Emergency situations often call for quick decisions — which sometimes lead to long-term regrets. If you’re in need of quick money, you might consider a car title loan to get the funds you need.

Before you do so, consider these car title loans for bad credit and their top alternatives. That’s because, if you choose the wrong lender, you could end up with a lot of debt — and no vehicle.

Many car title loans aren’t what they appear to be. After our research, we’ve discovered several other ways that you can get your loan without risking your personal property. Click below to learn more.

Alternatives | Car Title Loans | FAQs

Car Title Loans Are Risky: Consider Your Alternatives

Most people qualify for a car title loan. Many lenders won’t even require a credit check for approval. That’s because you’re using your car’s title as collateral to secure the loan. The lender then places a lien on your title — and can repossess the car if you default on the loan.

And because of the often sky-high interest rates attached to these loans, 1 in 5 borrowers lose their vehicles due to default.

Instead of risking your valuable personal property for a quick loan, consider the options below that often provide unsecured loans for consumers who have bad credit histories.

Personal Loans for Bad Credit

The average car title loan charges 25% interest… per month. That averages to more than 300% per year. If you borrow $1,000 and use your car’s title as collateral, by the end of the month, you will owe $1,250.

And that’s not accounting for the origination and setup fees you’ll also likely have to pay. If you can’t make the loan payments, the lender can take your car.

With a good personal loan for bad credit, like the options listed below, you won’t have to risk your personal property to get the loan. And since most of the lenders in these networks specialize in creating loans for consumers who have bad credit, you’ll have a better chance than you may think of approval.

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

MoneyMutual maintains one of the largest online lending marketplaces. The lenders who partner with the network have worked with more than 2 million customers in 49 states (MoneyMutual is not available in New York). One brief pre-qualifying form can net you multiple short-term loan offers of up to $2,500. Interest rates and other terms vary, depending on the lender you choose to work with.

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

CashUSA.com operates in all 50 states and hosts many lenders who offer same-day approvals on loans ranging between $500 and $10,000. Interest rates vary between 5.99% and 35.99% — which is substantially less than a typical car title loan.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

CreditLoan offers the smallest minimum loan amount on this list — with options starting at $250 and topping off at $5,000. The network’s lenders offer same-day approvals and electronic funding to a linked checking account by the next business day. The partner lenders don’t have a minimum credit rating for approval and often work to help applicants who have bad credit find a loan option that suits their needs.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 60 Months | See representative example |

Bad Credit Loans has one of the easiest prequalifying forms to complete on this list. In a matter of minutes, you could receive multiple loan offers of between $500 and $5,000 with repayment terms that start at three months and extend as long as 60 months.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

PersonalLoans.com accepts applications for all credit types. Each lender on the network has varying standards for acceptance, but many work with applicants who have poor credit on loans that start at $500 all the way up to $35,000. The network claims it can go from application to funding in as little as one business day — which is great if you’re in a jam and need money fast.

- Short-term loan of $100 to $1,000

- Large network of lenders

- Loan decision as fast as a few minutes

- Funding as soon as the next business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $1,000 | 200% - 2,290% | Varies | See representative example |

Applicants to CashAdvance.com must have at least $1,000 in verifiable monthly income and at least 90 days on the job to qualify for a cash advance loan between $100 and $1,000. These short-term loans often come with a one- to two-week repayment window and interest rates that can climb as high as 2,290%. Be certain you can pay off your loan on time before considering this option.

Cash-Out Refinance Loans

If you make monthly car payments, you may qualify for a cash-out refinance loan. These loans pay out the current value of your car. You use part of the proceeds to pay off your existing car loan and keep the rest as cash. You then pay back the new loan as you did with your previous vehicle loan.

The lenders below work with vehicle owners of varying credit backgrounds to complete cash-out refinancing loans to give you access to your vehicle’s equity.

- Free, no-obligation application

- Specializes in auto loans for bankruptcy, bad credit, first-time buyer, and subprime

- Affordable payments and no application fees

- Connects thousands of car buyers with auto financing daily

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1994 | 3 minutes | 9.0/10 |

Auto Credit Express connects applicants with bad credit to dealer partners that find loan options for new and used vehicles, as well as cash-out refinancing. Since 1999, the network’s lenders have combined to underwrite more than $1 billion in bad credit auto loans. Applicants must have at least $1,500 in verifiable monthly income to qualify.

- Network of dealer partners has closed $1 billion in bad credit auto loans

- Specializes in bad credit, no credit, bankruptcy and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have $1500/month income to qualify

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 3.99% - 29.99% | 1999 | 3 minutes | 9.5/10 |

Car.Loan.com claims that thousands of car buyers access its network every day and find financing options — including cash-out refinancing — that meet their financial needs. The network’s lenders even have loan options for applicants who have recent bankruptcies or bad credit histories.

- Loans for new, used, and refinancing

- Queries a national network of lenders

- Bad credit OK

- Get up to 4 offers in minutes

- Receive online loan certificate or check within 24 hours

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2003 | 2 minutes | 8.5/10 |

With MyAutoloan.com, you can receive up to four loan offers within minutes of submitting your prequalifying form. If you find a loan option that works for you, the network will redirect you to the lender’s website, where you’ll complete the loan paperwork and get your funds, typically within 24 hours.

5 Online Car Title Loans for Bad Credit

If you’ve exhausted your options — or still feel a car title loan is your best option for getting the money you need — these online lenders work across the country and can complete loan packages that include an electronic deposit of your loan funds to a linked checking account.

1. TMG Loan Processing

Tradition Media Group provides application options over the phone or online at any time of day or night. Auto title loans through the lender top off at $50,000, with your loan amount dependent on your vehicle’s equity and your ability to make monthly payments. If approved, you can receive your loan funds in as little as one business day.

2. MaxCash Title Loans

MaxCash Title Loans has completed more than 350,000 car title loans for applicants who have bad credit histories — and provide funding in as little as one business day. Through the lender, you can receive a car title loan for your paid-off vehicle or complete a cash-out refinancing loan that gives you access to your financed vehicle’s current equity.

3. Premier Title Loans

Premier Title Loans requires a clear pink slip and paid-off vehicle with no current liens for approval. Once you apply, you can receive preliminary approval within 15 minutes. Some applicants can receive same-day funding (for a fee) — though most loans payout within one business day.

4. Champion Title Loans

Champion Title Loans isn’t a direct lender. Instead, it shops your application to multiple lenders and can return with a loan option to meet your needs. Tradition Media Group (named within this listing) manages the website and brokers all the loans completed through the network.

5. Ace Cash Express Loans

Ace Credit Express runs the gamut of short-term, high-interest loan options. Through the lender, you can qualify for an auto title loan, a payday cash advance loan, or a personal installment loan. ACE maintains physical locations in 23 states that can process your application. You can also apply online and receive your loan proceeds electronically within one business day.

Can You Get a Title Loan with Bad Credit?

Most auto title lenders pay little attention to your credit score when considering your application. That’s because they supply secured auto loans that use your vehicle as collateral.

If you have a car that’s paid off (or has current equity within the loan) and you have verifiable employment that pays enough to afford your monthly loan payment, then you’ll likely be approved for a title loan.

Title lenders forgive bad credit histories because they have a fallback option should you default on your loan. The lender can repossess your vehicle should you stop making payments, since your car’s title secures the loan.

An unsecured loan — the type that doesn’t require you to risk your personal property for approval — traditionally has strict approval standards and requires thorough credit checks. That’s because, should you stop paying, the lender has little recourse other than selling your loan to a collection agency for pennies on the dollar.

To mitigate that risk, lenders often scrutinize your payment history to avoid taking a big loss on a loan. But if you default on an auto title loan, the lender can take your vehicle, sell it, and recoup most (and sometimes more) of the money lent to you.

The lender can repossess your vehicle if you do not make the loan payments.

That’s why many auto title loan applications don’t include credit history information. Instead, the lender will ask for information regarding your vehicle, proof that you own it outright, and proof-of-income information that shows how much you make, as well as your current monthly bill obligations, to determine your debt-to-income ratio.

Once the lender decides if you can afford the loan, he or she is likely to issue your funds quickly and then place a lien on your vehicle that gives the lending agency access to it if payments aren’t made.

How Much Can You Get for a Title Loan?

Lenders design most auto title loans for consumers who have a bad credit history. These loans often feature enormously high interest rates and short repayment terms.

They also feature low payouts.

Lenders want to make money. The only way they do that is by minimizing their risk and maximizing their interest options. Since so many of these loans end up in default, the only way lenders can guarantee some sort of a profit is if they lend you substantially less money than your car is worth.

Then, if you stop making payments and the lender seizes your car, the agency can sell it and recoup its original loan funds along with the same profit it would have earned through your interest. Sometimes, they make more through selling your vehicle than if you satisfy your loan obligations through monthly payments.

How much you get for your loan will depend on your lender’s loan-to-value ratio standards. Each lender sets a cap on how much they loan — which typically equals a percentage of your car’s current value.

Most lenders will lend out 50% to 85% of your vehicle’s Blue Book value. Some lenders, although rare, will go as low as 20% and as high as 120%. Few lenders publicize their loan-to-value ratio standards, so you’ll need to contact your lender — before applying — to get an idea of how much you may qualify for.

Keep in mind that some lenders also tack on origination fees, set-up charges, or other add-ons to your loan that can take away from your payout. This is on top of very high interest rates that make these loans incredibly expensive.

Your lender should disclose all the fees you’ll incur before you sign for a loan. But, to be on the safe side, it’s better to ask before you finalize any deal.

Is there a Credit Check for Title Loans?

Every lender sets different standards for acceptance when reviewing a loan application. While some lenders always require a credit check and income verification for approval, many auto title lenders forego a credit check and simply ask for proof of income and detailed information about your car.

Credit doesn’t matter as much to the lender because they can profit from the loan whether you pay it or not. That’s because they gain from the interest added to each payment — or they make money from selling your car if they repossess it in the case of a default.

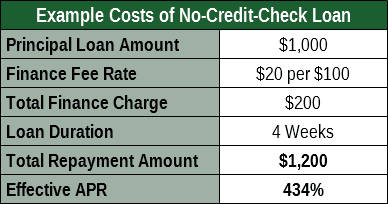

But for the convenience of a no-credit-check loan, you’ll pay interest rates that climb as high as 25% monthly (which equates to more than 300% annually). You’ll also likely face loan set-up fees and other stipulations that may seem odd to you.

For example, many auto title lenders require borrowers to install a GPS unit in the car used as collateral. That way, the lender can track the vehicle’s movements and know where it is if he or she needs to schedule a repossession.

If you don’t mind your lender tracking your location, then you may not care about the lender’s actual location. But maybe you should.

Many internet auto title lenders purchase offshore office space or rent areas on Native American tribal lands to evade state and federal laws that limit the interest and fees they can charge.

Like most things in life, if something seems too good to be true, it often is. Just because you may qualify for an auto title loan without a credit check doesn’t mean it’s the best financial option for you. Before you apply for one of these loans, consider one of the alternatives listed above.

An Auto Title Loan May Worsen Your Situation

Emergencies wait for no one. And when you need cash in a hurry, there aren’t always options that provide a quick payout and easy access to funds.

But an auto title loan could make the situation even worse. Not only could you end up with substantial debt from the loan, but you may end up without transportation if you can’t repay the loan and the lender seizes your vehicle.

Before you risk your personal property for a loan, consider the alternatives to car title loans that could give you same-day approvals, next-day payouts, and far fewer fees and risks.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.