Loans can be helpful financial tools, enabling you to do things like pay for expensive items over time or efficiently reorganize debt. However, borrowing money from a financial institution isn’t free. In exchange for extending you the funds, a variety of fees may be attached.

Although it may not be possible to steer clear of every associated loan fee, some are preventable. Here are the most common (and a few not-so-common but good to watch out for) fees. Even if you can’t avoid them entirely, you may be able to reduce the cost.

1. Application Fee

Some lenders will charge a non-refundable fee when you apply and submit your paperwork. The money is meant to go toward the effort that is required to analyze and process the forms.

Can you avoid it? Usually.

If you come across a lender that charges an application fee, this is your cue to wait and research other financial institutions that are offering loans with similar terms but without that upfront fee.

2. Origination Fee

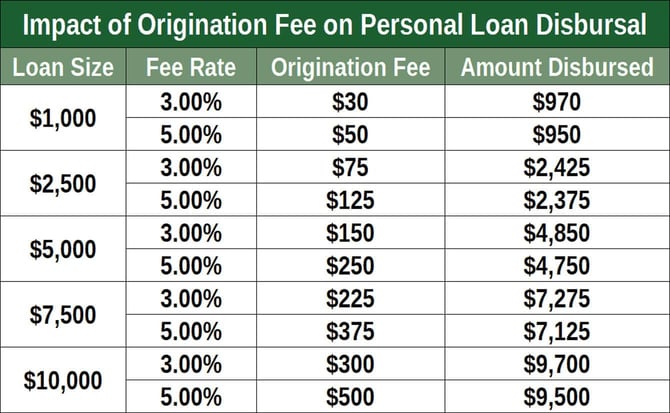

Origination fees are tacked on to many types of loans. It is calculated as a percentage of the amount you take out and can range from 1% to 10%. The fee may be deducted from the amount you borrow or added to the loan.

For example, a loan of $5,000 will either drop to $4,850 or be increased to $5,150, depending on how the fee is charged.

Can you avoid it? Rarely.

However, you can look for a loan that has the lowest origination fee and increase your chances of getting it by making yourself as creditworthy as possible. You will want to have a high credit score and a steady income that indicates that you can afford to make your payments for the duration of the loan.

If you cannot secure a loan with the lowest origination fee because you have damaged credit or your income isn’t sufficient, you may consider bringing a more creditworthy person to cosign the loan.

3. Late Payment Fee

When you take out a loan, you are expected to make the full payments by a certain day of the month. For example, you may have to pay by the 15th. If you don’t, a late fee will be assessed.

The amount of the late fee will be listed in the terms of the agreement, but it is usually somewhere between $15 and $50. Be aware that many lenders also will grant a grace period of 10 days to two weeks before the late fee is assessed.

Can you avoid it? Yes.

When you make your payments by the due date, no late fee will be assessed. The easiest way will be to arrange for automatic bill pay with your bank, so the money is deducted on a specific date of the month and delivered to the lander. That will not only ensure that you avoid the late fee, but you will establish a steady payment history, which will help your credit.

If you pay manually but forget to send the money on time or you simply don’t have it, you can also avoid a late payment by contacting the lender and asking for a waiver. This may only work once or twice, but it doesn’t hurt to ask.

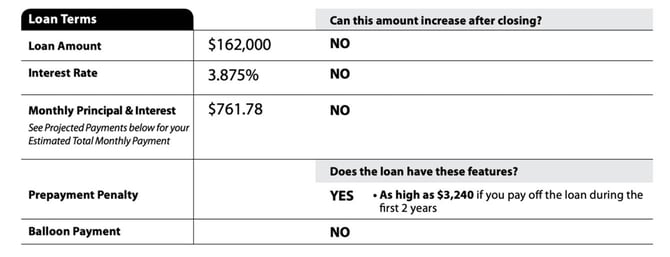

4. Prepayment Penalty

Some types of loans will charge you a penalty if you repay the balance early. For example, mortgage lenders will usually assess a prepayment fee because they make money from the interest that is attached to the monthly payments.

As per the Dodd-Frank Act, the amount you’re charged can’t exceed 2% of the balance for the first two years and 1% of the balance in the third year — and nothing after that. Finance companies that provide auto loans will also assess prepayment penalties of a couple of percentage points of the remaining balance. Some personal loans will also impose a prepayment penalty.

Can you avoid it? Sometimes.

Only take out the loans you need because if you change your mind and want to pay the entire loan amount in advance, it can cost you. When researching loans, pay attention to where it outlines what the prepayment penalty is, if there is one. If you think there is any chance that you may want to delete the debt early, look for a loan that either doesn’t charge the fee or has the lowest fee.

5. Processing Fee

Another type of fee that you may encounter is that for processing the loan. It may go toward such expenses as administrative, document, handling, and hard credit checks when you take out the loan and be charged as a one-time fee. There may also be payment processing fees that are added to every payment you make on a monthly basis or any time you make the payment with a wire transfer.

Can you avoid it? Yes.

Be very careful to read the terms of the loan before you accept it. Not all lenders charge processing fees, so if you see them in the agreement, take a pass.

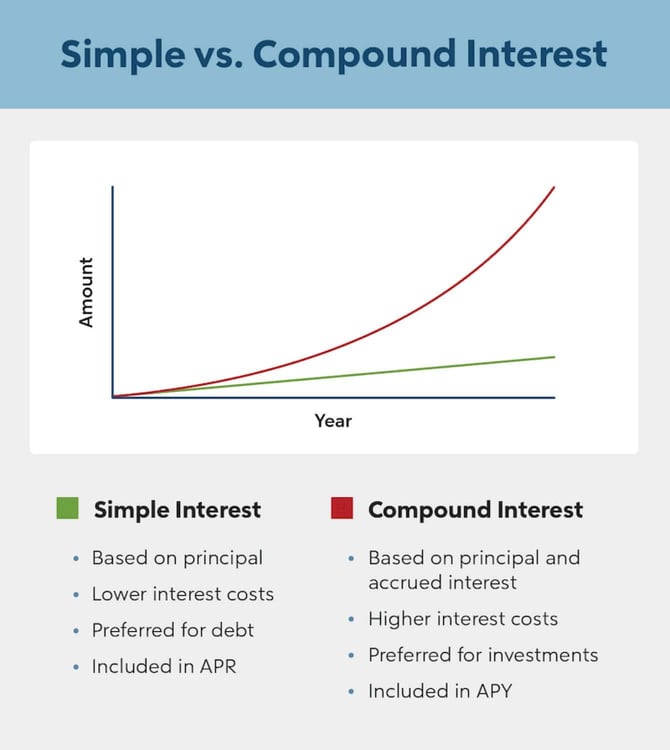

6. Interest

Interest is the amount the lender will charge you to finance the loan. Although credit cards use the compound interest method, where interest is assessed on balances already increased with accumulated interest, loans usually use the simple interest method, where interest is calculated monthly.

The lender takes that month’s ending balance, multiplies it by the interest rate, then divides it by 12. So if you owe $5,000 and the interest rate is 9%, the interest for that month is $$37.50 (5,000 x .09 / 12 = $37.5).

Can you avoid it? No.

Interest is the cost of doing business with the lender. Your best-case scenario is to secure the lowest interest rate you can get. That means ensuring that your credit score is as high as it can be before you apply for the loan.

7. Credit Insurance

Credit insurance is an insurance policy that covers you under certain events. It may be disability insurance that makes part or all your loan payments if you have a qualifying illness, injury, or disability, or unemployment insurance, which makes your monthly payments if you become involuntarily unemployed. There is also credit life insurance that will pay a loan balance if you die unexpectedly.

Can you avoid it? Yes.

All forms of credit insurance are voluntary. You may decide that the fees are worth it for the benefits, but that decision is yours to make.

Don’t Pay More Than You Have to When You Borrow Money

Before you start the loan application process, pull your credit reports from the three credit bureaus by going to annualcreditreport.com. Make sure everything is accurate, and dispute mistakes — especially if they are negative and are pulling your credit scores down.

The most common credit scoring model used by lenders is the FICO Score, so check it prior to applying for a loan. These scores range from 300 to 850, and though you can often get a loan with low credit scores, those that are 720 and above will help you get the lowest rate and qualify for loans with the fewest fees.

In the event there is negative but correct information appearing on your file, take swift action. The two most important credit scoring factors are your payment history and credit utilization:

- If your reports show evidence of late payments, start from this point to get them all on time.

- If your reports show that you owe a lot of money on your credit cards compared to their credit limits, reduce the balances so they are no more than 30% of the credit line, both per card and in total.

It is almost impossible to avoid every fee that could be associated with a loan. The fact is, these are products that financial institutions have created so they can make money. As a borrower, though, it will be your job to read the terms so you understand how much the loan will cost you, and to make yourself into the most appealing borrower.