Whether you’re looking for a bad credit personal loan or any other unsecured personal loans, this CreditLoan.com review is for you.

Since 1998, CreditLoan.com has helped connect more than 750,000 consumers with lenders that offer unsecured loan products in various loan amounts with an affordable interest rate, loan term, and monthly payment.

And since CreditLoan.com has two distinct lending networks — one for poor credit applicants and another for consumers who have good or better credit — you can rest assured that the right lenders have access to your loan request.

But does CreditLoan.com only partner with reputable lenders? Let’s dig a little deeper and find out.

How to Apply | Qualifications | Around the Web | FAQs

A Dedicated Network of Bad Credit Lenders

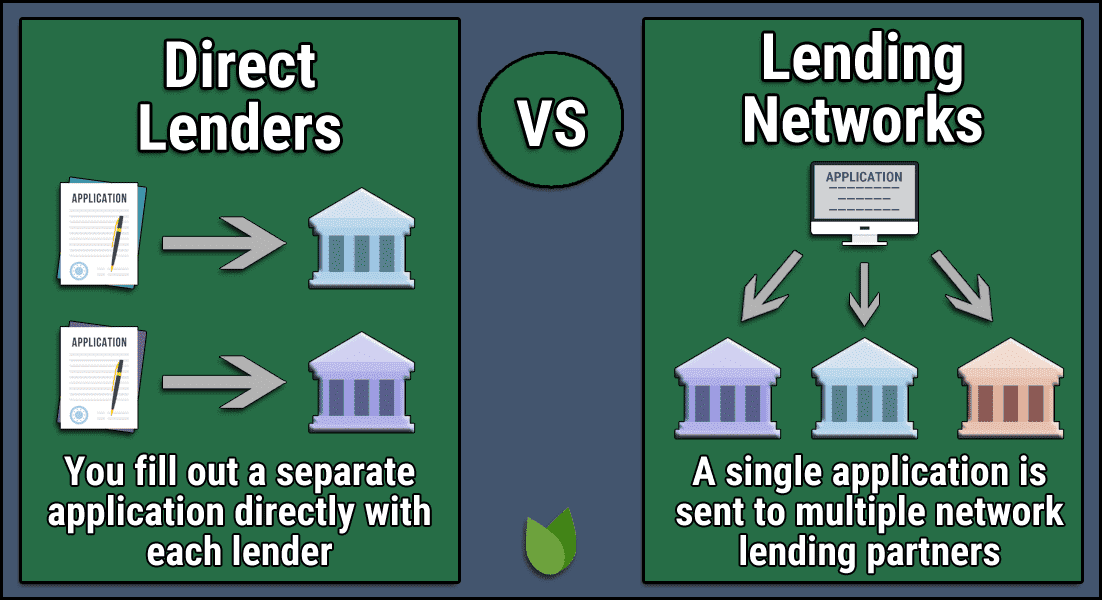

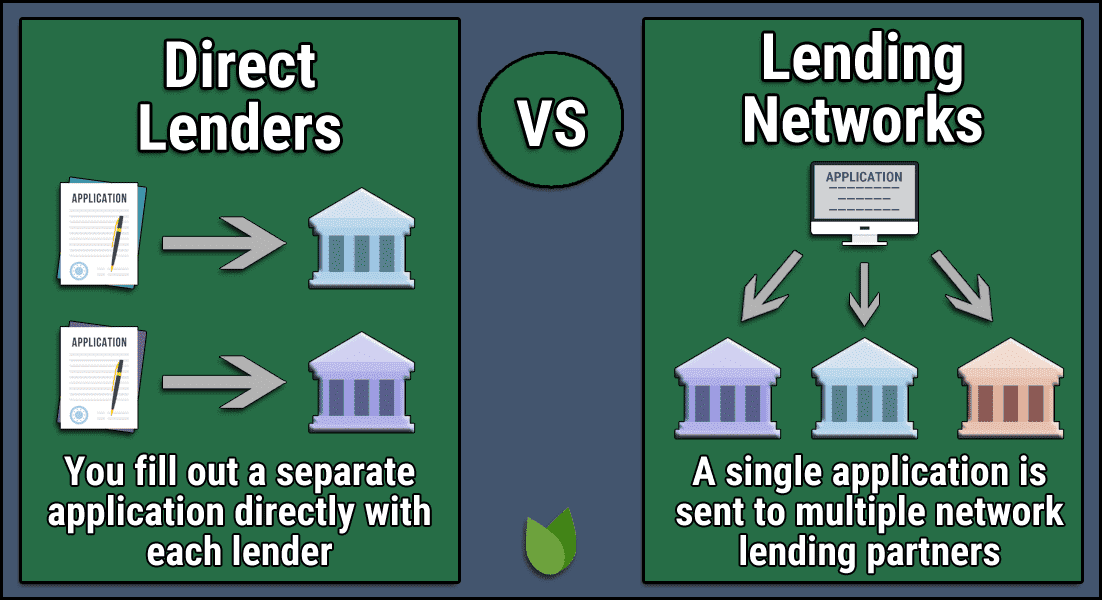

When you submit a single loan request to CreditLoan.com, the network forwards your needs to every eligible partner lender. This requires a simple soft credit pull that will not harm your credit score.

In a matter of minutes, you may receive an email with multiple loan offers to choose from. If you find a loan offer that meets your needs, you can complete your loan paperwork in as little as an hour and have money in your linked bank account by the next business day.

How to Apply For a Loan of Up to $5,000

Although CreditLoan.com states on its website that it accepts loan applications for up to $25,000, the dedicated group of lenders that specialize in bad credit personal loan products cap their offers at $5,000. The minimum loan amount for any credit rating is $250.

A loan of $5,000 is still a larger-than-average subprime loan and can be a boon for your finances, especially when you consider the competitive auto loan, student loan, and personal loan interest rate options. Before you apply, be aware that the network currently does not accept loan requests from residents of New York or Connecticut.

When you’re ready to apply, follow these steps:

- Choose your state: This lets the network know if you qualify to apply for a loan.

- Provide your name, email address, and zip code to begin the loan request process.

- Enter how much you want to borrow, between $250 and $5,000.

- The network will then ask for your phone number. CreditLoan.com may use this to send you texts or push notifications related to your loan request.

- The next page will ask if you are an active member of the military. This could affect the type of loan you qualify for.

- The following screen will require you to provide your total monthly income. This isn’t just from full- or part-time employment. You can also choose an option for Social Security, disability, retirement, veterans, public assistance, or unemployment benefits.

- Enter whether you receive your income via a paper check or direct deposit. You’ll also have to clarify whether you have a checking account — you must have an active checking account in your name to qualify for a loan.

- You’ll then be asked about your relative credit health. If you’re not sure, you can estimate. Your options are Excellent (a credit score of 740 or greater), Good (680 to 740), Fair (620 to 680), or poor (under 620).

- You’ll then enter your home address and whether you currently rent or own the property.

- Next, enter how often you receive a paycheck or benefits check. Your options are weekly, every-other week, twice a month, or monthly.

- Finally, you must provide your Social Security number and date of birth. This is how the network will access the soft credit pull that it will forward to its partner lenders. The network will not accept any other identification number, such as an ITIN or driver’s license number.

If you only complete a portion of the loan request and later come back to the website, you’ll restart where you left off. The entire request typically takes less than five minutes to complete.

Once you submit that information, CreditLoan.com will go to work sending your request to all of the lenders that work with your specific type of credit. Each loan broker uses an automated underwriting system and can make credit decisions in a matter of minutes at any time of the day or night.

Shortly after you submit your loan request — typically between five and 10 minutes — you’ll receive an email from CreditLoan.com with the results of your request. This will tell you whether you prequalify and may contain multiple loan offers for you to choose from.

If you don’t qualify, this is unfortunately the last step in the process. If you receive a loan offer, you can choose if you want to accept a loan product. If you do, the network will forward you to the website of the lender of your choice.

This is where you’ll complete the official loan agreement paperwork. You’ll also have to agree to a formal credit check. While pre-approval is a strong indicator of future success, it isn’t a guarantee that you’ll get the loan. Like most things in the financial world, nothing is certain until all of the parties sign the final paperwork.

A lender could still decline your loan application if your credit report shows something that wasn’t present on the modified version of your credit history submitted during the soft credit pull.

But if your credit check passes with the lender, you can submit your final paperwork for approval. Once the lender signs off on your loan, you will receive your funds via direct deposit to your linked bank account by the next business day.

The time it takes to complete the entire process will depend on when you apply. If you submit your paperwork late at night, over the weekend, or on a holiday, you’ll have to wait until the next business day to complete the process and receive your money.

If you make time to submit a loan application early on a business day, you can often complete the process in an hour or less without ever leaving your home or visiting a bank branch or lending center.

You’ll never have to pay CreditLoan.com for its services. Instead, the network will receive a referral fee from the loan broker after your loan closes. Once the process ends, you’ll only communicate with the lender and send all of your payments directly to the lender.

How to Qualify

CreditLoan.com doesn’t publish a list of requirements an applicant must meet to qualify for a loan product. The network states that each lender has its own criteria for approval. What may be a non-starter with one lender may be completely acceptable for another.

But you should know a few things before you apply:

- You cannot apply if you’re a resident of New York or Connecticut

- You must be 18 or older

- You must have an active bank account in your name

- You cannot have an active bankruptcy case

- You must have some form of consistent income

Unlike other online lending networks, CreditLoan.com doesn’t insist that the potential borrower meet specific income requirements to apply. While each partner lender will have such standards, their target numbers aren’t published on the network’s website.

You can include several forms of qualifying income on your application in addition to money earned from full- or part-time employment, including:

- disability benefits

- Social Security

- unemployment benefits

- a structured settlement

- an annuity

- rental property income

- student aid

- investment returns

While the network’s FAQs section states that a borrower won’t likely qualify for an installment loan if they have an active bankruptcy case pending in court, it claims that it often finds loan options for those who have previous bankruptcies or bad debt on their credit history.

You must also have a bank account (checking or savings) with a bank or credit union in your name to qualify. The online lender that you choose to work with will use this account to deposit your loan proceeds and will also rely on this account to accept your monthly payment.

Reviews Around the Web

As with most online lenders, CreditLoan.com has a mixed bag of reviews from around the internet. Although the company maintains a fairly high rating on most review websites, a little digging shows that a majority of the negative consumer reviews come from applicants who were denied a loan.

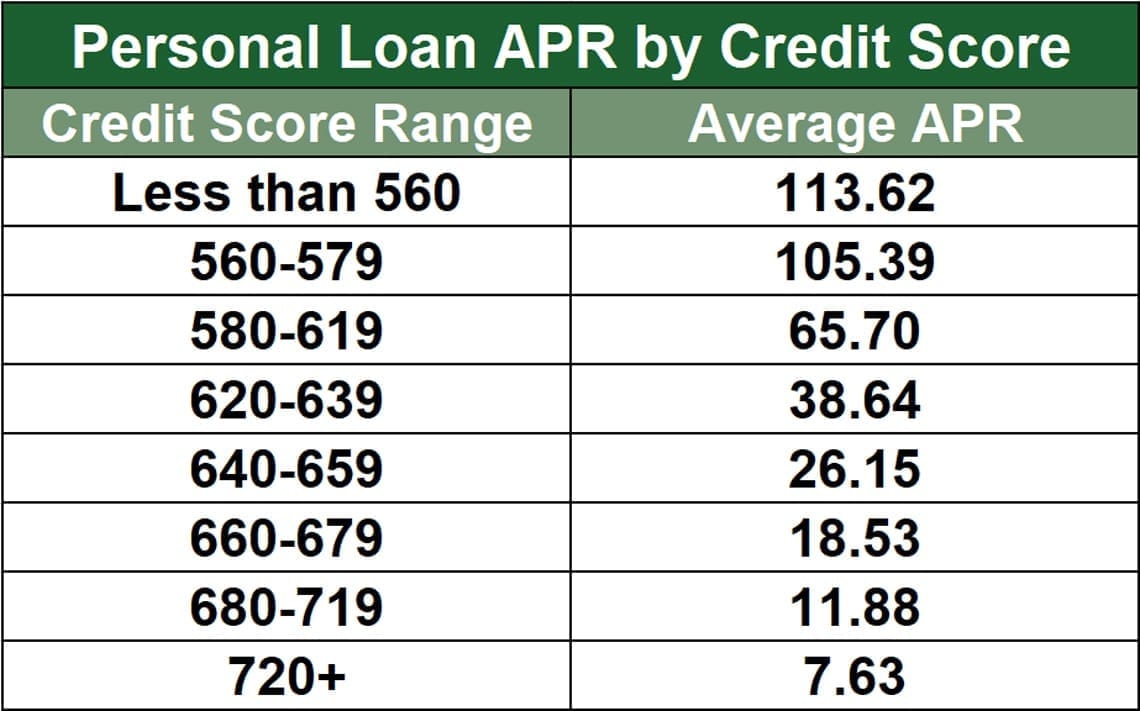

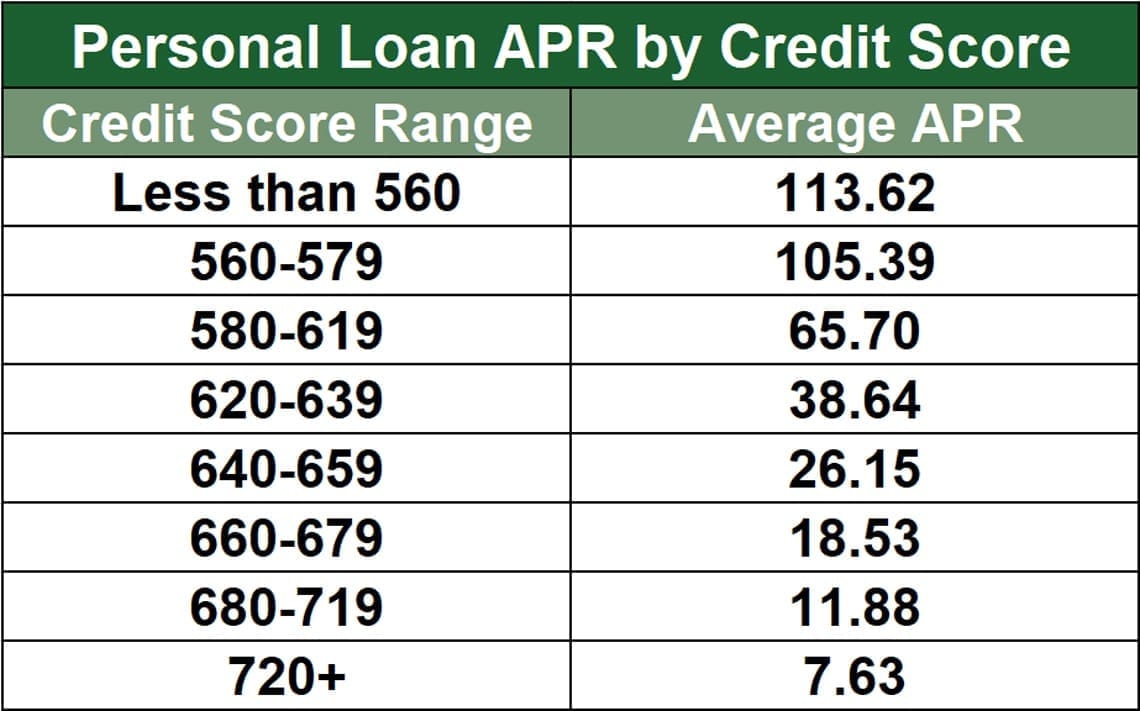

The chief complaint among those who qualified for a loan seems to be the cost of credit. These borrowers cited a higher than expected origination fee and interest rate charges. Although this is certainly a hindrance for many people’s budgets, you will receive the loan terms — including the APR and fees — from each lender before you accept a loan. It’s up to you to choose the loan offer you’re most comfortable with.

Keep in mind that any subprime loan — whether through a bank, a credit union, or an online lender — will come at a higher cost compared with a loan for someone who has good credit.

To date, CreditLoan.com maintains an A+ rating with the Better Business Bureau and has no complaints on file. The BBB does not accredit the lending network, though. According to Reviewopedia, this is because the network once had a D+ rating from previous reviews that caused it to lose its accreditation.

Recent reviews, however, show a company that works with reputable lenders that offer affordable loans with good repayment terms. Lenders also report your payment and balance history to each credit bureau, which can help you improve your credit score with responsible behavior.

The network also has a 3.6 out of 5 rating with Trustpilot.com. As of the time of publication, 55% of all reviews gave the network five stars. This includes:

“Their site was safe and quickly connected me to a reliable lender. I was approved for a reasonable amount, but I couldn’t provide a collateral. But the company they connected me to is good and well known” — Elizabeth, a Trustpilot reviewer

The mention of collateral shows that a borrower can qualify for both unsecured personal loans and secured loan options. Secured loans are typically easier to qualify for but will require collateral — such as a vehicle title, home, or another valuable item — to secure the loan against default.

The different types of loans — and the vague declarations of what a consumer needs to qualify — seem to strike a negative chord with some reviewers.

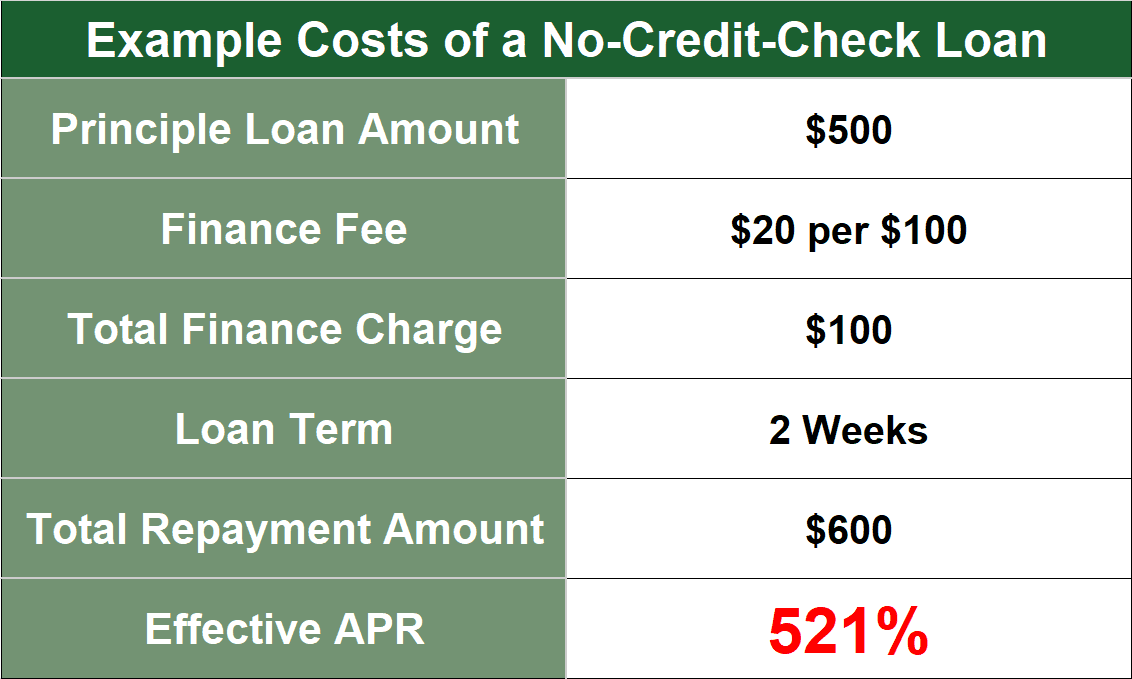

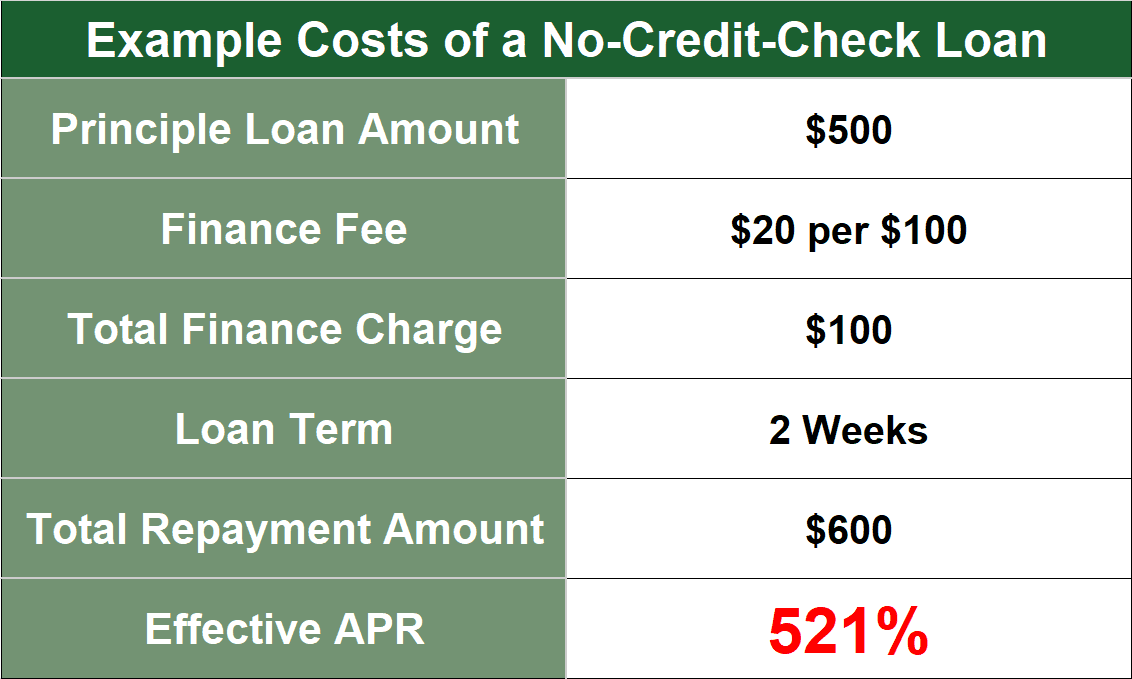

“I looked at several lenders it was going to match me up with and the first one was offering a 500$ but you would be paying 360+% of the borrowed amount. All the other ones it showed me acted very vague and did not give me details about the APR, loan lifetime or even the loan amount. You will run into some shady looking sites. I would not recommend this to anyone.” — Chris Fisher, a Trustpilot reviewer

The network holds a similar 3.9 out of 5 rating with USALoanReviews, which, at the time of publishing, included more than 250 five-star reviews. Those reviews include:

“I have been in debt for many years. I sometimes feel like I am drowning in it and that there is no escape. After visiting CreditLoan.com I actually have some hope that there might be a light at the end of the tunnel for me after all. This site broke everything down for me in an easy to understand kind of way. I would highly recommend anyone who is drowning in debt to spend 15 minutes on this site and see if they can help you.” — a USALoanReviews reviewer

The reviews aren’t all good, though. Although the network claims on its website that no applicant is guaranteed a loan, some feel that the company’s advertising is deceptive in claiming that a borrower can get a loan as long as they’re employed.

“The advertising said ‘bad credit or good credit, it doesn’t matter.’ I also saw an add that said if you are working you can get up to at least $800. That is not true. I was denied from all the lenders credit loan found for me.” — a USALoansReview reviewer

These reviews show that some consumers may go into the loan request process with CreditLoan.com without fully understanding how it works. Like any other lending network or direct lender, CreditLoan can not guarantee loan approval to any borrower.

And since Credit Loan is not a lender, your approval or denial will depend on the approval standards of the lenders that review your loan request.

If you receive one or more loan offers, be sure to carefully inspect every detail of each offer. Every lender on the network offers a unique interest rate, repayment term, and origination fee. Your cost of credit and monthly payment will vary based on these numbers.

In many cases, a borrower may simply accept the loan offer that has the lowest monthly payment. While this may help your monthly budget, it could cost you substantially more over the life of your loan.

When you extend a loan and add more payments to the loan term, you open yourself to paying more interest charges. That’s because every monthly payment contains some interest fees. The more payments you make, the more fees you pay.

A longer loan stretches your loan out and makes each monthly payment smaller. In return, you’ll pay much more interest to repay the debt.

Is CreditLoan.com Safe to Use?

CreditLoan.com takes security seriously and has protected sensitive consumer information for nearly two decades.

The network was awarded the TRUSTe® seal, which shows its compliance with best practices and rigorous online privacy standards. The seal is awarded by TRUSTe®, an independent organization that monitors website privacy and email policies.

In addition, Creditloan.com has been issued SSL and McAfee Safe certifications, attesting to its use of the highest level of encryption and security online.

All of this adds up to a safe experience, where any information that you submit to CreditLoan, and any that it transfers to its partner lenders, will travel through encrypted lines that remain out of the view of malicious hackers.

One thing to consider, though, is the wording found within CreditLoan’s privacy policy that states what it does with the information it collects from users. This states:

“By submitting your personal information, you understand and agree such personal information (including the Sensitive Information) may be shared with third-parties.” Later on, it says, “Furthermore, you authorize us to use any information collected from you to obtain other information about you from third-parties, such as your social security number, where such information was incompletely or improperly filled out on our registration form.”

By agreeing to these statements — which you have to do to apply for a loan — you give CreditLoan permission to sell your information to third parties that can, and likely will, contact you to promote their services. There’s no way of telling how many third parties you may hear from, but reviewers claim that number may be high.

The second statement is especially concerning, as it gives CreditLoan permission to use other means to option information about you that you may not provide during your application. This means that you’re opening yourself up to a lot of digging into your personal data — which the company may then sell to other parties.

While no reports of negative consumer experiences — aside from spam emails and calls — came from this policy, it’s something to consider when you submit a loan request to CreditLoan and agree to its terms of service and privacy policy.

Does CreditLoan.com Approve Bad Credit?

CreditLoan.com maintains two separate lending networks. One is for consumers who have good credit or excellent credit while the other works specifically with applicants who have bad credit.

Creating this division actually improves your chances of approval if you have bad credit. Instead of forwarding your loan request to several lenders that won’t approve you, CreditLoan.com whittles down the options and focuses on the lenders that are most likely to make you an offer.

Some partner lenders work within both networks. The main differences between a bad credit loan and a good credit loan are the loan amounts and interest rates.

For example, the network that focuses on good credit loans will consider personal loan applications of up to $40,000. The bad credit personal loan division caps loan amounts to $5,000 — but both require a $250 loan minimum.

Applicants aren’t guaranteed a loan for any amount. Your loan approval odds, as well as the loan amounts you may qualify for, will depend on your credit history and current debt load.

Although CreditLoan.com touts its personal loan products as some of the most competitive in the space, these aren’t the only loans you may qualify for. Lenders also consider applications for auto loans and student loans.

The auto loan offers include varying interest rates and repayment terms based on your credit score. Like other car lenders, rates will change with the market, but once you’re locked into a rate, your charges will not change when the market shifts.

How Much Can I Borrow With CreditLoan.com?

The amount you can borrow through CreditLoan.com’s lenders will depend on your credit rating. If you have a FICO score of 579 or lower, you fall into the poor credit category. The lenders that specialize in these loans will consider loan applications of between $250 and $5,000.

If you have a credit score above 650, you could qualify for as much as $40,000 in installment loan products.

Keep in mind that not everyone will qualify for a large loan. The loan amounts offered vary by lender. No applicant is guaranteed to receive a loan offer when they submit a loan request to CreditLoan.com. According to its privacy policy:

“This Web Site does not constitute an offer or solicitation to lend. This site will securely submit the information provided to a lender. Providing your information on this Website does not guarantee approval for a product offering.”

While your credit score may dictate which lenders the network sends your loan request to, it isn’t the only factor that will determine your loan eligibility.

Someone who has excellent credit may still not qualify for a loan if he or she has too much current debt to afford a new monthly payment. On the other hand, someone with a poor credit history may qualify for a larger installment loan if he or she has a good income and few monthly debt obligations.

Is CreditLoan.com a Payday Lender?

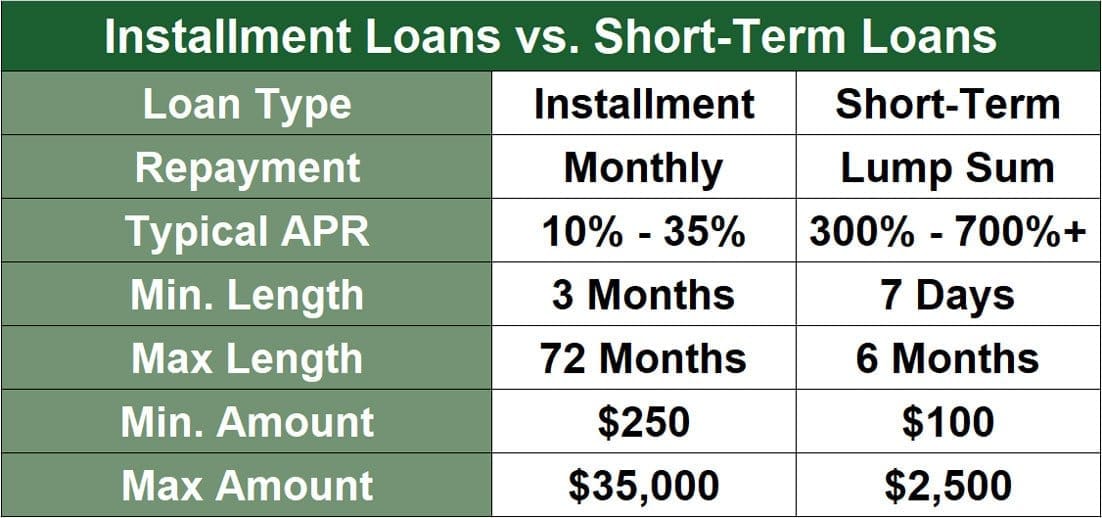

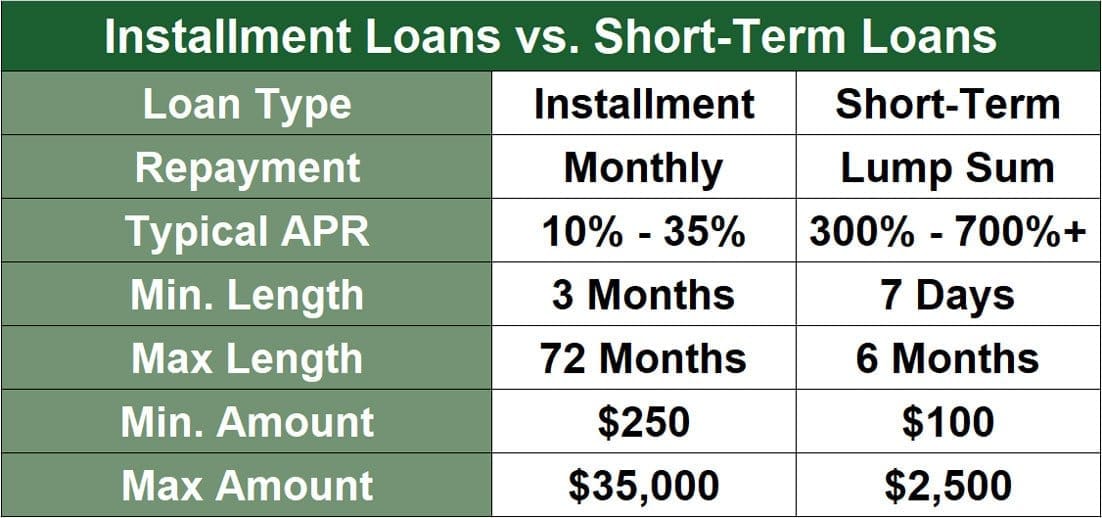

CreditLoan.com is not a payday lender. Instead, the partner lenders that the network connects you with will offer installment loan products at competitive interest rates.

A payday lender only offers short-term loans with interest rates that typically start around 400%. These loans require repayment in full within 15 or 30 days. Instead of making monthly payments — or installments — on these loans, you must repay the entire debt, including interest, in one lump sum.

These loans can get incredibly expensive, which is why most states have enacted laws that limit how much a payday lender can charge you for a payday loan.

While many consumers have successfully used these cash advance loans as a bridge to their next payday, others have accumulated tremendous amounts of debt through the loan products.

These loans still appeal to some consumers because they’re easy to qualify for and rarely require the borrower to submit to a credit check. Instead, the payday lender will likely approve your application if you can provide proof of enough income to afford the loan repayment when you receive your next paycheck.

If you fail to live up to your promise, the lender will roll your debt into a new loan package that includes a higher interest rate and more fees. The rollovers continue until you pay the debt in full.

CreditLoan.com does not promote payday loans as a form of loan product offered through its services.

Before you consider a payday loan, research the best online lending networks. You may find one that will offer a far less expensive alternative — even if you have bad credit.

Does it Cost Anything To Use CreditLoan.com?

You will never pay to use CreditLoan.com’s services. As a loan referral service, CreditLoan.com partners with lenders from around the US to connect them with borrowers.

Instead of charging the borrower for the service, each lender agrees to pay the network a referral fee for every closed loan that the network sends their way. This is how the network makes part of its profit.

But just because CreditLoan.com doesn’t charge you for its services doesn’t mean that it doesn’t make money off your application.

As stated above, CreditLoan’s privacy policy clearly states that it will collect any personal information — including sensitive information — and share (in other words sell) it to third-party partners.

These data purchasers may resell it to other companies or use it to try and sell you products and services. This is a particularly tricky situation because you must agree to this clause to submit a loan request.

This tactic isn’t unique to CreditLoan.com. One of the network’s competitors, CashUSA.com, displays a banner at the top of every page of its website that clearly states that it may sell applicants’ data to third parties.

Before you submit any data to CreditLoan.com or any other online lending network, be certain that you’re comfortable with the network’s privacy policies and how it may impact your day-to-day life if you start to receive several product or service solicitations through text, phone call, email, or paper mail.

Does CreditLoan.com Require a Credit Check?

CreditLoan.com requires a soft credit pull for your initial loan request. This does not result in an inquiry on your credit report and will not impact your credit score.

Any loan offers you receive will have unique terms and come from individual lenders that partner with the CreditLoan network. These offers will have varying interest rates, repayment terms, and fee structures.

Some lenders on the network may not require a credit check for approval. Your loan offers should highlight that information if it’s an option.

Just remember that any loan that skips the credit check process will likely contain higher fees and a much higher interest rate. This is how the lender offsets the risk of accepting a loan without first reviewing the applicant’s financial history.

If a loan offer does not explicitly state that it does not require a credit check, you should assume that the lender will pull your credit — and leave an inquiry on your credit history — as part of the formal application process.

Does CreditLoan.com Verify Income?

Since CreditLoan.com is not the actual lender, it will not require income verification during the loan request process. But if you decide to accept a loan offer, the lender you choose to work with may require income verification to approve your loan application.

This can happen in several ways. In most scenarios, you can provide a picture or scans of at least two recent paycheck stubs that show your year-to-date earnings, as well as how frequently you receive a paycheck.

If you do not receive paychecks, you can provide documentation from your government benefits or another income provider. You can do this with a benefit verification letter.

Under rare circumstances, the lender may contact your employer to verify employment. This typically only happens if you cannot provide proof of income.

How Do I Know If an Online Lender is Legitimate?

You can look for several signs to avoid a personal loan scam. In most cases, a loan scammer may request certain information before finalizing your loan. This could include access or passwords to your bank account, email, or other websites.

A loan scammer may also attempt to collect advance fees upfront before closing your loan. Never pay a lender any fees or money before you have an official loan document in your hands — or email box.

You should also never sign any property over to a lender as collateral. While you may have to use collateral — such as a vehicle title — to secure a loan if you have very bad credit, this will not include reassigning ownership of the item to the lender.

Make sure your online lender uses secure technology on its website when transmitting information, and don’t respond to emails or cold calls that ask for sensitive information such as your Social Security number or passwords.

CreditLoan.com Review: A Network of Lenders that Understand Your Needs

If you made it this far in our CreditLoan.com review, you should be fully prepared to make an educated decision as to whether this lending network is for you. Whether you have bad credit or excellent credit, this network partners with lenders that will consider your application and provide quick loan application decisions.

Before applying, make sure you’re comfortable with the network’s privacy policy, which outright states that it will sell your personal information to third-party vendors that will use that data to try and sell you their products and services. Although you can typically opt-out of this communication through an unsubscribe link at the bottom of each email, it’s still a potential nuisance that takes time and energy away from the things you want to do.

But if you’re looking for a quick loan from a legitimate lender that isn’t running a loan scam, consider giving CreditLoan.com a try. Sending a loan request will not harm your credit and will give you a better idea of your approval odds before you officially apply.