If your abysmal FICO credit score makes you want to put a bag over your head every time you enter a bank, check out these credit repair tips. These tips aren’t secret hacks, yet more than a third of Americans surveyed for a LendingTree poll had no idea how FICO calculates credit scores.

The mechanism responsible for credit reporting and scoring starts with data that creditors and lenders periodically send to the three major credit agencies (Equifax, TransUnion, and Experian). This credit reporting data includes information about the amount you owe and the payments you make (or fail to make).

The credit reporting agencies collect the information, record it in a person’s credit report, and use it to calculate one or more credit scores. FICO and VantageScore are the most widely used credit scoring models and both range from 300 (worst) to 850 (best).

If your score is below 670, you’ll increase your access to good credit terms by boosting your credit score. Numbers generally lower than 600 indicate poor credit and can negatively impact your lifestyle.

Even if you are credit-literate, we’re guessing that one or more of these tips may contain information new to you. Each tip specifies a step you can take to repair your credit and keep it in good shape.

1. Always Pay Your Bills On Time

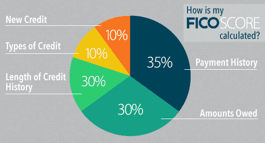

Your payment history is the most significant factor that determines your credit score.

As you can see, 35% of your FICO score stems from your credit history. Paying your bills on time is mandatory if you’re serious about repairing your credit.

Payments overdue by 30 or more days get reported to the credit bureaus, where they immediately cause your score to drop by dozens of points. Moreover, each item lingers on your credit report for seven years.

Credit bureaus collect and report other derogatory information, including collections, repossessions, settlements, foreclosures, and bankruptcy petitions. These items can devastate your credit score and haunt your reports for up to 10 years in the event of a Chapter 7 bankruptcy.

It’s not all bleak, however. The influence of negative items upon your score wanes over time. The sooner you adopt good credit habits, such as prompt bill payment, the faster your score will begin recovering.

If you miss payment dates because of sloppy bookkeeping, consider setting up auto payments with your creditors. Most credit cards allow you to pay a fixed amount or your minimum payment due automatically each billing cycle. You may also benefit from personal finance software or services that schedule your bills and automatically pay them.

It’s another story altogether if the reason you miss payments is that you can’t afford to pay them. Check Tip #4 to learn about one way — credit card consolidation — to address this problem.

2. Pay Off Your Debts

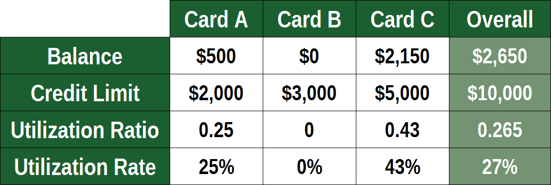

FICO rewards you for keeping your unsecured debt levels under control. FICO measures your credit card debt using the credit utilization ratio metric (CUR, also known as the debt-to-credit ratio).

CUR equals the credit you’re currently using divided by the credit available to you (i.e., your credit card credit limits).

Realistically, you’ll have to shell out more than just the minimum payments on your credit cards if you want to reduce your unsecured debt. Those tiny minimums are lovely for the card issuers because they ensure you’ll pay the maximum amount of interest. Good for them, bad for you.

Take as an example a credit card with a 10% APR and a $5,000 balance. The minimum monthly payment on the card is $50. At that rate, 16 years will elapse before you pay off the balance.

Even this scenario is optimistic since your APR is likely to be well above 10%. Nonetheless, notice how increasing the monthly amount accelerates payoff.

3. Seek a Higher Credit Limit

Perhaps seeking a higher credit limit to repair your credit sounds counterintuitive. After all, doesn’t increasing your access to credit make you a riskier prospect?

The answer is subtle — a higher credit limit can help when you don’t use it. Our old friend, credit utilization ratio, is responsible for the seeming paradox.

When you increase your credit limit, you fatten the denominator in the CUR equation — credit available. As long as you don’t spend the increased amount, your CUR will decrease, as the following example illustrates:

Jill currently has three credit cards with spending limits of $3,000, $2,000, and $1,500. The sum of her unpaid balances is $2,100, giving her a CUR of ($2,100 / ($3,000 + $2,000 + $1,500)), or 32%.

She receives a $1,000 credit limit increase on her third card, raising it to $2,500. Her CUR becomes ($2,100 / ($3,000 + $2,000 + $2,500)), or 28%. She’s achieved a lower CUR simply by getting a bigger credit line.

Wisely, Jill doesn’t squander her advantage and refrains from increasing her unpaid balances. Had she instead rushed out to spend the extra $1,000, her CUR would become ($3,100 / ($3,000 + $2,000 + $2,500)), or 41%, higher than before she received the increase!

Depending on your current CUR, you may be able to spend some or all of a credit line increase while remaining below the magic 30% threshold. But if credit repair is your primary aim, you’d do best to keep from spending the credit increase.

Your credit limit can increase in a few ways:

- Direct negotiation: You can call the credit card’s customer service desk and ask a company representative for an increase. Review the reasons why you deserve a higher credit line, not the reasons why you need one. Those reasons may include excellent payment history, brand loyalty, higher income, and less debt.

- Document your finances: If you’ve improved your financial standing, share the good news with the credit card representative. Send them documented evidence, such as pay stubs, tax lien releases, and payoff notices before they render a decision.

- Get a new card from the same issuer: You may have better luck getting another card from your current issuer than obtaining a higher credit limit. Most card issuers let you transfer credit limits among their cards. You’ll end up with a higher credit limit where you want it.

On the downside, asking for new credit usually prompts the issuer to pull your credit report. As we cover in Tip #7, that can harm your score.

4. Consolidate Your Credit Card Balances

If you have unpaid balances on two or more credit cards, you may want to consider a balance transfer maneuver. When properly handled, balance transfers can help you pay down your debt and boost your credit score. You can arrange balance transfers online.

The goal is to consolidate all your credit card debt on one card, a potentially helpful action because:

- It helps you focus: Having only one unpaid balance lets you focus your energy on paying it down. You won’t be distracted by a bunch of monthly minimum payments on your other cards. And with only one credit card bill per month, you’re less likely to forget to pay it.

- It can save you money: Ideally, the interest rate on the consolidating card is lower than the weighted average interest on your other cards. By reducing your APR, you’ll have more money left over to pay down your balance.

- It may be free (almost): Many credit cards offer introductory 0% APR promotions to new cardmembers. If you can obtain such a card (or recently received one), you can transfer your balances and not pay any interest until the promotion expires. You will have to pay fees, however, usually 3% to 5% for each transfer.

You can help your balance transfers repair your credit by putting all your other credit cards in the drawer until you repay your total balance. Temporarily using only your debit card or cash to pay for purchases ensures that your debt won’t increase during the repayment period.

5. Limit Your Credit Utilization

As discussed earlier, your credit utilization ratio significantly impacts your FICO score.

Your goal is to keep your credit utilization ratio under 30% if possible, but the lower the better. For example, if your credit card lines total $10,000, you want to keep your unpaid balances below $3,000.

Higher CUR values will hurt your score because FICO assumes that you’re experiencing financial distress.

CUR specifically relates to unsecured credit cards — the calculation excludes other forms of debt, including home equity revolving accounts. CUR will also ignore your secured credit card (if you have one).

Some strategies for limiting your credit utilization include:

- Stick to a budget: To keep your credit under control, you’ll need to spend according to a plan that doesn’t rely on debt. Your monthly budget should reflect your priorities and include only items you can afford. You may have to find ways to increase your income or cut expenses if you’re serious about controlling your debt.

- Pay in cash: Whenever possible, use cash or your debit card to pay for your purchases. By avoiding new credit charges, you improve your ability to control your credit utilization.

- Check out complimentary amenities: Your surrounding area probably has many free amenities, such as zoos, gardens, and arboretums. Museums often waive admission fees at least once a week. Libraries are great resources that cost nothing to use. Your lifestyle choices can help you spend less.

- Consolidate credit card debt with a loan: FICO clips your credit score for owing money to unsecured credit cards but is indifferent to other types of debt, such as a personal loan. By taking out a consolidating personal loan and using it to repay your credit cards, your credit score may receive a nice boost.

6. Don’t Close Credit Accounts

There is a valid reason to keep old credit accounts open, but it’s not the reason usually cited. The confusion stems from the language FICO uses to describe the role of credit account length in calculating your score (i.e., it accounts for 15% of the total).

To quote FICO:

“You may be tempted to shut down that credit card that you just paid off after years of making payments. Before you do, take a moment to consider what impact closing that account may have on your length of credit history.”

If the quote leads you to think that closing an account shortens your credit history, think again. Your average credit age remains the same whether the account is open or closed.

The real reason to keep accounts open is to preserve your credit utilization ratio. As described earlier, your CUR rewards you for keeping low balances on your credit card accounts. After you’ve paid off an account with a large credit limit, the last thing you want to do is cancel it, as this is guaranteed to raise your CUR.

Instead, put the card in a drawer and use it only once a year. FICO tracks how long it’s been since you last used a credit account. FICO may omit the card from your CUR calculation if you fail to use it for an extended period.

7. Refrain From Applying For New Credit

When you apply for credit, the lender or creditor will issue a hard inquiry of your credit history. These so-called hard pulls arise only from new credit applications, and you must first authorize them.

FICO gets nervous when you apply for new credit. It is afraid that you may be on the slippery slope to financial desperation. Overblown? Perhaps. But FICO will shave five to eight points from your credit score for every hard pull. The damage dissipates after one year.

Soft pulls — inquiries made for reasons other than account opening — don’t hurt your credit score, and only you can see them.

The credit agencies drop inquiries from your credit reports after two years. New credit accounts for only 10% of your FICO score, so unless you are in full credit repair mode, you shouldn’t let it stop you from applying for new credit when you need it.

If you feel that your credit report contains hard inquiries, you can take steps to remove them, as we mention in Tip #9.

8. Diversify Your Credit Mix

The final 10% of your FICO score depends on your credit mix, that is, the variety of credit accounts you have used. As far as FICO is concerned, the more, the merrier. It’s looking for fixed-length accounts like mortgages, student loan accounts, and revolving credit accounts such as home equity lines of credit and different types of credit cards.

You may notice some tension between this factor and the one for new credit. One punishes you for opening a new account while the other rewards you. The only sane way through this maze is to only open accounts that you need.

9. Fix Your Credit Reports

Your credit reports may contain mistakes that harm your credit score. You can fight back by ordering free copies of your Experian, TransUnion, and Equifax credit reports and disputing any errors you find.

You can challenge report information on your own, but many folks hire a credit repair company like Lexington Law rather than attempting DIY credit repair. While they can’t guarantee results, they can aggressively pursue every questionable item, forcing the credit agencies to verify the information or remove it.

- Since 2004, Lexington Law Firm clients saw over 81 million items removed from their credit reports

- Get started today with a free online credit report consultation

- Cancel anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2004 | $99.95 | 8/10 |

Credit repair scams are alive, well, and ready to pounce. Stick to a legitimate credit repair service like those we review at BadCredit.org. The typical price ranges from $50 to $150 per month, and subscriptions usually run from four to six months. You can cancel at any time.

These companies may offer more than just a credit repair service, such as credit counseling, debt management, or debt relief. Credit counseling and debt management are less aggressive than debt relief.

If you’re a victim of identity theft, you’ll need a fair amount of time and energy to fix the problem. Consider hiring an identity theft repair company to help you get back on your feet.

10. Open a Credit Builder Loan

Credit unions, local banks, and online sites offer credit builder loans for folks who need to establish or rebuild credit. These secured debts work like this:

- You open a credit builder account and agree to a loan amount.

- The creditor places the loan proceeds into a locked escrow account. These loans become secured debts.

- You repay the secured loan monthly, and the lender reports your payments to all three credit bureaus.

- After you repay your secured loan in full, the lender releases the escrow account and refunds you the money.

In effect, a credit builder account allows you to prepay for a loan. There is no risk to the lender, and you build credit by reporting your monthly payments. As long as you make timely payments each month, the arrangement is a win-win for you and the lender.

11. Become an Authorized User

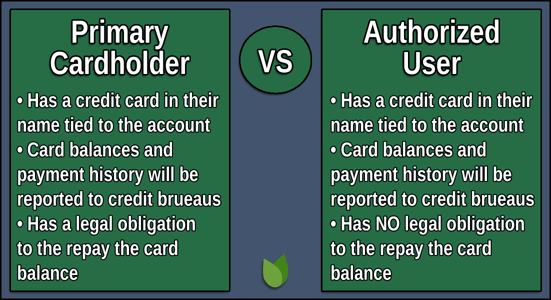

A credit card owner can designate one or more authorized users who can use the card to make purchases. You can become an authorized user without a credit check, making it ideal for consumers with poor credit.

The arrangement benefits you because all card payments appear on the credit reports of the card owner and authorized users. Being an authorized user allows you to rebuild your credit over time. You are not responsible for the credit card payments (at least, not legally).

12. Sign Up For A Service to Boost Your FICO Score

In recent years, several services have emerged, offering new ways to report your payments to the credit bureaus. As long as your payment record is good, this additional reporting can help rebuild your credit faster.

Some notable examples of these services include:

- UltraFICO: A service of FICO available only through Experian, UltraFICO is a new scoring system that looks at your personal bank account information.

- Experian Boost: This free service can get you credit for bills like your phone, utilities, and popular streaming services. Experian reports an average credit score increase of 13 points from Boost.

- Rent Reporting: Several services, including RentTrack, report your rent payments to the credit bureaus. Making timely payments of your rent can help accelerate the repair of your credit.

We imagine other services will appear offering additional ways to boost your credit scores. Check out a service carefully before signing up — some new services may turn out to be credit repair scams.

13. Be Patient

We’re not sure whether time heals all wounds, but our discussion of 13 credit repair tips does show that you can rebuild your credit just by letting time pass. A negative item can remain on your credit reports for 10 years, but most expire after seven. The effect of hard credit pulls on your score lessens after one year.

You don’t have to wait for a negative item to naturally drop from your credit report to begin undoing the damage. Adopt responsible credit behavior, and eventually, your score should recover. Until then, keep the faith.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.