In the internet era, it’s obsolete to ask, “Where are the personal loans near me?” Online personal loans are literally at your fingertips, as close as your computer, perfect for when you suddenly face an unexpected expense.

A typical personal loan (or signature loan) offers relatively good debt protection because it doesn’t require collateral that you could forfeit by missing a payment. This article makes borrowing even more accessible by providing links to nine top online loan services. One click and you’re ready to start a process that may put funds in your bank account as soon as tomorrow.

Nationwide Personal Loan Networks (Bad Credit OK)

These online personal loan networks operate in most, if not all, of the 50 states. Each can find you a signature loan provider experienced in working with borrowers of every credit stripe, including subprime consumers with past credit problems.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

MoneyMutual can connect you to an online lender for quick loans of up to $5,000. You must collect at least $800 monthly from work or government benefits to prequalify. BadCredit.org perennially rates MoneyMutual highest for its instant cash loan referral service. It’s a prime destination for the best bad credit loans at competitive rates.

2. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

You can prequalify for the CashUSA.com lender-finding service if you collect an income of at least $1,000 per month after taxes. This network promises that poor credit need not disqualify you from obtaining a fast personal loan. You could receive a loan offer within minutes and collect your money by the next business day.

- Quick loans up to $5,000 as soon as tomorrow

- Submit one form, get multiple options

- All credit ratings welcome — good or bad

- Requires a checking account and $800 minimum monthly income to apply

- No collateral or cosigner required

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

The InstallmentLoans.com website doesn’t mention a minimum required income but does state that you must be employed, self-employed, or receiving benefits. You can expect an immediate prequalification decision after you request a personal loan. The company’s lender network can provide you with an installment loan of up to $5,000 at competitive rates.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

CreditLoan.com requires you to have a bank or credit union account (chartered by your state or the National Credit Union Administration). Many borrowers with bad credit receive next-day funding from a direct lender on the network.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% – 35.99% | 3 to 60 Months | See representative example |

BadCreditLoans.com can prequalify you for a loan of up to $10,000 if you collect regular income from full-time employment, self-employment, or Social Security benefits. Your personal information is protected with advanced encryption technology. You may also be presented with non-loan offers targeted toward your credit profile.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% – 35.99% | 3 to 72 Months | See representative example |

At PersonalLoans.com, the maximum and minimum loan amount depends on your credit score and income. The minimum loan amount is $1,000, which is higher than what other networks on this list offer. This network is better for those with 600+ credit scores seeking larger loan amounts.

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% – 35.99% | 60 Days to 72 Months | See representative example |

If you have a job, 24/7 Lending Group can get you one or more loan quotes in minutes. This lender-finding service receives an excellent rating from Trustpilot. Furthermore, it insists that the direct lenders on its network comply with the Fair Debt Collection Practices Act.

- Small personal loans starting at $100

- Receive an approval decision in as little as 2 minutes

- Funds can be deposited into your account in one business day and used for any purpose

- No hidden fees

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $20,000 | Varies | Varies | See representative example |

SmartAdvances.com can quickly match you to multiple online lenders. You must collect at least $1,000 monthly to be eligible. The company is a member of the Online Lenders Alliance (OLA), which is committed to a responsible lending policy that complies with the letter and spirit of federal law.

- Short-term loan of $100 to $1,000

- Large network of lenders

- Loan decision as fast as a few minutes

- Funding as soon as the next business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $1,000 | 200% – 2,290% | Varies | See representative example |

If you have a steady income, CashAdvance.com can prequalify you for a short-term payday loan with a minimum loan amount of $100. You must be at least 18 years old, a US citizen, and have a phone number, bank account, and email address to be eligible. This lender-finding service quickly arranges online loans that you repay in full by your next payday with no prepayment penalty.

What Is a Personal Loan?

Personal loans let you borrow money you repay at fixed rates through monthly installments. It is an unsecured loan with terms that usually range from three months to seven years. You shell out the same payment amount each month, which consists of principal repayment and interest charges at the annual percentage rate.

You can use a personal loan for any purpose. If you have bad credit, you should be able to borrow relatively modest amounts without collateral.

The lender sets the terms, including the loan amount, interest rate, repayment period, and fees.

While you can make the monthly payment by check, most lenders prefer to transfer funds monthly from your checking or savings account through automatic payments. Electronic transfers help you budget because the loan payment amount and transfer date stay the same throughout the loan term, and you don’t have to remember to make automatic payments.

You may be able to significantly reduce your monthly payments when you use a personal loan as a debt consolidation loan.

How Can I Get a Fast And Easy Personal Loan?

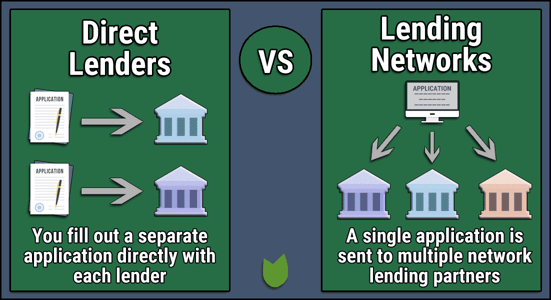

An online loan-finding service provides the most convenient way to get a personal loan. You start the process by completing a loan request form on the lending service’s website — you need only one form to generate multiple offers at various fixed rates.

The service will prequalify you for a loan if you meet its eligibility requirements, including:

- Being at least 18 years old

- Being a US citizen or permanent resident

- Having a reliable source of income (from a job, alimony, or government benefits)

- Having an active bank account in your name

- Providing a valid phone number and email address

It takes only a few minutes to provide the requested information and receive a response. You will need to include details about your identity (including your Social Security number or equivalent), employment status, income, and rental/mortgage costs.

The loan services don’t conduct a hard credit check when prequalifying your request to borrow — that’s a task for direct lenders. Hard credit pulls may reduce your credit score by a few points and remain part of your credit history for two years.

Upon successful prequalification, the services circulate your loan request across their lending networks.

Borrowing money this way saves you the bother of filling out separate loan applications. The lending services can instantly connect you to a direct lender’s website or provide multiple links from which to choose. Direct lenders may require additional information to make a determination on your loan application.

You’ll typically receive a quick approval decision and next-day funding, although it may take longer for lenders to resolve any outstanding questions. If you receive approval for your loan, the lender will provide you with an agreement form to e-sign.

The agreement contains the details of the loan terms and allows the lender to access your checking account. It will also disclose the amount of the origination fee, if any. The lender will then send the money, which could arrive by the next business day, to your bank or credit union account.

What Are the Alternatives to Personal Loans?

You have other ways to borrow money despite having poor credit, including:

- Payday loans: These are high-cost, short-term loan options that you repay on your next payday, typically in one to four weeks. This is an unsecured loan, dependent primarily on your work history.

- Pawnshop loans: You can hock personal property at a pawnshop, typically for 30% to 50% of the item’s value. This is a secured loan that comes at a high cost, and you will forfeit your property if you don’t repay the loan on time.

- Home equity loan or line of credit (HELOC): A HELOC is a low-cost, revolving personal line of credit collateralized by your home. You can borrow and repay on your own schedule as long as you pay the minimum amount each month for the outstanding balance on your personal line of credit. A home equity loan is usually a second mortgage, with an initial loan amount you repay in monthly installments.

- Car refinancing loans: You can cash out your vehicle’s current equity by replacing your auto loan with a new loan larger than your remaining loan amount. An auto loan doesn’t provide debt protection since non-payment can trigger repossession of your vehicle because it is a secured loan backed by the vehicle.

- Federal credit union Payday Alternative Loans (PALs): These small loans from a participating federal credit union (governed by the National Credit Union Administration) are a low-cost alternative to payday loans for folks with bad credit.

- Credit card cash advances: If you own a credit card, you can take a quick cash loan at your local bank branch or ATM. The relatively lower interest rate on these loans tops out at 36%, but it accrues interest daily until repaid.

- Share secured loan: Your broker may let you borrow money by accepting your stock shares as collateral. A share secured loan usually has a lower interest rate and an open-ended repayment term.

Another potential source of money is a loan from family and friends. The terms can be very lenient, but be sure to repay as agreed, lest you jeopardize a personal relationship.

Online Personal Loans Are at Your Fingertips

You don’t have to do a Google search for “personal loans near me” to find the most convenient source for online lender-finding services such as the companies reviewed in this article. It takes only minutes to arrange borrowing through an online personal loan network, which is important when you need to pay for an unexpected expense.

Everything about these loans is fast, from application to funding, which can occur as soon as the next business day.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.