You depend on your car every day to get to and from work or school, run errands, and make it to social events. So, if it breaks down or is long past its prime, you may have no choice but to get a new one. But what if you have no credit history?

Rest assured you can still get an auto loan even if you don’t have an established credit history. We’ve compiled this list of options, approval tips, and frequently asked questions to help take the hassle out of looking for no-credit auto loans.

Lenders | Approval Tips | FAQs

Auto Loans for People with No Credit History

In a perfect world, all borrowers would have a positive credit history that proves they are responsible borrowers. However, lenders know this isn’t the case.

You may have no credit history because you’re young and inexperienced with credit. Maybe you’re a recent immigrant or simply have never used traditional credit accounts. Whatever your reason for not having credit may be, these auto loans for no credit history can give you the financing you need to buy a car.

- Network of dealer partners has closed $1 billion in bad credit auto loans

- Specializes in bad credit, no credit, bankruptcy and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have $1500/month income to qualify

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 3.99% - 29.99% | 1999 | 3 minutes | 9.5/10 |

Instead of offering auto loans directly, Auto Credit Express can connect you to dealers and lenders who offer no credit auto loans. To see which types of auto loans you’re eligible for, all you have to do is fill out a 30-second prequalification form.

While each lender has its own unique set of requirements, you’ll need to be at least 18 years old and have a monthly minimum income of $1,500 to use this service. Auto Credit Express accepts co-signers and can be used to find financing for both new and used cars.

2. LendingTree

- Auto loans for purchase, refinance, and lease buyouts

- Nationwide lender network

- Get matched with up to 5 lenders that fit your financial profile

- It only takes a few minutes and is free with no obligation

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1998 | 4 minutes | 9.5/10 |

LendingTree is one of the largest lending networks and can show you up to five loan offers within seconds of submitting a quick prequalifying form. No credit history is required to submit a form and see which offers for which you may qualify.

No credit isn’t a barrier to car ownership. Lenders understand people need reliable transportation, so getting a secured auto loan from a lender within the LendingTree network is attainable even with no credit history to show.

- Loans for new, used, and refinancing

- Queries a national network of lenders

- Bad credit OK

- Get up to 4 offers in minutes

- Receive online loan certificate or check within 24 hours

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2003 | 2 minutes | 8.5/10 |

MyAutoloan.com made its debut in 2003 to “help consumers take control of the research, finance, and buy processes for auto and motorcycle.” You can apply to this financing marketplace for free and get matched with up to four auto loan offers in minutes.

While most of the lenders it partners with will offer financing for new and used cars, there are some financing restrictions. These restrictions apply to conversion vans, high-end sports cars, salvaged title vehicles, or vehicles that have been repossessed or auctioned.

- Free, no-obligation application

- Specializes in auto loans for bankruptcy, bad credit, first-time buyer, and subprime

- Affordable payments and no application fees

- Connects thousands of car buyers with auto financing daily

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1994 | 3 minutes | 9.0/10 |

Since 1994, Car.Loan.com has been connecting people dealing with tough credit situations with auto loans. If you have no credit, you can use it to find lenders that will approve you for an auto loan.

In addition to affordable payments and no application fees, Car.Loan.com offers same-day approvals. Its website also features calculators you can use to figure out monthly payments and estimate how much money you can get to buy a car.

- Prequalify in minutes without impacting your credit score

- Refinancing loans save an average of $191 per month

- 125% financing available for cash-out refis

- PenFed Credit Union membership required but can be applied for at the same time as your loan

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 5.19% and up | 1935 | 5 minutes | 8.5/10 |

PenFed Credit Union may be able to help you secure an auto loan with a low rate. That’s because credit unions generally have lower interest rates and fees than other types of lenders.

You must become a member to qualify for a loan, but you can become a member at the same time you apply by opening a checking or savings account with the credit union. The required minimum deposit is $5.

Tips for Auto Loan Approval with No Credit History

Some things you can do to increase your chances of getting approved for a car loan with no credit history include:

- Get a cosigner: If you have a trustworthy friend or family member who has good credit, you may want to ask them to cosign your auto loan. By doing so, you are more likely to get approved for a lower interest rate. Since a cosigner will be on the hook for your loan if you’re unable to repay it, ask someone to cosign your loan only if you know you’ll make your payments.

- Have a steady source of income: A lender will be more likely to approve you for an auto loan if you can prove that you have a consistent paycheck or another source of income you can use to repay your loan.

- Put some money down: You won’t need to borrow as much money — and you will save on interest — if you make a down payment. Even a small down payment can make a positive difference in your auto loan.

- Shop around: Instead of going with the first lender that approves your loan application, shop around and compare all your options. Doing your due diligence can save you a lot of money over the life of your auto loan.

- Establish credit: If you don’t need a new car right away, you may want to build your credit and wait to buy a car. To do this, pay your bills on time, reduce your debt as much as possible, and dispute any errors or inaccuracies you find on your reports. You’ll be more likely to get approved for lower interest rates and more favorable terms with a positive credit history.

Not only can the above strategies improve your chances of obtaining an auto loan, but they can also help you get the best deal, regardless of your credit history.

How Can I Finance a Car with No Credit History?

The truth is that financing a car with no credit history is difficult. Fortunately, however, it’s not impossible.

Some lenders are willing to help borrowers with no credit history get auto loans. Auto Credit Express, Car.Loan.com, and myAutoloan.com can connect you to these types of lenders so you can receive the financing you need to buy a car.

Just keep in mind that if you do get approved for an auto loan without any credit history, you can’t expect your rate and terms to be as good as those of someone with a solid history. Here’s why: Lenders will consider you a greater risk because you don’t have a credit history that shows you make timely payments.

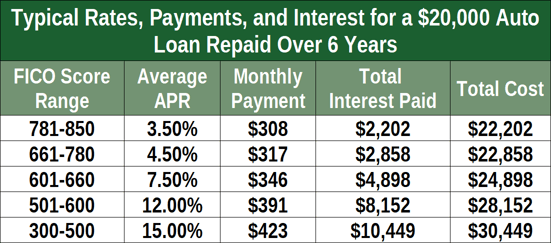

So, they don’t know if you’re a responsible borrower and are taking a bigger chance on you. Therefore, they’ll likely offer you a higher interest rate and less favorable terms than they’d offer to someone with a positive credit history. You can see an example of how your credit score will affect your interest rates in the chart below.

The good news is that you can use your no-credit auto loan to build your credit history and land a better loan in the future. As long as you make your auto loan payments on time, lenders will perceive you as a borrower who is less likely to default on his or her loan. And you are more likely to get better loan terms — and maybe higher loan amounts — the next time you apply for an auto loan or any other type of financing.

Remember that everyone has to start somewhere so if you currently have no credit, use your auto loan as an opportunity to improve your future financial situation.

Is No Credit Worse than Bad Credit?

While both bad credit and no credit can make it difficult to get an auto loan with a low interest rate and favorable terms, bad credit is usually worse than no credit. Bad credit shows that you’ve made some credit mistakes and could be irresponsible when you borrow money.

If you have bad credit, you likely have a track record of late payments, use more than 30% of your available credit limits, have let accounts go to collections, and may even have a past bankruptcy. Your goal should be to rebuild your credit so you can position yourself as a low-risk borrower in the eyes of lenders.

No credit means that you don’t have any credit history. There is nothing on your credit report because you have not borrowed any money within the last seven years.

Maybe you’re a college graduate and have never had to borrow money before. Or, maybe you’re an immigrant who recently moved to the United States with no track record of borrowing. You may also have no credit because you simply don’t believe in borrowing money and have paid for everything in cash.

If you have no credit, you have a clean slate and can focus on building a positive credit history. On the other hand, if you have bad credit, the damage has already been done and you’ll have to work hard to rebuild your credit.

It will take longer to rebuild and recover from bad credit than it will to establish credit and build a positive history.

Why Do I Have a 0 Credit Score?

Believe it or not, there is no such thing as a zero credit score. Even if you have no credit history, your credit score is not zero.

However, you are “credit invisible,” meaning the three major credit bureaus do not have a credit history on you. To make yourself “visible” to the credit bureaus, you can do the following:

- Get a retail store card: A retail store will likely give you a branded credit card you can use to establish credit. Make sure to pay off your entire balance every month and ask the store to report your payment history to the credit bureaus. One such example is the Fingerhut Credit Account, which is easy to be approved for and charges no annual fee.

- Opt for a secured credit card: If you don’t qualify for a traditional credit card, try a secured credit card. While a secured credit card will require a deposit, it can help you build credit as long as you use it responsibly.

- Take out an auto loan: Find a lender that will give you an auto loan and make your payments on time to build your credit. You may want to get a cosigner to secure a better rate and terms.

- Monitor your credit history: After you’ve taken steps to establish credit, visit AnnualCreditReport.com to get a copy of your credit reports from Experian, TransUnion, and Equifax. Dispute any inaccurate information that can bring your credit score down.

Once you begin to establish credit, your credit score will likely be somewhere below 500 under the FICO scoring model, which ranges from 300 to 850.

A No Credit Auto Loan Can Improve Your Finances

If you need to buy a car but don’t have any credit, don’t despair. There are lenders that specialize in auto loans for no credit history. Before you choose one, compare all of the options available to you and make sure you can afford the monthly payments.

Look at a no-credit auto loan as a positive. You can use it as a tool to establish credit and save hundreds or even thousands of dollars on loans in the future.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.