Do-it-yourself credit repair may sound like a lot of work. And it can be — but putting in the time and effort to see your credit score improve is worth it.

Living with bad credit isn’t just a nuisance; it can impact every area of your life. If you’ve finally decided to take matters into your own hands and fix your credit problems, you’ve made a wise choice. Now you may be asking yourself where to begin. Luckily, these days there are a lot of options for proactive and hands-on folks who want to take back control of their financial lives.

While much of the DIY credit repair information available out there can be helpful, the sheer volume can feel overwhelming — not to mention being sure you’re getting the right information. That’s why we’ve put together this short tutorial outlining three easy ways you can fix your credit problems. As with every endeavor, educating yourself on the options available is the crucial first step. So let’s dive in and explore the credit repair process, including writing dispute letters, seeking the assistance of credit repair professionals, and finding the best eBooks on the topic.

Sample Letters | Software Solutions | Credit Repair eBooks | Free Consultation

Dispute Negative Items by Writing Letters to the Bureaus

Negative entries on your credit report that are either erroneous or inaccurate can often be removed by simply writing a letter to the reporting agency. In fact, the Fair Credit Reporting Act (FCRA) states that the credit reporting agencies must investigate any disputed entry a consumer discovers on their credit report. If the agency finds that the entry is erroneous, they must remove it from the report.

Writing a letter to the credit reporting agency or agencies that have listed the erroneous entries on your report is the easiest way to get them removed. The reporting agencies must respond within 30 days to letters sent to them disputing credit report entries — it’s the law!

They must complete their investigation into whether this disputed entry should remain on your report within that same 30-day period. For an entry to remain or be reinstated on your credit report, there must be compelling evidence of its accuracy.

Writing a letter disputing a credit report entry can be done either through the mail or online. If a letter is sent through the mail, it should be done via certified mail so the receipt date can be verified. When sending a letter, there are a few things to remember to ensure your letter gets processed and not rejected.

- A separate dispute letter is required for each erroneous entry you are disputing.

- Attach a recent copy of your credit report with the erroneous entry highlighted and with the front page included.

- Keep your dispute letter clear and simple. State only the relevant facts, and explain the reason for disputing the entry.

- Be sure to include copies of any relevant documents supporting your claim.

- If you know who the furnisher of the disputed information is, send them an identical letter at the same time.

- Keep copies of all your correspondence with the reporting agencies, along with dates sent.

Here is a link to a sample letter recommended by the Federal Trade Commission. If you want a faster method of disputing credit report entries, all three major credit reporting agencies — Equifax, Experian, and TransUnion — now allow consumers to file dispute claims online free of charge. Here are the links to each company’s online dispute page:

Equifax: https://www.ai.equifax.com/CreditInvestigation

Experian: http://www.experian.com/disputes

TransUnion: http://www.transunion.com/credit-disputes

Credit Repair Software Helps Through Templates & Guidance

For those people who want a little extra help in repairing their credit, there are credit repair software tools available. Credit repair software still lets you take control of your DIY credit repair, but offers extra help in the form of step-by-step guidance and formatted templates for you to use.

In general, credit repair software tools work by scanning your credit reports (entered either manually or automatically through the software) and then allowing you to identify the entries you wish to dispute. Once the erroneous entries have been identified, the software takes over and can create, track and manage the dispute process, generate dispute letters, graphically display the progress of your disputes, and more.

Of course, these tools can be costly, with some credit repair software running as much as $400 or more. However, depending on your credit report status, it may be well worth the investment. Here are some of the more effective and affordable credit repair software tools we’ve found.

TurboScore Home Edition ($39.95)

A relatively inexpensive stand-alone software product designed to help consumers remove negative entries and improve their credit scores. The step-by-step process is easy to follow and requires no special computer skills or financial knowledge.

A relatively inexpensive stand-alone software product designed to help consumers remove negative entries and improve their credit scores. The step-by-step process is easy to follow and requires no special computer skills or financial knowledge.

TurboScore Home comes with an automated Dispute Manager™ and dispute letters that have been tailored to meet the requirements of each of the three reporting agencies.

Credit Detailer Personal Edition ($99.99)

Functionally the same as the much more expensive Professional Edition, the Credit Detailer for home users is a powerful credit repair tool. It contains information on credit repair regulations and consumer rights, and is designed for both effective credit repair and educational opportunity. Simple, automated and customizable, Credit Detailer is worth checking out.

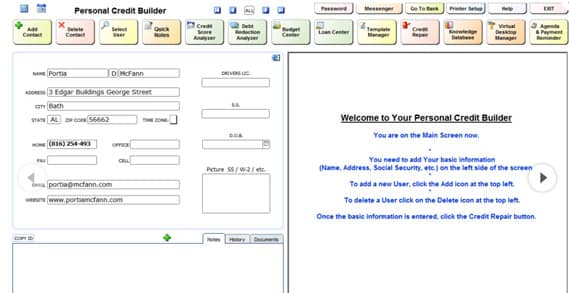

Personal Credit Repair Software ($199.97)

This product is also known as Personal Credit Builder, and is based on the software tool called Credit Money Manager that many professional credit repair businesses use. Personal Credit Repair Software automatically imports your credit information from the credit reporting agencies, and then walks you through the steps required to identify and dispute erroneous entries on your report. This software also comes with bonus products, tips and strategies included in the price.

Credit repair software can be expensive, and some of the tools are complex to learn and operate. For an in-depth report of the 16 best personal and professional credit repair software solutions we found, check out our credit repair software review.

You Can Help Teach Yourself & Execute with an eBook

Let’s face it, when you’re up against a system that’s as large as the credit reporting industry, educating yourself on your rights as a consumer is your best defense. Toward this end, it’s often worth spending a little money to read about strategies written by experts in credit repair and the credit dispute process. A great place to begin this research process is to check out some of the current eBooks written on the subject.

When discussing eBooks on any topic, it’s important to realize that the information provided may or may not be the most accurate or well-researched. Often times the editing and fact-checking that goes into a professionally published book is circumscribed in self-published eBooks. That’s why we’ve done a little digging into the most recommended and best-reviewed eBooks on the topic. Here are some that we can recommend.

“Hidden Credit Repair Secrets” (Kindle, 3rd Ed., 2016 — $9.99)

This #1 best-selling eBook was completely revised and updated in 2016 and is among the most widely recommended books on credit repair. It includes a detailed 6-step dispute plan and a bonus chapter on credit repair companies and their techniques.

“The Easy Section 609 Credit Repair Secret” (Kindle, 2015 — $9.99)

Written by someone who put this technique into practice for himself and dramatically improved his credit score, this eBook is filled with actionable information.

It focuses on a particular section of the FCRA called Section 609, which states that credit reporting agencies must provide consumers with a copy of their original signed contract from a creditor — which consumers seldom have access to.

“How to Remove All Negative Items From Your Credit Report” (Kindle, 2012 — $2.99)

This book is based on the experiences of a financial planner with more than 18 years of experience helping clients with their credit and financial problems. The author shows you how to identify inaccurate entries, how to get them easily removed, and then how to remove all negative credit report entries. It also details alternative methods, and how to deal with obstructive or harassing agencies.

For Expert Help and a Free Consultation Call Lexington Law

The process of credit repair can be a slow and sometimes daunting one for many people, and turning it over to a professional can sometimes be the best solution. If after reading through this guide you’ve decided that DIY credit repair just isn’t for you, we have another recommendation.

The expert consumer credit specialists at Lexington Law have helped hundreds of thousands of clients to repair their credit and retake control of their financial lives.

- Since 2004, Lexington Law Firm clients saw over 81 million items removed from their credit reports

- Get started today with a free online credit report consultation

- Cancel anytime

- See official site, terms, and details.

| Better Business Bureau | In Business Since | Monthly Cost | Reputation Score |

|---|---|---|---|

| See BBB Listing | 2004 | $99.95 | 8/10 |

For more than 26 years, Lexington Law has been providing consumers with affordable credit repair solutions. If paying a small monthly fee in return for hands-on help from the credit repair experts sounds like a good idea, we highly recommend Lexington Law.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.