cards to consumers with sub-500 credit scores. Each has benefits and drawbacks to consider.

- New feature! Earn up to 10% cash back* on everyday purchases

- No credit check to apply. Zero credit risk to apply!

- Looking to build or rebuild your credit? 2 out of 3 OpenSky cardholders increase their credit score by an average of 41 points in just 3 months

- Get free monthly access to your FICO score in our mobile application

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Fund your card with a low $200 refundable security deposit to get a $200 credit line

- Apply in less than 5 minutes with our mobile first application

- Choose the due date that fits your schedule with flexible payment dates

- Fund your security deposit over 60 days with the option to make partial payments

- Over 1.4 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit

- *See Rewards Terms and Conditions for more information

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 25.64% (variable) | Yes | 7.0/10 |

The OpenSky® Secured Visa® Credit Card can help you build your credit score over time with responsible use. You can open an account with as low as a $200 refundable deposit, and your credit limit will be equal to the deposit amount.

The card issuer doesn’t perform a credit check and you can access your free FICO score every month through its mobile app. We advise you to read the terms and conditions of this card and look at its variable APR before applying.

- 1% Cash Back Rewards on payments

- Choose your own credit line – $200 to $2000 – based on your security deposit

- Build your credit score.¹ Reports to all 3 credit bureaus

- No minimum credit score required for approval!

- ¹ Cardholders who keep their balance low and pay their credit card bill on time every month typically do see an increase in their credit score.

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 9 minutes | 19.24% (V) | Yes | 7.5/10 |

The First Progress Platinum Select Mastercard® Secured Credit Card is a card that doesn’t require a minimum credit score for approval. The card sets your credit line based on your deposit amount — from $200 to $2,000.

This card charges an annual fee, late payment fees, and a high variable interest rate for a secured card. Unfortunately, that is often the cost of having a poor credit score. But this card can help you boost your score over time with on-time payments as it does report to all three credit bureaus.

- Earn 1% Cash Back Rewards on payments made to your First Latitude Secured credit card account.

- Past credit issues shouldn’t prevent you from getting a credit card with great benefits & rewards!

- Choose your own fully-refundable credit line – $200 to $2000 – based on your security deposit.

- Build or rebuild your credit!¹

- Accepted wherever Mastercard® is accepted

- Reports to all 3 credit bureaus

- No minimum credit score required for approval!

- ¹Cardholders who keep their balance low and pay their credit card bill on time every month typically do see an increase in their credit score.

- *See Important Disclosures for complete offer details

| Application Length | Interest Rate | Reports Monthly | Reputation Score |

|---|---|---|---|

| 5 minutes | 19.24% (V) | Yes | 8.0/10 |

The First Latitude Select Mastercard® Secured Credit Card is another unsecured card option that welcomes applicants with poor credit.

No minimum credit score is required for approval, and using the card responsibly can strengthen your credit history because the card account is reported to the three national credit bureaus. The issuer provides a quick and easy application process.

Auto Loans: 400-450 Credit Score

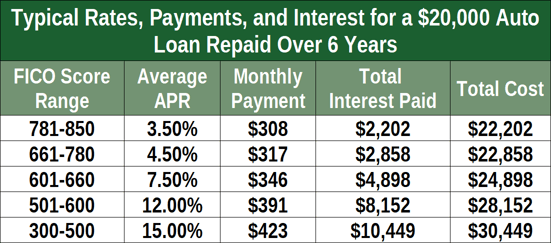

Auto loans are a type of installment loan, though they differ from personal loans in a few ways. The main difference is they can only be used to buy a vehicle. Auto loans are also secured loans, meaning the vehicle is the collateral for the loan and can be taken (vehicle repossession) if you default on the payments.

That makes auto loans less risky for the lender and can make an auto loan a little easier to get approved for than some unsecured loans.

- Network of dealer partners has closed $1 billion in bad credit auto loans

- Specializes in bad credit, no credit, bankruptcy and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have $1500/month income to qualify

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 3.99% - 29.99% | 1999 | 3 minutes | 9.5/10 |

Auto Credit Express is an online dealer network that helps car buyers with poor credit find dealers that will work with them. It will offer you a list of dealers in your area that use its services, you choose the car you want to buy, and then arrange financing through the dealer.

Auto dealers often have more flexible credit requirements than banks, credit unions, and third-party lenders, and may be more willing to work with borrowers who have credit scores of 400 to 450. But they also charge higher interest rates.

There aren’t any minimum credit score requirements, though you’ll need a monthly income of $1,500 or more to qualify for financing through an Auto Credit Express dealer.

8. LendingTree

- Auto loans for purchase, refinance, and lease buyouts

- Nationwide lender network

- Get matched with up to 5 lenders that fit your financial profile

- It only takes a few minutes and is free with no obligation

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1998 | 4 minutes | 9.5/10 |

You can submit an online application to LendingTree and get up to five offers in minutes, even with a very poor credit score.

Whether you need to purchase, refinance, or buy out your lease, LendingTree can connect you with a direct lender to secure the auto loan you need. LendingTree is rated Excellent by Trustpilot reviewers.

- Loans for new, used, and refinancing

- Queries a national network of lenders

- Bad credit OK

- Get up to 4 offers in minutes

- Receive online loan certificate or check within 24 hours

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2003 | 2 minutes | 8.5/10 |

The website myAutoloan.com works the same as Auto Credit Express by connecting car shoppers with bad credit to car dealers to find the best loan option for their financial situation.

The service will set up your meeting with the dealership’s finance manager. All you have to do is go to the dealership, choose your new or used vehicle, sign the papers, and drive away.

Home Loans: 400-450 Credit Score

A home loan is one of the largest loans you’ll ever take out in your life. And you don’t need a perfect credit score to get one.

What will help, however, is having a sizable down payment, preferably 20%. A down payment of at least 10% is needed to qualify for an FHA loan if your credit score is below 580, compared to 3.5% if your score is 580 or better.

10. eMortgage

- Get today's mortgage rates from the top mortgage lenders and banks

- Easily compare and choose mortgage lenders with no obligations or fees

- Review current mortgage rates side by side

- Pick mortgage lenders that meet your specific needs

- Compare rates from pre-qualified and approved mortgage lenders — 100% online, 100% free

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1979 | 4 minutes | 8.5/10 |

The online lending network eMortgage is a simple way to get quotes from multiple lenders without going from bank to bank.

It helps you find conventional and FHA lenders for new purchases and mortgage refinancing. If you qualify for a loan, you can get up to five offers to compare, and a mortgage is one loan you definitely want to shop around to compare the best rates for.

11. FHA Rate Guide

- Options for home purchase or refinance

- Get 4 free refinance quotes in 30 seconds

- Network of lenders compete for your loan

- Trusted by 2 million+ home loan borrowers to date

- Interest rates are near all-time lows

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2004 | 4 minutes | 8.5/10 |

Available for both home purchases and refinancing, the FHA Rate Guide will provide you with four free quotes in 30 seconds.

A network of lenders will compete for your loan, which is important when shopping for the best rate.

- For military veterans, service members, their spouses, and other eligible beneficiaries only

- No down payment and no monthly mortgage insurance

- The basic entitlement available to each eligible veteran is $36,000

- Lenders generally loan up to 4 times a veteran's available entitlement without a down payment

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies by Applicant | 1944 | 9 Minutes | 7.5/10 |

Military veterans can get a home loan through the U.S. Department of Veterans Affairs, which provides a home loan guarantee to private lenders. The VA guarantees a portion of the loan, enabling the lender to provide veterans with more favorable terms.

The VA doesn’t have a minimum credit score requirement to guarantee a mortgage, and most VA loans are obtained without a down payment. However, lenders that make these loans do have credit score benchmarks — usually a credit score of at least 620 — so a down payment may be needed if you have a credit score of 400 to 450.

FAQs About Bad Credit Loans

Don’t assume you can’t get a loan — whether it’s a personal loan, credit card, auto loan, or home loan — because you have poor credit. As we’ve explained through our list of best loans and credit cards for 400 to 450 credit scores, there are lenders that work directly with such consumers and want to provide them credit.

It can be confusing, so here are some frequently asked questions that will hopefully clear some things up:

How Bad is a Credit Score of 450?

Credit scores start as low as 300. If your credit score is 450, then you’re significantly below the average credit score.

Your credit applications are likely to be rejected or you may have to put down deposits on secured credit cards as a way to rebuild your credit. You’ll basically have to live off whatever cash you have on hand.

Among consumers with scores of 450, 27% have credit histories showing they’ve gone 30 or more days past due on a payment within the last 10 years. That’s a lot of financial history to make up for, and it will take time as your credit behaviors improve.

The average utilization rate for people with scores below 579 is 73%, according to 2020 Experian data. That’s a high rate, especially when considering that a 100% rate is using your entire spending limit and maxing out your credit cards.

Ideally, your credit utilization rate should be below 30%. To figure out what yours is, add up the balances on your credit cards and divide by the sum of their credit limits.

What’s the Easiest Loan to Get with Bad Credit?

A personal loan may be one of the easiest loan types to get with bad credit. Most personal loans are unsecured, meaning you don’t have to put your home or car up as collateral in case you default on the loan, when your property could be seized and sold to repay the loan.

The downside of having bad credit, however, is that you will be charged the highest interest rates of 36% or so (much higher with short-term cash advances) to get a personal loan. The upside is that you’ll get the money you need.

Quotes for personal loans can be found from lenders online, making it easy to apply. Look for companies that don’t charge prepayment fees. They’ll normally get their profit from commissions for referring customers to lenders.

The other type of loan that is generally easy to get with bad credit is an auto loan. That’s because the lender can repossess the vehicle if you miss payments, and you’ll be out the money you paid to the loan up until that point and left without a ride.

Which Loan Company is Best for Bad Credit?

All the companies we’ve listed have online applications that take only minutes to fill out, and responses also often come back within minutes. Your best matches — if you have any — are returned, and you can compare each offer from there.

Having a credit score of between 400 and 450 will likely get you the highest interest rate on a loan. That’s to be expected. However, it’s still worthwhile to shop around for the best rate because it determines the amount you pay for the loan.

Our top-recommended lending networks and products are as follows:

Personal Loans: MoneyMutual

Credit Cards: PREMIER Bankcard® Mastercard® Credit Card

Auto Loans: Auto Credit Express

Home Loans: eMortgage

If an offer is returned, look for lenders that charge minimal or no fees, penalties, or require collateral.

Are there Any Guaranteed Loans for Bad Credit?

There’s no such thing as a 100% guaranteed loan, even for people with excellent credit. But many lenders have flexible credit requirements that will take a chance on your poor or limited credit history.

Some close-to-guaranteed options include a pawn loan, where you visit a pawnshop with a valuable item you can use as collateral for a quick cash loan. But the amount you’ll receive is usually far less than what the item’s actually worth.

Another option is a title loan if you own your car. You can use your vehicle’s title as collateral for cash, but these are incredibly risky because if you stop making payments, the lender will take your car.

Finally, payday loans are generally easy to be approved for without a credit check if you can provide proof of income to repay the loan. These loans have triple-digital interest rates and are not legal in every state due to their predatory nature.

A credit card is a possibility if you only need a couple hundred dollars and need time to repay the debt. Still, it may not be a good choice, because some credit cards offered to people with bad credit require a cash deposit to cover the credit amount being issued. These secured credit lines are best when used as a tool to build credit, not when you need a loan.

What’s the Lowest Credit Score Needed to Buy a Car?

Getting an auto loan with a credit score of between 400 and 450 is more possible than you may think. These are installment loans, and since the vehicle is used as collateral to secure the loan if you default on the payments, the lender has a good chance of getting your car or your money.

Obviously, they’d prefer you made your loan payments on time.

The secured nature of auto loans makes getting approved for car financing, even if you have bad credit, easier than some unsecured loans. The interest rate from a lender that specializes in auto loans for people with bad credit will likely be higher than it would be from a bank or credit union.

Online dealer networks, some of which we’ve listed above, specialize in helping consumers with poor credit buy cars they can afford with payments they can afford and make on time. Loans are arranged through an auto dealer. Credit score requirements are usually minimal, and a monthly income of at least $1,500 is often required.

Very Poor Credit Shouldn’t Be a Roadblock

Hopefully, our list of the best loans and credit cards for 400 to 450 credit scores has convinced you that you can get a loan or credit card with very poor credit. Several options are out there to provide you money when you need it.

You can start improving your credit score by making on-time payments and not using more than 30% of your credit limit. From there, the road to a better credit score and, ultimately, better credit terms should only improve.

Range of credit scores covered in this article: 400, 401, 402, 403, 404, 405, 406, 407, 408, 409, 410, 411, 412, 413, 414, 415, 416, 417, 418, 419, 420, 421, 422, 423, 424, 425, 426, 427, 428, 429, 430, 431, 432, 433, 434, 435, 436, 437, 438, 439, 440, 441, 442, 443, 444, 445, 446, 447, 448, 449, 450 credit score

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.