Having fair credit — defined by FICO as a score of between 580 and 669 — can make it harder to qualify for a loan. But many lenders are willing to make personal loans for fair credit borrowers.

You may pay a little more in interest, but you’ll have access to the cash you need. And if your lender reports payments to the bureaus, your personal loan can help you work your way back up the credit score food chain.

Read on for some of our experts’ top selections for personal loans for fair credit, including the overall best loan providers, installment loans, short-term loans, low-interest loans, unsecured loans, secured loans, and more.

Overall | Installment | Short Term | Secured | Bank | Credit Union | FAQs

Best Overall Personal Loan Lenders For Fair Credit

If you’re just beginning your search for a personal loan lender, or just don’t have the time to research and apply to all of the available lenders out there, then the following loan networks may be right for you. That’s because these aren’t direct lenders but rather online lending networks that connect you with a variety of potential lenders based on your qualifications.

1. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

CashUSA provides personal loans of up to $10,000 in four easy steps: complete the online form, connect to a lender and review the terms, accept the offer and provide the required info, and receive your funds as soon as tomorrow.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

By filling out a single application, PersonalLoans.com will submit your loan request to its many partner lending institutions whose criteria you meet. Loans are available from $500 to $35,000. This lending network also provides personal loans for things from debt consolidation to home improvements and even small business loans.

- Loans from $500 to $10,000

- Get connected with a lender

- Simple form & quick funding

- Get your money as soon as next the business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 60 Months | See representative example |

For those toward the bottom end of the fair credit range, you may find a lender that specializes in bad credit loan options more helpful. BadCreditLoans.com is another online lending network with a large number of lending partners that specialize in loans with no minimum credit score requirements.

Top Personal Installment Loan Providers For Fair Credit

The following companies can help you find the best personal loan for your needs. Whether you have a fair credit score or lower, these networks don’t discriminate against less-than-perfect credit scores.

4. CashUSA.com

- Loans from $500 to $10,000

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $10,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

After submitting your loan request, CashUSA.com network lending partners will review it and decide whether to extend a loan offer. The company uses an advanced algorithm to ensure your loan request gets sent to the best potential matches. You’ll then receive quotes from lenders with clear terms and conditions, including the interest rate and repayment schedule.

- Loans from $250 to $35,000

- Large lender network

- Fast loan decision

- Use the loan for any purpose

- Funding as soon as one business day, if approved

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $35,000 | 5.99% - 35.99% | 3 to 72 Months | See representative example |

Simplicity and flexibility are at the heart of what PersonalLoans.com promises with its online loan request process. Simple because the entire process can be completed in just a few easy steps, and flexible because you select the amount you want to borrow and how long you need to repay it.

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% - 35.99% | 60 Days to 72 Months | See representative example |

The 24/7 Lending Group online loan request asks for some basic personal, banking, and income information, which will be used to determine the type of loan you may qualify for. To meet the requirements for most loans, you must show an income, have a bank account, and be at least 18 years of age.

Top Personal Short-Term Loan Providers For Fair Credit

What would you do if you had an emergency and needed to come up with $400 in just a few days? According to a Federal Reserve survey on the economic well-being of American households, 130 million of us couldn’t come up with even this amount from our personal savings. These lenders can help you secure a loan when you’re in a cash crunch, which may include an offer for a payday loan.

7. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

The interest rates and repayment term for a loan from MoneyMutual will vary based on the lender and your credit history and income. The online application process is one of the fastest around and can take less than five minutes. Once you receive loan approval, the exact repayment term and loan rates will be presented in the agreement. As a member of the Online Lenders Alliance, MoneyMutual adheres to the best practices and code of conduct of this trusted group.

- Quick loans up to $5,000 as soon as tomorrow

- Submit one form, get multiple options

- All credit ratings welcome — good or bad

- Requires a checking account and $800 minimum monthly income to apply

- No collateral or cosigner required

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

InstallmentLoans.com is a trusted lender network that can help you find the best loan option for your needs. You can get an unsecured loan with a quick repayment term or a longer-term loan with more time to repay, depending on your credit history and other qualifying criteria.

- Loans from $250 to $5,000

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad credit OK

- More than 750,000 customers since 1998

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $250 to $5,000 | Varies | Varies | See representative example |

CreditLoan is another lender network that specializes in small loans of up to $5,000. This company has been funding loans for more than two decades at fair personal loan rates.

Top Secured Personal Loan Provider For Fair Credit

For fair credit borrowers who don’t qualify for an unsecured personal loan, consider a secured loan from OneMain Financial. A secured loan is one that uses the value of an asset as collateral for the loan. This allows protection for the lender in case of default and therefore gives the borrower better terms for the loan.

10. OneMain Financial

Used primarily for debt consolidation, life events, auto loans, and home projects, secured personal loans from OneMain use the value of a paid-off vehicle — your car title — as the loan’s collateral.

- Loans available from $1,500 up to $30,000

- APRs start at 16.05% up to 35.99%

- 24-, 36-, 48- or 60-month repayment terms

OneMain says there is no minimum credit score needed to qualify, however, its average customer has a credit score between 600 and 650.

Top Personal Loan From a Bank For Fair Credit

For borrowers who reside at the upper end of the fair credit range, it may be worth your consideration to try for a Wells Fargo personal loan.

11. Wells Fargo Personal Loan

This well-known bank offers many of the conveniences of online lenders, including a completely electronic application process, while providing the security of one of the nation’s largest financial institutions. If you have a current account with the bank, a relationship discount may even apply.

- Loans available from $3,000 up to $100,000

- Funds often deposited the next business day

- Fixed APR

- No collateral required

A Wells Fargo personal loan offers a fixed APR, fixed terms, and fixed monthly payments. A representative example might be: $11,000.00 borrowed over 36 months at 12.99% APR results in a monthly payment of $370.58 over the life of the loan. There are no loan origination fees or prepayment penalties with a Wells Fargo personal loan.

Top Personal Loan From a Credit Union For Fair Credit

Credit unions are great places to apply for some of the best personal loans when you have fair credit. As member-owned organizations, interest rates and fees charged by credit unions tend to be much lower than those of traditional banks.

12. Alliant Credit Union

Alliant, as with all credit unions, requires you to be a member of the credit union to apply for a loan; however, membership is open to more people than you may think. Headquartered in Chicago, Alliant membership is open to employees and retirees of certain organizations, relatives of Alliant members, and even some nationwide clubs that are free to join.

- Loans from $1,000 to $50,000 available

- No collateral required and no prepayment penalties

- Same-day deposits into your Alliant account

Once you’re a member, personal loans from $1,000 to $50,000 are available for terms from 12 months to 5 years. Interest rates start as low as 6.74% up to 10.74% for longer-term loans.

Can You Get a Personal Loan with a Fair Credit Score?

Having fair or average credit puts many Americans right at the edge of qualifying for better loan terms and APRs. It’s not quite the nose-snubbing you’d get if you had really poor credit, but it’s a far cry from the welcome mat you’d see if your credit was good or excellent.

The positive news, though, is that there are lenders out there who really want your business.

Traditional lenders, like banks and credit unions, are the places most people think of first when it comes to getting a personal loan. And while there are a willing few, including the ones we mentioned above, most will require a score at the high end of the fair credit range.

Credit unions are generally more likely to consider factors other than just your credit score, but if you’re below 620 or so, it becomes much harder.

The graph shows the credit score ranges for the two main scoring models used by credit bureaus.

The lenders most likely to offer you a personal loan are those that specialize in serving this demogrpahic. Small lenders that are part of a lending network are a good bet. They have their own unique criteria and lending algorithms designed to identify qualified borrowers like you, who just so happen to have less-than-stellar credit.

Online lending networks don’t make direct loans, but rather connect lenders in their affiliate networks with borrowers. When you do receive a loan offer, it will be from one of these lending partners. As always, make sure to read the loan agreement completely and ask questions about anything you don’t understand.

How Do I Apply For a Personal Loan With Fair Credit?

Applying for any loan requires you to fill out a loan application. Depending on the lender and the format, a personal loan application can take minutes or hours to complete.

Online applications tend to take less time, and if you’re filling out an application on one of the lender networks we’ve recommended, you only need to apply once for all potential lenders. The type of information required by most lenders includes:

- personal data, such as your full legal name and address

- date of birth

- Social Security number

- employment status

- statement of income

- banking information, such as a checking account

This information will be used to verify your identity, check your credit report, and analyze your credit risk as a borrower. Almost all of our financial information these days is stored in various banking and credit system databases, and computers do the majority of the verification.

That’s why many lender networks can provide loan offers within minutes of receiving an online application.

When you do receive a loan offer (or multiple offers if you’re lucky), the terms should be clearly laid out. You should know the interest rate and length of the loan, how much you will be paying each month, and any fees you may be charged either now or in the future.

Once you agree and sign, the funds may be available to you in as little as one business day.

Do Personal Loans Help Your Credit?

Anyone with a fair credit score should be doing everything within their means to increase it. The reason for this is probably obvious — the higher your score, the better your credit and loan terms will be. Moving from fair to good or even excellent credit can mean a savings of hundreds of dollars in interest on future loans.

So, can getting a personal loan actually help your credit score? In a word, yes.

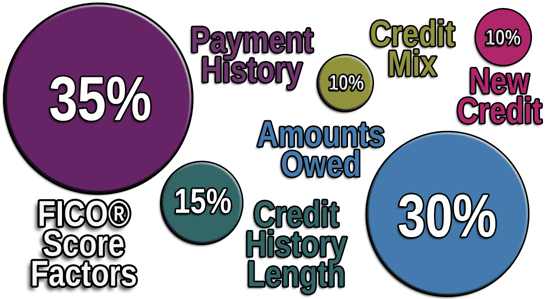

That’s because a portion of your credit score, 10% to be exact, is based on your credit mix. The credit rating agencies that calculate your score like to see a blend of credit types from revolving accounts such as credit cards, auto loans, and personal or installment loans.

Almost all lenders that make personal loans will report the payments to the credit bureaus. An exception to this could be loans secured by property, although even these lenders have begun to report payments to the bureaus more consistently.

One thing to make note of is that applying for a personal loan may result in a hard credit inquiry or “pull” by the lender, which can have a minor impact on your credit score for up to a year. If you’re using a lending network, any of the lenders who consider you for a loan may pull your credit.

The result may be a drop of a few points in your score. It is possible this could have a negative impact if you’re on the border of fair credit and bad credit.

Fair Credit Qualifies You For Fair Financing

People choose to apply for a personal loan because they need one, for reasons as varied as consolidating credit card debt, paying off medical expenses, and other emergencies. If you’ve decided a personal loan is your best option, then shopping around for the best personal loan you can find makes good financial sense.

Having a credit score that’s considered fair shouldn’t consign you to the junk heap of loan offers. We know people deserve to be treated fairly and with respect always — not just if you happen to have a good credit score. Plenty of options are available out there so you don’t have to settle for exorbitant interest rates and revolving debt traps.

As you work your way back up the credit score ladder, consider the lenders we’ve recommended here as trusted sources for fair loans. When included as part of a plan to rebuild and improve your score, a personal loan from one of these lenders or lender networks can help you on your way to a better score and better future offers.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.