When negative items appear on your credit reports, they can complicate your life in many ways. Negative credit items can lead to poor credit scores. Poor credit scores, in turn, can make it difficult to find lenders and credit card issuers that are willing to approve your applications for financing.

And while making it harder to find competitive financing is bad enough, poor credit reports can complicate other areas of your life as well. In some cases, it’s possible to remove derogatory items from your credit reports. But, that’s not always the case.

Some derogatory items on your credit reports are actionable, and some are not. As in, you may be able to remove some negative items but not others. And, of course, you’ll have to deal with either the credit reporting agencies or the companies that furnish information to them.

The process can be complicated, time-consuming, and may require a considerable amount of patience.

Types of Negative Credit Information That Can Be Removed

It’s not illegal for creditors, lenders, and debt collectors to furnish (report) derogatory information to your credit reports. If you pay your bills late, default on your debt, experience a repossession, break on an apartment lease, file bankruptcy, or experience other negative events, the data furnisher is well within its rights to report those details to one or more credit reporting agencies.

Your current and future lenders rely on this type of information on your credit reports to assess the risk of doing new business with you or continuing to do business with you if you already have an account with them. Your credit history helps lenders decide whether to loan you money and how much to charge you if they do.

Seeing how you’ve handled your credit obligations in the past helps lenders make better decisions. This process is called Risk-Based Pricing.

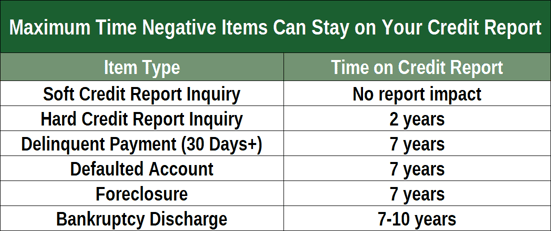

According to the Fair Credit Reporting Act (or FCRA), most negative information can remain on your credit report from seven to 10 years. Things like late payments, collections, and foreclosures will remain on your credit reports for up to seven years. Some forms of bankruptcy will stay on your credit reports for up to 10 years.

The point being, missing payments can lead to many years of poor credit reports and low credit scores.

Despite what some people would have you believe, credit reports are accurate around 98% of the time. However, mistakes can happen from time to time. And, if credit reporting errors happen to you, they can make it harder to borrow money and do so at an affordable rate.

An error-riddled credit report can also cost you a job, an insurance policy, and force you to pay large deposits with landlords and utility providers.

The seriousness of these potential issues is why the FCRA allows you to dispute information on your credit reports with any or all of the credit bureaus. And when Experian, TransUnion, or Equifax receive your disputes, they must perform a reasonable investigation into the matter.

While they can take as long as 30 days, these investigations generally take no longer than a couple of weeks.

How to File Disputes With the Credit Bureaus on Your Own

The Fair Credit Reporting Act outlines the rules governing credit report disputes. For starters, while you can certainly hire someone to facilitate the credit dispute process, you don’t have to. You have every right to dispute inaccurate items with the appropriate credit bureaus on your own and free of charge.

Below are the basic steps you should follow if you want to file a dispute with a credit reporting agency.

- Get a copy of your credit report. Better yet, request all three of your credit reports from the major credit bureaus via AnnualCreditReport.com or another resource of your choosing. Once you download your credit reports, make a note of any incorrect or suspicious items you wish to dispute. If you don’t know what’s on your credit reports, you won’t know what’s potentially incorrect.

- Choose how to file your disputes. The credit bureaus accept disputes from consumers in several different ways. You can mail your dispute using the good old-fashioned U.S. mail system or you can file a dispute online. You can also call the credit bureaus and file disputes verbally. When I worked at Equifax, we even had people show up to our office in person and file disputes.

- File your dispute. You’ll want to have key details about the item(s) you wish to dispute when you contact a credit reporting agency. It’s helpful to list the creditor’s name to help the credit bureau identify the account you believe to be incorrect with written disputes that you plan to mail. The Federal Trade Commission (FTC) recommends mailing dispute letters via certified mail (return receipt requested). The FTC also provides a free sample dispute letter template you can use to write your letter.

- Wait for a response. Once a credit bureau completes its investigation, it is obligated to provide you with the results of its investigation, which is normally done in writing. Depending on how the data furnisher or furnishers responded, the credit bureaus will either update the item, delete it from your credit reports, or allow it to remain because it has been verified as accurate.

It’s worth noting that some people prefer to hire a credit repair company to help them manage the credit dispute process. Doing so is entirely legal, and in many cases, it can be effective. However, there is a cost to credit repair, and, as such, it may not be the best fit for everyone.

Steps You Can Take If You Can’t Remove Negative Information from Your Credit Reports

The credit bureaus don’t have to remove accurate information from your credit reports earlier than required by the Fair Credit Reporting Act. If a data furnisher verifies that its credit reporting is accurate, the credit bureaus can typically leave the item on your credit reports. You cannot force a credit bureau to remove information from your credit reports.

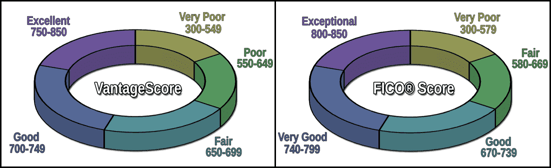

There are, however, some steps you can take to try and offset the damage any negative information may have on your FICO or VantageScore credit scores.

Here are a few strategies that may help you start to rebuild a poor credit score caused by information that you are unable to get removed:

- Avoid future late payments. Most of your credit score points (about one-third) come from the payment history information on your credit report. So, if you can make a habit of paying your bills on time every month, you may slowly start to reverse some of the damage those old negative accounts are causing.

- Lower your credit card utilization ratio. Using a large percentage of your available credit limit on credit cards can hurt your credit scores. But if you can pay down your credit card debt and lower your credit card utilization ratio, your score may start to rebound. The target percentage for FICO scores is less than 10%. The target percentage for VantageScore credit scores is less than 30%. So, if you’re using less than 10% of your available credit, you’ll be optimal for either scoring platform.

- Establish positive credit. Opening a new credit card or credit builder loan isn’t going to erase old, negative information from your credit reports. But if you establish new credit and use it responsibly, those positive actions may start to raise your scores over time. Keep in mind that qualifying for new accounts when you have damaged credit can be tricky. Consider starting with credit cards for bad credit (like secured accounts) or credit builder loans if you’re in this position.

But most of all, manage any accounts you open responsibly. On-time payments and low credit card utilization rates are essential to your credit-building journey.

The Bottom Line: You May Have to Wait It Out

In some cases, it is possible to remove negative items from your credit reports. But if the information is accurate, you may have to wait several years before it is deleted.

On a happier note, negative credit history doesn’t have to be the end of your story. You can start rebuilding your credit immediately, regardless of how bad your credit reports look today.

Work on establishing new credit if you need it and develop good credit management habits. These positive changes will start to benefit you long before your old credit mistakes fall off your credit reports.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.