Removing an error from your credit report is generally as simple as completing a credit reporting agency’s dispute form and submitting it online or by mail. As long as you’re in the right, the result will usually be in your favor. Unfortunately, sometimes it isn’t, and correcting the mistakes can be a lengthy process. Don’t let this deter you, however.

Incorrect, negative information hurts your credit history and lowers your credit scores, which not only affects your borrowing opportunities but your ability to rent a home and sometimes get a job. An oft-cited study conducted by the Federal Trade Commission found that 1 in 5 people have an error on at least one of their credit reports.

If disputing erroneous data with the credit reporting agencies hasn’t generated the desired results, your next step may be to write what’s known as a “609 letter” to the credit reporting agencies. In this article, we’ll provide you with valuable information on what you need to know regarding 609 letters and some recommendations for credit repair agencies, should you need to hire one.

Sample 609 Letter & Everything You’ll Need

The 609 letter is similar to a debt verification letter you would send to a third-party collector when trying to validate the legitimacy of a balance due, which is your right under the Fair Debt Collection Practices Act. The 609 letter, however, is based on Section 609 of the Fair Credit Reporting Act (FCRA), a federal law that regulates the credit reporting agencies.

As per the FCRA, only accurate and timely information may be listed on your credit report. Section 609 of the FCRA gives you the right to see what the furnisher (such as a lender, creditor, collector, or court) sent to the credit reporting agency as evidence that the information is correct. But the information needs to be verifiable, so if it’s not, it should be removed from your credit report.

Some people and companies sell 609 sample letter templates to worried consumers, but there is no reason to spend any money. There is nothing proprietary about the format or wording, although it should be carefully written and requires quite a bit of your own documentation.

To write a well-crafted 609 letter, first gather the following documents and make four copies of each:

- Credit report with the account in question circled and/or highlighted

- Birth certificate

- Social Security card

- Passport (if you have one) — the page showing your photo and the number

- Driver’s license or state-issued identification card

- Tax document that shows your SSN

- Either a rental agreement or mortgage contract with your name and address

- Utility bills with your name and address

After that, use the following sample letter as a guide:

Your Name

123 Main Street

San Francisco, CA 94109

(111) 222-3333

12/31/2022

Subject: Fair Credit Reporting Act, Section 609

Dear Credit Reporting Agency (Experian, TransUnion, or Equifax),

I am exercising my right under the Fair Credit Reporting Act, Section 609, to request information regarding an item that is listed on my consumer credit report: ABC Collection Agency, account number 0123456789.

As per Section 609, I am entitled to see the source of the information, which is the original contract that contains my signature.

My identifying information is as follows:

Date of Birth: 01/21/1989

SSN: 123-45-6789

[If you have a lawyer, state that you have legal representation and provide that person’s contact information]

As proof of my identity, I have included copies of my birth certificate, Social Security card, passport, driver’s license, W-2, rental agreement, and a cellphone bill. I have also included a copy of my credit report with the account I am requesting to have verified circled and highlighted.

If you are unable to verify the account with the original contract, the information should be removed from my credit report within 30 days.

Sincerely,

[Signature]

You will need to assemble three separate packets and send one to each of the credit reporting agencies (assuming all are reporting the same account). Include a copy of your letter and copies of the supporting documents. Keep one set of the letter and documents for your own records.

Where to Send Your 609 Letter

Send your 609 letter to each of the credit reporting agencies that are listing the account you need verified:

Experian

P.O. Box 4500

Allen, TX 75013

TransUnion Consumer Solutions

P.O. Box 2000

Chester, PA 19016-2000

Equifax

P.O. Box 740256

Atlanta, GA 30374-0256

Do not just pop your letters in the corner mailbox — these are important letters, and you’ll want to be sure they arrive. Go to the post office and send them via certified mail, return receipt requested. Sending them from the U.S. Post Office this way will cost less than $7 per letter, so it’s a pretty minor investment.

What a 609 Letter Can & Cannot Do

Once the credit reporting company receives your Section 609 letter, it will either respond by sending you the contract with your signature on it that supports the furnisher’s claim or notify you that it does not have the original contract.

The credit bureau may delete the information from your file without you having to do anything else. But if the incorrect information remains, you’ll have to take the next step and dispute it with the credit bureau again. On the dispute form, clearly point out that the information can’t be verified by you or the credit reporting agency, so it needs to be removed. This should do the trick.

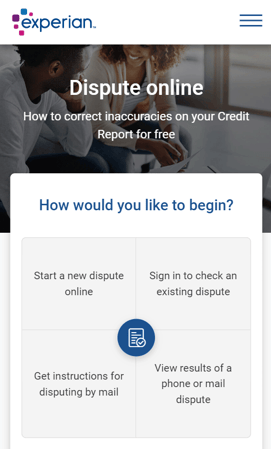

You can file online disputes with each credit bureau on their websites.

On the other hand, if the credit bureau is able to produce the requested original contract with your signature, the information will remain in place until it drops off your credit report when it’s timed out. Most negative information (such as late payments, defaults, charge-offs, and debts that were sent to collectors) can only stay on a credit report for seven years. A Chapter 7 bankruptcy will stay for 10 years from the filing date.

Be aware that Section 609 gives you the right to request information about the items listed on your credit reports, but not specifically to dispute them. Such disputes are covered in Sections 611 and 623 of the FCRA.

Still, many consumers have found that the credit reporting agencies will remove unverifiable information after receiving the Section 609 letter.

That said, do not waste your time writing and sending these letters if you know the offending credit report information is correct. Despite the hoopla surrounding 609 letters, they are not get-out-of-debt-free cards. They are to be used honestly and judiciously. Anything else is an abuse of the process.

Hire a Credit Repair Agency if You Need Help with a Dispute

As you can see, there are a number of steps to developing a 609 letter and it is very important to be thorough and precise. If you are in a time crunch because you’re in the market for a credit card or loan, or are simply frustrated with the process and want help, do not hesitate to go to the pros for assistance.

While these are matters that you can technically handle yourself, hiring a qualified and highly-rated credit repair agency — such as Lexington Law, CreditRepair.com, and Sky Blue Credit Repair — can be money well spent.

- Since 2004, Lexington Law Firm clients saw over 81 million items removed from their credit reports

- Get started today with a free online credit report consultation

- Cancel anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2004 | $99.95 | 8/10 |

- Best-in-class support

- In business since 1989

- Rapid 35-day dispute cycle, tailored to your situation

- 90-day 100% money-back guarantee

- Low $79 cost to get started, cancel or pause membership anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| A+ | 1989 | $79 | 9.5/10 |

- Free online consultation

- CreditRepair.com members saw over 8.6 million removals on their credit reports since 2012

- Free access to your credit report summary

- Three-step plan for checking, challenging and changing your credit report

- Online tools to help clients track results

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2012 | $69.95+ | 8/10 |

A reputable credit repair company will access your credit reports, then discuss your credit problems with you in a free consultation call. If you want the credit agency to manage the situation for you, you can move forward and hire them.

The cost of credit repair depends on what you’re looking for in terms of service and what state law allows, but it’s not uncommon for a month’s worth of work to cost around $100.

Once the credit repair agency gathers all the relevant information from you, it will take over the verification requests and dispute process, including writing and sending all the letters and conducting follow-ups. Essentially, it will represent you by acting as a go-between with the credit reporting agencies.

Assuming the credit repair agency is successful, the erroneous information will be purged from your credit file. At that stage, you’ll receive an updated copy of your credit reports, and you’ll be done.

Be sure to keep an eye on your credit reports going forward so you know what is being reported about you. Request a copy of each of your three credit reports from AnnualCreditReport.com once a year to catch future potential errors early.

Section 609 is Designed to Protect You

Rest assured that the FCRA protects you against unverifiable credit report information that could be damaging your credit history and scores. If you have the time and wherewithal, take control and use a Section 609 letter.

Credit repair agencies can definitely help reduce the anxiety and effort too, so if you’re in a rush to bump up your credit scores but don’t have the time to put in the necessary work, consider using their services. What’s crucial is that you ensure your credit reports contain only true and timely data points. Don’t delay in taking action. It’s your right and your responsibility.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.