Although most people these days know that bad credit can make it hard to get a loan, a low credit score can have many more negative side effects. For instance, even if you manage to qualify for a loan with poor credit, that low score will likely mean a high APR. When it comes to making a large purchase such as a vehicle when your credit score isn’t exactly great, finding low-interest auto loans for bad credit can make a big difference in the amount you pay over the life of the loan.

Indeed, lenders are more likely to require that borrowers with bad credit pay higher interest rates and fees to help offset the higher credit risk. While paying a month or two of high interest on a small credit card balance is one thing, an extra percentage point on your five-digit auto loan can damage your budget.

There are some ways to help mitigate the damage, however, including finding a lender with flexible credit requirements. Other steps, such as providing a decent down payment, can also help you score a lower rate.

Providers | Getting a Lower Rate

Best Providers for Low-Interest Auto Loans

When trying to obtain an affordable auto loan with bad credit, finding a flexible lender can be half the battle (or more). Credit unions and small community banks are popular sources of financing for consumers with less-than-great credit, but your local dealer may also be an option.

Auto dealers who also offer financing often have extra incentive to sell you a vehicle, often making them more likely to approve your application. A simple way to find local dealers with flexible requirements is to use an online dealer network, like our top-rated picks below.

- Network of dealer partners has closed $1 billion in bad credit auto loans

- Specializes in bad credit, no credit, bankruptcy and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have $1500/month income to qualify

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 3.99% - 29.99% | 1999 | 3 minutes | 9.5/10 |

2. LendingTree

- Auto loans for purchase, refinance, and lease buyouts

- Nationwide lender network

- Get matched with up to 5 lenders that fit your financial profile

- It only takes a few minutes and is free with no obligation

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1998 | 4 minutes | 9.5/10 |

- Loans for new, used, and refinancing

- Queries a national network of lenders

- Bad credit OK

- Get up to 4 offers in minutes

- Receive online loan certificate or check within 24 hours

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2003 | 2 minutes | 8.5/10 |

Using an online dealer network is similar to using any other aggregate site. In essence, you fill out one application, then the network uses your needs and qualifications to sort through dozens or hundreds of partners to find the dealer(s) best able to meet your requirements.

Once you choose a dealer, the network will connect with you with a dealer representative. At this point, the dealer network has done its job, and you’ll complete the process with the dealer you selected.

In most cases, you’ll typically set up a time to meet with the dealer representative and to shop the dealer’s available inventory. When you find a car that matches your needs — and, more importantly, your budget — you’ll then work with the dealer to secure financing and sign the final loan agreement.

Tips for Getting a Lower Interest Rate

If your credit score is bad enough, simply being approved for an auto loan at all can feel like a major win. But a low credit score doesn’t necessarily mean you have to jump on the first offer that comes along — especially if the interest rate is sky-high.

While a few percentage points typically won’t break the bank on a smaller loan, auto loans worth thousands of dollars — or, worse, tens of thousands of dollars — will definitely feel the pinch of a high interest rate. For an average automobile, a few percentage points can mean paying significantly more over the course of the loan.

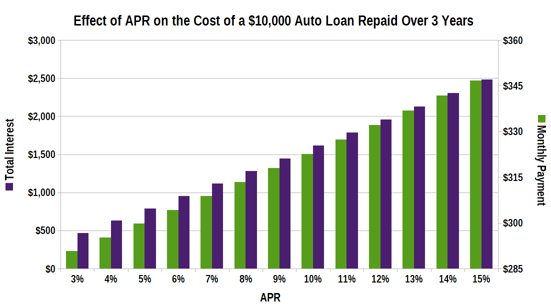

For example, consider a $10,000 car loan repaid over three years. At a low 5% APR, that loan will cost just under $800 in interest over its life and have a monthly payment of approximately $300, as shown in the graph below.

The higher your auto loan’s APR, the more you’ll pay in interest fees over the life of the loan.

An APR increase of just one percentage point would have a corresponding monthly payment increase of only $5, but that adds up to about $150 in additional interest across three years. A more severe APR jump, say up to 10% APR, would mean a monthly payment of over $320, and more than $1,600 in total interest over the life of the loan.

Moreover, some subprime auto loans can charge as much as 15% APR (or even higher), which could mean paying nearly $2,500 over the cost of your vehicle just in interest fees.

On the bright side, you may not be stuck with an unreasonably high interest rate. Borrowers can use a number of methods to try and obtain a lower rate, though success will, of course, depend on your specific credit profile and the lender you choose to use.

Apply with a Qualified Cosigner

One of the most effective ways to improve both your chances of being approved as well as the interest rate you’re offered is to use a cosigner when you apply.

Unlike a joint or co-applicant, cosigners aren’t typically expected to use the loan. Instead, a cosigner is someone with good personal credit who agrees to take responsibility for the loan should the primary borrower be unable or unwilling to do so.

In other words, bad credit is a warning to creditors that you may not always repay your debts. Applying with a cosigner helps reassure the lender that the loan will be repaid (one way or another).

Unfortunately, cosigning isn’t always a win-win scenario — especially for the cosigner. If you obtain an auto loan using a cosigner, and you fall behind on the loan, the lender can — and almost certainly will — come after your cosigner for repayment.

And it’s often the cosigner who is most likely to be in the crosshairs if something goes wrong. Why? Because lenders are smart, and they know that a cosigner is more likely to be in a position to repay the loan than someone struggling with poor credit who is already falling behind.

Additionally, consumers with good credit are more likely to fight to keep that good credit intact.

Since any cosigned debts will appear on the credit reports of both the primary applicant and the cosigner, any poor payment behaviors, such as late or missing payments, can severely damage your cosigner’s credit scores.

All in all, it’s a good idea to be completely sure you can make your auto loan payments on time and as agreed — and that you can do so over the entire life of the loan — before you start asking friends and family members to act as your cosigner.

In fact, a good way to reassure everyone involved that you can handle an auto loan may be to create a realistic budget of your finances that you can share with your potential cosigner. This can help you stay on track, as well as show your cosigner that you’re serious about keeping up with your payments.

Make a Down Payment or Offer a Trade-In

Given that auto loans are secured loans — i.e., the vehicle acts as collateral for the loan — another potential method for reducing the interest rate of your auto loan is to reduce the loan-to-value (LTV) ratio of the loan, either by making a down payment or by offering a valuable trade-in vehicle.

Essentially, you may get a better rate if you make it less of a risk for the lender to, well, lend you money.

If you can’t repay your auto loan for some reason, the lender can — and almost always will — repossess your vehicle and sell it in an attempt to recover the outstanding debt. But the success of that fallback depends entirely on the value of the vehicle.

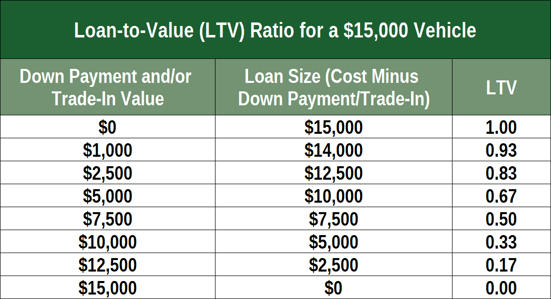

For an auto loan, the LTV is used to determine how hard it will be to recover an unpaid debt (plus the associated costs of repossessing and selling the vehicle). Mathematically, the LTV is the amount of the loan divided by the value of the vehicle.

For example, consider a vehicle with a value of $15,000. If you were to provide a $5,000 trade-in and you obtain a $10,000 loan, the LTV of the loan would be $10,000 / $15,000 = 0.67, or 67%.

In general, a high LTV means the lender would have to get top dollar for the vehicle to make back its money. Conversely, a low LTV means that the lender will likely have an easier time selling the vehicle for enough money to cover the total outstanding balance.

When you make a down payment or offer a trade-in vehicle, you reduce the LTV on the loan, which also reduces the overall risk of the loan for the lender. This can both help you get approved for the loan as well as help you negotiate for a better interest rate.

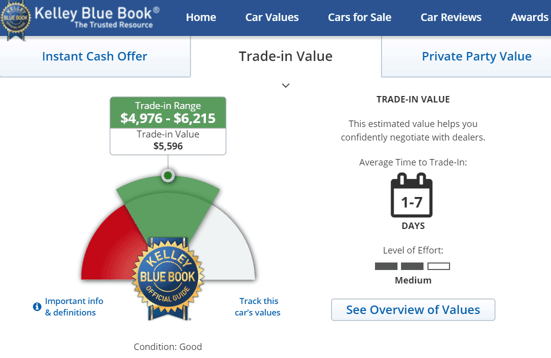

You can use online calculators to determine a fair market value for your vehicle to help decide whether to sell it or trade it in to the dealer.

Before deciding whether to trade-in or sell your vehicle, be sure to investigate its market value. Some sites, like Kelley Blue Book, will show you the estimated value of trading in your vehicle, as well as the general amounts similar vehicles have sold for in your area.

In many cases, experts recommend selling your vehicle yourself and making a cash down payment, rather than trading in your vehicle at the dealership. Dealers rarely give full market value for a trade-in vehicle, in part due to the costs of storing, transporting, and selling the trade-in.

Build Credit & Refinance

Depending on your situation, taking on a high-interest loan may really be the only option. Thankfully, you aren’t necessarily stuck with that high interest rate for the life of your loan, especially if you work hard to build your credit as you go — something your new loan may help with if used responsibly.

That’s because, of all the factors that go into your loan rates, your credit profile is by far the most important. The less risk you appear to be, the more lenders are willing to trust that you’ll repay them. That trust equates to lower interest rates and larger loan offers.

If you’ve managed to improve your credit sufficiently, you can then shop for a refinance loan with a lower interest rate. Basically, you take out a new auto loan with better terms, using the new loan to pay off your older, more expensive loan.

So long as you don’t extend your loan terms — i.e., as long as your new loan is the same or shorter than how long you had left on your old loan — then you will pay less overall for the loan due to the reduced interest fees.

The best way to improve your credit score will depend entirely on your personal credit profile, so it’s important to understand the factors that impact your score. Of course, the models used by lenders and scoring agencies are complex creatures, but you can use FICO’s five core metrics as a good baseline.

- Payment History – 35%: Pay all of your debts on time and as agreed to score well here.

- Amounts Owed – 30%: Keep your credit card balances low and your overall debt-to-income (DTI) ratio low.

- Credit History Length – 15%: Establish credit early and avoid closing old credit accounts in good standing.

- New Accounts – 10%: Open new credit accounts sparingly and avoid excessive hard inquiries.

- Credit Mix – 10%: Responsibly use a variety of credit account types, including installment and revolving credit.

Short of making sure you pay your bills on time, it’s hard to actively improve your payment history. However, improving your amounts owed factor can be a quick way to boost your score. This can be especially effective if you can pay off any credit cards with high utilization rates.

If you have negative items, like delinquent payments, that are dragging down your score, time may be your only real answer. Most negative items can only stay on your credit reports for up to seven years (up to 10 years for certain bankruptcies).

But you may not need to wait that long. Credit scoring models are designed to place more emphasis on newer activity, so many negative accounts will impact your score less as they age and are replaced by newer — and hopefully more positive — financial behaviors.

Pay Down Debt Faster to Reduce Overall Interest Payments

Although the average consumer is woefully under-educated about credit, resources for learning how to build and maintain good credit are abundant. With a little research, most consumers can learn to improve their credit — and keep it that way.

And improving your credit is the only guaranteed way to reduce the interest rates you’re offered on any type of credit, including auto loans. That being said, there are still things you can do to limit the interest you pay, including using a cosigner or making a down payment.

Paying off your debt faster than you’re required to can also help you save on interest. Just be sure that your loan doesn’t charge a prepayment fee for paying it off before the end of the agreed-upon term.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.