You’ll want to read this SmartAdvances.com review if you want fast, reliable funding despite having less than perfect credit. It is a lender-matching service with a network of personal loan providers, including tribal lenders.

Smart Advances is a free service, and checking whether you prequalify for a loan causes no harm to your credit score. You have nothing to lose by seeing the loan offers that will prequalify you. The loans are unsecured, meaning you don’t need to post collateral to get one.

Online personal loans are helpful alternatives when you face a sudden cash need, such as unexpected medical or car repair bills. In fact, a person can use these personal loan products for any purpose.

Smart Advances joins a group of lending networks we regularly review at BadCredit.org that shares a similar goal — to provide fast loans (often available within 24 hours) to subprime consumers. We found it to be a legitimate service that delivers what it promises: A fast prequalification process that can match you to multiple direct lenders that can provide you with a cash advance.

The SmartAdvances.com website doesn’t indicate whether it can arrange a payday or business loan. Of course, an owner of a business can get a personal loan and treat it as a business loan, using the proceeds to help operate and grow their company.

Cash Loans of Up to $20,000 as Soon as Tomorrow

SmartAdvances.com is neither a lender nor a loan broker. Instead, it accepts personal loan requests from consumers looking to borrow from $100 to $20,000 and submits the information to a network of direct online lenders.

The service may transfer you to a lender’s website, and you may receive additional offers by email from vetted lenders. There is no fee for this service, and you are under no obligation to accept any loan offer.

The loan terms, including the loan amount, APR, fees, repayment period, and monthly payment amount, depend on the lender’s review of your credit history. These are personal loan products that you repay in monthly installments, although one of your options is to prepay the loan ahead of schedule.

Because the payment amount is fixed, this type of loan helps you budget your finances easier than you would with some other alternatives, such as payday loans, title loans, and similar high-cost options.

How to Apply

It takes only a few minutes to request a loan from SmartAdvances.com. You’ll need to answer a series of questions about your personal information, including your name, address, phone number, and email address, among other items. And you will need to provide your Social Security number, bank account number, driver’s license, work status, annual earnings, and whether you own or rent your home.

Smart Advances does not perform a hard credit check, protecting your credit score from damage.

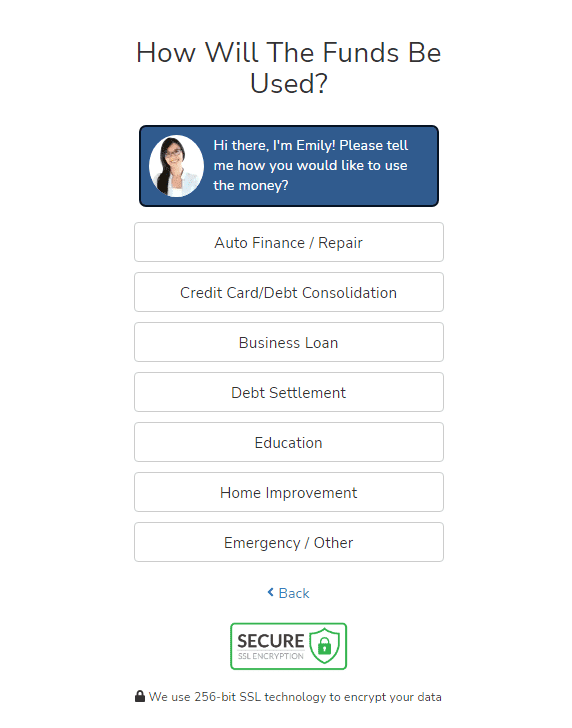

After selecting a loan amount, you’ll be asked what you need the money for, and then you’ll be required to enter your email address.

If you successfully prequalify for a personal loan, SmartAdvances.com will connect you to a personal loan provider’s website, where you can complete the application process.

The lender will probably pull your credit. If you suffer from poor financial wellness, the lender may decide not to make you an offer. You may need to provide additional information and documentation, or the lender may simply present you with a loan agreement specifying all the terms and features.

Please read the agreement carefully, as interest rates and other terms vary considerably. E-sign the loan agreement only if you find the offer satisfactory. Your funds should arrive in your bank within 24 hours, more or less.

General Criteria

SmartAdvances.com lists its prequalification requirements:

- Have a regular income

- Be 18 years or older

- Be a US citizen with a valid Social Security number. We do not know if permanent residents can prequalify.

- Have a valid US driver’s license or state ID

- Have an open bank account (the lender will deposit your funds directly into this account)

You must also satisfy any additional requirements your direct lender may have, such as credit score, debt-to-income ratio, state of residence, and credit history. If you don’t have a job, you can still qualify for a loan if you receive regular disability, Social Security, retirement, or pension benefits of at least $1,000 per month.

There is no assurance that prequalification by Smart Advances will lead to a loan. That insurance can come only from the direct lender. Residents of certain states may not have access to Smart Advances’ services.

Is SmartAdvances Safe to Use?

From all appearances, SmartAdvances.com is a safe, legitimate lender-matching service. It demonstrates a commitment to your safety and security in several ways:

- It is a member of the Online Lenders Association, committing it to “the highest standards of conduct, dedicated to ensuring the best possible experience for its customers, fully compliant with federal law, and working hard to protect consumers from fraud.” As an OLA member, SmartAdvances.com must abide by the organization’s Best Practices and Code of Conduct to ensure clients are fully informed and fairly treated.

- The SmartAdvances.com website communications are encrypted using 256-bit SSL technology, as confirmed by its HTTPS address prefix. You can use the website securely from your online browser or web server.

- Unfortunately, some personal finance websites dealing in subprime lending can sometimes generate spam. Smart Advances enforces an Anti-Spam Policy that prohibits any reference or advertisement of its brand and website using unsolicited email messages. It pledges to investigate all complaints and take the actions necessary to protect clients.

Information about the website’s owning entity, Net Media1, LLC, is sparse, other than it has been a provider of management consulting services in the United States since 2011. The entity specializes in targeted online and mobile lead generation through various methods.

Dun & Bradstreet indicates limited information, some of whom may be software engineers, brand marketers, marketing, and with finance backgrounds. A privately held corporation, the company has limited public information. The company now employs over 24 people.

We have no information about its board members, or indeed, whether it even has any board members. We also have no address for any investor relations department and no financial information, such as tax revenue.

SmartAdvances.com Privacy Policy

Some potential users of SmartAdvances.com may object to the company’s privacy policy, which it describes clearly. It collects your private identifiable information and rents, shares, or sells it to third parties.

When you submit information to the website, you agree to receive marketing emails, phone calls, and texts from the company and third parties. The company stores cookies on your computer unless you withhold permission.

“We use the information we collect to enhance your experience at our Website and to help us to offer content we determine may be of interest to you. We use your contact information to offer you promotional material from our partners. We may also use your personal, demographic, and profile data to improve our Website, conduct statistical analysis, and for marketing, promotional, editorial, or feedback purposes. Information collected by us may be added to our databases and used for future e-mails or postal mailings of products and services.”

You can opt out of Smart Advances emails and SMS messages by clicking on the appropriate links in the company’s privacy policy. Our advice is to make an informed decision by reading all the fine print in detail before signing a loan agreement.

The website’s privacy policy is conventional and widely adopted throughout the lead generation industry in the United States and the United Kingdom. The company restricts unauthorized access to your data and is “dedicated to ensuring the security and privacy of all user information.”

Smart Advances: A Legitimate Lending Network That Can Help

Our research for this SmartAdvances.com review leads us to believe the company does what it says, namely matching borrowers to lenders. It is a valuable resource for quickly lining up a personal loan with no cost or obligation.

If you are a person with bad credit but need money fast, you should find the options that SmartAdvances.com provides helpful. As always, our advice is for you to carefully read a loan agreement in detail so that you can make an informed decision.