Americans spend a lot of time getting to and from the places they need to be. According to Census data, US commuters spend an average of 27.6 minutes each way during their daily commute.

If you have a full-time job or class schedule, that comes out to 4.6 hours a week and more than 200 hours each year. And, if you don’t have your own car, taking public transportation can add substantially more time, where the average one-way commute is 46.6 minutes.

We’ve researched the field, and here’s what we found for those who need an auto loan but have less-than-perfect credit hindering their approval chances.

Best Providers of Car Dealership Loans For Bad Credit

Many car shoppers think their only dealership loan option is through the actual dealer. But dealers work with dozens of lenders so they can approve as many customers as possible. After all, they want the sale just as much as you want the car.

The following lending networks work with dealers that specialize in extending loans to applicants with all kinds of credit histories. Many will allow you to obtain loan pre-approval before heading to the dealership, which can cut down on the time it takes to drive off the lot in your new ride.

- Network of dealer partners has closed $1 billion in bad credit auto loans

- Specializes in bad credit, no credit, bankruptcy and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have $1500/month income to qualify

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 3.99% - 29.99% | 1999 | 3 minutes | 9.5/10 |

More than 1,200 U.S. auto dealers partner with Auto Credit Express to find car loan options for applicants who have bad credit. And since Auto Credit Express is a lending marketplace, it shops your single application to several partner lenders to find the best deal for you.

While the network doesn’t set a minimum credit score for approval, it does require proof of at least $1,500 in monthly income. Qualified applicants can fill out a prequalification application for a bad credit car loan that takes less than 30 seconds to complete. If approved, you can start shopping for your new car almost immediately.

2. LendingTree

- Auto loans for purchase, refinance, and lease buyouts

- Nationwide lender network

- Get matched with up to 5 lenders that fit your financial profile

- It only takes a few minutes and is free with no obligation

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1998 | 4 minutes | 9.5/10 |

LendingTree partners with dealers across the country to help you secure the best loan offer based on your credit profile. You may also qualify for a loan from a bank or other lender that allows you to choose your vehicle from anywhere, not just from one specific dealer.

Bad credit need not hinder your ability to get an auto loan — lenders understand that a vehicle is necessary for getting to work, school, and everywhere in between, so these loans are notoriously easier to be approved for than other types of financing.

- Loans for new, used, and refinancing

- Queries a national network of lenders

- Bad credit OK

- Get up to 4 offers in minutes

- Receive online loan certificate or check within 24 hours

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 2003 | 2 minutes | 8.5/10 |

The partner lenders in the MyAutoloan.com network provide loans for new and used cars, as well as refinancing options if you’re currently paying off a high-interest auto loan. Qualified applicants can receive up to four loan offers within minutes of submitting a brief application.

And once you finalize a loan, you can receive your loan certificate or check within 24 hours. With such a quick turnaround, you’ll be on your way home in your new car in no time.

- Free, no-obligation application

- Specializes in auto loans for bankruptcy, bad credit, first-time buyer, and subprime

- Affordable payments and no application fees

- Connects thousands of car buyers with auto financing daily

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| Varies | 1994 | 3 minutes | 9.0/10 |

Car.Loan.Com offers same-day approvals to thousands of daily applicants. The lending network doesn’t require a minimum credit score for you to apply, and if approved, you’ll receive the best offer from all the partner lenders in the network.

Since the network shops your finance application to several partner lenders, each offer you receive may contain a different loan term, loan amount, or interest rate. Before you sign for a bad credit auto loan, make sure you understand how much the loan will cost you and how long it will take you to fully repay the debt.

Dealers That Accept Bad Credit

The following are three used-car dealerships that work with applicants who have bad credit. Chances are one or more are near you.

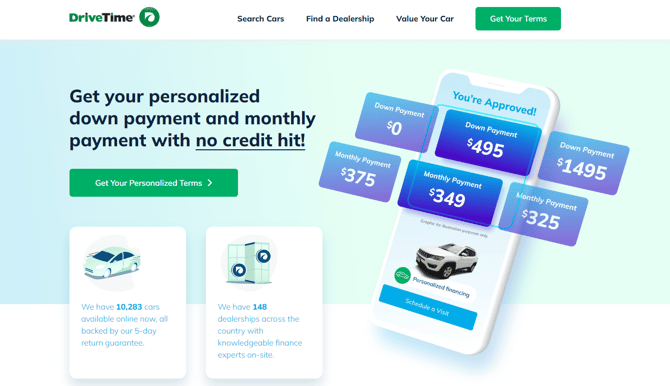

5. DriveTime

DriveTime acts as both your car dealer and the bank, meaning you won’t have to haggle with loan officers to finalize your deal. The dealer offers more than 12,000 vehicles through 130+ U.S. locations and boasts a 99.9% customer approval rating.

DriveTime also provides fully customized loan options through an application it says takes two minutes or less to complete. And, since the dealer’s salespeople receive a salary, you won’t have to worry about commission-crazed employees chasing you around the lot.

6. Carvana

Like DriveTime, Carvana is both a dealer and a lender. The difference between the two is that Carvana completes all its car sales online. You can apply for a loan through the company and, upon approval, immediately begin shopping among the thousands of vehicles in Carvana’s inventory.

Once you find the right car — and loan — for you, you can purchase the vehicle online and have it delivered to your doorstep. Some cars require a delivery charge, while others provide free shipping. If you’d rather pick the car up yourself, you can do so at one of Carvana’s vehicle vending machines located in major cities around the country. You can also book a one-way flight to a city with a vending machine, and Carvana will subsidize $200 of the flight cost.

7. CarMax

CarMax attempts to make the car-buying process faster and easier by allowing applicants to complete much of the transaction online. You can start by browsing the company’s online car inventory.

If you find the right set of wheels, you reserve the car for up to seven days. If the car isn’t at your nearby location, you can have it shipped there for a fee. The company’s website also provides prequalified financing that allows you to get fully approved for your loan online before going to a nearby dealership to sign your paperwork and seal the deal.

Can I Get a Loan From a Dealership With Bad Credit?

Yes, most dealerships will work with applicants who have bad credit. That’s because they partner with several banks, credit unions, and other lending institutions to find favorable loan terms for every applicant. Their job is to sell cars, and they’re heavily incentivized to do so.

Your income and outstanding debts will ultimately determine how much you qualify to borrow and whether you can head on over to the new vehicle showroom or be confined to used vehicle specials.

The point is, the dealer’s finance department wants to approve your finance application and will try to match you with appropriate inventory to meet your needs.

What is a Decent Credit Score to Buy a Car?

Having bad credit doesn’t mean you can’t get special financing. It just means your loan will likely cost more over the long haul.

That’s because lenders that specialize in extending loans to consumers who have bad credit often charge higher interest rates, more expensive origination fees, and possibly other charges.

According to Experian, the average interest rates for borrowers with a credit score below 600 ranged from 11.86% to 14.17% for new vehicles and 18.39% to 21.18% for used cars in Q3 of 2023:

| Credit Score | Average APR (New) | Average APR (Used) |

|---|---|---|

| Superprime: 781-850 | 5.61% | 7.43% |

| Prime: 661-780 | 6.88% | 9.33% |

| Nonprime: 601-660 | 9.29% | 13.53% |

| Subprime: 501-600 | 11.86% | 18.39% |

| Deep subprime: 300-500 | 14.17% | 21.18% |

The positive takeaway from those numbers is that borrowers who have a sub-600 credit score are being approved for loans for both new and used vehicles.

Few lenders publicize their minimum lending requirements, so it’s difficult to truly say what credit score you must have for loan approval. But the rule of thumb is, for a more affordable loan, you should fall within the “good” range in FICO’s credit wheel — which starts at a 670 credit score.

But some consumers report getting loan approvals — albeit under pricey terms — with credit scores at or below 580.

Keep in mind that your credit score isn’t the only determining factor in your request for an auto loan. A lender may consider you a stronger candidate if you have a good income or can provide a sizable down payment that shows you have the incentive to make your payments on time.

You can also lower your loan costs by providing a trade-in vehicle or setting up automatic withdrawals for your monthly payments.

How Can I Get Financed For a Car With Bad Credit?

As a shopper, you aren’t limited to whatever loan options a dealer presents you with. The internet is home to numerous lending networks that shop your loan request and qualifying credentials to several lenders to find you the best deal.

Most of these networks require that you fill out a short application you can complete within minutes. Once you submit your information, the network goes to work and can return multiple loan offers in a matter of minutes.

And since each network partners with several lenders who all want to earn your business, you may find far more favorable terms than if you were to apply through a dealership.

Once you’ve chosen your best loan option, you can complete your loan paperwork online. Most lenders provide a loan certificate or check within 24 hours, which allows you to start shopping faster than many traditional lending methods. Some even provide same-day funding.

Another positive to using a lending network is that it can minimize credit report inquiries. Every time you apply for a loan or credit card, the lender places a hard inquiry on your credit report to gain access to your profile.

By itself, an inquiry isn’t a big deal. But once you start accumulating several of them — and that’s easy to do if you apply for multiple car loans — your credit score may drop.

By vetting loan offers through a lending network, you not only increase your chances of approval, but you’re also limiting potential damage to your credit profile.

What is the Best Auto Loan Company For Bad Credit?

If you have bad credit, it can sometimes feel like the best loan company is whichever loan company accepts you. But you don’t want to wait until after you sign for a loan to find out what separates good lenders from bad ones.

You can start your research with the Better Business Bureau to see how the lender treated other consumers. You can also study your proposed loan terms and fees to see which lenders may try to overcharge you or place hidden fees in the fine print of the contract.

But, overall, your best bet is to find a lender that has a long and successful track record of working with borrowers who have bad credit. This can include a lending network that shops your application to multiple partner lenders — such as Auto Credit Express — or a lender or dealer that allows you to shop for a car and acquire bad credit financing under the same roof, such as DriveTime.

- Network of dealer partners has closed $1 billion in bad credit auto loans

- Specializes in bad credit, no credit, bankruptcy and repossession

- In business since 1999

- Easy, 30-second pre-qualification form

- Bad credit applicants must have $1500/month income to qualify

- See application, terms, and details.

| Interest Rate | In Business Since | Application Length | Reputation Score |

|---|---|---|---|

| 3.99% - 29.99% | 1999 | 3 minutes | 9.5/10 |

Whichever lending method you choose, you’re likely to find more affordable — and faster — lending practices by researching and applying for loans on your own. That’s because dealerships often partner with specific lenders who provide commissions when they send borrowers their way.

And, like most things in life, people tend to lose their impartial nature when there’s money at stake. You are always going to be your own biggest advocate. By finding your own loan, you can rest assured you’re getting a deal that’s catered to your needs and not the desires of the dealership.

Step Off the Bus and Into Your New Vehicle

If you’re still taking public transportation because you think your low credit score is disqualifying you from getting an auto loan, think again.

By researching the best bad credit car dealership loans, you can leverage your buying power to possibly overcome your credit history and get yourself on the road — and out of the bus or subway station.

Advertiser Disclosure

BadCredit.org is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free for users, we receive advertising compensation from the financial products listed on this page. Along with key review factors, this compensation may impact how and where products appear on the page (including, for example, the order in which they appear). BadCredit.org does not include listings for all financial products.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.