When you apply for and take out a loan, you agree to make payments to your lenders and return their money, plus fees and/or interest. Loans can be used to pay for houses, cars, boats, tuition, and pretty much anything else you’d like to finance. In fact, some lenders don’t require you to identify what it is you’re buying with their money.

When people borrow money in the form of loans, it’s most likely that these will be the largest extensions of credit they’ll ever have to service.

Service, in a lending context, means to manage the debt obligation by paying it back.

All extensions of credit, whether they’re credit cards or loans, have similar attributes as it pertains to credit reporting. All of your accounts will have an account opening date, designation of your relationship with your creditors, the account type, balances, scheduled monthly payment amounts, account statuses, and your payment history.

The Type of Loan

All accounts are reported with a code that identifies the type of account. For loans, the account type, better known formally as portfolio type, is identified as “Installment.”

Loans are, of course, paid back in installments, which is why they are often referred to as installment loans.

An example of a common installment loan is an auto loan. When you borrow money to buy a car, your loan is paid back as you make the same payment for a fixed number of months.

While there are different types of auto loans, 48, 60, and 72 months of installment payments are pretty common terms.

The Original Loan Amount

Your lenders will report the original loan amount to the credit bureaus as part of their account furnishing. So, for example, if you borrowed $40,000 to buy a car, that’s your original loan amount.

That value will never change and will be a part of your account history as long as it remains on your credit reports.

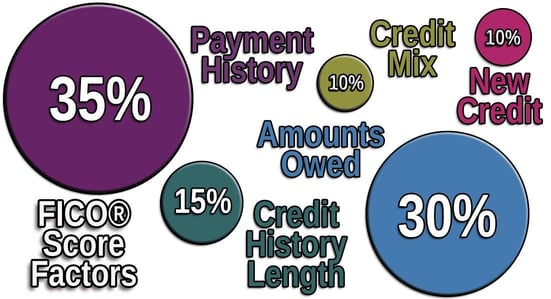

This value is important to credit scoring models, including those built by FICO, because credit scoring calculations take your debt into consideration. That includes, for example, how much debt you have, how many of your accounts have balances, what your revolving debt is versus your installment debt, and what your current balances are relative to your original loan amounts.

While these are certainly part of your FICO score calculations, you should be aware that the metrics that deal with installment debt are not nearly as important as those that deal with revolving debt (credit cards).

You can have six or seven figures of installment debt and still have excellent credit scores. You can’t, however, say the same about credit card debt. The point being, you should never shy away from installment loans because you’re fearful of the impact they may have on your credit scores.

Your Scheduled Monthly Payment

The scheduled monthly payment amount is, you guessed it, the amount you’re obligated to pay the lender each month for the duration of the loan term. The value reported by lenders does not change because you make the same payment for the duration of the loan.

For credit cards, your minimum payment is based on your balance, which can and often does change every month. So one month your minimum payment may be $100, and the next it could be $110.

The amount of your scheduled monthly payment is NOT considered in credit scoring systems. One common misconception about credit scores is that they consider everything on your credit reports, which is incorrect.

Some account information is considered, and some account information is ignored or “bypassed.” The scheduled monthly payment amount is bypassed, which means your score can never be higher or lower because of the value in this field.

Student Loan Disbursements

A student loan is an extension of credit, normally guaranteed by the federal government, and used to finance an education. Student loans, as with most other loans, are paid back in installments (same payment for a fixed period of time).

But unlike other loans, student loans do have some unique aspects when it comes to credit reporting.

Student loans are normally reported to the bureaus by loan servicers. A loan servicer is tasked with managing the administrative aspects of your student loans.

So when you make your payment every month, you’re likely paying the servicer rather than the actual lender. The loan servicer is also the company responsible for furnishing information about your loans to the credit bureaus and the one that performs investigations in cases of the disputed accuracy of credit reporting.

Another interesting aspect of student loan credit reporting is that student loan accounts are reported on a disbursement basis.

For those of you who took out student loans to pay for college, you may recall that you took out several disbursements over time to pay for tuition. That is, you didn’t get four years’ worth of tuition on day one.

What this means is you likely have several student loans appearing on your credit reports because you took multiple disbursements. This is unique to student loans and only student loans. You didn’t take out multiple disbursements to pay for your house or your car.

Contextual Narratives

Companies that furnish information to the credit bureaus can include language that adds context to your account information. These are formally referred to as Special Comment Codes in credit reporting language.

Companies that furnish loans to the credit bureaus can include narratives with your accounts to indicate a variety of conditions, including repossession, foreclosure, lease, forbearance, loan modified, or loan assumption.

Some of these narratives, including repossession and foreclosure, are considered derogatory by credit scoring systems. And some, such as forbearance and loan modification are considered neutral.

Whether a Loan is Secured or Unsecured

While not universally accurate, loans tend to be secured and credit cards tend to be unsecured, and can be reported to the bureaus as such.

In a lending context, secured indicates that the loan is guaranteed by a physical asset, such as your car or your house.

Some loans, including student loans and personal loans, are not secured by anything other than your contractual promise to make your payments.

The loan’s security only becomes relevant if you default. When you default on a secured loan, the lender can take back the property, normally via repossession or foreclosure, and sell it to cover the outstanding and unpaid balance.

As addressed above, repos and foreclosures can be reported to the credit bureaus.

After the asset is sold, the sale proceeds are applied to the remaining loan balance. If the loan is paid in full, then that ends the process. If there is a surplus of funds after the loan is paid, which is rare, then those funds are returned to you.

If the funds are not sufficient to pay off the loan, which is much more common, then you will have what’s called a deficiency balance. In some states, the deficiency balance is still your obligation, and the lender can come after you for payment.

In some states, the lender cannot come after you for the deficiency balance. Either way, it can be reported to the main credit bureaus, and that reporting is considered to be derogatory.

There Is No “Date Closed”

Loans have a finite life cycle. Credit cards do not. Credit cards can remain open indefinitely, while loans cannot.

Accordingly, credit cards have a field that would include the date you or your credit card issuer closed the account. That would indicate the card is no longer available for further purchases.

Loans, on the other hand, are temporary by design. For example, if you have a 48-month auto loan, then your account is active for only 48 months.

Once the loan has been paid in full, which may or may not take the full 48 months, your account is no longer active and your scheduled monthly payment amount is now zero. You don’t have access to the loan’s funds again just because you paid the loan off as you would if you had just paid off a credit card or a line of credit.

There is no formal process that designates the account as closed. When it has reached a finalized status, it is reported to the credit bureaus as such, and any competent person/lender that reviews your credit reports afterward understands what that means.

Most Loans Are Reported to the Bureaus

While the credit reporting process is largely out of your control, you should know that loans are commonly reported to the credit bureaus. And, because loans are different from credit cards, those reports don’t look the same or include the same attributes.

Loans in good standing are largely immaterial to your credit scores, but if they’re delinquent or in default, they can be punishing.

If you’d like to see whether or how many installment loans you have on your credit reports, you can check them for free every week through the end of 2022 at www.annualcreditreport.com.