Sometimes, an extra $100 can make all the difference in the world. And thanks to our reviewed apps, you should have no trouble quickly securing a small loan without jumping through hoops.

Whether you use a mobile app or an online loan network, you can get a $100-plus short-term loan even with bad credit. Best of all, most of these loan sources can put money in your bank account within hours.

This article will explore the best of these loans and answer your frequently asked questions. Bookmark it for the next time you need fast cash right away.

Best Overall $100+ Instant Loans

These loan sources are a mix of instant cash advance apps and online networks. They earn top rankings for their streamlined service and excellent reputations.

- Get up to $500 to your Dave Spending Account in 5 minutes or less or to a different linked debit card within an hour, subject to eligibility and identity verification.

- See how much of an advance you qualify for with no credit check.

- You agree to a settlement date when you take the advance. There’s no interest or late fees.

- Follow the link to download or open the Dave app and tap ExtraCash™. We’ll ask for a few pieces of info about you and your bank before you can get your first ExtraCash™ advance in just a few taps.

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $500 | N/A | View terms | See representative example |

The Dave ExtraCash™ Account has been downloaded more than 7 million times, attesting to its popularity. The app lets you create an online bank account to speed up your direct deposit time by up to two days. Once your setup is complete, you can receive a cash advance of up to $500 at no charge and automatically repay it on your next pay date.

Dave also partners with LevelCredit, enabling account holders to report their rent payments to the major credit bureaus, an opportunity to build credit through prompt remittance.

- Personal loans from $500 to $35,000

- All credit types are considered and welcome

- Simple, no credit impact form

- Helping consumers since 2001

- 4.7 out of 5 Trustpilot rating with 2,000+ reviews!

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| $500 to $35,000 | 5.99% – 35.99% | 60 Days to 72 Months | See representative example |

24/7 Lending Group is a lending service that connects borrowers with lenders catering to consumers with bad credit who need a small loan. You can choose from a wide range of loan amounts starting at $100, and the online application process is fast.

You can instantly prequalify for the best personal loans by completing a short online form and receiving an instant response. Then, choose an offer and apply for final loan approval. Your loan proceeds should arrive in your bank account by the next business day.

3. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $5,000 | Varies | Varies | See representative example |

MoneyMutual specializes in personal and payday lending and can help you find a loan as small as $200. This service is not a lender but instead connects you to a network of direct loan providers that can deliver next-day funding.

You can complete a short online form to receive an instant prequalification decision. Money Mutual’s lending partners will review your information and present you with offers for the best personal loans if you meet certain requirements, including a monthly minimum income of $800. To qualify, you must also be a US resident, 18 or older, and have a valid checking account, email address, and phone number.

Additional $100 Instant Loan Apps

The following mobile apps let eligible workers take an advance on their upcoming paycheck. Loans of $100 to $500 are available, and eligibility criteria vary by app. These free and low-cost solutions help you avoid the astronomical interest rates of traditional payday lenders.

4. EarnIn

The EarnIn mobile app provides access to your earnings before payday. To qualify, you can open an account and link your work time sheet to an active checking account. You can then quickly receive a direct deposit based on the work you’ve already performed.

New users can borrow up to $100 per pay period. You can eventually increase your loan amount to $500 through timely repayments. You also choose how much to tip EarnIn for the service — and it’s completely optional.

5. Possible

You can apply, receive loan approval, and accept up to a $500 cash advance on the Possible mobile app within minutes. You’ll join more than 1 million consumers who have accessed these short-term payday-style loans.

Possible doesn’t check your credit to determine eligibility. Instead, the lender examines your work history and regular pay schedule to evaluate your loan application.

6. MoneyLion

The comprehensive MoneyLion app provides mobile banking accounts, credit score tracking, credit builder loans, and investment products. The app’s InstacashSM feature lends you up to $500 without a credit check, interest, or monthly fees.

It usually takes up to five business days to receive your loan proceeds, but for a fee, Turbo Delivery can provide instant funding.

7. Cash App

Cash App lends users $20 to $200 with a 5% flat fee and a four-week repayment term (plus a one-week grace period). Overdue payments trigger a 1.25% finance charge per week on the outstanding balance.

The app has no hidden or overdraft fees. Cash App loans require a hard inquiry from a major credit bureau. These credit checks will appear on your credit report. Your ability to borrow from Cash App depends on your creditworthiness.

8. Brigit

The Brigit app lets you link a checking account to receive regular direct deposits. It takes only two minutes to sign up without a credit check. You can then request a payday advance of up to $250, but only if you’re a Plus or Premium subscriber.

You may receive your money as soon as the same day. The app provides insights about your spending habits and tips on how to grow your savings and income. Brigit has attracted more than 4 million users since its launch.

What Are Instant Loan Apps?

Instant loan apps are mobile digital platforms that offer quick and easy access to loans, usually without needing a credit check or a lengthy approval process. These apps use technology to streamline the lending process, allowing you to apply for a loan directly from your smartphone or other mobile device.

These apps typically provide short-term payday advances, perfect for individuals who need a small loan instantly. The process takes only minutes and approved loans transfer funds directly to your bank account as quickly as the same day.

These loans are usually low- or no-cost, making them ideal for workers receiving deposits directly from their bank accounts. Each app is unique, so you should read the loan agreement and understand the terms before accepting a loan from this source.

How Do I Qualify For an Instant Loan?

How you qualify for an instant loan depends on the source — lending network or mobile app.

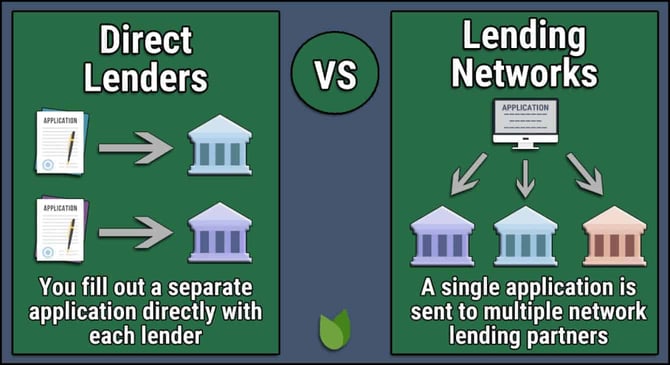

Lending Networks

Online lending networks are lender-finding services that prequalify your loan requests. Basic requirements include being a US resident or citizen, at least 18 years old, and having a valid ID, bank account, reliable income source, email address, and phone number.

Lender-finding services do not perform hard credit checks. The direct lenders in their networks may do so for instant personal loan requests but generally not for payday loans. You may receive one or more direct loan offers with specific terms and conditions if you successfully prequalify.

Review these carefully, and pay attention to interest rates, fees, and repayment terms before accepting an offer.

Mobile Apps

To qualify for an instant loan from a cash advance app, you must first download the specific app and create an account by providing the necessary personal information, such as your name, address, employment details, and Social Security number.

You must also connect a bank account to the instant cash advance app to accept loan proceeds and automatically repay the amount due on your next pay date.

Some apps may conduct a soft or hard credit check to determine your creditworthiness. A soft check typically doesn’t affect your credit score, but a hard inquiry remains on your credit report for two years.

Eligibility criteria vary, but income level, banking history, employment record, and credit score requirements can vary. You must provide proof of income, such as bank statements, pay stubs, timesheets, or other verification forms.

Reviewing the app’s terms and conditions carefully before accepting a loan is essential. Once you accept the terms, the app disburses the loan directly to your linked bank account.

How Quickly Will I Receive the Loan After Approval?

A mobile app can fund your loan on the same day, depending on when you apply. The app will deposit loan proceeds into your bank account and automatically withdraw the borrowed amount from your bank account on your next payday.

Network loans may take a little longer. Expect your loan proceeds to appear in your bank account as soon as the next business day.

As with the loan apps, network lenders withdraw payment from your bank account. You repay an instant payday loan in a lump sum on your next pay date, but you repay an instant personal loan in a series of installments.

What Is the Interest Rate For a $100 Loan?

Interest rates on small loans vary tremendously, from 0% to 700% or more. Cash advance apps often charge no interest. Instead, they accept optional tips from borrowers. Some assess transaction fees or offer paid subscriptions for premium services.

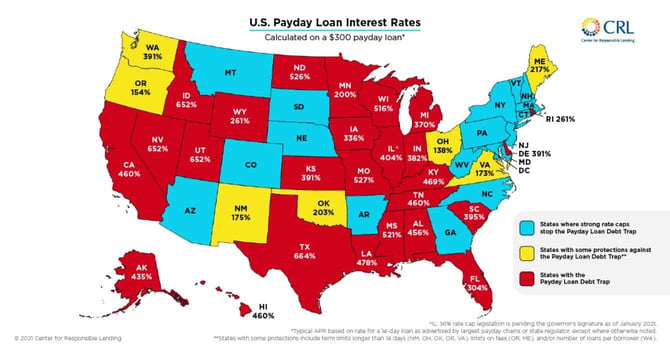

Although state limits vary, personal loan interest rates typically don’t exceed 36%. Payday loans are incredibly costly, with APRs generally ranging from 400% to 700%.

Payday loans cost more because they don’t require credit checks. Without such checks, payday lenders must charge high rates due to the greater risk that borrowers may default on these loans.

Are There Any Fees Associated With Instant Loans?

Cash advance apps may charge transaction or subscription fees, but some allow you to leave a tip instead. Most charge a fee if your bank account has insufficient funds to repay the loan on your next payday. At least one app charges a flat rate for a four-week loan.

Providers of personal loans often charge origination fees for processing new loan applications. This fee is typically a percentage (up to 10%) of the loan amount.

Payday loans charge high interest rates, but you can avoid additional fees if you repay by the due date. If you roll over the loan, you’ll pay a late fee, and the lender will add your accrued interest to the loan principal.

What Is the Easiest App to Borrow $100?

We recommend Dave for easy borrowing. Its ExtraCash™ advances of up to $500 have no credit checks, interest charges, or late fees. You can get a cash advance as soon as you download Dave and connect a bank account.

- Get up to $500 to your Dave Spending Account in 5 minutes or less or to a different linked debit card within an hour, subject to eligibility and identity verification.

- See how much of an advance you qualify for with no credit check.

- You agree to a settlement date when you take the advance. There’s no interest or late fees.

- Follow the link to download or open the Dave app and tap ExtraCash™. We’ll ask for a few pieces of info about you and your bank before you can get your first ExtraCash™ advance in just a few taps.

- See official site, terms, and details.

| Loan Amount | Interest Rate | Loan Term | Loan Example |

|---|---|---|---|

| Up to $500 | N/A | View terms | See representative example |

For a small fee, you can instantly transfer your advance to a Dave Spending Account or a different debit card within an hour. When you take the advance, you agree to a settlement date (usually your next pay date). Dave doesn’t charge interest or late fees, so setting up an account shouldn’t involve any surprises.

You can leave an optional tip when you take an advance. A portion helps run ExtraCash, and the rest goes to Feeding America. Dave members have donated enough money to purchase more than 110 million meals to date.

You can deposit some spare money in your ExtraCash account to simplify your next loan. The more you contribute, the less you have to pay back.

How Do Instant Loan Apps Compare to Payday Loans?

You can borrow modest amounts without a credit check via an instant loan app or a payday loan. The chief difference is cost, but the loans also vary in other ways.

The following chart compares the two types of loans.

| FEATURES | INSTANT LOAN APPS | PAYDAY LOANS |

|---|---|---|

| Application Process | Online or app-based, often streamlined | In-person or online application |

| Approval Time | Rapid, sometimes within minutes | Fast for in-person loans, but online loans may require 24 hours |

| Credit Check | Varies; some require soft credit checks | Typically, no credit check is required |

| Loan Amount | Generally smaller amounts | Usually small, based on income |

| Repayment Terms | Varies, often flexible | Short-term, usually by next payday |

| Interest Rates and Fees | May include various fees (assuming no interest) | Extremely high APR and fees |

| Accessibility | Widely accessible via smartphone | Accessible online and at physical locations |

| Regulatory Compliance | Typically regulated, with standards for data protection and fair lending | Regulated, but the level varies by state |

| Data Security | Advanced encryption that varies by app | Varies: digital security for online; physical security in stores |

| Privacy Concerns | Collects data, may share with third parties | Collects personal data; risk varies by data handling practices |

| Risk of Debt Traps | Unlikely since most charge no interest | High, due to high fees and risk of repeated borrowing |

| User Authentication | Robust, often with two-factor authentication | Requires ID verification; varies for online services |

| Transparency | Usually good; most apps have no hidden charges | Widely criticized for lack of transparency |

Repeatedly rolling over a payday loan can cause a debt spiral that may lead to bankruptcy. Cash app loans are initially low and don’t pile up late fees, making them safer financially.

How Do I Repay My Instant Loan?

Repaying a loan from an app versus a payday lender involves a different process. The options for repaying a cash app instant loan include the following:

- Automatic withdrawal: The most common repayment method is automatic withdrawal from the bank account linked to the cash app. The app automatically withdraws the loan amount plus any fees on the due date.

- Manual payments: Some apps allow manual payments through the app interface, where you can choose to pay on or before the due date.

- Flexible schedules: Depending on the app, you may have options to adjust the repayment schedule if needed, though this could trigger additional fees.

- In-app notifications: Cash apps typically send reminders and announcements about upcoming payments to help you manage your repayment schedule.

- Partial payments: Some apps may allow partial or minimum payments, although these extend the loan term and may increase the total amount due.

Repaying a payday loan involves the following options:

- Post-dated check: When you take an in-person payday loan, you may provide a post-dated check that the lender will cash on the repayment date.

- Direct debit authorization: Similar to cash apps, payday lenders often require authorization to withdraw the repayment amount from your bank account automatically.

- In-person repayment: You can often repay in person on the due date if you took the loan at a physical store.

- Rollovers: If you can’t repay on time, payday loans often offer rollovers (with additional fees), which extend the repayment period but increase the cost.

- Full repayment: Payday loans typically require full repayment by your next payday without the option for partial payments.

Each method has its own set of pros and cons. Automatic payments are convenient but require you to have sufficient funds in your bank account. Manual payments offer more control, but you need to remember the due dates. Understanding these differences can help you choose the more suitable loan.

Can I Extend My Loan If I Cannot Pay It Back on Time?

You can usually extend cash advances and payday loans, but the consequences are wildly different. Apps such as Dave let you reschedule repayment without a late fee or other penalty.

Payday loans typically allow rollovers (although some states ban the practice). For example, suppose Joe takes a $100 instant payday loan with a 400% APR, due on his next pay date in two weeks. On that date, Joe realizes he cannot repay the loan and asks for a rollover.

The interest for the two weeks depends on the annual percentage rate. For a 400% APR, the interest for this period is approximately $15.38. The lender charges a flat late fee of $25.

Assuming the lender capitalizes the rollover fees and accrued interest (i.e., adds it to the principal amount), the new principal amount after the missed payment becomes approximately $140.38. This amount is subject to the 400% APR for the next two weeks, causing the repayment amount to rise to $161.98.

Repeatedly rolling over his payday loan can lead to runaway debt that Joe may be unable to repay.

Is My Financial Information Safe With Instant Loan Apps?

The safety of your financial information when using instant loan apps depends on several factors. Here are actions you can take to increase the security of your private data.

- Reputation and reviews: Research the app’s reputation, looking for user reviews or ratings on trusted platforms such as BadCredit.org. A solid positive reputation can indicate reliability.

- Data encryption: Ensure the app uses robust encryption to protect your data, especially during transmission and storage. This practice prevents unauthorized access to your confidential information.

- Privacy policy: Read the app’s privacy policy. It should clearly state what information the app collects, how it is used, and whether the app shares it with third parties.

- Regulatory compliance: Search the internet to check if regulators have acted against the app’s publisher for not complying with relevant financial regulations and standards, such as those set by the Consumer Financial Protection Bureau (CFPB). Compliance with these standards signifies the app’s commitment to protecting your information.

- Two-factor authentication (2FA): Look for apps that offer 2FA. This feature adds an extra layer of security beyond just a password.

- Permissions and data access: Be cautious about the permissions the app requests. Provide only necessary information and be wary of apps asking for excessive access to personal data.

- Regular updates: Ensure the publisher regularly updates the app. Updates often include security enhancements.

- Avoid public wifi: When using loan apps, avoid public wifi networks as they may not be secure. Use a virtual private network (VPN) to secure a public wifi connection.

- Monitor your accounts: Regularly monitor your bank statements and credit reports for unauthorized transactions.

- Secure Devices: Make sure your mobile device uses security measures, such as strong passwords, and is free from malware.

Remember, no app can guarantee 100% security, so taking proactive steps to protect your information when using instant loan apps is essential.

Borrow $100+ Instantly With a Loan App

You can borrow a small amount even with poor credit if you know where to look. Our review of online loan networks and cash advance apps provides excellent guidance on which options are available to you.

Although borrowing $100 may not seem risky, remember that you must disclose private information to qualify for the loan. In the wrong hands, this information can be costly indeed, as it could result in identity theft. That’s why you should be diligent when choosing a lender, regardless of the loan size.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.