When you have bad credit, every financial decision you make should be focused on increasing your credit score. Unfortunately, even something as necessary as applying for a loan can cause a hard credit check and a potential ding to your score. To avoid this credit score trap, you should only consider bad credit loans with no hard credit check when you’re in dire need of cash.

Not all bad credit loans are alike, and many lending networks have no-credit-check lenders that understand the plight of borrowers with poor credit. Using a lending network has the advantage of getting your application in front of dozens of potential lenders, allowing you to choose the one that best fits your needs.

And, when you’re considering a potential loan offer, you can find out ahead of time if it entails a hard credit check.

Loans | Approval Tips | FAQs

Personal Loans with No Hard Credit Check

Lending networks that specialize in bad credit personal loans often work with lenders that don’t automatically perform a hard credit check. Completing the online application with a lending network may result in a soft credit check to verify the identity and eligibility of an applicant, but performing a hard check is at the discretion of each lender in the network.

All of the lending networks we recommend here have no-credit-check lenders available.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

Money Mutual is an online lending platform connecting borrowers of all credit types to lenders that offer a variety of financial products. Lenders in this network offer personal loans, short-term loans, cash advance loans, and title loans, among others, in amounts from $250 to $2,500.

Terms and conditions will be provided by any lender making a loan offer, including offers with no hard credit check. The Money Mutual service is free and easy to use, with an online application that takes just minutes to complete.

2. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

Lenders in the CashUSA network offer personal or installment loans in amounts up to $10,000 with loan durations from 90 days to 72 months. All credit types are accepted, and there’s never any fee or cost charged by CashUSA to apply.

Loan requests are often approved in minutes, with proceeds being deposited in your checking account in as little as 24 hours. By filling out the online application, you could be connected directly with a lender who will provide you with all of the terms and conditions for the loan you need.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

CreditLoan.com has been helping people with bad credit get the personal loan they need since 1998. Lenders in this network offer loans from $250 to $5,000 and funds are often available the next business day.

Depending on the type of loan and amount you need, lenders may rely on your income alone in making a loan decision, meaning there may be no hard credit check. All terms and conditions of any loan will be clearly laid out in writing before you complete the loan, and there is no obligation to accept.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 60 Months | See representative example |

The name says it all — BadCreditLoans.com helps borrowers with bad credit get the personal loan they need. The lenders and financial service providers in this network offer loans from $500 to $5,000 to borrowers of all credit types.

Loan durations range from as short as three months to as long as 72 months, with funds often available within 24 hours after you sign. The details of any loan offer you receive, and whether you can expect a hard credit check, will depend on the individual lender making the offer.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

The PersonalLoans.com lending network offers a variety of personal loans to borrowers of all credit types, including those with bad credit. By completing the online form, your loan application can be matched with lenders whose criteria you meet. Loans from $500 to $35,000 are available depending on the lender and your qualifications.

PersonalLoans.com does not charge a fee to apply, and, if you receive a loan offer, you’re under no obligation to accept it. Questions about a hard credit check can be directed toward the lenders making the loan offer.

- Short-term loan of $100 to $1,000

- Large network of lenders

- Loan decision as fast as a few minutes

- Funding as soon as the next business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $100 to $1,000 | 200% - 2,290% | Varies | See representative example |

Cash Advance offers short-term cash advance loans from $100 to $1,000 through a network of lenders specializing in loans for all credit types. If you meet certain basic criteria, such as being employed with an income of at least $1,000 a month, are at least 18, a citizen or permanent resident, and have a valid phone and email, you are eligible to apply.

There’s no fee for applicants, and lenders may rely solely on your income for approval without requiring a hard credit check.

How to Get Approved for a No-Credit-Check Loan

Getting approved for a loan can sometimes feel like you’re competing in a beauty contest – one in which your credit and finances are being judged for how good they look. With a high enough credit score and lots of money in the bank, you could be crowned the winner of a gleaming new personal loan.

But what if your credit doesn’t look that great? Do all loans require a credit check?

These days lenders are becoming a lot more specialized in the kind of loans they make and the credit types they accept. Borrowers with bad credit, or those with a limited credit history, are finding it easier to qualify for a loan with no hard credit check.

Here are some things you should know and tips for improving your chances of landing a no-credit-check loan.

- If your credit score can’t withstand the scrutiny of a credit check, perhaps it’s best not to go it alone. Finding a cosigner with a good or even excellent credit score can allow you to bypass the credit check yourself. Not only can a cosigner’s credit score help you, but the added income on the application can also help ensure you qualify for the amount you need.

- Another way to land a loan that doesn’t require a credit check is to offer collateral to help secure the loan. While this isn’t always the best way to get a personal loan (you run the chance of losing the asset if you default), it can work in the case of a vehicle, boat, or equipment loan.

- Lenders offering personal loans will consider the income of a potential borrower and compare that with the requested loan amount. If your earnings are high enough and the loan amount modest enough, a hard credit check may not be required.

Just be sure to check the terms and conditions of any loan carefully, as some no-credit-check loans come with very high interest rates.

Can You Get a Loan without a Credit Check?

Many loans that don’t require a credit check are not loans you’d really want to have. They often come with sky-high APRs, huge fees and penalties, and are structured to keep you in a cycle of debt. I’m talking, of course, about payday loans, title loans, and loans you can get from a pawn shop for hocking something of value.

True personal or installment loans from a legitimate lending institution are different. Lenders use credit checks to determine if a potential borrower is a good credit risk. The process, known as loan underwriting, is meant to assess the ability of a borrower to repay the loan based on factors that include credit history.

So does that mean a hard credit check is always done prior to a loan offer being made? Not necessarily. To understand why, it’s important to know the difference between a hard and soft credit check, and what if any impact it can have on your score.

A soft inquiry or soft credit check can occur when a company looks at your credit for information or to verify general financial data. This type of inquiry won’t affect your score because you didn’t apply for credit or give express permission to a company to perform the inquiry.

A hard credit check, on the other hand, is specifically related to you applying for credit, thereby giving a potential lender permission to look into your credit history. This type of inquiry can have a negative impact on your score, especially if you apply for multiple loans or credit cards over a short time frame.

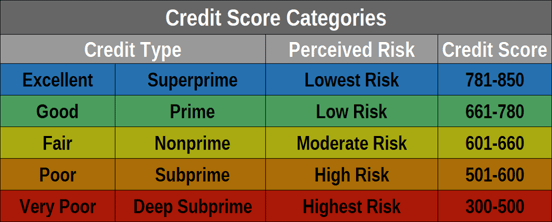

It should be noted that credit inquiries comprise the smallest portion of your overall credit score — 10% to be exact. However, they can have an impact, especially when your score is already low.

Whether applying for a loan will always result in a hard credit check depends. Lenders have the ability to make a loan without a hard inquiry, and some bad credit lenders will forego this step in some cases. Be sure to ask before applying.

Are No-Credit-Check Loans Safe?

In the world of non-traditional lending, which is where no-credit-check loans fall, it pays to be very cautious. Some loans, like the payday and title loans already mentioned, are designed to simply keep you in debt and paying far more than you should have to. However, not all loans without a credit check are inherently bad.

As has already been mentioned, lenders use credit scores to help predict how likely someone is to repay their debt. The higher the score, the more likely the person is to repay, or so the story goes.

By that reasoning, if a borrower is unwilling to have their credit checked, the lender must assume it’s because they have bad credit.

However, some lenders have begun using sources other than credit scores to help make loan decisions. Many of the lenders that participate in the lending networks we’ve recommended use factors such as length of employment, income, time at current address, and other data in their loan approval process.

The downside to this practice — at least from the standpoint of a borrower — is that these loans are often more expensive than a traditional loan. While not at payday loan levels, the APR on these no-credit-check loans can still be quite high. Be sure to read any loan agreement carefully to ensure you’re not falling victim to predatory lending practices.

Do Banks Give Loans with Bad Credit?

Banks and other traditional lending institutions are notoriously rigid in their standards for issuing loans. Underwriting rules and FDIC guidelines mandate strict adherence to high credit standards. Try getting a personal loan from a traditional bank when you have bad credit, and you’ll find out just how difficult it can be.

That said, some institutions will consider extending a personal loan to someone with bad credit.

Credit unions, those community lending institutions that were originally set up to provide loans when the big banks wouldn’t, are still a good place to turn. Your local credit union is likely to charge a lower interest rate and have less stringent income or credit requirements than a bank.

Another advantage of a loan from a credit union is that they’re nonprofit financial institutions that are required by law to charge lower fees. Federal credit unions offer small-dollar loans known as Payday Alternative Loans (PALs) as an alternative to high-cost payday loans that keep so many borrowers in debt.

PAL loan amounts range from $200 to $1,000 depending on the income level of the borrower, and loan terms are required to extend up to six months. That makes it easier to pay back the loan without defaulting or rolling over the loan. The result is lower payments, fewer fees, and a higher likelihood of repayment.

Lending Networks May Be Your Solution

Having bad credit is a hard enough burden to carry without the stress of being denied a loan when you need one. Lending networks can offer a solution by connecting you with lenders that offer bad credit loans with no hard credit check.

Just be sure to do your research and verify the terms and conditions of any loan you’re offered before accepting it. After all, your first priority is to rebuild and reestablish a good credit score.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.